Feeling overwhelmed by small business accounting? You’re not alone!

Choosing the best software can feel like navigating a maze.

Many entrepreneurs struggle with clunky interfaces, hidden fees, and features they don’t actually need.

But what if there was a solution that simplified everything?

What if your accounting software was intuitive, affordable, and packed with the tools you actually use?

In this Wave Review, Best Small Business Accounting Software in 2025, we’ll dive deep into whether Wave is the answer you’ve been searching for.

Let’s explore its features and see if it truly lives up to the hype.

Over 4 million small businesses trust Wave to manage their finances. See why 88% of users report saving an average of 5 hours per month on bookkeeping with Wave. Explore Wave’s plans and find the right fit for your business today!

What is Wave?

Wave is a tool to help small business owners manage their money.

It’s like having a digital notebook and calculator all in one place.

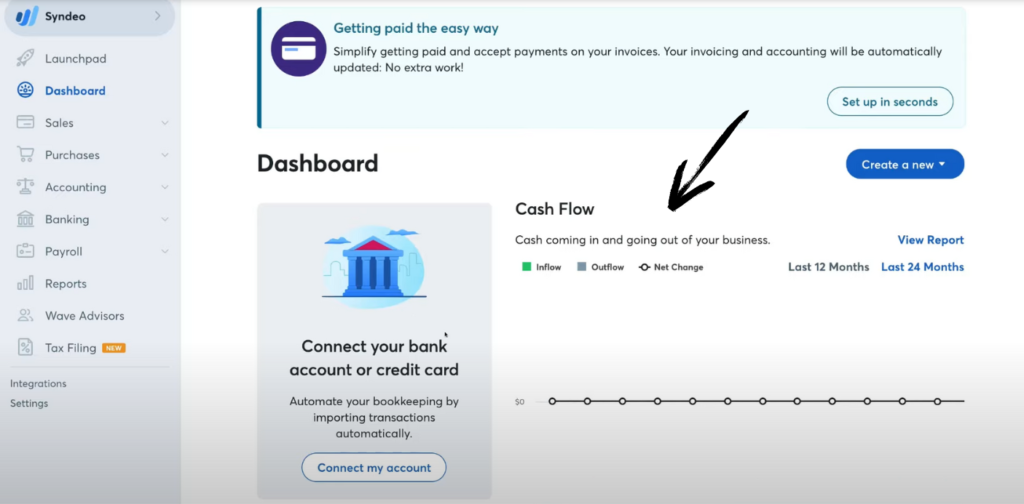

You can keep track of the money coming in and the money going out.

Think of it as a way to see how your business is doing financially without needing a fancy degree.

It helps you with things like sending bills to customers and keeping your income and expenses organized.

This makes it easier to understand your business’s money and make smart choices.

Who Created Wave?

Kirk Simpson and James Lochrie co-founded Wave in 2009 in Canada.

Their goal was simple: make money management easy for small businesses.

They envisioned a user-friendly, affordable tool, unlike the complex options available.

They wanted to empower entrepreneurs to understand their finances without being experts.

Wave has since grown to help millions globally.

Top Benefits of wave

Here are some key reasons why small businesses choose Wave:

- It’s Free for Core Features: One of the biggest draws is that many essential features, like income and expense tracking, invoicing, and basic accounting reports, are offered for free. This helps new businesses save money.

- Easy to Use: Wave is designed to be simple and intuitive, even for people without an accounting background. The straightforward interface makes navigating your finances less complicated.

- Cloud-Based Accessibility: Because it’s online, you can access your wave data from anywhere with an internet connection. This provides flexibility for business owners on the go.

- Integrated Invoicing: Creating and sending professional invoices to your customers is easy within Wave. You can also track payment statuses, helping you manage your cash flow effectively.

- Bank Connections: You can also connect your bank accounts and credit cards to Wave, which automatically pulls in your transactions. This saves time on manual data entry and helps keep your records accurate.

- Scalable Options: While the core features are free, Wave also offers paid add-ons like payroll and payment processing as your business grows and your needs become more complex.

- Good for Service-Based Businesses: Many freelancers and service providers find Wave particularly well-suited for their needs, especially with its invoicing and expense-tracking capabilities.

