You’re a small business owner. You’re juggling a lot. Invoicing?

You need simple accounting. But, finding the right software? Tough.

You’re wasting time. Time you could spend growing your business.

Confusing software slows you down. Mistakes cost money, and Frustration builds.

FreshBooks claims to be the answer. Simple. Powerful. But is it really?

We’ll break down FreshBooks and see if it’s worth your time and money. Let’s get started.

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

What is FreshBooks?

FreshBooks is an online tool. It helps small businesses manage money.

Think of it as a digital helper. You can create invoices. Send them to customers.

Get paid faster with online payment options. Track your expenses.

FreshBooks even helps with payroll.

You can use it on your computer or with their mobile app.

It’s designed to be easy. Even if you’re not an expert at accounting.

FreshBooks makes payments and keeping track of money easier for small businesses.

Who Created FreshBooks?

Mike McDerment created FreshBooks. He ran a small web design company.

He got frustrated with invoicing. He lost billable hours.

He built FreshBooks to fix that. He wanted an easy time tracking.

Plus, simple invoices. He wanted to customize templates.

Now, small businesses use its dashboard. It helps them avoid hiring an accountant.

FreshBooks’ vision: save small businesses time.

Top Benefits of FreshBooks

- Send Invoices: FreshBooks lets you quickly create and send invoices. With online options, you can get paid faster and customize them, too.

- Accounting Software for Small Businesses: It’s built for people who don’t love accounting. It simplifies complex tasks, helping you focus on your work.

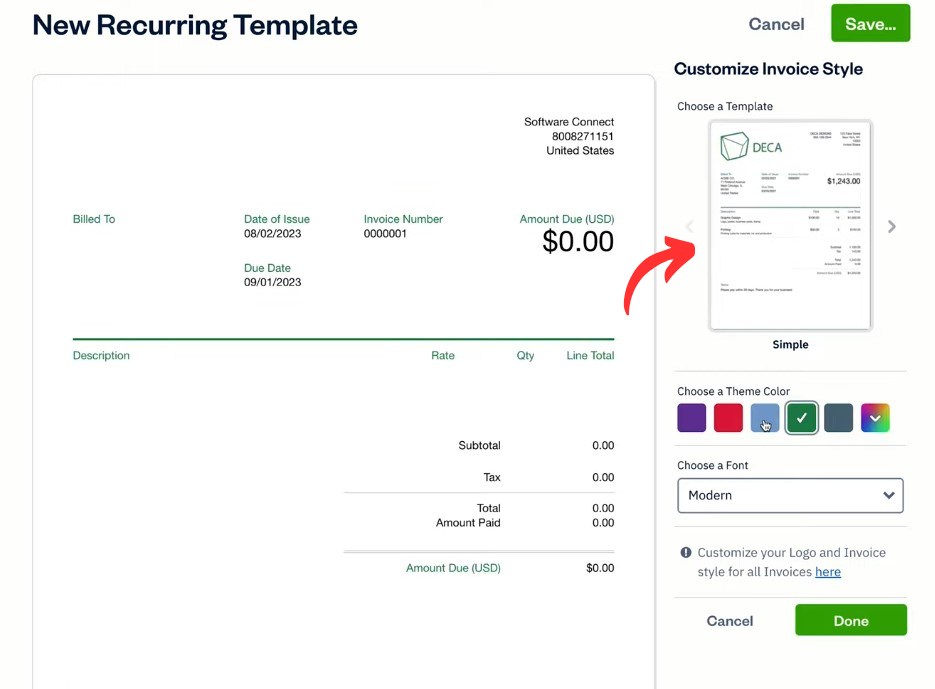

- Recurring Invoices: Set up invoices to send automatically. Great for repeat customers. Save time each month.

