Are you tired of stressful month-end closing processes?

Do you wish there were a simpler, more efficient way to handle your financial tasks?

You’re not alone!

Many businesses and individuals find the month-end routine overwhelming.

But what if I told you there’s a way to make it easy?

This guide will explain how to use Easy Month End.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial today!

Introduction: Simplifying Your Month-End

Hey, ever feel like the month-end close is a big deal?

Confusing mountain of stuff you have to do? You’re not the only one!

Lots of people who deal with money stuff for businesses feel the same way.

It can seem like a huge task that takes forever.

But guess what? It doesn’t have to be that hard!

Think of it like this: imagine you’re cleaning your room.

In this guide, we’ll show you how to make your month-end close easier than you ever thought possible.

We’ll use your computer money-managing tools (that fancy accounting software!) to help us.

We’ll go through it step by step, like following a super helpful checklist.

Ready to make your end close a breeze?

Let’s get started!

Understanding the Importance

Okay, so we said the month-end close can feel like a pain.

But why do we bother doing it right and doing it quickly?

Think of it like getting your report card on time.

If your teacher takes forever to grade everything, you won’t know how you did for ages, right?

It’s kind of the same for a business.

A fast and smooth month-end close process helps everyone see how the business is doing now, not months later.

Why is that important? Let’s break it down:

- Knowing the Real Score: Imagine trying to play a game without knowing the score. You wouldn’t know if you’re winning or losing! The month-end close helps create a financial report that shows the business’s real score for the month. This includes things like how much money came in and how much went out.

- Seeing the Big Picture (Balance Sheet Time!): Remember that balance sheet we talked about? It’s a key part of the financial report. It shows what the business owns (like cash in the bank or stuff it can sell) and what it owes to others (like bills it needs to pay). A quick month-end close means you get to see this big picture sooner.

- Spotting Mistakes Early: Think of reconciliation like double-checking your homework. When you reconcile things, you’re making sure that the numbers in your computer money system match the numbers in the real world (like the bank statements). Doing this during the month-end close helps the finance team catch any mistakes before they become big problems. For example, maybe someone typed in a number wrong. Balance sheet reconciliation is super important here to make sure the numbers on the balance sheet are correct.

- Making Smart Choices: If you know how your business did last month, you can make better choices this month. Did you sell a lot of one thing? Maybe you should get more of it! Did you spend too much on something else? Maybe you need to cut back. A timely financial close gives you the info you need to make these smart moves.

- Keeping Everyone Happy: Banks, investors, and even the government sometimes want to see these financial statements. A fast month-end close means the finance team can get these reports out on time, which keeps everyone happy and avoids any penalties.

- Less Stress for the Team: Imagine trying to finish a huge project with a super tight deadline. It’s stressful! An efficient month-end close process means the finance team isn’t scrambling at the last minute, trying to put everything together in Excel spreadsheets that might not even be accurate.

So, even though it might seem like just a bunch of paperwork.

A quick and accurate month-end close is super important for knowing how your business is doing, spotting mistakes.

Making smart choices and keeping everyone happy.

It’s way more than just numbers on a page!

How Does Easy Month End Integrate with Accounting Software?

Okay, so “Easy Month End” isn’t some special software you buy.

Think of it more like a smart way of using the money-managing software you already have.

It’s about using the tools inside that software to make your month-end close process way smoother.

Imagine your accounting software as a super-organized digital notebook.

It keeps track of all the money coming in and going out.

Easy Month End” is about using all the cool features in that notebook to make your month-end close less of a headache.

Here’s how it works with some of the stuff your software probably does:

- Keeping Track of Bills (Accounts Payable): Your software helps you keep tabs on all the invoices you need to pay. For an easy month-end close, you’d make sure all the bills that came in during the month are entered into the system. This way, you know exactly how much money your business owes.

- Matching Bank Stuff (Bank Reconciliation): Remember how we talked about bank reconciliation? Your software usually has a special place to help you match the money in your bank account with what your digital notebook says. “Easy Month End” means using this tool regularly to make sure everything lines up. This helps you ensure there aren’t any weird surprises or mistakes.

- Looking at All the Money Trails (Ledger): Your software has a ledger, which is like a detailed history of every single money move. For an easy month-end close, you might run reports from this ledger to double-check that everything looks right.

- Handling Big Stuff (Fixed Assets): If your business owns big things like computers or machines (fixed assets), your software helps keep track of them and how they lose value over time. “Easy Month End” involves making sure this is all up to date.

- Getting Ready for Check-Ups (Audit): Think of an audit as a health check for your business’s finances. If you’ve been using your software in an organized way for your monthly closing, it makes the audit much easier because all your information is neat and tidy.

Using Your Accounting Software

Alright, let’s get down to the nitty-gritty.

