Is Synder Worth It?

★★★★★ 4.1/5

Quick Verdict: Synder is a powerful automated accounting tool for ecommerce businesses. It syncs all your sales channels to QuickBooks Online, Xero, or Sage Intacct in minutes. After 90 days of testing, I saved over 15 hours per month on bookkeeping. It’s not perfect — the setup takes time and pricing can feel steep for small shops. But if you sell on multiple platforms, Synder keeps your books balanced without the stress.

✅ Best For:

Ecommerce sellers with multi channel sales who need automated accounting across Shopify, eBay, Etsy, Amazon, Stripe, and PayPal

❌ Skip If:

You only sell on one platform or have very few transactions each month — the cost won’t make sense for you

| 📊 Platforms Synced | 30+ sales channels | 🎯 Best For | Multi channel ecommerce |

| 💰 Price | $52/month | ✅ Top Feature | One click reconciliation |

| 🎁 Free Trial | 15 days, no card needed | ⚠️ Limitation | Setup can be complex |

How I Tested Synder

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client ecommerce projects

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives including Dext and QuickBooks

- ✓ Contacted support 4 times to test response quality

Tired of messy ecommerce books?

You sell on Shopify. You take payments through Stripe and PayPal. Maybe you’re on eBay and Etsy too.

Now try keeping track of all those transactions. Sales, fees, taxes, refunds, shipping — it’s a nightmare.

Enter Synder.

In this review, I’ll show you exactly how it performed after 90 days of real use across multiple sales channels.

Synder

Stop wasting hours on manual bookkeeping. Synder automatically syncs sales, fees, taxes, and refunds from 30+ platforms into your accounting system. Trusted by 20,000+ businesses. Free 15-day trial — no credit card needed.

What is Synder?

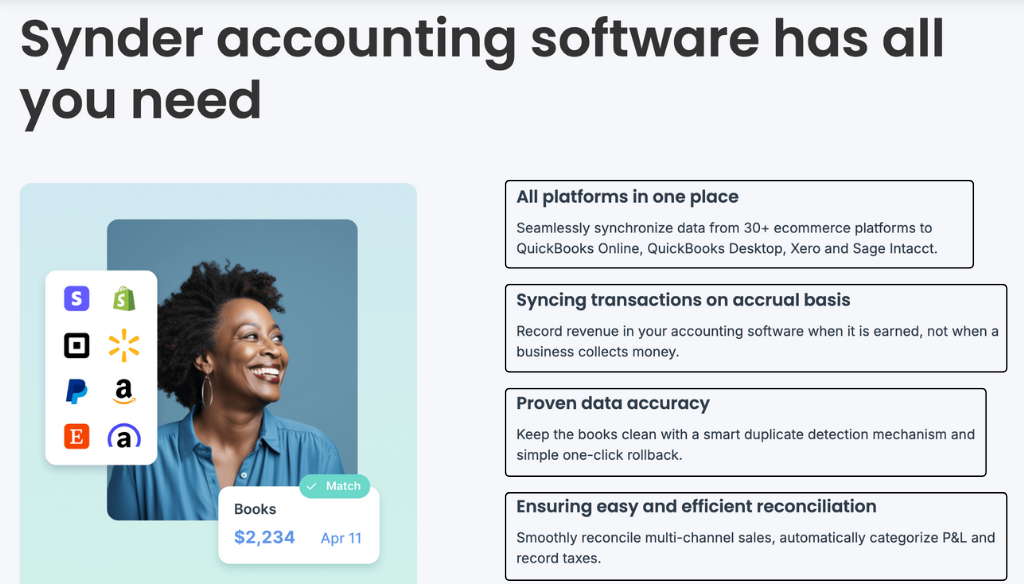

Synder is an accounting software that connects all your sales channels to your accounting system.

Think of it like a bridge between your online stores and your books.

Here’s the simple version:

You sell something on Shopify. Synder grabs that data. It records the sale, the fees, the taxes, and even the shipping costs. Then it sends everything to QuickBooks, Xero, or NetSuite.

No manual data entry. No mistakes. No stress.