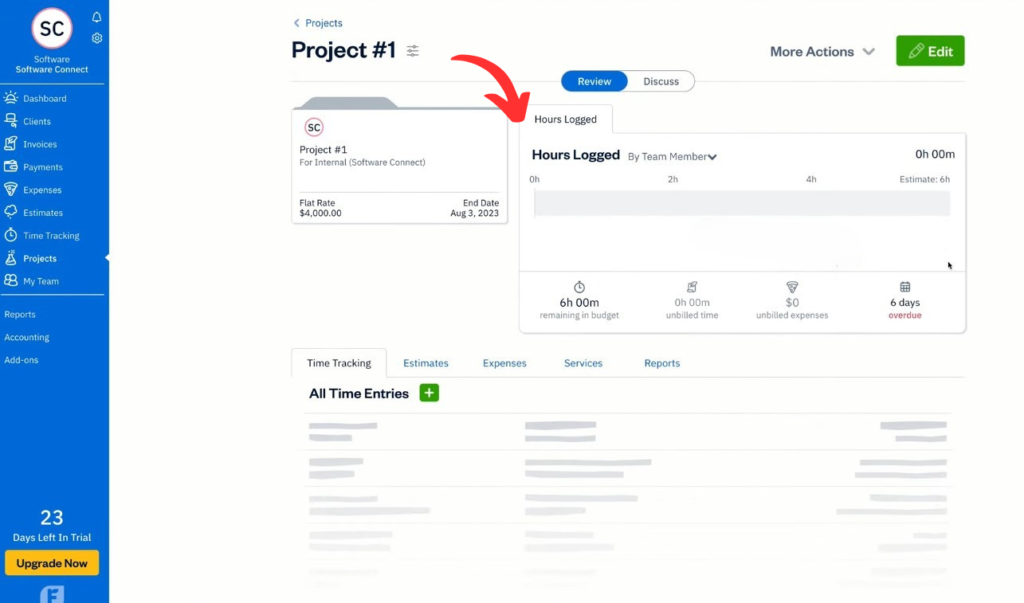

- Track Time: Keep track of your hours for projects. Know exactly how much to bill. This ensures you get paid for all your work.

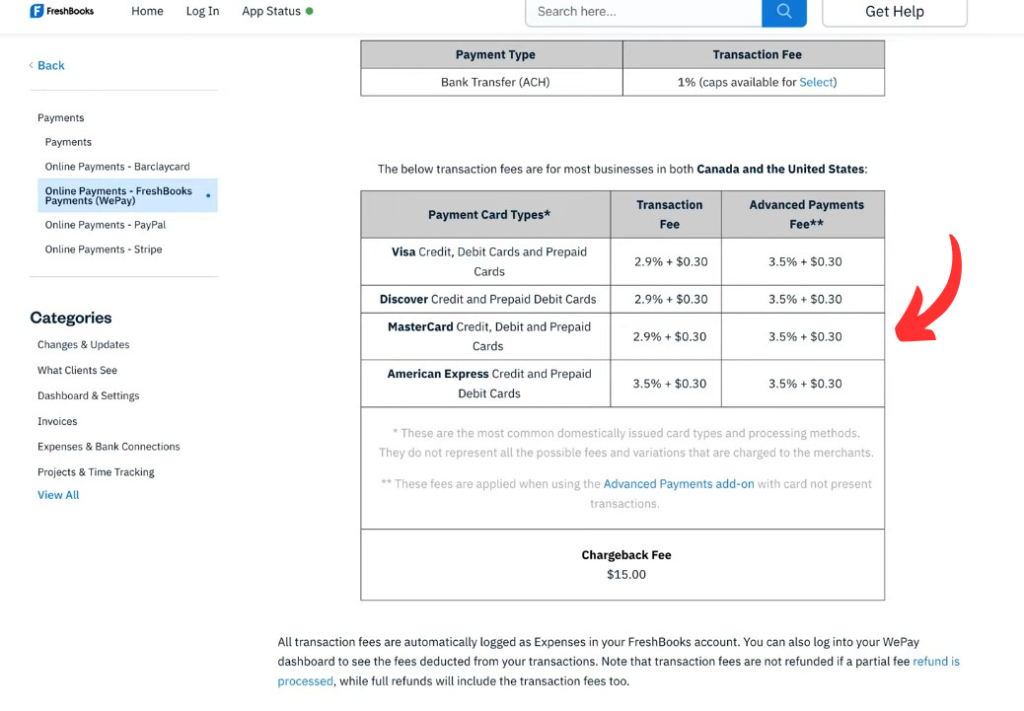

- FreshBooks Payments: Get paid directly through FreshBooks. It makes online payments easy, and customers can pay with a click.

