Tired of drowning in receipts and paperwork?

Imagine effortlessly managing your finances, saving time, and reducing stress.

This Dext review’ll explore whether it lives up to the hype.

Discover how Dext can simplify your financial life, from automated data entry to real-time insights.

Is it the solution you’ve been searching for? Let’s find out!

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

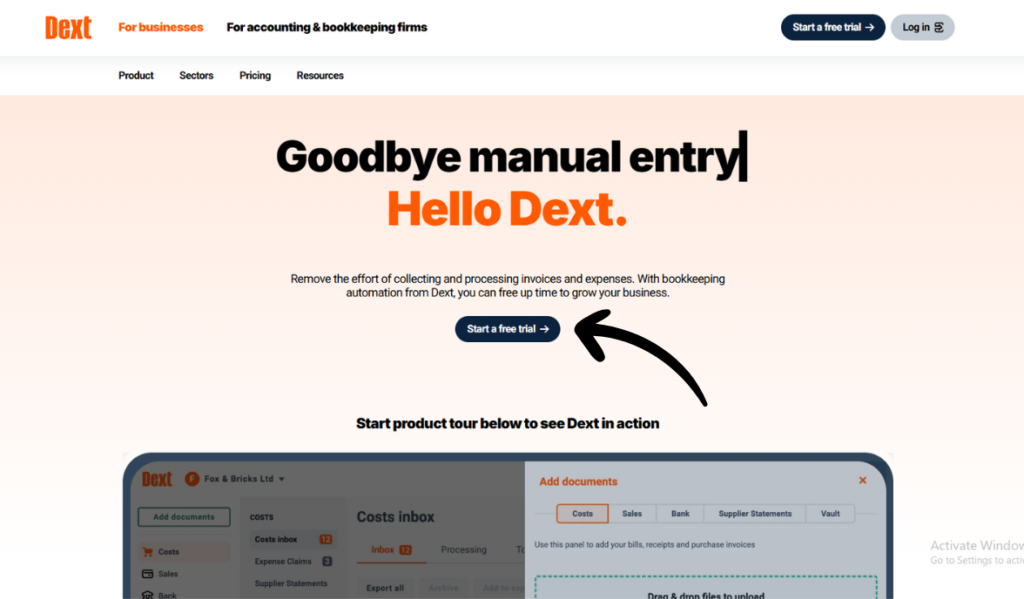

What is Dext?

Dext is accounting software for small businesses.

It’s cloud-based and easy to use.

Dext helps you capture receipts with its mobile app and digitize them using OCR.

It extracts the info, so you don’t need manual data entry.