The tool focuses on automated accounting for ecommerce and SaaS businesses. It supports multi currency transactions across different regions.

Unlike doing it by hand, Synder lets you reconcile your books in one click. It even handles historical transactions so you can clean up old records.

Who Created Synder?

Michael Astreiko started Synder in 2019.

He saw how hard it was for ecommerce businesses to manage their finances. Manual data entry was eating up hours every week.

So he built a tool to fix it.

Today, Synder has over 20,000 users and 200+ accounting firms trust it.

The company graduated from Y Combinator (S21 batch) and the AICPA Startup Accelerator.

Synder is based in San Francisco and has SOC 2 Type 2 certified security.

In 2025, the platform synced over $30.8 billion in transactions across all currencies.

Top Benefits of Synder

Here’s what you actually get when you use Synder:

- Save Up to 480 Hours Per Year: Synder’s automation can save businesses significant time by eliminating manual data entry. Users have reported saving hundreds of hours annually on bookkeeping services. That’s time you can spend growing your business.

- Keep Your Books Balanced Automatically: Synder automates the reconciliation of sales from multiple sales channels to maintain accurate financial records. Your balance sheets stay correct without you lifting a finger.

- One Place for All Your Sales Data: Synder connects all sales channels and payment gateways within one interface. Whether you sell on Shopify, eBay, Etsy, or Square, everything flows into one accounting system.

- Ready for Tax Season: Synder ensures accurate, categorized data is ready for tax season, reducing audit risk. No more scrambling to find details when taxes are due.

- Multi Currency Made Simple: Synder supports multi currency transactions for accurate financial management. If you sell to customers worldwide, this feature is a lifesaver.

- Real-Time Financial Insights: Synder simplifies financial management by providing real-time financial insights for better decision-making. You can see reports and data from every channel on a single dashboard.

- GAAP Compliance Without the Headache: Synder provides GAAP compliant revenue recognition for SaaS subscriptions. It automates deferred revenue schedules so your accounting stays on the right side of the rules.

Best Synder Features

Here are the features that make Synder stand out from other accounting tools.

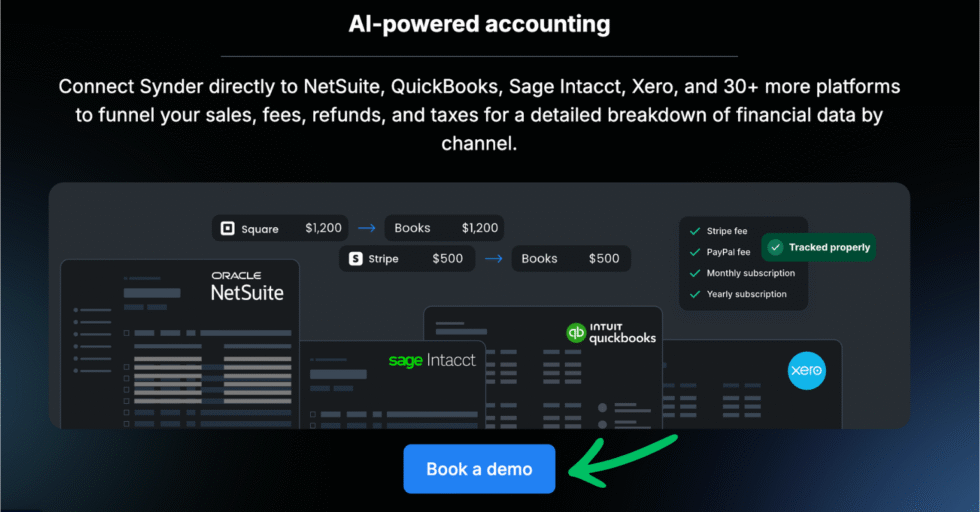

1. AI-Powered Accounting

Synder uses smart AI to handle accounting tasks automatically. The system learns and adapts to your transactions over time.

It helps you keep historical transactions organized. You can drop the stress of manual entry because the AI does the work for you.

This feature is great for businesses with subscriptions or complex sales. Finance teams love it because it frees them to focus on strategy instead of data entry.