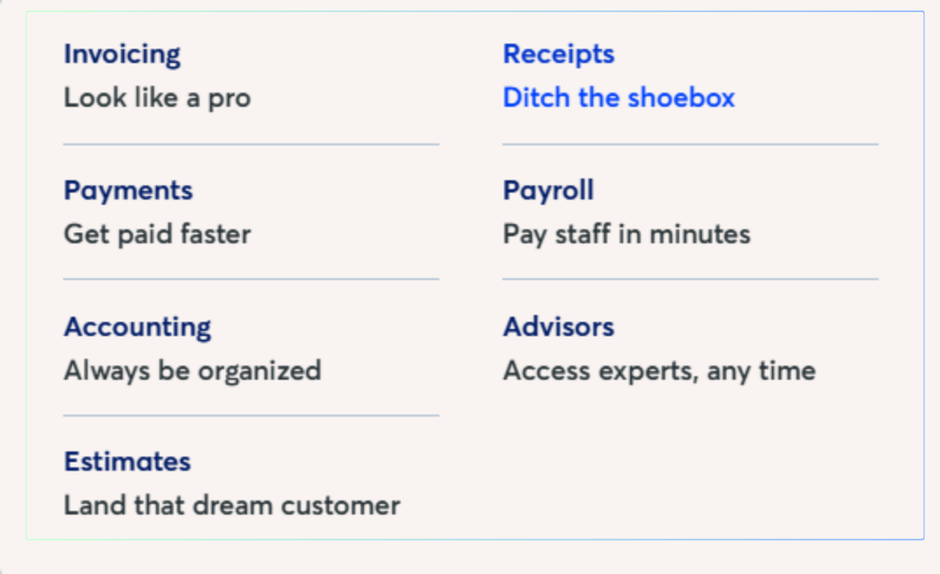

Best Features of Wave

Wave has some great tools to simplify managing your business money.

These features help keep you organized and give you a clearer picture of your finances.

Let’s explore some of Wave’s top capabilities.

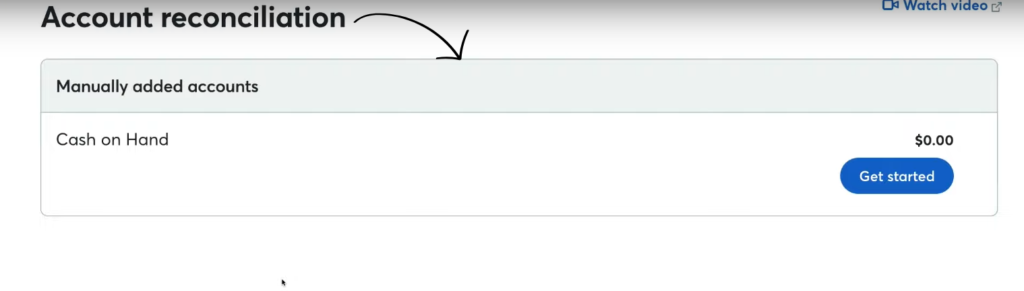

1. Account Reconciliation

Account reconciliation is like checking if your bank records and Wave records agree.

You compare your bank statement to what’s in Wave to find any errors.

This helps you know your true balance.