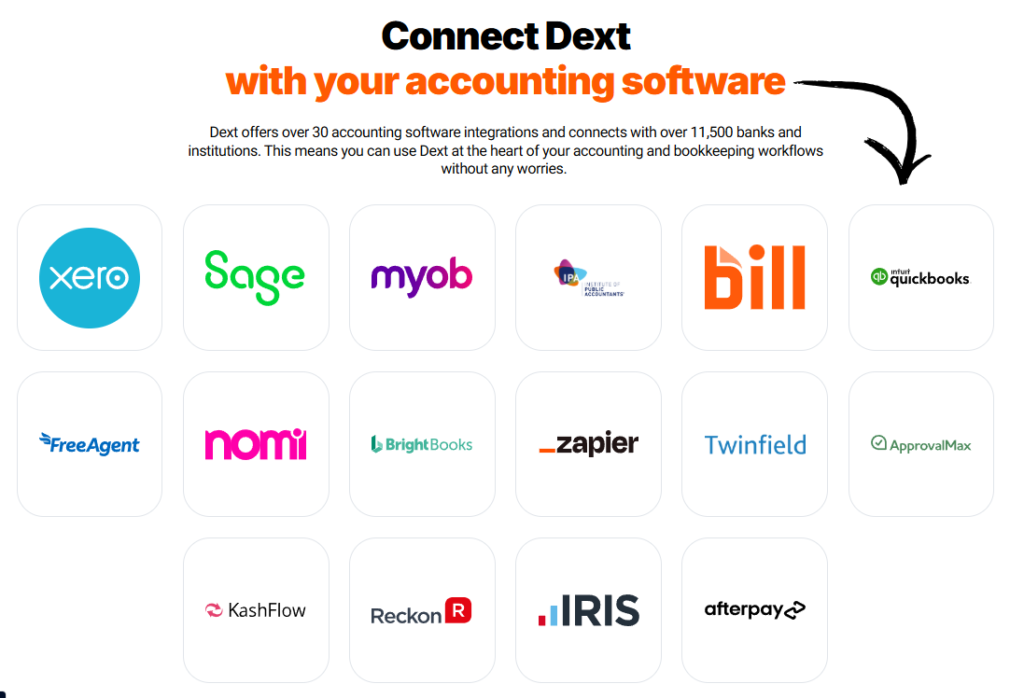

Dext integrates with Quickbooks, Xero, Sage, and more.

It helps you create expense reports, categorize transactions, and integrate with bank statements.

Try Dext with a free trial and ditch manual entry today!

Who Created Dext?

Dext was founded by Alexis and Damian Hughes in 2010.

Their vision was to simplify bookkeeping for small businesses.

They aimed to eliminate manual data entry and capture receipts digitally.

Dext’s goal is to empower business owners with easy-to-use tools.

That integrates seamlessly with accounting software like Quickbooks and Xero, freeing them from tedious financial tasks.

Top Benefits of Dext

- Effortless Receipt Capture: Snap a photo of your receipts with the mobile app, and Dext’s optical character recognition (OCR) extracts the data. No more piles of paper!

- Automated Data Entry: Dext eliminates manual data entry of financial documents. It extracts key information from receipts and invoices, saving time and reducing errors.

- Seamless Integration: Dext integrates with popular accounting software, such as Quickbooks Online, Xero, Sage, and FreeAgent. Your financial data flows directly into your accounting system.

- Improved Organization: Dext helps you organize your financial records. It makes it easy to track expenses and supplier information all in one place.

- Secure Storage: Your financial documents are stored securely in the cloud. Access them anytime, anywhere.

- Expert Support (Optional): Dext can connect you with an expert accountant if you need help with your bookkeeping.

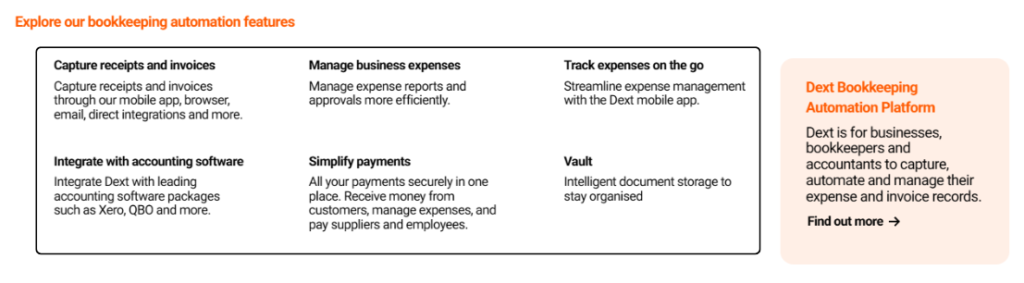

Best Features of Dext

Dext offers some great features that make accounting and bookkeeping easier.

Let’s take a closer look at some of the best ones.

We’d like you to comment below and leave us some feedback about your experience!

