Want something cool but don’t have all the cash right now? It’s frustrating.

You see that item. You want it. But your wallet says “no.”

Waiting for payday feels like forever. Plus, what if it sells out?

Or does it go on sale somewhere else? You worry about missing out. You’re stuck.

You need a way to buy now.

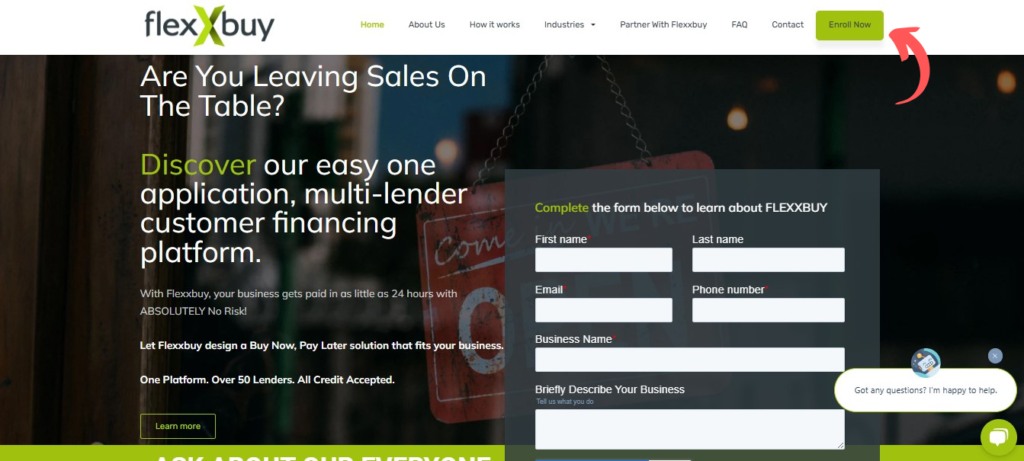

That’s where Flexxbuy comes in. It offers payment plans, so you can get what you want when you want. Is it the best? Let’s find out.

Flexxbuy: $50M+ in customer financing. Find your best consumer financing options now. Easy financing solutions. Shop with confidence!

What is Flexxbuy?

Flexxbuy is a way to buy things now and pay for them later. It’s like a special financing program.

You know, when you want something but don’t have all the money?

Flexxbuy helps with that. They work with many companies called lenders.

These lenders offer financing. You fill out an application process. If you approve, you get to pick from different finance options.

It helps you buy things you need or want without paying for them all at once.

Getting approval means the lender says, “Yes, we will loan you the money.”

Who Created Flexxbuy?

Flexxbuy was created under Crease Solutions, with Mr. Bob Lovinger as President.

They wanted to help stores boost revenue. The idea? Let people pay later.

They knew many folks worried about their credit score. Flexxbuy uses multiple lenders.

This multi-lender approach means more people can get approved.

They also wanted to make interest rates fairer. So, more people can buy what they need.

Ultimately, they aim to make big purchases less stressful for everyday shoppers.

Top Benefits of Flexxbuy

- Easy “Buy Now, Pay Later” Access: Flexxbuy helps you get things now and pay later, simplifying big purchases.

- Multiple Financing Options: As a strong customer financing solution, it provides various payment choices.

- Simple and Clear Process: Flexxbuy customer financing is easy to understand, avoiding confusing terms.

- Increased Approval Chances: As a customer financing platform, it connects users with many lenders, boosting approval odds.

- Flexible Payment Plans: The multi-lender platform enables you to choose the best payment plan for your budget.

- Medical Financing Solutions: It’s a great patient financing solution and works in the patient financing space, assisting with medical care costs.

- Customizable Financing Products: You can create different financing products, allowing stores to offer tailored plans.

- Home Improvement Made Affordable: It makes home improvement projects more manageable by spreading costs over time.

Best Features

Let’s dive into what makes Flexxbuy stand out. It’s not just another way to pay later.

Flexxbuy has neat tools that make buying and selling easier.

Here are some of the best features.

