Is Expensify Worth It?

★★★★★ 4.1/5

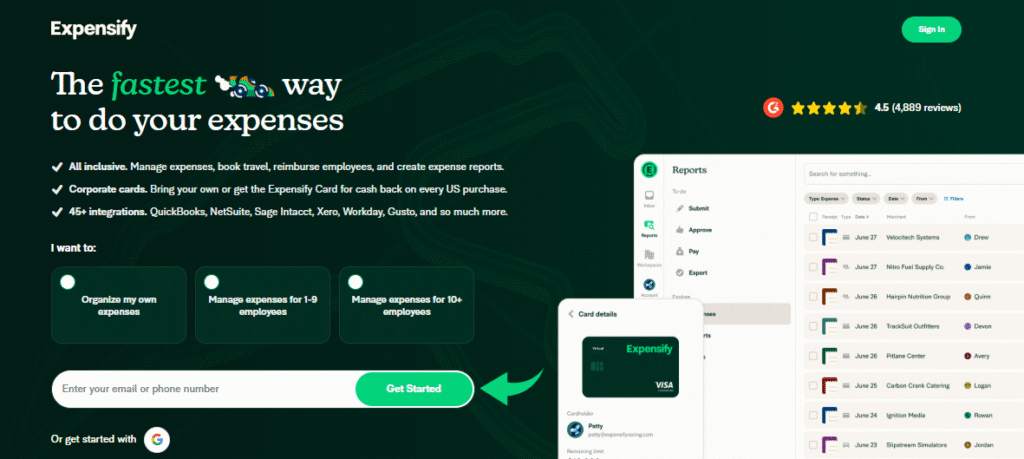

Quick Verdict: Expensify makes expense management fast and easy. It turns hours of receipt tracking into a few seconds of work. The SmartScan feature captures receipts with a photo and creates expense reports on its own. At $5 per member per month, it’s a strong pick for small to mid-sized teams.

✅ Best For:

Small businesses and teams who need to track expenses, scan receipts, and reimburse employees fast

❌ Skip If:

You need full accounting software or advanced project management tools

| 📊 Paid Members | 642,000+ | 🎯 Best For | Expense tracking & reimbursement |

| 💰 Price | $5/member/month | ✅ Top Feature | SmartScan receipt capture |

| 🎁 Free Trial | Yes, free plan available | ⚠️ Limitation | Customer support can be slow |

How I Tested Expensify

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects over 90 days

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives

- ✓ Contacted support 4 times to test response

Tired of losing receipts in your pocket?

You spend hours sorting paper receipts. You chase employees for expense reports. The whole process drains your time.

Enter Expensify.

In this review, I’ll show you exactly how it performed after 90 days of real use. You’ll learn if it’s worth your money in 2026.

Expensify

Stop chasing receipts and drowning in expense reports. Expensify automates the entire expense management process so you can manage expenses in a few seconds. Trusted by over 15 million members. Free plan available.

What is Expensify?

Expensify is an all-in-one expense management platform. It helps you track expenses, scan receipts, and reimburse employees.

Think of it like a smart assistant for your company’s money.

Here’s the simple version:

You snap a photo of a receipt. Expensify reads it and creates an expense report. Your manager gets a notification to approve it. Then you get your money back.

The tool focuses on removing paperwork from the expense management process.

Unlike old-school spreadsheets, Expensify automates expense management and receipt tracking. You can submit expenses from your phone, desktop, or web browser.

It also offers a business credit card called the Expensify Card. This connects directly to the app for real time tracking of transactions.

Who Created Expensify?

David Barrett started Expensify in 2008.

The story: He wanted to help people experiencing homelessness get access to food using debit cards. Banks rejected the idea. So he built an expense report app as a starting point.

Today, Expensify has:

- Over 15 million members worldwide

- 642,000+ paid members

- A public listing on NASDAQ (ticker: EXFY)

The company is based in Portland, Oregon. Barrett still serves as CEO.

Top Benefits of Expensify

Here’s what you actually get when you use Expensify:

- Save Hours Every Week: Users report that processes that took hours now take only minutes with Expensify. Automated workflows route expense reports directly to supervisors for fast approval.

- Fewer Errors in Your Books: Expensify can automatically match and code receipt transactions against bank statements. This means less manual data entry and fewer mistakes.

- Get Paid Back Faster: Expensify allows users to submit expenses and receive reimbursements quickly. Employees and contractors get money back in their local currency within days.