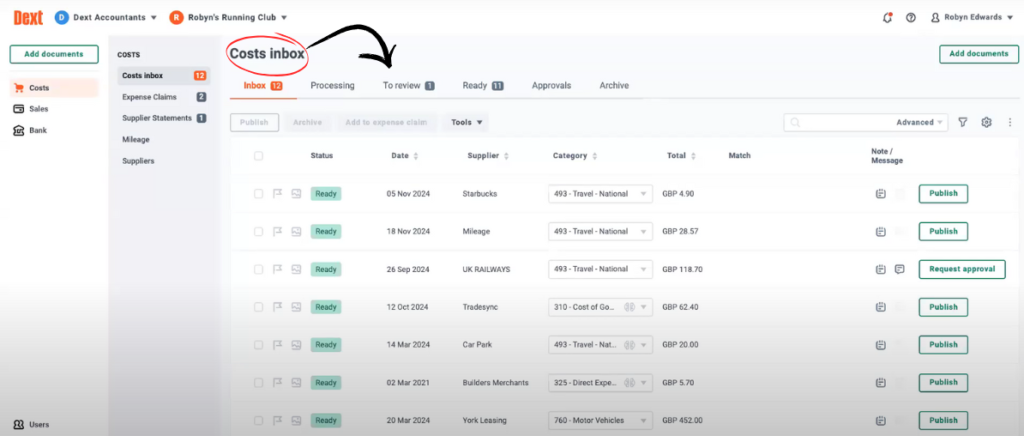

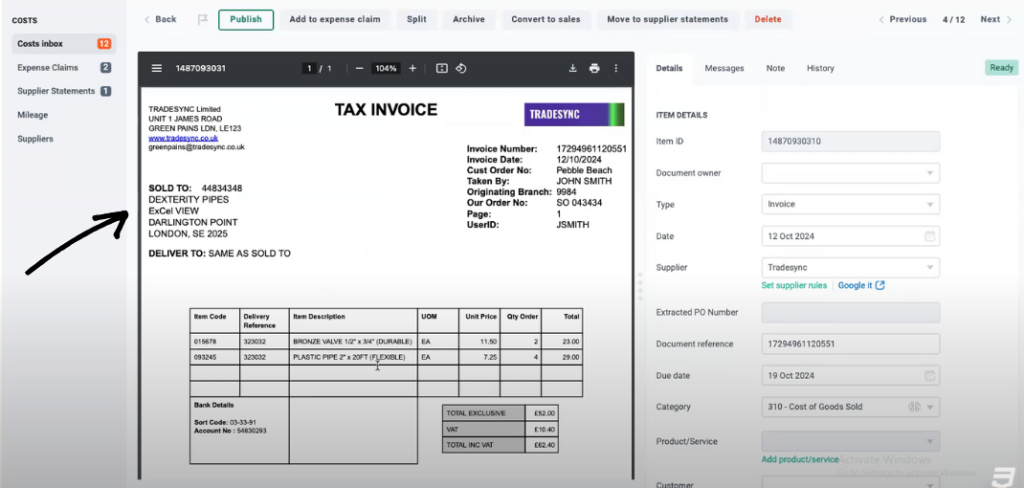

1. Costs Inbox

Dext’s Costs Inbox is a central hub for all your expenses.

You can easily submit receipts and invoices in multiple ways.

This expense tracker app lets you upload documents from across different devices.

Dext dext ensures your expense data is organized and ready for processing.

2. Integration

Dext integrates with popular accounting software like Xero, Sage, and Quickbooks.

This integration with Quickbooks Online and other platforms saves you time and effort.

Dext also syncs with bank feeds and e-commerce platforms.

Dext works with financial institutions worldwide.

3. Capture Receipts & Invoices

Dext uses OCR technology to scan receipts and invoices.

You can take a photo of your receipt and dext provides data extraction.

Dext also handles invoice processing.

This bookkeeping automation feature helps you avoid data entry.