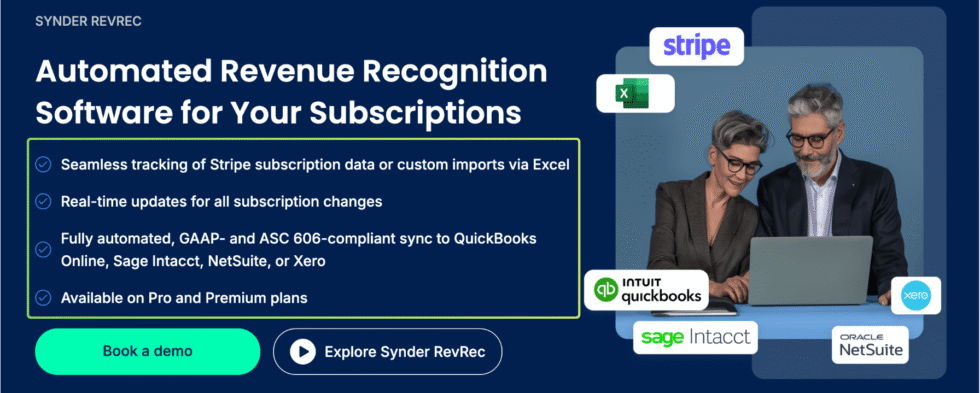

2. Automated Revenue Recognition

Synder helps you follow GAAP compliance rules automatically. It recognizes your revenue at the right time without any manual process.

This saves a lot of trouble for high volume businesses. Your balance sheets stay accurate all year long.

If you run a SaaS business or sell subscriptions, this is a must-have. Synder provides GAAP compliant revenue recognition by automating deferred revenue schedules.

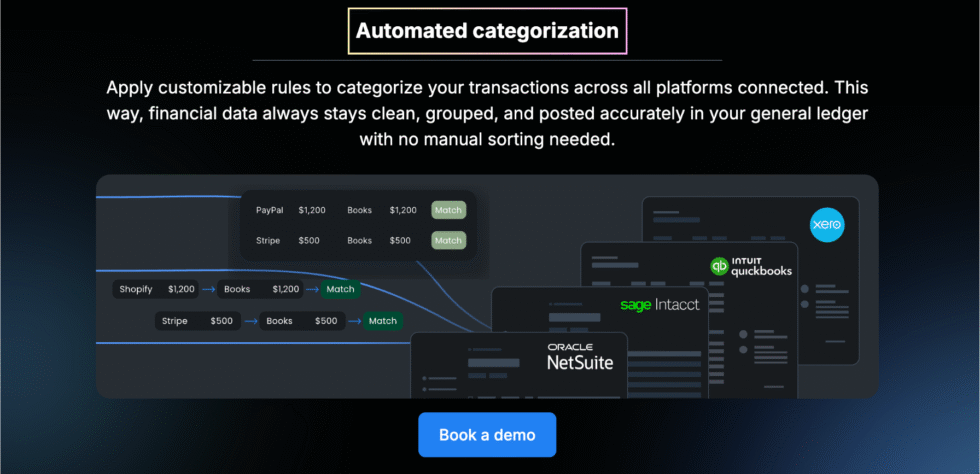

3. Automated Categorization

Synder provides automated categorization of transactions across all connected platforms. It sorts your sales, fees, shipping costs, discounts, and taxes into the right buckets.

This works for all your multi channel sales from places like Shopify, eBay, and Square. The system can even handle transactions from PayPal and Clover.

Users can customize transaction mapping and settings to fit their specific accounting needs. No more manual sorting.