- Accounts Payable: Manage your bills and vendor payments. See what you owe and when. Stay on top of your expenses.

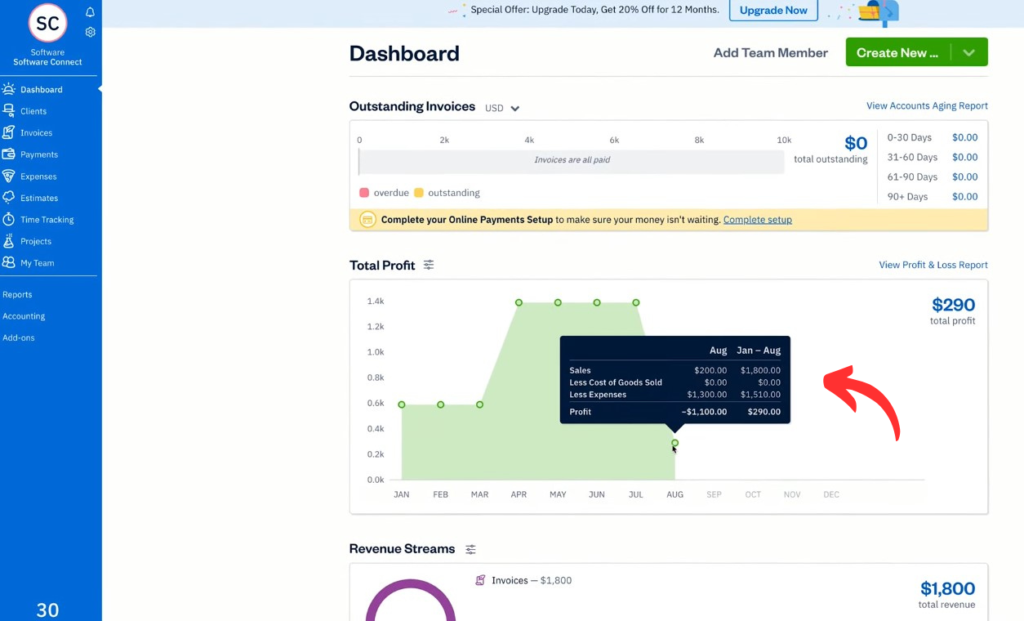

- Accounting Reports: Get clear reports on your business finances. See where your money is going. This will help you make smart decisions.

- Double-Entry Accounting: FreshBooks uses this method for accuracy. It helps keep your books balanced, reducing mistakes.

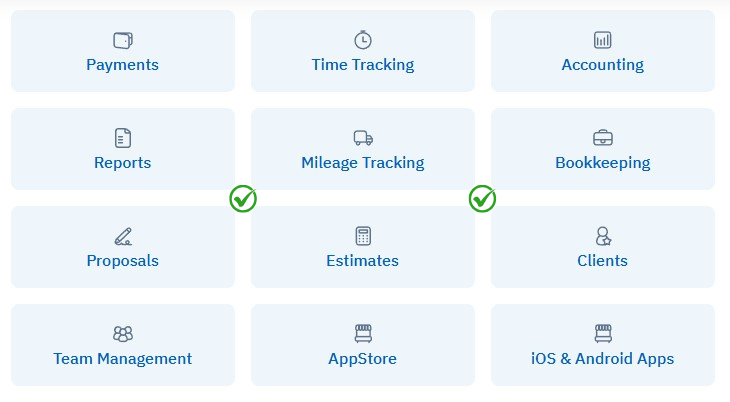

Best Features

FreshBooks has some cool features.

They make running a small business easier.

Let’s look at five of the best ones.

