Credit scores got you down? Struggling to fix errors and boost your creditworthiness?

You’re not alone. Many people find credit repair confusing and overwhelming.

But what if there was a tool to simplify the process?

In this Credit Repair Cloud review, we’ll explore whether this software lives up to the hype and whether it’s the best option for you.

Keep reading to find out!

Join the thousands using Credit Repair Cloud to take control of their credit. See how it can help you, too! Click here for a special offer.

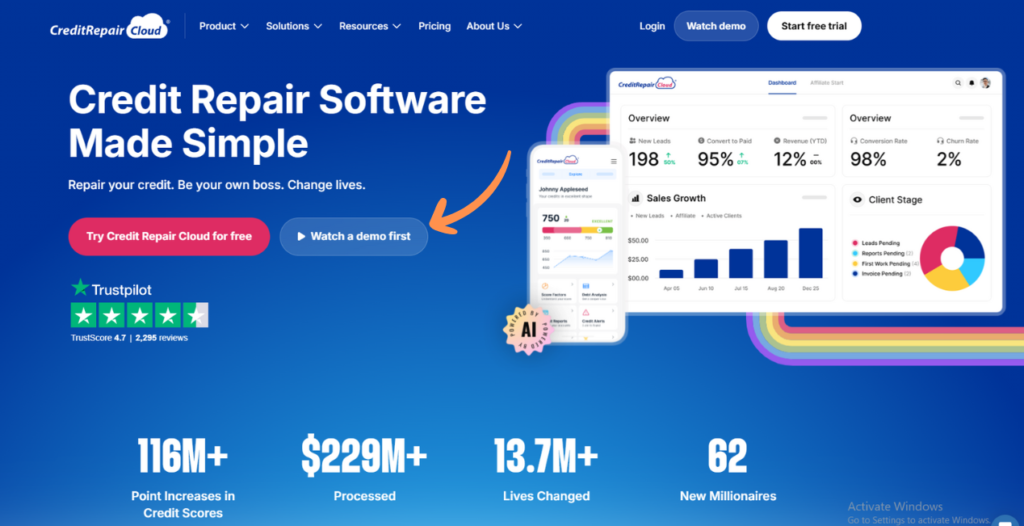

What is Credit Repair Cloud?

Credit Repair Cloud is credit repair software that helps you create and run a credit repair business.

It’s easy to learn and automates every step of the way.

You can pull credit reports, audit credit, and dispute errors with the bureau.

It helps you manage clients and provide excellent credit repair services.

Founded by Daniel Rosen, it’s designed for entrepreneurs who want to help others improve their credit.

Who Created Credit Repair Cloud?

Credit Repair Cloud was founded by Daniel Rosen.

He started in the credit repair industry himself and saw a need for better tools.

His vision was to empower others to start their own credit repair business & change lives by helping people improve their credit.

He wanted to make the process easy to learn and automate the tedious tasks.

Today, Credit Repair Cloud is a leading software in the credit repair industry that helps entrepreneurs worldwide.

Top Benefits of Credit Repair Cloud

- Become a Credit Hero: Credit Repair Cloud empowers you to become a credit hero for your clients. You’ll have the tools and resources to guide them through the complex world of credit repair and help them achieve their financial goals.

- Excellent Customer Support: Need help? Credit Repair Cloud offers top-notch customer support to guide you every step of the way. They’re there to answer your questions and help you maximize the software’s potential.

- Streamlined Credit Audits: Credit audits can be time-consuming. Credit Repair Cloud simplifies this process, making it easy to identify inaccurate items on clients’ credit reports.

- Effective Dispute Management: Dealing with the bank or credit bureaus regarding a complaint can be frustrating. This software helps you manage and track disputes efficiently, improving your chances of success.

- Built by an Industry Expert: Credit Repair Cloud, founded by Daniel Rosen, CEO and founder, was designed by someone with deep experience in the credit repair industry. This translates to a powerful and effective tool.

Best Features of Credit Repair Cloud

Credit Repair Cloud isn’t just software; it’s a complete system to transform credit repair and help their clients.

It’s designed to enable you to kickstart or grow a successful career in the credit repair industry.