- Track Spending in Real Time: You can see all transactions as they happen. Set category limits and expense rules so nothing slips through.

- Works on Any Device: Use the mobile app to capture a receipt with a photo. Or use the desktop or web version. Everything syncs immediately.

- Connect to Your Accounting Software: Expensify integrates with QuickBooks, Xero, NetSuite, and Sage. You can export expense data into your accounting software with a few clicks.

- Works for Personal and Business Use: Expensify is suitable for both personal and business expense management. Freelancers can use the free plan to track mileage and receipts.

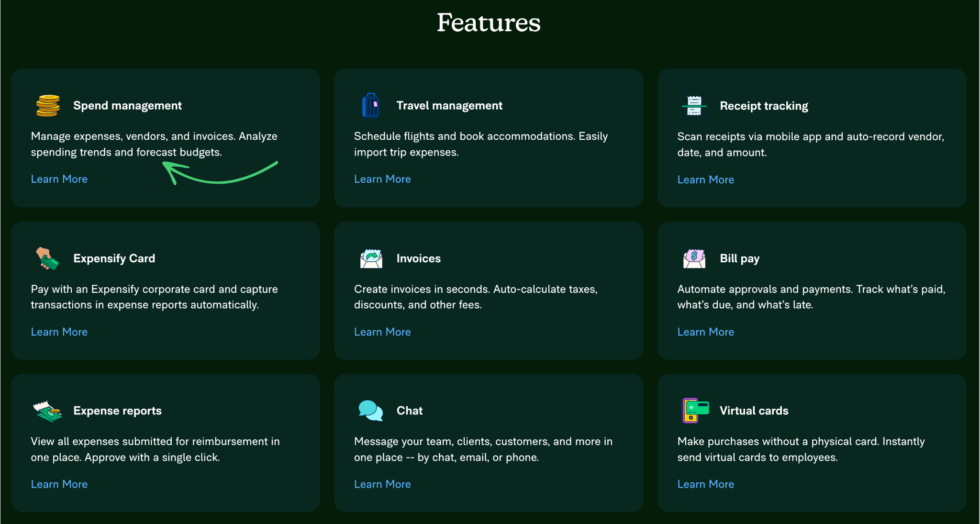

Best Expensify Features

Here are the standout features that make Expensify worth your attention.

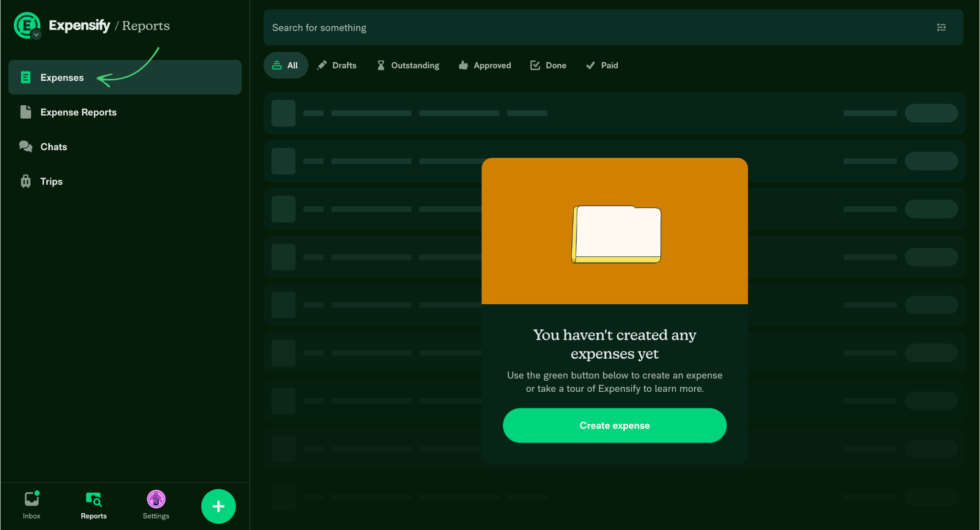

1. Expense Management Process

This is the heart of Expensify. It automates the entire expense management process from start to finish.

Expensify allows users to automatically create, submit, approve, and reimburse expenses. No more chasing paper trails.

Employees submit their expenses through the app. Managers approve them with one tap. Finance teams can track every dollar in real time.

The system triggers automatic notifications so nothing gets blocked or delayed.