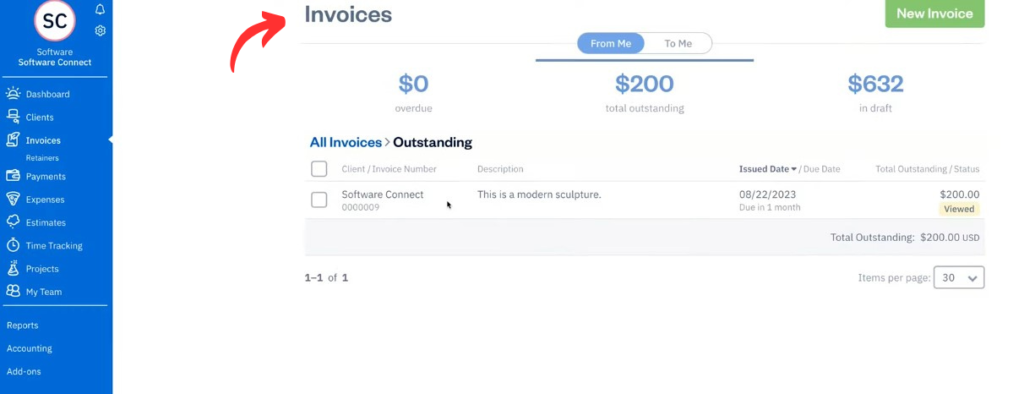

1. Automated Invoices

You can set invoices to send on their own. This is great for regular clients.

You don’t have to remember to send them. FreshBooks does it for you.

This saves you time. You can focus on other work.

You just set it up once. Then, it works automatically.

2. Easy Navigation

The FreshBooks website is simple to use. You can find what you need quickly.

The dashboard shows you important information.

You don’t need to be an expert. Everything is easy to understand.

This makes managing your money less stressful.

3. Payment Management

FreshBooks lets you accept payments online. Customers can pay with credit cards.

This makes getting paid faster. You can see all your payments in one place.

You can also track who has paid. This helps you keep your cash flow organized.

4. Invoice Customization

You can make your invoices look professional. You can add your logo and colors.

This makes your brand look good. You can also add notes and details.

This helps customers understand the bill. It makes your business look more professional.

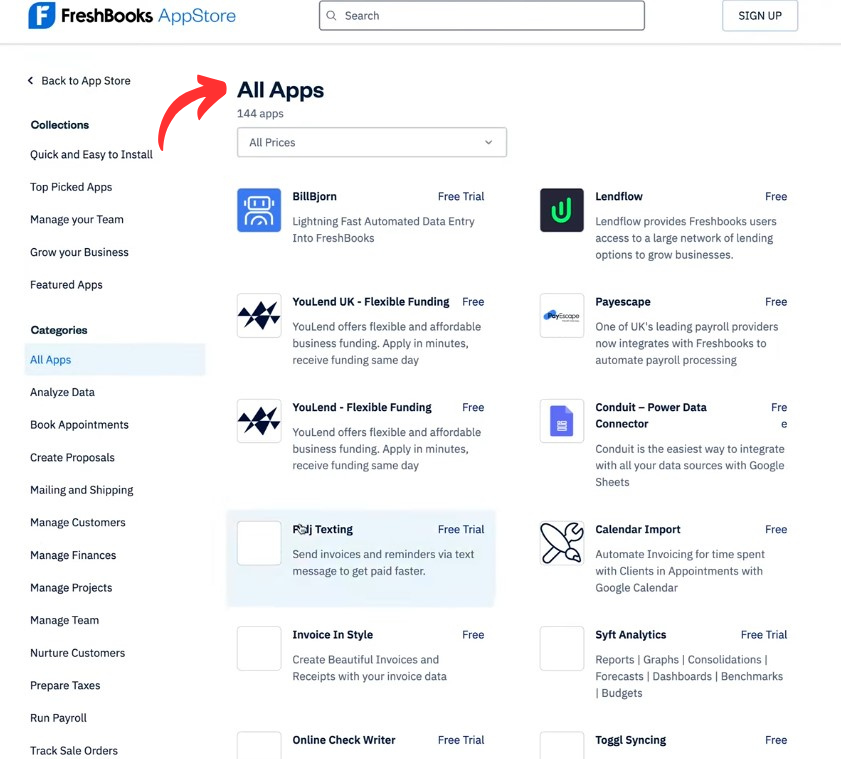

5. Apps Integration

FreshBooks works with other apps. You can integrate it into your bank accounts.

You can also connect it to other tools. This makes your work easier.

You don’t have to enter data twice. This saves you time.

It helps you keep all your information in one place.