Let’s explore some of its best features:

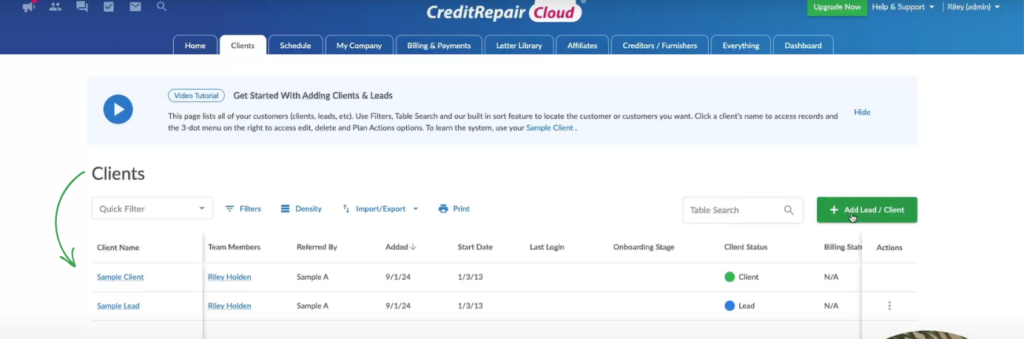

1. Clients & Leads

Managing clients with their credit is easy with Credit Repair Cloud.

The system helps you onboard clients smoothly.

You can import client data and keep everything organized.

It’s like having a dedicated portal for each client, making tracking their progress and better serving them easy.