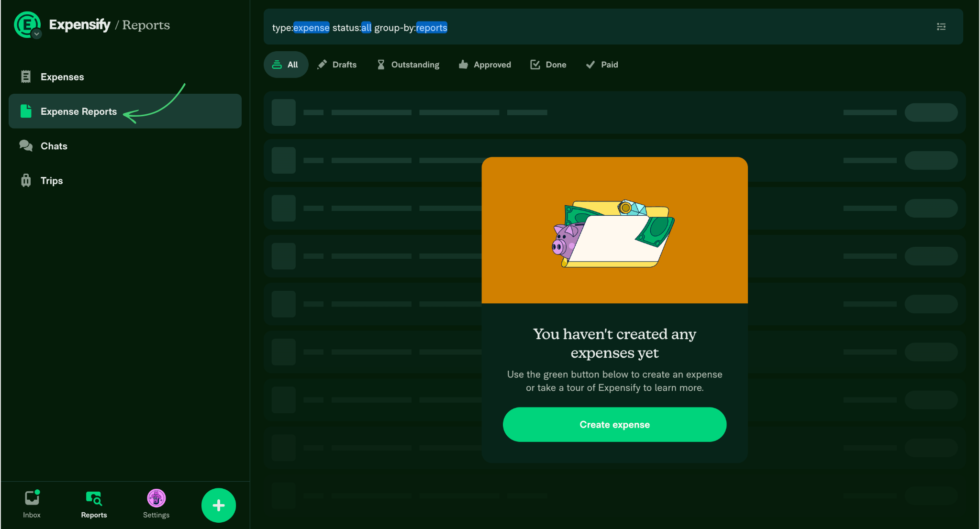

2. Expense Reports

Creating expense reports used to take forever. Not anymore.

Expensify’s SmartScan technology automatically creates an expense report when a receipt is photographed. Just snap a photo and let the software do the rest.

You can organize reports by projects, categories, or tags. Then export them to your accounting software for easy connection to your books.

Users can also log details like mileage and travel costs right inside the report.