1. Easy Client Financing Solution

Flexxbuy makes it simple. Stores can offer payment plans to their customers.

It’s like giving people a way to buy things without paying all at once.

This helps stores sell more. Customers get what they want. It’s a win-win.

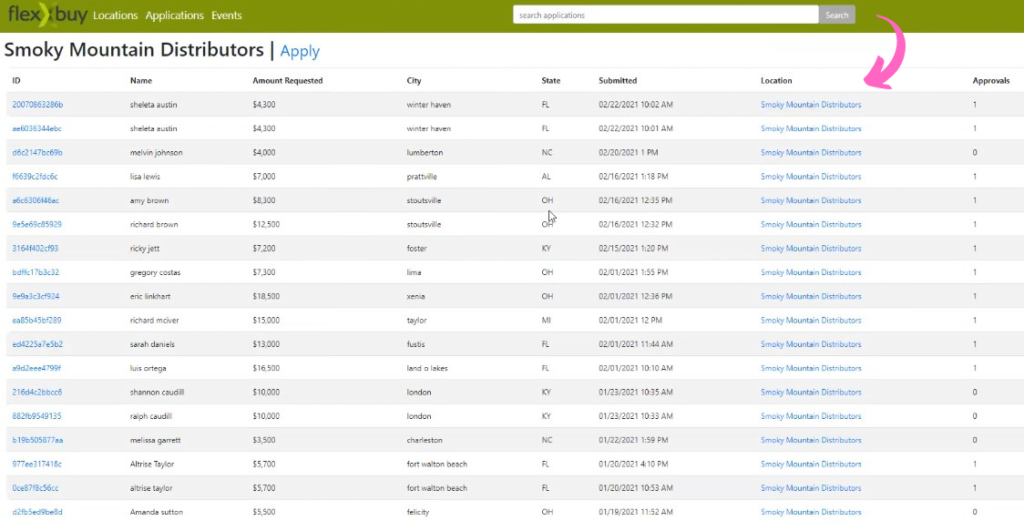

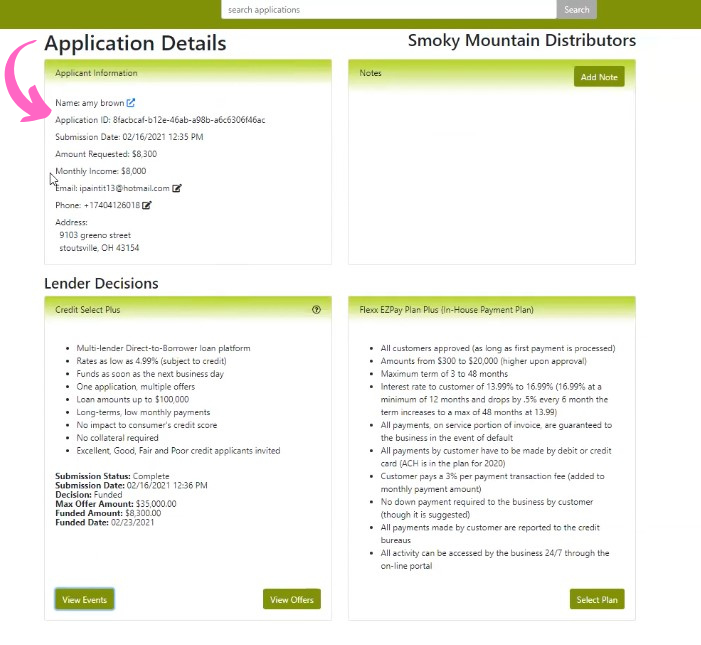

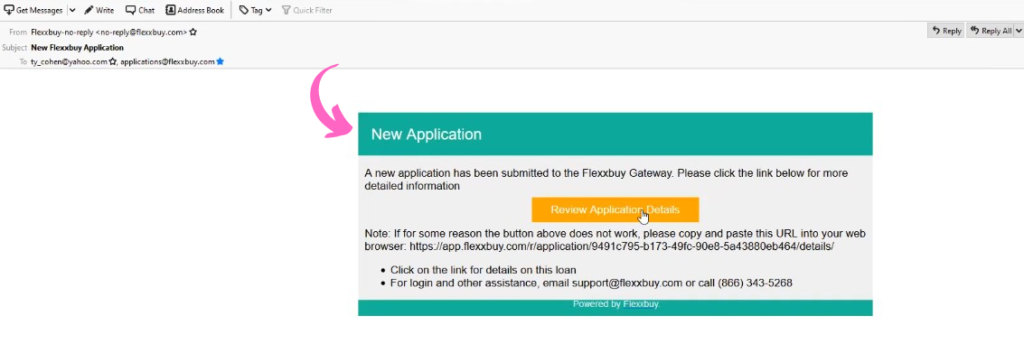

2. Applications Management

Keeping track of who wants to pay later can be tricky. Flexxbuy helps with that.