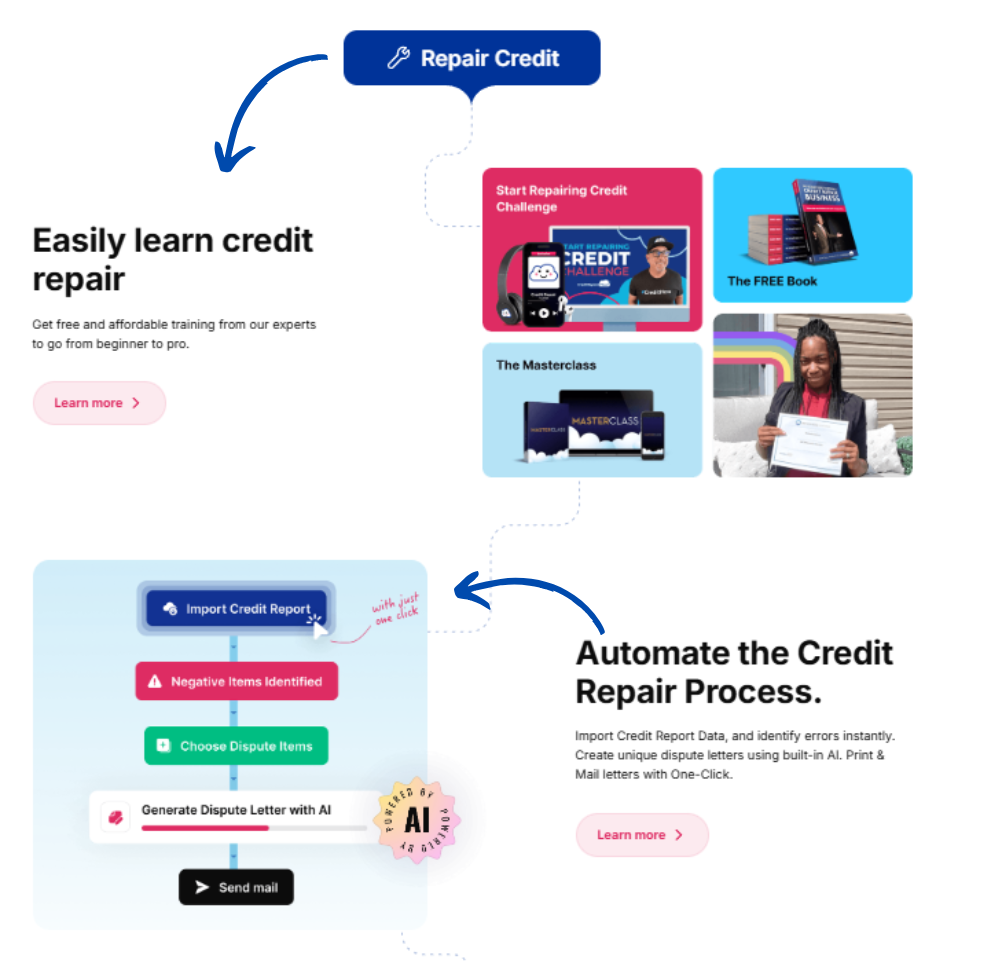

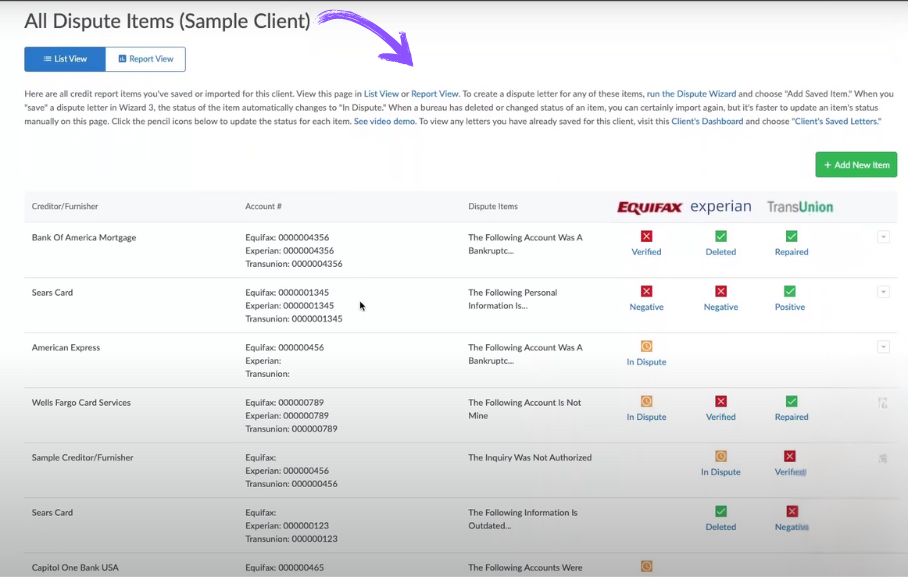

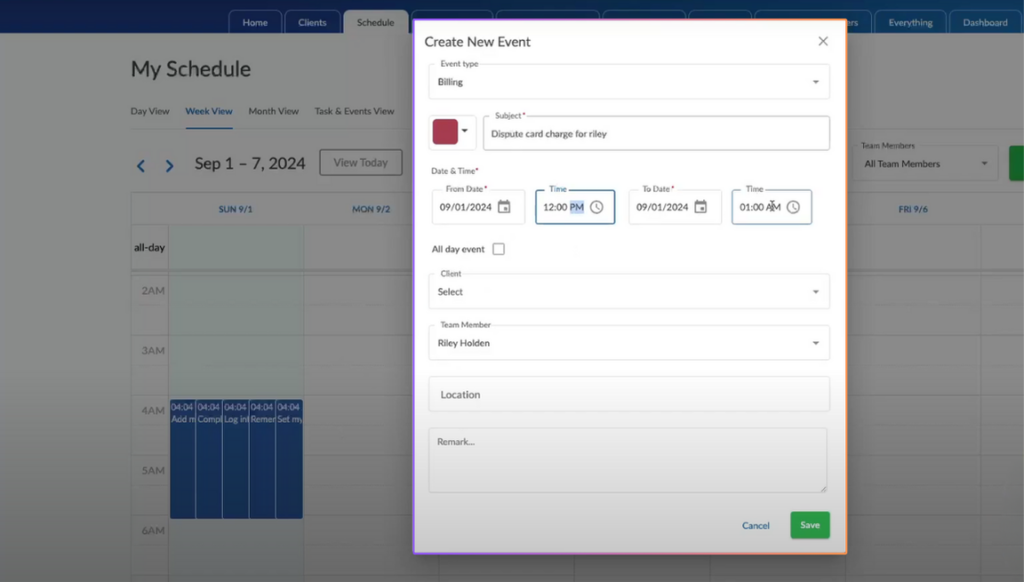

2. Dispute Items

Disputing inaccurate items is key to improving a person’s credit.