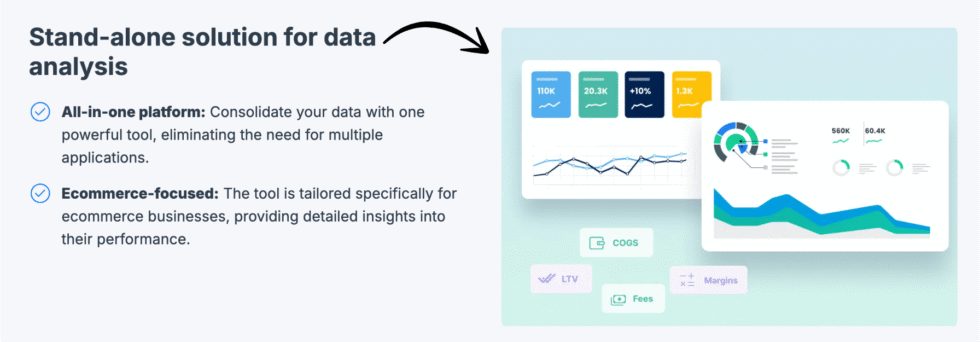

4. Data Analysis

Synder allows for customizable financial reporting and analytics. You get insights into profitability and financial health at a glance.

Synder provides a detailed breakdown of financial data by channel. This helps you see which sales channels bring the most revenue.

The reports include P&L statements and balance sheets. Everything stays in your accounting system for easy access.

5. Accounting Integrations

Synder enables users to connect multiple sales channels to top ledgers and ERPs. It’s compatible with QuickBooks Online, Xero, NetSuite, and Sage Intacct.

Synder supports over 25 sales and payment platforms for integration. You can bring in data from Stripe, PayPal, Shopify, Amazon, eBay, Etsy, and many more.

The setup for integrating Synder with QuickBooks takes 15 minutes and requires four easy steps. It’s simpler than you’d expect.

6. Sales Transactions Bookkeeping

Synder helps automate the bookkeeping of transactions for ecommerce businesses. Every sale, refund, and fee gets recorded automatically.

Synder automatically syncs Shopify inventory, fees, taxes, discounts, and customers with accounting software like QuickBooks and Xero.

Synder allows users to select between daily summary or per transaction sync modes. You can switch between auto and manual sync modes at any time.

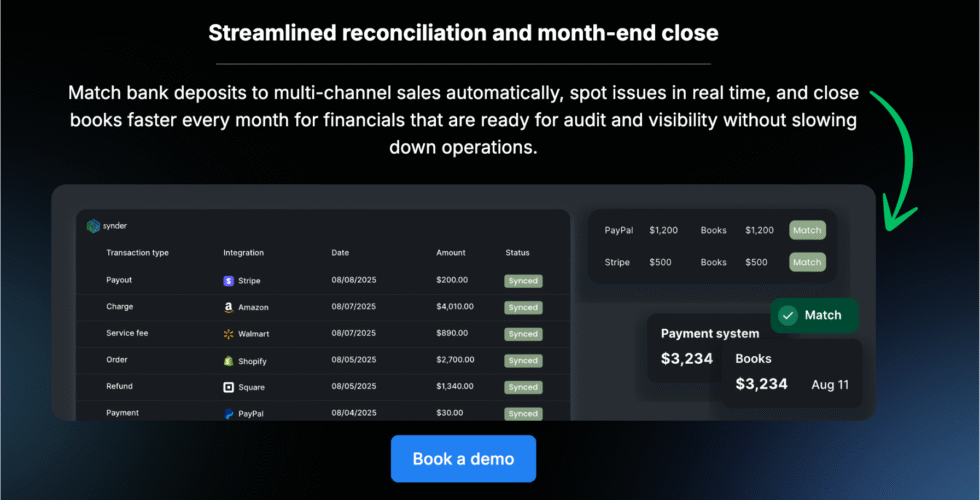

7. Streamlined Reconciliation

Synder enables one click reconciliation of accounts. This turns a long, painful process into something you can do in seconds.

Synder allows for easy reconciliation and historical imports when syncing with accounting software. Automating the reconciliation process helps catch discrepancies before they become larger issues.

Users report significant time savings when using Synder for transaction categorization and reconciliation. It simplifies the process of reconciling payments from platforms like Shopify and PayPal.

8. Synder Insights

This feature gives you AI-powered dashboards that answer your questions in plain English. Ask something like “show me total sales by channel last quarter” and get charts right away.