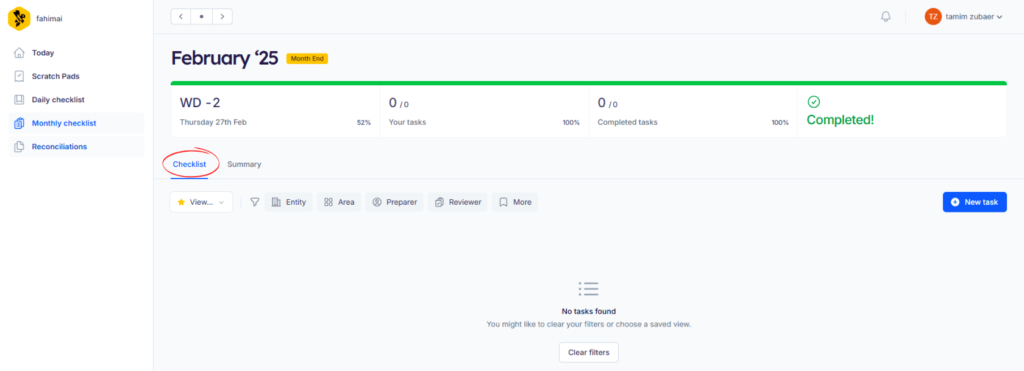

Here’s a simple step-by-step way to use your accounting software to make your month-end close process way easier

Step 1: Getting Ready Before the Month Ends

- Think of this as packing your backpack the night before school. It makes the morning way less crazy.

- Have a Plan: Do you know what needs to be done and when? Make a simple list or checklist for your month-end close.

- Know Who Does What: If more than one person is helping with the money, make sure everyone knows what they’re in charge of.

- Check Your List of Accounts: Your accounting software has a list of all your money categories (like “money in the bank,” “money customers owe us,” etc.). This is called your general ledger. Take a quick look to make sure everything looks right.

- Set Up Repeat Stuff: If you have the same money things happening every month (like paying rent or when things lose value over time – that’s called depreciation), make sure these are set up to happen automatically in your software.

- Gather Your Papers: Think about all the important money papers you’ll need, like bank statements and invoices. Knowing where they are beforehand saves time later.

- Explore Your Software: Take a few minutes to click around the month-end close section of your accounting software to see what tools and reports are there.

Step 2: Setting the End Date

- This is like saying, “Okay, we’re stopping here for this month’s count.”

- Tell your accounting software, “This is the last day of the month we’re looking at.” This will help it determine which transactions to include in your monthly financial reports.

Step 3: Checking the Bank and Card Stuff

- Time to make sure your software’s numbers match the bank’s numbers.

- Use the bank reconciliation tool in your software. It helps you compare what your software says you have in the bank with what the bank says you have.

- Look for any differences. Maybe a customer paid you, but it hasn’t shown up in your software yet, or maybe the bank charged a small fee. Figure out why the numbers don’t match and fix it.

Step 4: Looking at Who Owes You Money

- This is like checking your list of friends who borrowed your toys.

- Your software will have a list of all the customers who have yet to pay you (accounts receivable).

- Take a look at this list. Are there any customers who are really late on their payments? Maybe you need to send them a reminder.

- Make sure all the payments you received from customers are recorded correctly in your software.

Leveraging Accounting Software Features

Guess what?

Your accounting software has a bunch of cool tools built right in to make your month-end close process way easier.

It’s like having a bunch of helpers that can do some of the boring stuff for you!

Let’s look at some of these helpful features:

- Automatic Repeating Stuff: Remember how some bills or income happen the same way every month? Your software can often be set up to record these automatically, saving you from having to type them in every single month during the month-end close.

- Connecting to Your Bank (Automatic Bank Feeds): Instead of you having to type in every single thing that goes in and out of your bank account, your software can often connect directly to your bank. This brings in your bank financial data automatically, making bank reconciliation (that matching game we talked about) much faster.

- Helping You Match Things Up (Reconciliation Tools): We know bank reconciliation is important for making sure your financial records are right. Your software usually has special tools that help you see which transactions in your system match the ones in your bank statements. It can even guess some of the matches for you!

- Making Reports Just for You (Customizable Reports): Instead of looking at a giant list of all your money stuff, your software can make reports that show you just the information you need for your month-end close. You can often choose exactly what you want to see.