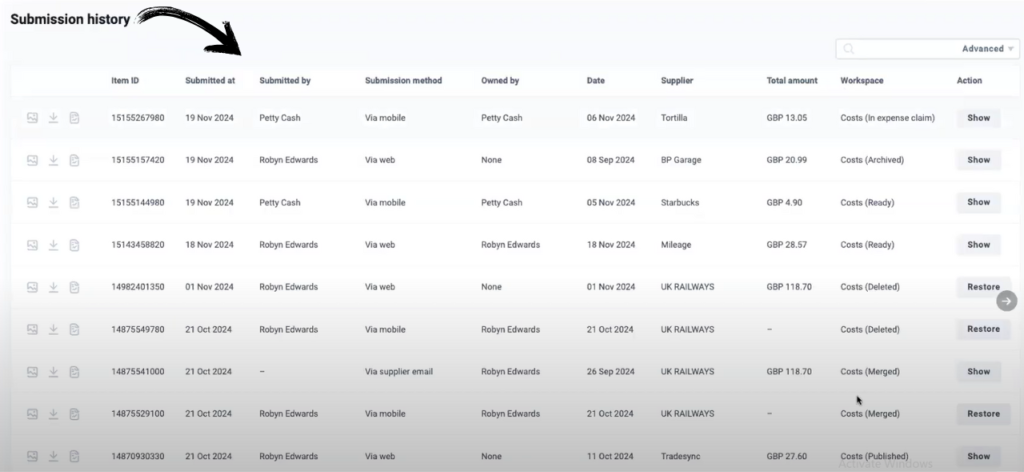

4. Submission History

Dext keeps a record of all your submissions.

This submission history lets you track your expenses and see what you’ve already submitted.

Dext’s software also lets you check the status of your submissions.

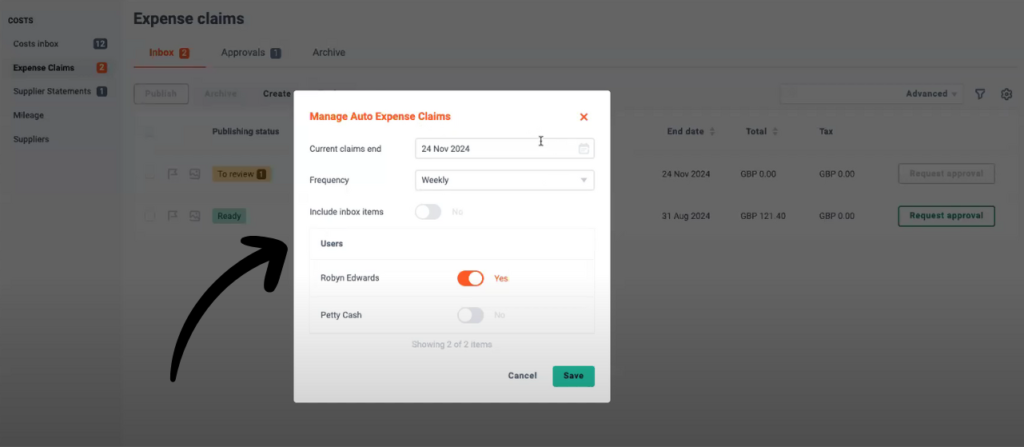

5. Automating Expense Workflow

Dext automates your expense workflow.

It combines AI with data extraction to categorize expenses and format them for reports.

You can even track mileage.

Dext is the best expense management solution to suit your business needs.

Dext’s submission methods make it easy to use, and the data is accurate.