Credit Repair Cloud simplifies this process.

You can quickly generate dispute letters and track the status of each dispute.

This feature helps you comply with the Consumer Financial Protection Bureau (CFPB) and other regulations, ensuring you operate within federal law.

This is crucial to avoid violating the Fair Credit Reporting Act and potential lawsuits.

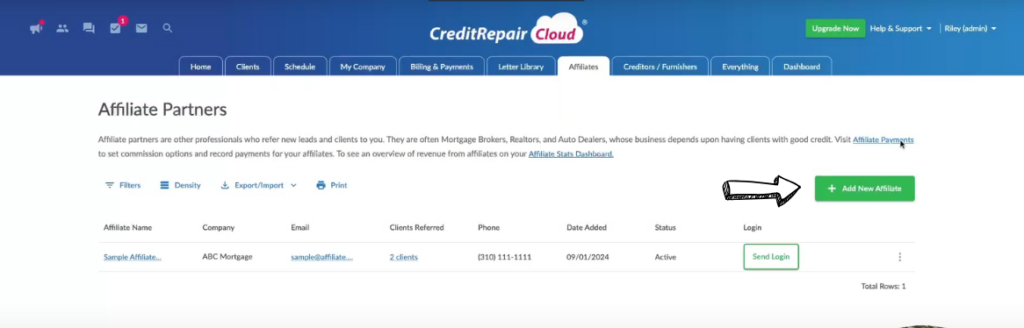

3. Affiliate Partners

Want to grow your business?

Credit Repair Cloud lets you partner with mortgage brokers and other professionals.

This helps you reach more clients and build a stronger network.

It’s a great way to generate leads and make a great living.

It’s helped thousands of entrepreneurs grow their businesses and helped their clients improve their credit ratings and histories.

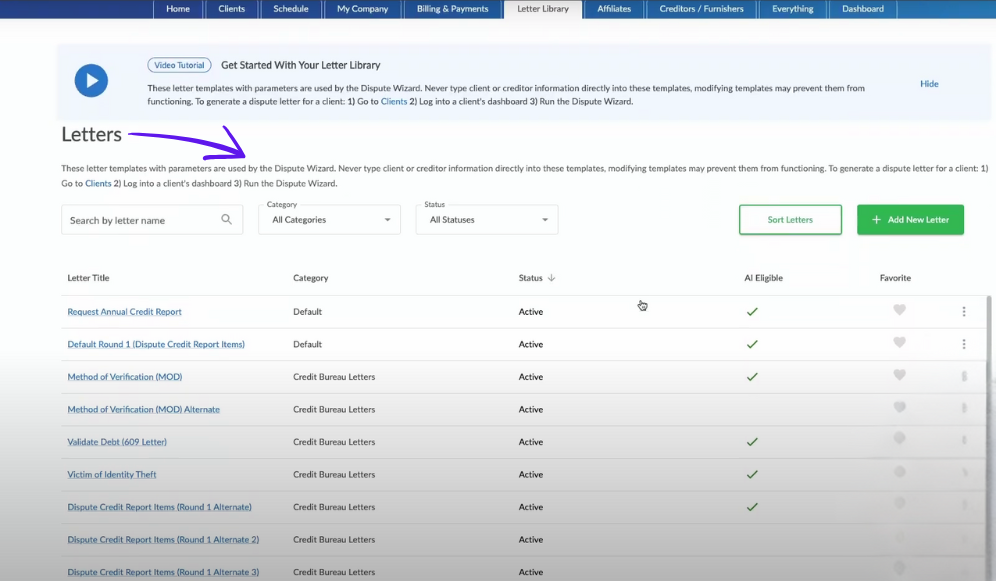

4. Letter Library

Credit Repair Cloud provides a library of pre-written letters.

These templates cover many situations, saving you time and effort.

You can customize these letters to fit your specific needs.

This makes it easy to start a credit repair business and repair your credit effectively.

It also helps you enforce your clients’ rights when dealing with big banks and bureaus.