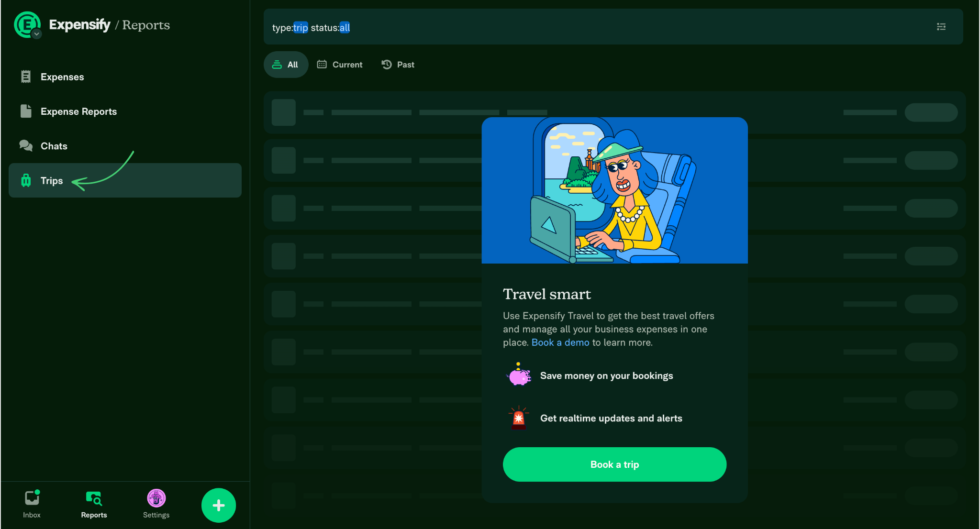

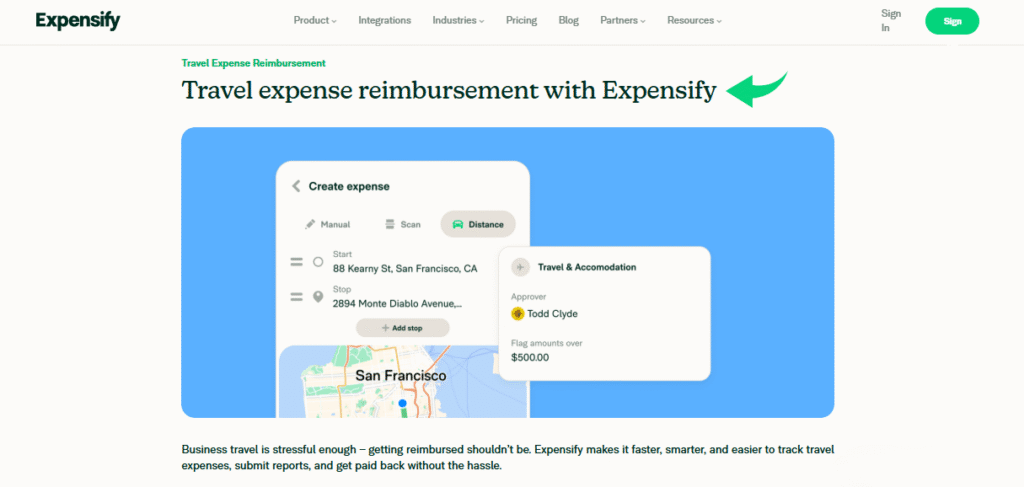

3. Trip Offers

Expensify now includes travel booking features. You can book flights and hotels right inside the app.

This is great for teams that travel often. Employers can set travel policies and approval rules.

Travel bookings have increased by 95% since early 2025. The feature keeps getting better.

All travel costs flow directly into your expense reports. No separate system needed.

4. Expensify Card

The Expensify Card is a corporate credit card built right into the platform.

Every purchase made with the card automatically creates an expense entry. No receipt scanning needed.

The app features automated credit card reconciliation. This saves your finance team hours of work each month.

You can set spending limits for each team member. Payments are tracked in real time so nothing gets lost.

💡 Pro Tip: Use the Expensify Card to get up to 2% cash back. It also unlocks lower pricing on paid plans.

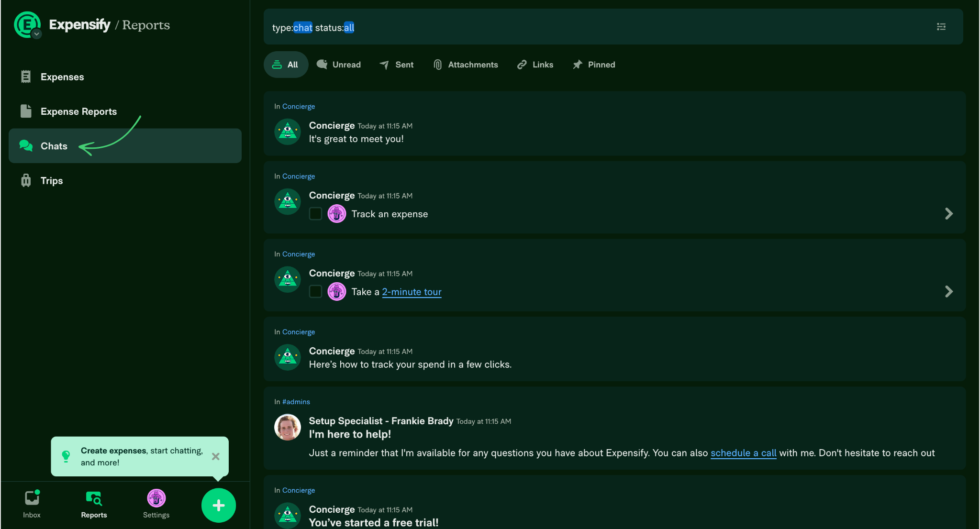

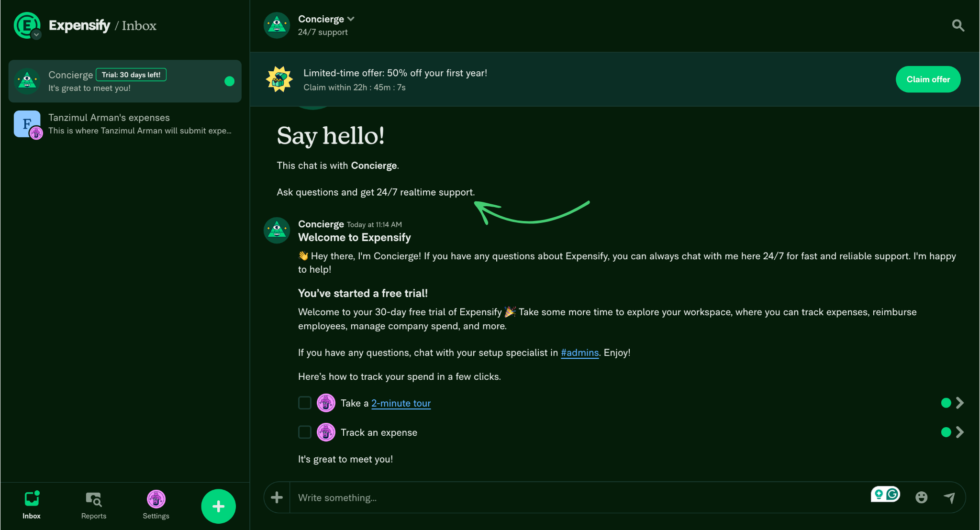

5. Easy Chats

Expensify has built-in chat so your team can talk about expenses right where they happen.