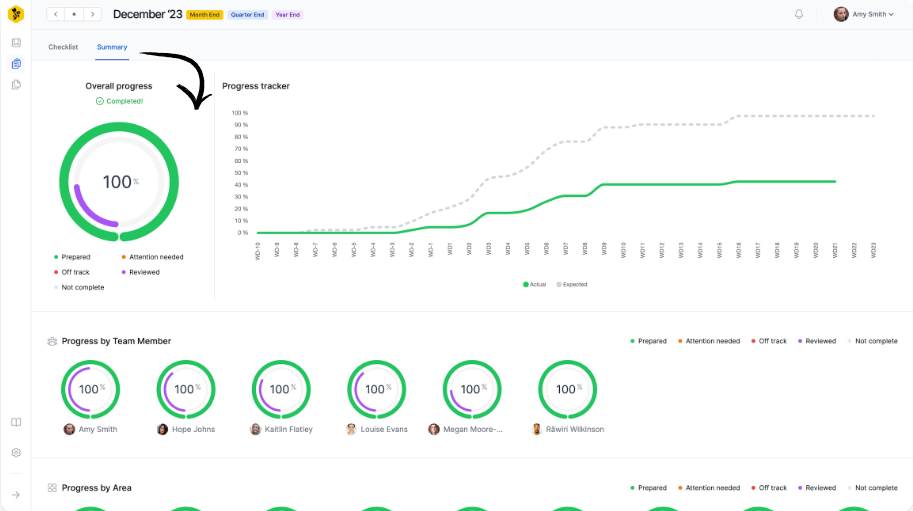

- Seeing the Big Picture at a Glance (Dashboards): Some software has dashboards—like a control panel in a car—that give you a quick look at your business’s performance. This can help you spot any problems early on before you even start the full month-end close.

- Keeping track of Little Cash (Petty Cash Management): If you have a little bit of petty cash, some software can help you keep track of what’s being spent and who’s using it, making it easier to balance at the month-end close.

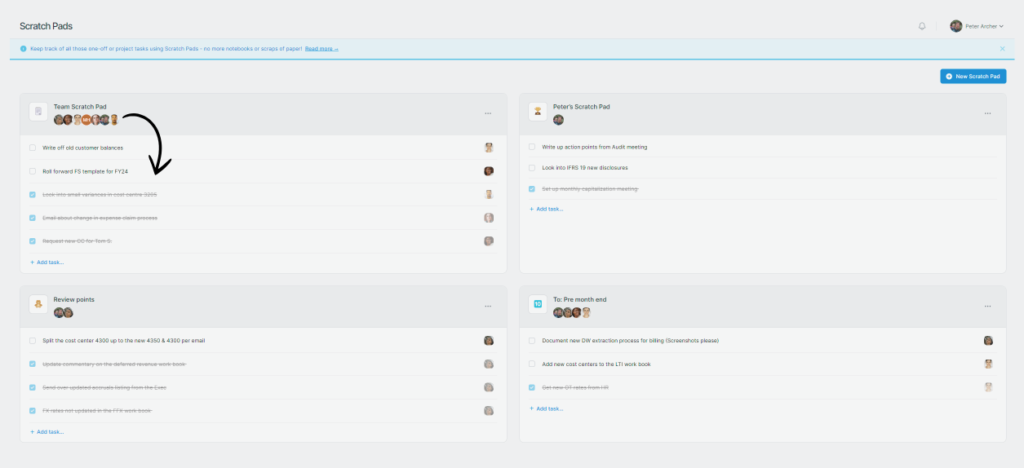

- Working Together (Collaboration Tools): If you have a team helping with the money stuff, some software lets you all work on things and see updates. This can make the month-end close process smoother when more than one person is involved.

By using these features in your accounting software.

You can automate a lot of the work, get a clearer picture of your financial data, and ensure that your financial records are accurate.

It’s like having a smart assistant that makes the whole month-end close much less of a hassle!

Wrapping Up

It might have seemed like a lot at first, but remember.

It’s all about breaking it down into smaller, manageable chunks.

The big takeaway here is that the month-end close doesn’t have to be a scary monster hiding at the end of every month.

Think of it like learning a new game.

At first, all the rules seem confusing.

But once you practice and understand how everything works together.

It becomes much easier and even a little bit fun (well, maybe not super fun, but definitely less stressful!).

So, take these tips, explore your accounting software, and don’t be afraid to try things out.

With a little practice, you’ll be a month-end close pro in no time! You got this!

Frequently Asked Questions

Why is the month-end close important?

The month-end close is important because it helps you create accurate financial reports. These reports show how your business is doing and help you make good decisions. A timely month-end close process also helps catch mistakes early.

How long should the month-end close process take?

The time it takes for the month-end close process varies depending on your business’s size and complexity. However, with good planning and effective use of your accounting software, you can significantly speed up the process.

What are some common mistakes during the month-end close?

Common mistakes during the month-end close include rushing reconciliations, not setting clear cut-off dates, and skipping the review of financial reports. These errors can lead to inaccurate financial data.

Can accounting software really simplify the month-end close?

Yes! Accounting software has many features that can simplify the month-end close. Automating recurring entries, using bank reconciliation tools, and creating customizable reports can all speed up the process and help ensure accurate financial records.

What happens if the month-end close isn’t done properly?

If the month-end close isn’t done properly, your financial reports may not be accurate. This can lead to poor business decisions, difficulties with taxes, and a lack of understanding of your company’s true financial health.