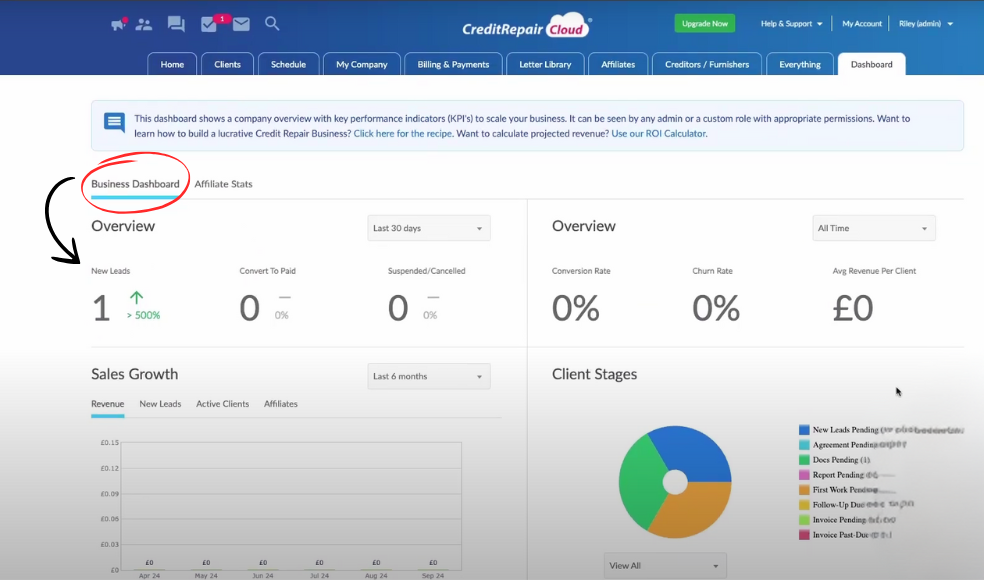

5. Business Dashboard

Keep track of your business performance with the Business Dashboard.

See how many clients you have, track your revenue, and monitor your progress.

This gives you valuable insights & helps you take action to grow your business.

Credit Repair Cloud’s pricing is designed to help you make a great living while providing a valuable service.

They have excellent training, and we’re always adding new features.

They even recommend this challenge to anyone looking to start a career in credit repair.

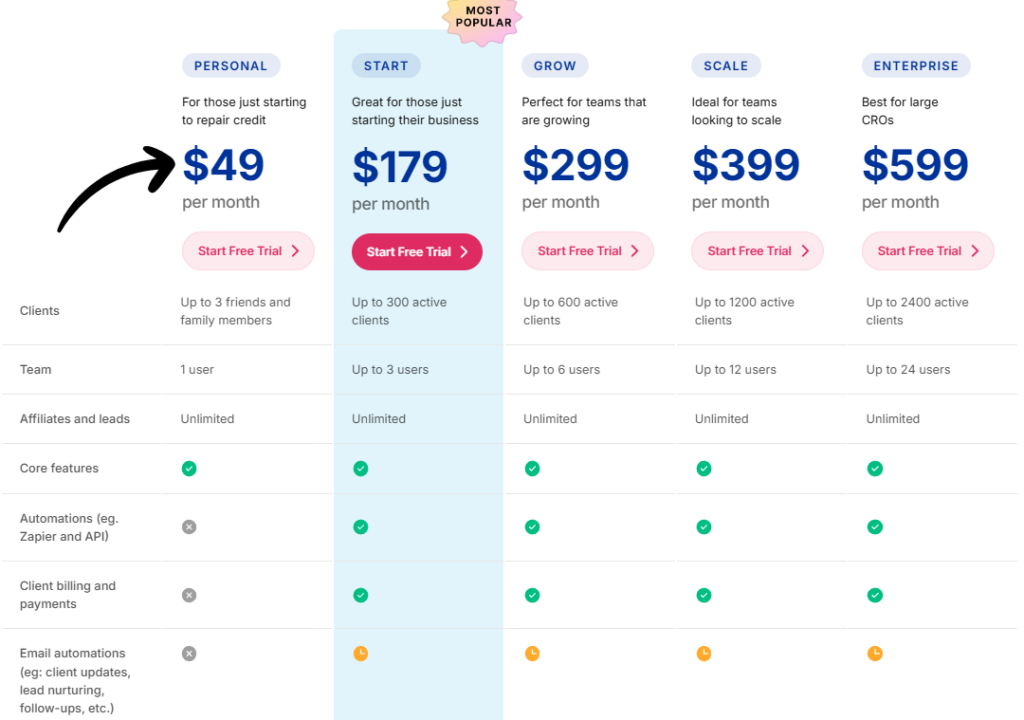

Pricing

Credit Repair Cloud offers different pricing tiers to suit various business sizes and needs.