Stores can see all the applications in one place. They know who got approved.

They know who needs more info. It’s organized and easy to use.

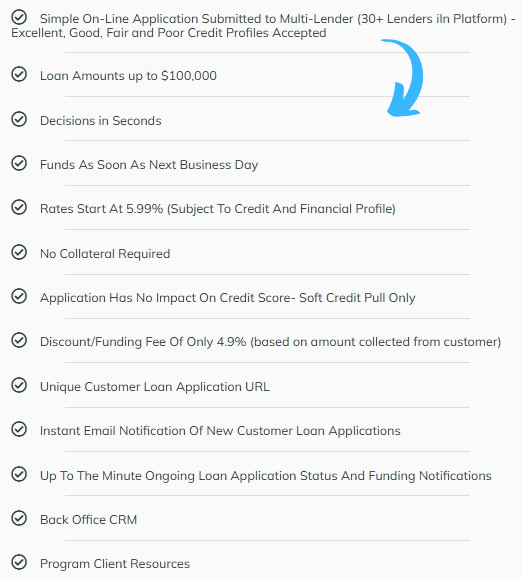

3. Popular Lending Partners

Flexxbuy works with many well-known lenders.

This is good for customers. More lenders mean more chances of getting approved.

It also means better payment options. You can pick a plan that fits your budget.

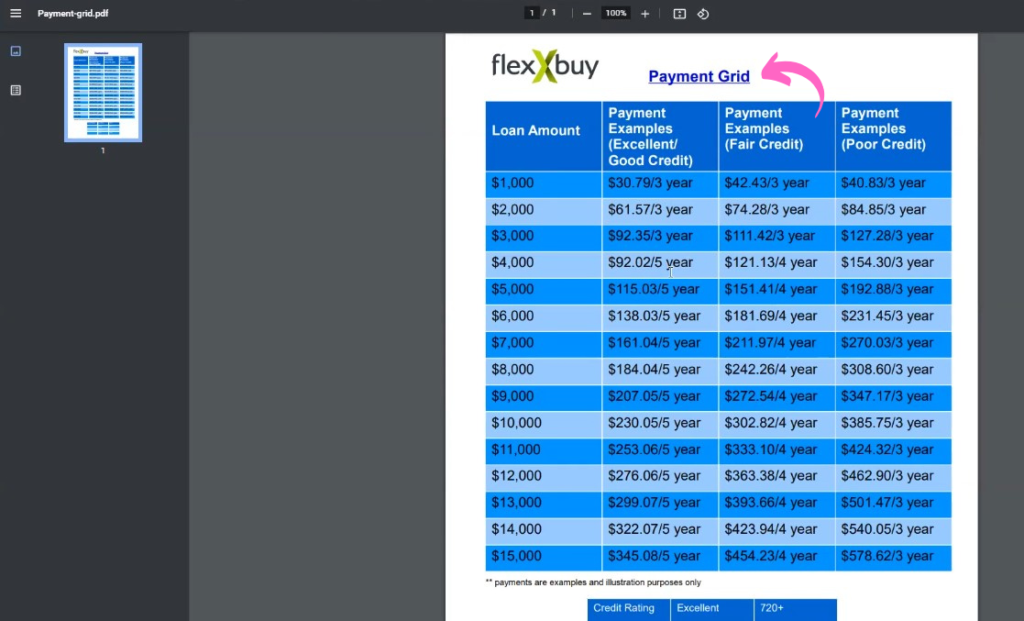

4. Detailed Payment Grid

Knowing exactly how much you’ll pay and when is important. Flexxbuy shows you.