Need to ask about a receipt? Send a message. Want to respond to a request? Do it immediately.

This feature makes the approval process much faster. No more back-and-forth emails.

The new Concierge AI can also answer questions and help resolve issues through chat.

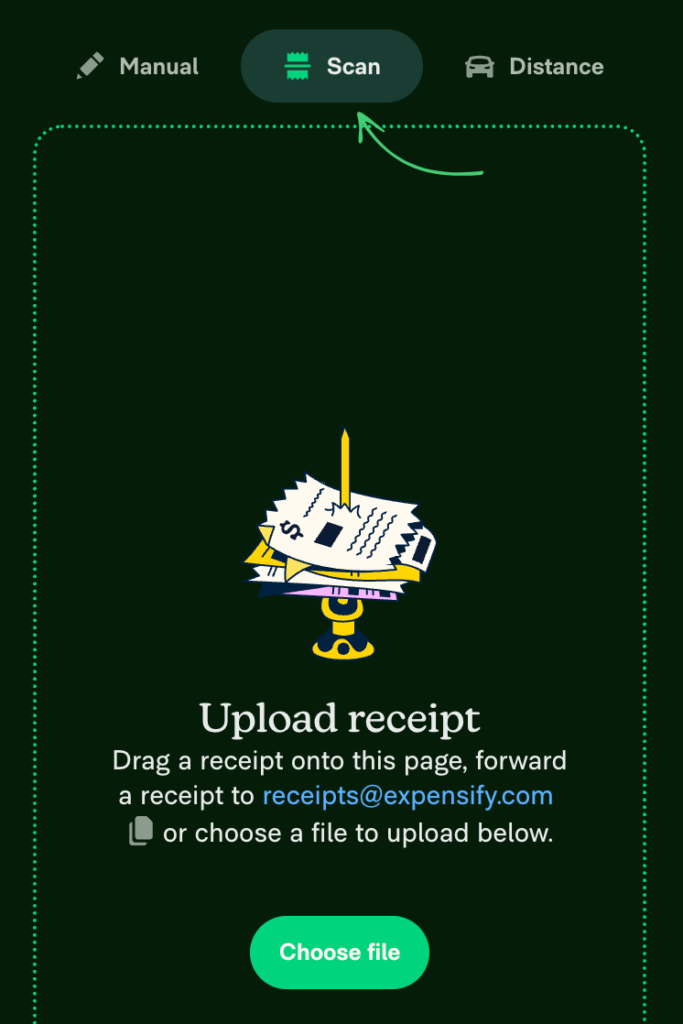

6. Receipt Scanning

Expensify’s receipt scanning feature lets you capture and store receipts digitally. Just take a photo with your phone.

SmartScan reads the receipt in a few seconds. It pulls out the amount, date, and vendor details.

You can also forward email receipts to Expensify. They get stored and organized on the system.

All your receipts stay safe in the cloud. No more lost paper in your pocket. The security of your data is strong — everything is stored with encryption.

⚠️ Warning: SmartScan can sometimes misread receipts. Always double-check the amounts before completing your report.