While specific pricing details can change, visiting their website for the most up-to-date information is best.

Generally, their pricing is structured around a monthly subscription model.

| Plan Name | Key Features | Typical Price Range (Monthly) |

|---|---|---|

| Personal | up to 3 friends and family members, 1 User, Unlimited. | $49/mo |

| Start | up to 300 active clients, 3 Users, Unlimited. | $179/mo |

| Grow | up to 600 active clients, 6 Users, Unlimited. | $299/mo |

| Scale | up to 1200 active clients, 12 Users, Unlimited. | $399/mo |

| Enterprise | up to 2400 active clients, 24 Users, Unlimited. | $599/mo |

Pros and Cons

Understanding the advantages and disadvantages of any software is crucial before making a decision.

This helps you determine if it aligns with your business goals and needs.

Pros

Cons

Alternatives of Credit Repair Cloud

While Credit Repair Cloud is a popular choice, several options exist.

Here are a few:

- Credit Repair Magic: Another cloud-based software. Offers similar features. It may have a different pricing structure.

- DisputeSuite: Focuses on dispute management. A good option for businesses prioritizing this aspect.

- Credit Admiral: A more affordable option. It may be suitable for smaller startups.

- Manual Methods: Using spreadsheets and templates. A fundamental, low-cost approach. Requires more manual work.

Choosing the right alternative depends on your budget, specific needs, and business size.

Research each option carefully before making a decision.

Personal Experience with Credit Repair Cloud

Our team recently used Credit Repair Cloud to help clients improve their credit scores.

We were impressed with how the software streamlined the entire process.

Here’s a breakdown of our experience:

- Client Onboarding: The client portal made onboarding a breeze. We easily imported their credit report and personal information.

- Credit Audit: The credit audit feature quickly identified several inaccurate items. This saved us significant time compared to manual review.

- Dispute Management: Generating and sending dispute letters was simple, thanks to the pre-written letter library. We tracked the status of each dispute within the software.

- Client Communication: We updated the client on our progress through the platform—this enhanced transparency and trust.

- Results: Our client’s credit rating improved noticeably within a few months. We attribute this success, in part, to Credit Repair Cloud’s practical tools and features.

Final Thoughts

Credit Repair Cloud is a powerful software for anyone serious about the credit repair business.

It simplifies complex tasks, automates workflows, and helps you manage clients effectively.

While it comes with a monthly cost, the benefits can outweigh the expense.

Credit Repair Cloud is worth considering if you want to streamline your operations & improve client outcomes.

Ready to take your credit repair business to the next level?

Visit the Credit Repair Cloud website today to learn more and start your free trial!

Frequently Asked Questions

What is Credit Repair Cloud?

Credit Repair Cloud is credit repair software that helps you create and run a credit repair business. It automates tasks like pulling credit reports, performing credit audits, and disputing inaccurate items with the bureau. It’s designed to help others improve their credit rating.

How much does Credit Repair Cloud cost?

Credit Repair Cloud offers different pricing plans. The cost varies depending on the features and the number of clients you manage. Visit their website for the most updated pricing information. They often have special offers.

Is Credit Repair Cloud easy to use?

Yes, Credit Repair Cloud is designed to be easy to learn. It has an intuitive interface and excellent training materials, so you can quickly get started even if you’re new to credit repair. We’re always here to help, too.

Does Credit Repair Cloud guarantee results?

No software can guarantee specific credit improvement. Credit repair depends on the various factors, including the accuracy of the credit report and the client’s cooperation. Credit Repair Cloud provides the tools to help clients, but results are not guaranteed.

What kind of customer support does Credit Repair Cloud offer?

Credit Repair Cloud offers excellent customer support. They provide resources, tutorials, and direct support channels to assist you with questions or issues. We’re committed to customer success.