It’s like a chart that breaks down each payment.

You see the amount. You see the dates. No surprises.

5. Reports and Analysis

Stores need to know how well their payment plans are working.

Flexxbuy gives them reports. They can see what’s selling and who’s using the plans.

This helps them make smart choices. They can improve their sales.

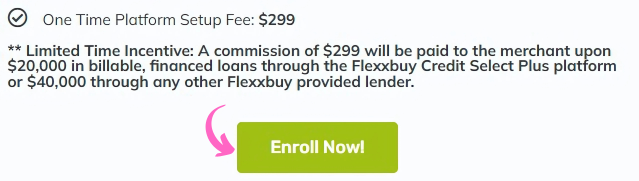

Pricing

| Plan Name | Pricing |

| One Time Platform Set-up Fee | $299 |

Pros and Cons

Pros

Cons

Alternatives of Flexxbuy

- Affirm: Offers flexible payment plans, often with clear, upfront interest rates. Good for online purchases.

- Klarna: This company offers “buy now, pay later” options and short-term and longer-term plans, which are useful for retail purchases.

- Afterpay: Focuses on short-term, interest-free installments. Great for smaller purchases.

- PayPal Credit: Gives a line of credit for PayPal purchases. Offers special financing for certain periods.

- LendingClub: A peer-to-peer lending platform. Can provide personal loans for larger purchases.

Personal Experience with Flexxbuy

Our team decided to test Flexxbuy to see if it could really help a small online store boost sales.

We were selling some higher-priced items, and many customers were hesitant to buy due to the upfront cost.

We wanted to offer a way for them to get those items without paying for everything at once.

The Flexxbuy platform was intuitive, and we were able to integrate it into our website with minimal hassle.

This saved us a lot of time and technical headaches.

Here’s a breakdown of what we really appreciated:

- Easy setup: We were up and running quickly, which was perfect for our small team.

- Clear payment plans: Customers loved being able to see exactly what they would pay each month. This transparency built trust.

- Noticeable increase in sales: We saw a significant jump in sales for our higher-priced items.

- Positive customer feedback: We received numerous compliments about the flexible payment options.

- Simple application tracking: The platform’s application tracking made it easy to manage approvals and follow up with customers.

Final Thoughts

Flexxbuy provides businesses with an easy way to offer payment plans.

It helps customers buy now and pay later. If you run a direct-to-consumer business, this could help your business grow.

Flexxbuy provides many lender options. Filling out one application can get you approved by different lenders.

The enrollment process is seamless. Even home-based businesses can use it.

Our expert team found it helpful. If you want to offer flexible payments, Flexxbuy is worth a look.

See if it fits your needs today!

Frequently Asked Questions

How does Flexxbuy’s interest-free plan work?

Flexxbuy’s interest-free plan splits payments. You pay in installments. No extra cost on time. A budgeting game-changer. Read the terms.

Is my personal information safe on the secure online portal?

Yes, a secure online portal protects your data. Strong encryption keeps information safe, and they follow privacy rules.

How fast are approvals instant for Flexxbuy?

Many approvals are instant. You apply, find out fast. Some cases take longer. Lenders check details.

Can healthcare providers be encouraged to use Flexxbuy?

Yes, healthcare providers are encouraged to check Flexxbuy. It provides flexible payment solutions for patients. Visit their site.

What types of businesses can use Flexxbuy?

Many businesses use Flexxbuy. Online stores, home improvement services, etc. Good for selling big items.