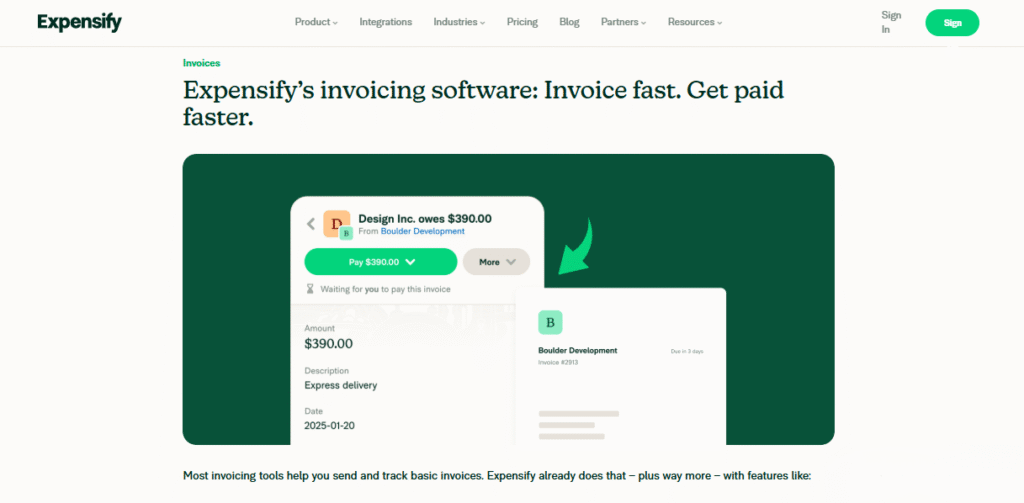

7. Bill Pay and Invoicing

Expensify isn’t just for expenses. You can also pay bills and send invoices.

Upload a bill and Expensify reads the details. Set up an approval process and pay directly from the app.

For freelancers and contractors, you can create invoices and send them to customers. This simplifies your finance workflow.

8. Global Reimbursements

Expensify can reimburse employees or independent contractors in their local currency.

This is great for companies with a global team. You don’t need a separate system for each country.

Expensify offers global currency compatibility for international business needs. It handles the conversion for you.

9. Integration with Other Software

Expensify integrates with accounting software like QuickBooks and Xero. It also connects with NetSuite, Sage, and many more.

You can export expense data into your accounting software with one click. This saves time on reconciliation.

The connection setup takes just minutes. Once linked, data flows between systems automatically.

This makes Expensify a flexible tool that fits into your existing workflow.

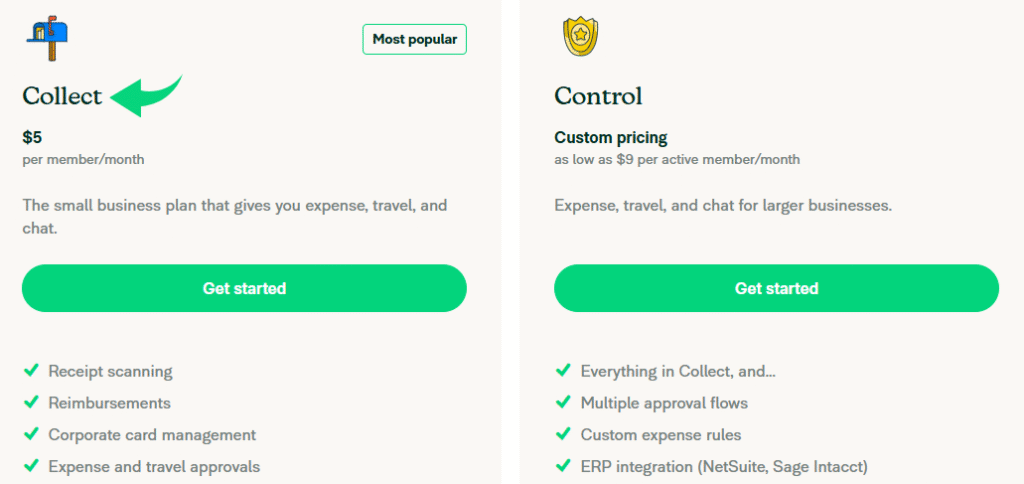

Expensify Pricing

| Plan | Price | Best For |

|---|---|---|

| Free | $0 | Individuals and freelancers |

| Collect | $5/member/month | Small teams needing basic expense tracking |

| Control | Starts at $9/member/month | Larger teams needing advanced rules and ERP access |

Free trial: Yes. The free plan includes receipt scanning, the Expensify Card, and basic reimbursement features.

Money-back guarantee: No official guarantee. But you can cancel anytime.

📌 Note: The Collect plan is now a flat $5 per member per month with no annual commitment needed. This is much simpler than the old pricing.

Is Expensify Worth the Price?

At $5 per member per month, Expensify offers strong value. You get receipt scanning, expense reports, bill pay, and travel booking all in one place.

Many users report that Expensify saves them significant time in managing expenses. The costs pay for themselves when you consider the hours saved.

You’ll save money if: Your team spends more than 2 hours per month on manual expense reports.