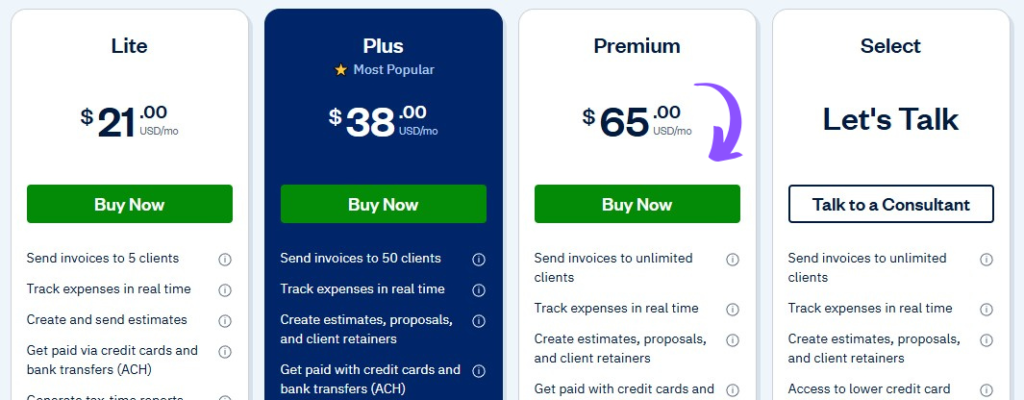

Pricing

| Plan Name | Pricing |

| Lite | $21/month |

| Plus | $38/month |

| Premium | $65/month |

| Select | Custom |

Pros and Cons

Pros

Cons

Alternatives of FreshBooks

Here are the FreshBooks alternatives with a one-line expansion for each:

- QuickBooks Online: A popular choice with more advanced accounting features, it’s suitable for businesses needing robust financial tracking.

- Xero: Great for collaboration and offers strong inventory management, ideal for companies with complex stock needs.

- Zoho Invoice: Budget-friendly with good customization, a solid choice for freelancers seeking affordable invoicing.

- Wave Accounting: Free accounting and invoicing software, perfect for startups & very small businesses on a tight budget.

- Sage Accounting: Sage Offers scalable options, good for growing companies needing advanced features as they expand.

- Harvest: Strong time tracking and project management, highly useful for small businesses that bill by the hour.

Personal Experience with FreshBooks

Our team tried FreshBooks for three months. We needed a simple way to manage invoices.

We also wanted to track time on projects. We had problems with late payments.

We spent too much time on paperwork. We needed a solution that was easy to use.

FreshBooks was a good fit. We hoped it would save us time.

It helped us get organized. Here are our results:

- Invoicing: We could send invoices quickly.

- Time Tracking: We accurately logged project hours.

- Payment Tracking: We saw who paid and who didn’t.

- Reports: We got clear financial overviews.

- Mobile App: We managed tasks on the go.

- Easy Navigation: The website was simple to understand.

- Customer Support: They were helpful when we had questions.

Final thoughts

FreshBooks is great for small businesses. It simplifies accounting.

It’s easy to use. It has strong invoicing and time tracking.

The management tools help you stay organized. It’s good cloud accounting software.

FreshBooks helps track billable time. The phone support is helpful.

It may not be best for large companies needing complex accounting features.

If you need simple invoicing and time tracking, we recommend FreshBooks.

If you want to use FreshBooks, try their free trial. See if it fits your needs.

Frequently Asked Questions

Does FreshBooks handle accounts receivable?

Yes, FreshBooks manages receivables. You see who owes money. It tracks unpaid invoices, which helps you get paid. Reminders help, too. It keeps the cash flow healthy.

Can I use FreshBooks and QuickBooks together?

FreshBooks and QuickBooks differ and serve varied needs. FreshBooks focuses on simplicity, while QuickBooks has more features. You cannot merge them, but data export is possible.

How does FreshBooks help with bill payments?

FreshBooks tracks bill payments, records payments from vendors, and shows what you owe. It keeps finances organized and allows you to upload receipts.

Does FreshBooks have a chart of accounts?

Yes, FreshBooks includes an accounts chart. This helps categorize transactions, which is important for accounting reports. It also simplifies tracking income and expenses and helps with double-entry accounting.

What makes FreshBooks good invoicing software?

FreshBooks is good software because it’s easy to use. It allows you to create & send invoices quickly, automate recurring invoices, and support online payments.