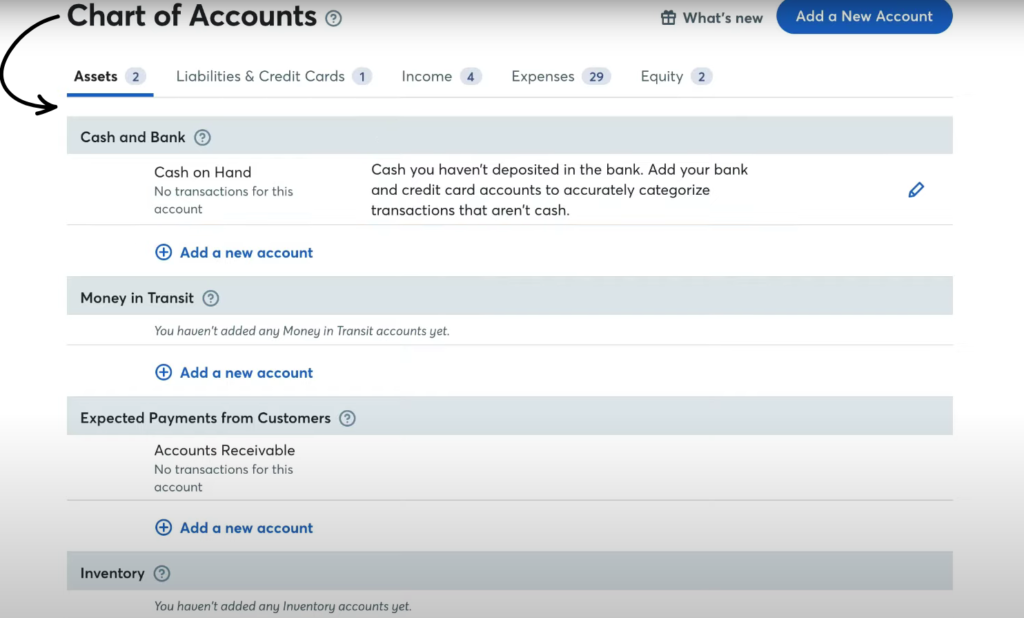

2. Charts of Accounts

Think of the charts of accounts as a list of all your business money categories.

It organizes income, expenses, and what you own and owe.

Wave has a basic setup, and you can add more. This shows where your money comes from and goes.

3. Invoices

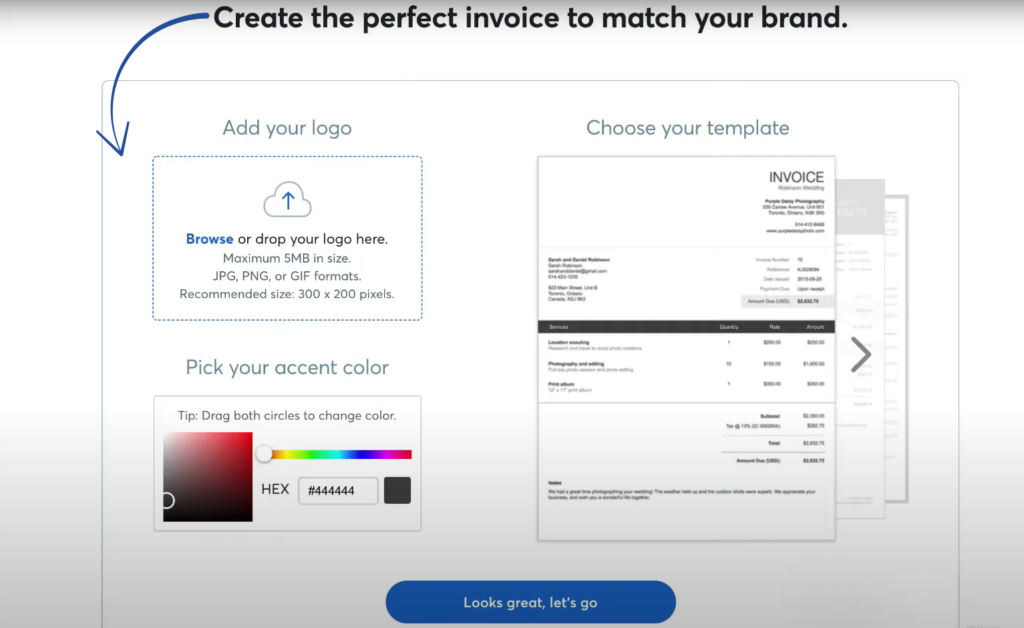

Wave lets you create and send professional bills (invoices) to customers.

You can add your logo and list what they bought.

Wave can even remind them to pay, helping you get paid faster.