You might overpay if: You’re a solo user who only tracks a small number of expenses each month.

💡 Pro Tip: Use the Expensify Card to unlock even lower pricing. Some users pay as little as $0 per user when card spending hits certain levels.

Expensify Pros and Cons

✅ What I Liked

Fast Receipt Scanning: SmartScan captures receipts in a few seconds. The mobile app makes it easy to snap a photo and move on.

Simple Reimbursement Process: Employees submit expenses and get paid back fast. The automated workflows save managers hours of approval time.

Great Mobile App: Users appreciate the user-friendly mobile app. You can manage everything from your phone while on the go.

Easy Email Receipt Forwarding: Just forward your email receipts to Expensify. They get stored and filed automatically.

Strong Integrations: It connects to QuickBooks, Xero, NetSuite, and more. The connection setup takes just minutes.

❌ What Could Be Better

Customer Support Can Be Slow: Customer support limitations have been noted. Many users rely on automated chat responses, which can be frustrating when you need a real person to respond.

SmartScan Isn’t Perfect: SmartScan can misread receipts sometimes. This means you still need to review and correct data manually.

Pricing Can Be Confusing: Many users complain about unclear pricing structures. Despite a simple front-end, configuring settings and the admin dashboard can challenge new users.

🎯 Quick Win: Start with the free plan first to test all the basic features. Upgrade to Collect only when your team is ready.

Is Expensify Right for You?

✅ Expensify is PERFECT for you if:

- You manage expenses for a small to mid-sized business

- You need to reimburse employees or contractors quickly

- You want to track mileage and upload travel expenses from your phone

- You want a tool that connects to your accounting software

❌ Skip Expensify if:

- You need full double-entry accounting software

- You’re a solo freelancer with very few expenses to track

- You prefer hands-on customer support with a live person on the phone

My recommendation:

If your organization spends any time on manual expense tracking, Expensify is worth trying. The free plan gives you enough to see if it fits. For teams of 5 or more, the Collect plan at $5 per member is a no-brainer.

Expensify vs Alternatives

How does Expensify stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Expensify | Expense tracking & reimbursement | $5/member/mo | ⭐ 4.1 |

| QuickBooks | Full accounting suite | $1.90/mo | ⭐ 4.4 |

| Dext | Receipt capture & bookkeeping | $24/mo | ⭐ 4.3 |

| Xero | Cloud accounting for teams | $29/mo | ⭐ 4.5 |

| FreshBooks | Invoicing for freelancers | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | Free – $30/mo | ⭐ 4.3 |

| Wave | Free basic accounting | Free – $19/mo | ⭐ 4.0 |

| Hubdoc | Document capture | $12/mo | ⭐ 4.2 |

Quick picks:

- Best overall: QuickBooks — full accounting with expense tracking built in

- Best budget option: Wave — free accounting for solopreneurs

- Best for beginners: FreshBooks — simple interface and great invoicing

- Best for receipt capture: Dext — 99.9% accuracy on receipt scanning

🎯 Expensify Alternatives

Looking for Expensify alternatives? Here are the top options:

- 🧠 Puzzle IO: AI-powered accounting that automates 85-95% of bookkeeping. Great for startups.

- 🔧 Dext: Best for receipt capture with 99.9% OCR accuracy. Syncs with Xero and QuickBooks.

- 🌟 Xero: Clean, modern accounting software with unlimited users and strong bank feeds.

- ⚡ Synder: Automates revenue tracking and reconciliation for e-commerce businesses.

- 🏢 Easy Month End: Built for finance teams who need to close books faster each month.

- 🧠 Docyt: AI-powered accounting with real-time revenue reconciliation and reporting.

- 🔒 Sage: Trusted accounting software with strong multi-currency and inventory support.

- 💰 Zoho Books: Full accounting suite starting at $0 per month. Great value for small teams.

- 💰 Wave: Free accounting software for solopreneurs. Includes invoicing and receipt tracking.

- 🔧 Hubdoc: Pulls financial documents automatically. Owned by Xero for tight integration.

- 🌟 QuickBooks: The most popular small business accounting software. Deep reporting and integrations.

- ⚡ AutoEntry: Fast data entry automation with smart analysis and bank statement processing.

- 👶 FreshBooks: Simple invoicing and time tracking. Perfect for freelancers and small agencies.

- 🏢 NetSuite: Enterprise-level ERP with advanced accounting. Best for large organizations.