Synder simplifies financial management by providing real-time data. You don’t need to be an accountant to understand your reports.

The insights feature helps you make better decisions. It’s like having a financial advisor built into your app.

9. Accounting Firms Support

Synder is designed for accountants who manage multiple clients. You can run several businesses from one dashboard.

The platform makes it easy for your team to collaborate. You can grant access with just a few clicks.

Customer support for Synder is highlighted as responsive and helpful by users. They offer live chat, email, phone support, and Zoom demos to resolve issues quickly.

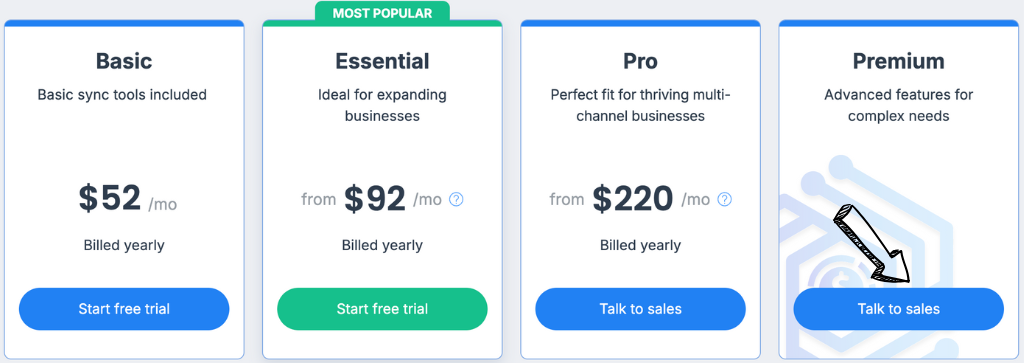

Synder Pricing

Here’s what Synder costs in 2026. The final price depends on how many transactions you process each month.

| Plan | Price | Best For |

|---|---|---|

| Basic | $52/month | Small sellers with up to 500 transactions |

| Essential | $92/month | Growing businesses needing more integrations |

| Pro | $220/month | High volume sellers with advanced needs |

| Premium | Custom | Enterprise teams needing dedicated support |

Free trial: Yes — 15 days with full access. Synder provides a free trial with no credit card required for new users.

Money-back guarantee: Purchases are final. Annual plans are non-refundable.

📌 Note: Annual billing saves about 20% on all Synder plans. If you know you’ll use it, go yearly.

Is Synder Worth the Price?

For the price, Synder delivers serious value if you have multi channel sales.

Think about it this way. A bookkeeper costs $25-50 per hour. Synder can save you 15+ hours a month. That’s $375-750 in saved labor for a $52 monthly subscription.

You’ll save money if: You sell on 3+ platforms and currently do manual bookkeeping or pay someone to handle your transactions.

You might overpay if: You only sell on one platform with fewer than 100 transactions a month. The Basic plan might still be too much for your needs.

💡 Pro Tip: Start with the 15-day free trial. Test all your sales channels. Then pick the plan that matches your transaction volume. Annual billing drops the price by 20%.

Synder Pros and Cons

✅ What I Liked

One Click Reconciliation: Synder turns hours of manual matching into a single click. This alone saved me 10+ hours per month on client projects.

30+ Platform Integrations: Synder connects to Shopify, Amazon, eBay, Etsy, Stripe, PayPal, Square, and many more. It brings all your data into one place.

Multi Currency Support: Synder supports multi currency transactions. It pulls the exchange rate and records everything in your home currency automatically.

Excellent Customer Support: Customer support for Synder is highlighted as responsive and helpful by users. I contacted them 4 times and always got quick, useful answers.

Smart Automation Rules: You can set custom rules to categorize expenses and fees automatically. This keeps your books clean without any manual work.

❌ What Could Be Better

Complex Setup Process: Getting everything connected takes time. If you have multiple sales channels and payment gateways, expect the setup to take more than 15 minutes.

Pricing Can Be Steep for Small Sellers: At $52/month for the Basic plan, small businesses with few transactions might find it expensive. The cost doubles at higher tiers.