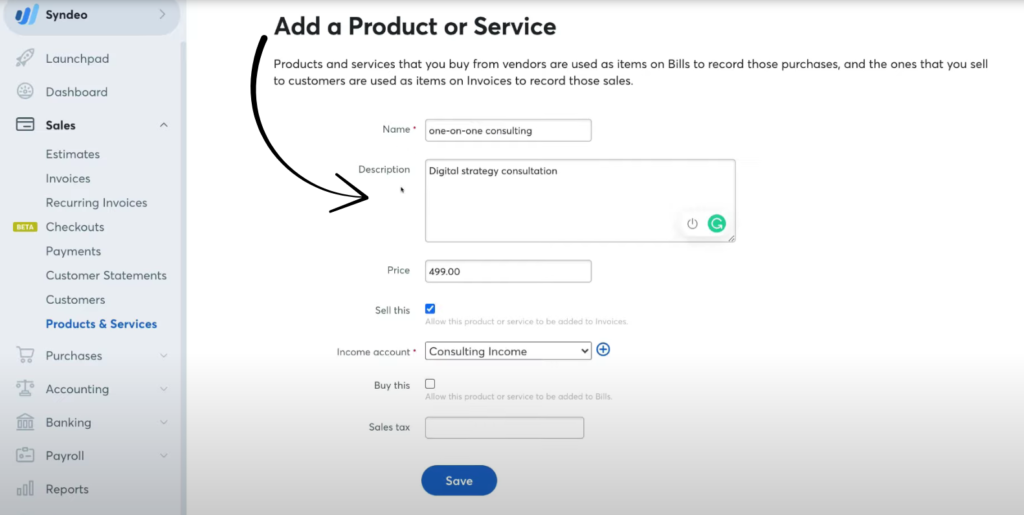

4. Products & Services

If you sell things, this helps you track them. You make a list of your items with prices.

When you bill customers, you just pick from the list.

This saves time and makes sure you bill correctly.

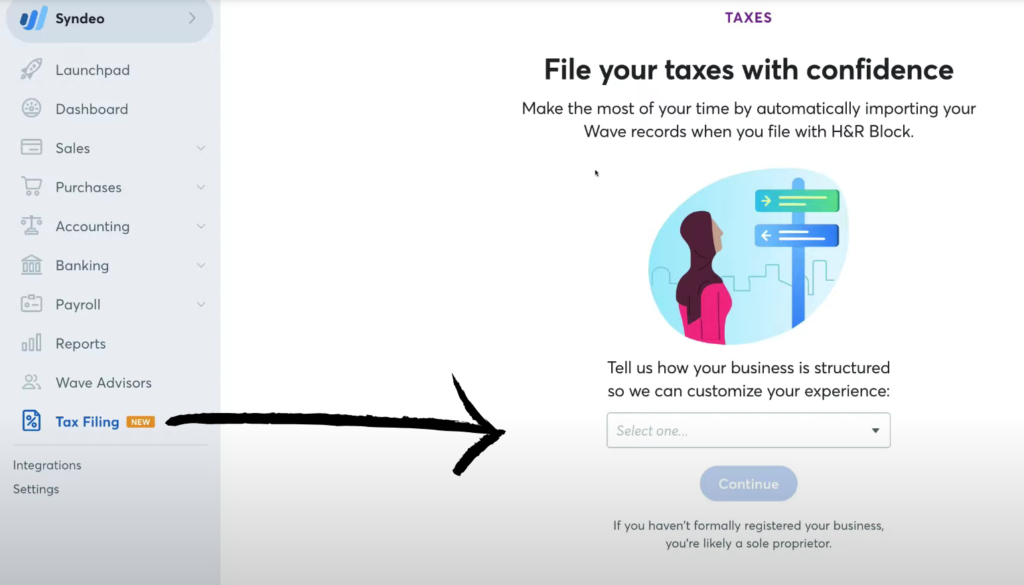

5. Tax Filing

Wave doesn’t file taxes for you, but it helps you prepare.

It organizes your income and expenses for the year.

This makes tax time easier for you or your accountant.