Pricing

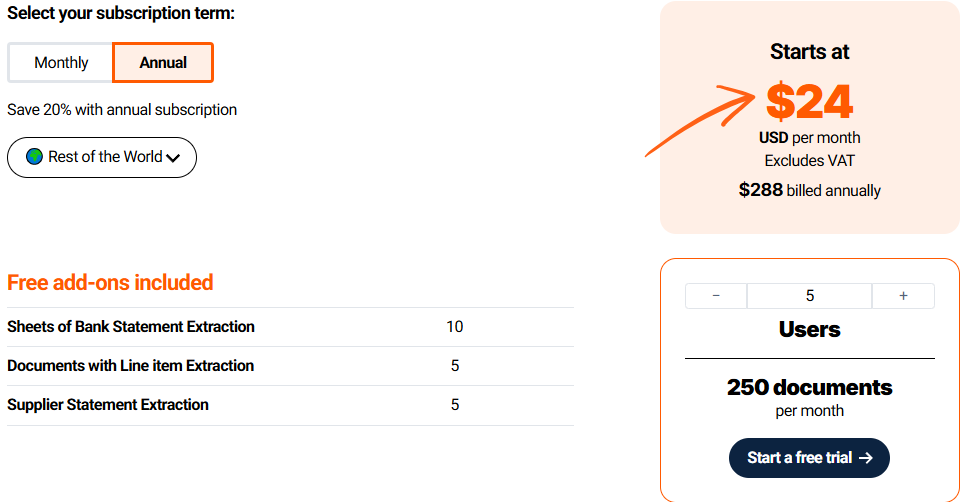

Dext offers different pricing plans to suit various business needs.

Here’s a breakdown of their typical pricing structure:

| Plan Name | Monthly Cost | Key Features |

|---|---|---|

| Annually Subscription | $24/mo | Core features: Receipt capture, data extraction, integrations |

Pros and Cons

Understanding the advantages and disadvantages of Dext is crucial before making a decision.

This helps you determine if it aligns with your business needs.

Pros

Cons

Alternatives of Dext

While Dext is a powerful tool, several alternatives cater to different needs and budgets.

Here are a few:

- Hubdoc: Similar to Dext, focusing on document management and automation. Good for smaller businesses.

- Receipt Bank (now Dext Precision): Another popular receipt capture and expense management solution. Offers robust reporting features.

- Zoho Expense: Part of the Zoho suite. Provides expense tracking and reporting. Integrates with other Zoho apps.

- Expensify: Comprehensive expense management with advanced features. Suitable for larger businesses.

- Quickbooks Online: Offers built-in expense tracking. It is a good option if you are already using QuickBooks.

Personal Experience with Dext

Our team recently used Dext to streamline our expense management process.

We spent a lot of time on manual data entry and struggled to organize our receipts.

Dext proved to be a game-changer. Here’s how it helped us:

- Drastically Reduced Data Entry: Dext’s OCR and data extraction features eliminated hours of tedious work. We could capture receipts with the mobile app, and Dext did the rest.

- Improved Accuracy: By automating data entry, Dext minimized errors and ensured our financial records were accurate.

- Streamlined Expense Reporting: Creating expense reports became significantly more straightforward. Dext’s categorization tools and integration with our Quickbooks Online made the process smooth and efficient.

- Enhanced Organization: Dext provided a central repository for all our financial documents. We could easily track expenses and access records from anywhere.

- Saved Time and Money: Dext freed up our team to focused on more strategic initiatives by automating key tasks, which saved us time and money.

Final Thoughts

Dext is a powerful tool for small businesses.

It simplifies bookkeeping and automates data entry.

Dext integrates with popular accounting software.

It helps you organize your finances and save time.

However, consider the cost and your specific needs.

If you’re tired of manual entry and want a streamlined solution, Dext is worth exploring.

Try Dext’s free trial today and see how it can transform your financial management!

Frequently Asked Questions

How much does Dext cost?

Dext offers different pricing plans based on your business needs. Check their website for the latest pricing. They often have a free trial available.

What accounting software does Dext integrate with?

Dext integrates with many popular platforms, including Quickbooks Online, Xero, Sage, and FreeAgent, making it easy to sync your financial data.

Is Dext secure?

Yes, Dext uses secure methods to store your financial documents. Your data is encrypted and protected.

Can I use Dext on my phone?

Absolutely! Dext has a mobile app for both iOS and Android. You can capture receipts and manage expenses from anywhere.

How accurate is Dext’s data extraction?

Dext’s OCR technology is very accurate. However, like any system, it might occasionally require minor adjustments. Dext ensures your data is as precise as possible.