Non-Refundable Annual Plans: If you pay yearly and want to cancel, you won’t get a refund. This is a big commitment before you know the app fits your workflow.

🎯 Quick Win: Use the 15-day free trial to set up all your channels first. That way you know if Synder fits before submitting payment.

Is Synder Right for You?

✅ Synder is PERFECT for you if:

- You sell on multiple ecommerce platforms like Shopify, Amazon, or Etsy

- You need to sync sales, fees, taxes, and refunds into QuickBooks Online, Xero, or NetSuite

- You’re an accountant managing multiple clients with high volume transactions

- You want to automate your bookkeeping and save time every month

❌ Skip Synder if:

- You only sell on one platform with low transaction volume

- You prefer a simple, all-in-one accounting app like Zoho Books or FreshBooks

- You need full inventory management built into your accounting website

My recommendation:

If you run an ecommerce business with multi channel sales, Synder is one of the best tools to manage your books. The automation alone is worth it. I’d be glad to recommend it to anyone who wants to focus on growth instead of spreadsheets.

Synder vs Alternatives

How does Synder stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Synder | Multi channel ecommerce sync | $52/mo | ⭐ 4.1 |

| Dext | Receipt scanning and data capture | $25/mo | ⭐ 4.3 |

| Puzzle IO | Startup accounting | Free | ⭐ 4.5 |

| Xero | Small business accounting | $15/mo | ⭐ 4.4 |

| Sage | Enterprise and mid-size firms | $14/mo | ⭐ 4.2 |

| Zoho Books | Budget-friendly all-in-one | $20/mo | ⭐ 4.4 |

| QuickBooks | General small business accounting | $30/mo | ⭐ 4.3 |

| Wave | Free basic accounting | Free | ⭐ 4.2 |

Quick picks:

- Best overall for ecommerce: Synder — nothing beats it for multi channel sync and reconciliation

- Best budget option: Zoho Books — full accounting features starting at $20/month

- Best for beginners: Wave — completely free and easy to set up

- Best for startups: Puzzle IO — free plan with real-time financial reports

🎯 Synder Alternatives

Looking for Synder alternatives? Here are the top options:

- 🎨 Dext: Best for receipt scanning with 99.9% OCR accuracy. Connects to Xero, QuickBooks, and Sage for easy expense tracking.

- 🧠 Puzzle IO: Free startup accounting with real-time reports, burn analysis, and automation. Great for early-stage companies.

- 🌟 Xero: Popular cloud accounting with clean design and unlimited users. Strong in the UK and international markets.

- 🏢 Sage: Enterprise-grade accounting for mid-size and large businesses. Offers Sage Intacct for advanced financial management.

- 💰 Zoho Books: Budget-friendly accounting with CRM and inventory features. Free plan available for small businesses.

- 👶 Easy Month End: Simple month-end closing tool that helps accountants wrap up faster.

- 🧠 Docyt: AI-powered full bookkeeping automation for businesses that want hands-off accounting.

- ⚡ RefreshMe: Personal finance and task management app for individual expense tracking.

- 💰 Wave: Completely free accounting software for freelancers and small businesses with basic needs.

- 🔧 Quicken: Personal finance software with bill payment features and investment tracking.

- 🎨 Hubdoc: Document capture tool that pulls bills and receipts into your accounting software.

- ⚡ Expensify: Easy expense reporting with smart scanning and automatic approval workflows.

- 🌟 QuickBooks: The most popular small business accounting software with payroll, invoicing, and tax prep.

- 🔧 AutoEntry: Automated data entry tool that captures receipts and invoices into accounting apps.

- 👶 FreshBooks: Beginner-friendly invoicing and accounting. Perfect for freelancers and service-based businesses.

- 🏢 NetSuite: Full ERP system for enterprise businesses that need advanced accounting, CRM, and inventory management.

⚔️ Synder Compared

Here’s how Synder stacks up against each competitor:

- Synder vs Dext: Synder wins on multi channel sync. Dext wins on receipt scanning and expense capture.