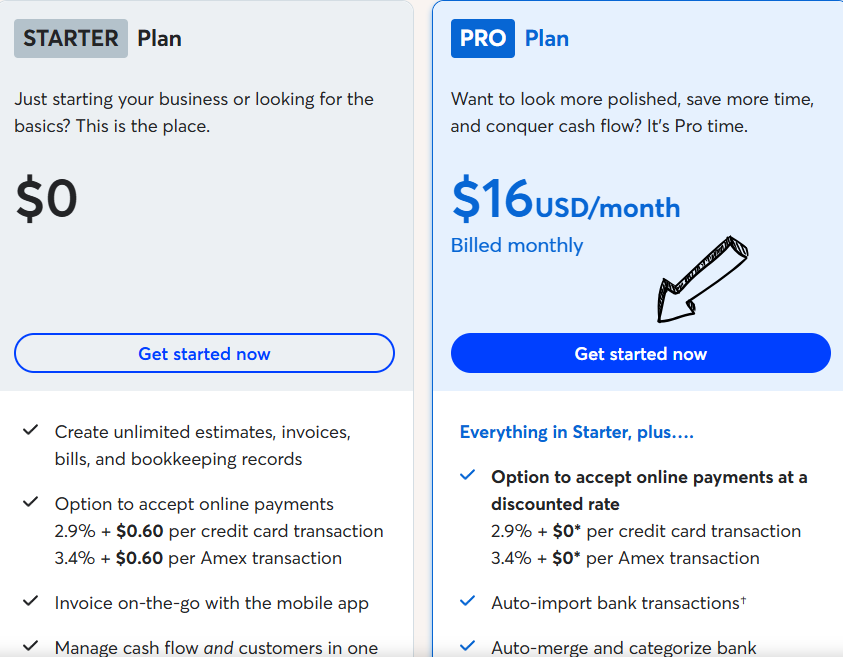

Pricing

Here’s a simple look at Wave Accounting’s pricing:

| Plan Name | Price (Billed Annually) | Key Features |

| Starter Plan | $0 | Create Unlimited estimates, invoices, bills and bookeeping records. |

| Pro plan | $16USD/mo/billed monthly | Auto import bank transactions, Auto merge and categories bank. |

Pros and Cons

Understanding both the good & bad sides helps you decide if Wave fits your business needs.

Let’s explore its key advantages and potential drawbacks.

Pros

Cons

Alternatives Of Wave

If Wave doesn’t quite meet your needs, here are a few alternatives to consider:

- Zoho Books: This software is known for its user-friendly interface and strong focus on automation. It offers various plans, including a free one for very small businesses.

- QuickBooks Online: A popular choice with a wide range of features and integrations. It’s scalable for growing businesses but can be more expensive than Wave.

- FreshBooks: Often favored by freelancers and service-based businesses for its excellent invoicing and time-tracking features. It has limits on clients in lower-tier plans.

Personal Experience with wave

Our team needed a simple yet effective way to manage finances for a small side-project.

wave proved to be a great fit.

We found its user-friendly interface allowed us to get started fast without a steep learning curve.

Here’s how Wave helped us:

- Effortless Invoicing: We easily created and sent professional invoices to our clients.

- Organized Income Tracking: Recording payments and seeing our income was straightforward.

- Simplified Expense Management: Logging business expenses helped us monitor our spending.

- Clear Financial Overview: The basic reports gave us a quick snapshot of our project’s financial health.

Overall, Wave’s core features provided the essential tools we needed to keep our project’s finances organized & transparent without incurring extra costs.

Final Thoughts

Wave is a good choice for new small businesses.

It has free tools for things like bills and tracking money.

It’s also not hard to learn.

However, if you need fancy features like automatic bank updates or employee payments, you’ll need to pay.

So, should you get Wave? It depends on your business needs and your software budget.

If you want free and easy tools to handle basic money stuff, give Wave a try.

See if it works well for your business.

Frequently Asked Questions

Is Wave really free?

Yes, Wave offers a free plan with core features like income and expense tracking, invoicing, and basic reports. However, some advanced features and add-ons, such as payroll and payment processing, do have associated costs.

Is Wave good for small businesses?

Wave is often a great fit for small businesses, especially startups and freelancers. Its free plan offers essential tools, and it’s known for its user-friendly design, making it accessible even without accounting expertise.

Does Wave connect to my bank?

While the free plan allows for manual transaction entry, Wave’s paid plans offer automatic bank feed connections. This feature automatically imports your bank and credit card transactions, saving time and improving accuracy.

Can I use Wave for payroll?

Yes, Wave offers payroll services as a paid add-on in some regions. This allows you to manage employee payments, deductions, and tax filings directly within the Wave platform, integrating your accounting and payroll.

Is my data secure with Wave?

Wave uses industry-standard security measures to protect your financial data. They employ encryption and other safeguards to ensure your information is kept private and secure on their platform.