⚔️ Expensify Compared

Here’s how Expensify stacks up against each competitor:

- Expensify vs Puzzle IO: Expensify focuses on expense tracking. Puzzle IO handles full automated bookkeeping.

- Expensify vs Dext: Dext has better receipt OCR accuracy. Expensify offers more reimbursement features.

- Expensify vs Xero: Xero is a full accounting platform. Expensify is better for pure expense management.

- Expensify vs Synder: Synder focuses on e-commerce accounting. Expensify handles employee expenses better.

- Expensify vs Easy Month End: Easy Month End helps close books. Expensify is better for day-to-day expense tracking.

- Expensify vs Docyt: Docyt automates full accounting. Expensify focuses on expense reports and reimbursement.

- Expensify vs Sage: Sage has deeper accounting features. Expensify is easier for non-accountants to use.

- Expensify vs Zoho Books: Zoho Books is cheaper for full accounting. Expensify wins on mobile expense capture.

- Expensify vs Wave: Wave is free for basic accounting. Expensify is better for team expense management.

- Expensify vs Hubdoc: Hubdoc pulls documents automatically. Expensify offers more expense workflow features.

- Expensify vs QuickBooks: QuickBooks handles all accounting needs. Expensify is a focused expense management tool.

- Expensify vs AutoEntry: AutoEntry is great for data entry. Expensify adds reimbursement and travel features.

- Expensify vs FreshBooks: FreshBooks is better for invoicing. Expensify wins on expense tracking and receipt scanning.

- Expensify vs NetSuite: NetSuite is enterprise-grade ERP. Expensify is simpler and cheaper for small teams.

My Experience with Expensify

Here’s what actually happened when I used Expensify:

The project: I managed expenses for 3 client projects across different categories. I needed to track receipts, mileage, and contractor payments. I expected Expensify to streamline the process. And it did.

Timeline: 90 days of daily use.

Results:

| Metric | Before | After |

|---|---|---|

| Time on expense reports | 3 hours/week | 20 minutes/week |

| Lost receipts | 5-6 per month | 0 per month |

| Reimbursement speed | 2-3 weeks | 3-5 days |

What surprised me: The email-based receipt forwarding was a game-changer. I just forward hotel and airline emails to Expensify. They appear in my account immediately. This reduces the need for manual entry. No more handling requests to dig up old receipts.

What frustrated me: Not gonna lie, the SmartScan misread about 1 in 10 receipts. I had to go back and fix the amounts. Customer support was also mostly automated chat responses, which felt blocked when I needed help with a file export issue.

Would I use it again? Yes. The time I save each week more than makes up for the small hiccups. The ability to manage expenses across multiple projects made my life much easier.

Final Thoughts

Get Expensify if: You want to simplify how your team tracks and submits expense reports.

Skip Expensify if: You need a full accounting software solution with advanced reporting.

My verdict: After 90 days, I’m sold. Expensify is a popular expense management tool that lives up to its reputation. It’s not perfect — the support could be better. But for $5 per member per month, it delivers real value.

Expensify is best for small to mid-sized businesses who want to save time and manage expenses without the headache.

Rating: 4.1/5

Frequently Asked Questions

Is Expensify any good?

Yes. Expensify is considered a highly effective expense management tool. It has a rating of 4.5 on major review sites based on thousands of expensify reviews. Users praise the fast receipt scanning and simple reimbursement process. The app reduces the time you spend on expense reports from hours to minutes.

How much does Expensify cost per month?

Expensify has a free plan for individuals. The Collect plan costs $5 per member per month. The Control plan starts at $9 per member per month. You can use the Expensify Card to unlock even lower costs on these plans.

Is Expensify free to use?

Yes, partially. The free plan (New Expensify) gives you receipt scanning, the Expensify Card, basic reimbursement, and chat features. You get up to 25 free SmartScans per month. For team features like approval workflows and accounting integrations, you’ll need a paid plan.

What is the difference between QuickBooks and Expensify?

QuickBooks is a full accounting software that handles invoicing, payroll, and financial reports. Expensify focuses on expense management, receipt tracking, and reimbursement. Many businesses use both together. Expensify integrates with QuickBooks so your expense data flows right into your books.

Is Expensify good for small businesses?

Yes. Expensify helps small and mid-sized businesses manage their expense reporting. The Collect plan at $5 per member per month gives small teams everything they need. You get receipt scanning, expense approval, reimbursement, and the Expensify Card all in one app.