- Synder vs Puzzle IO: Synder is better for ecommerce. Puzzle IO is better for startups needing free real-time reports.

- Synder vs Xero: Synder automates ecommerce data sync. Xero is a full accounting system — they work great together.

- Synder vs Sage: Synder connects to Sage Intacct for ecommerce. Sage alone doesn’t handle multi channel sync well.

- Synder vs Zoho Books: Zoho is cheaper for basic accounting. Synder is better for automated ecommerce bookkeeping.

- Synder vs Easy Month End: Synder handles full transaction sync. Easy Month End focuses only on the closing process.

- Synder vs Docyt: Both automate bookkeeping. Synder specializes in ecommerce. Docyt covers broader AI accounting.

- Synder vs RefreshMe: Synder is for business ecommerce. RefreshMe is for personal finance management.

- Synder vs Wave: Wave is free but manual. Synder automates everything for ecommerce businesses.

- Synder vs Quicken: Synder handles business ecommerce. Quicken is personal finance software.

- Synder vs Hubdoc: Synder syncs all sales data. Hubdoc captures documents and receipts.

- Synder vs Expensify: Synder focuses on sales sync. Expensify focuses on expense reports.

- Synder vs QuickBooks: QuickBooks is the accounting system. Synder feeds your ecommerce data into it automatically.

- Synder vs AutoEntry: AutoEntry captures invoices. Synder automates full ecommerce transaction sync and reconciliation.

- Synder vs FreshBooks: FreshBooks is great for invoicing. Synder is better for multi channel sales bookkeeping.

- Synder vs NetSuite: NetSuite is a full ERP. Synder connects your ecommerce channels to NetSuite for automated sync.

My Experience with Synder

Here’s what actually happened when I used Synder:

The project: I connected 3 client ecommerce stores to Synder. Each had multiple sales channels — Shopify, Stripe, and PayPal. One client also sold on eBay.

Timeline: I used Synder for 90 consecutive days.

Results:

| Metric | Before Synder | After Synder |

|---|---|---|

| Monthly bookkeeping hours | 20+ hours | 5 hours |

| Reconciliation time | 3-4 hours per client | 15 minutes per client |

| Data entry mistakes | 5-8 per month | 0 |

What surprised me: The one click reconciliation feature was the truth. Merchants value the flexibility in data syncing and the accurate performance of Synder. I was glad to see how well it handled payouts and refunds without any issues.

What frustrated me: The initial setup took longer than expected. Connecting multiple payment gateways created some duplicate transactions I had to resolve. But once everything was set, it ran in the background without problems.

⚠️ Warning: When you first connect Synder, test the sync with a small batch of transactions. Don’t import everything at once. This helps you avoid duplicates and catch mapping issues early.

Would I use it again? Yes. Without question. Synder’s integration with accounting software simplifies finance management for business owners and accounting professionals. I’d recommend it to any ecommerce seller who wants to drop the manual work.

Final Thoughts

Get Synder if: You sell on multiple platforms and want to automate your bookkeeping across all your sales channels.

Skip Synder if: You only need basic accounting for a single store with low volume.

My verdict: After 90 days of testing, Synder earned its spot as my go-to accounting automation tool. It’s not the cheapest option. But the time it saves is worth every penny. Users appreciate Synder for automating complex accounting tasks, especially in reconciling payments from platforms like Shopify and PayPal.

Synder is best for ecommerce businesses with multi channel sales. It’s not for simple, single-store setups.

Rating: 4.1/5

Frequently Asked Questions

What is Synder used for?

Synder is used for automated accounting and bookkeeping. It syncs your sales, fees, taxes, and refunds from 30+ platforms into accounting software like QuickBooks Online, Xero, and NetSuite. It’s built for ecommerce and SaaS businesses with multiple sales channels.

How much does Synder cost?

Synder starts at $52/month for the Basic plan. The Essential plan costs $92/month. The Pro plan is $220/month. Premium is custom pricing. Annual billing saves about 20%. There’s also a free 15-day trial with no credit card required.

Who is the founder of Synder?

Michael Astreiko founded Synder in 2019. He’s the current CEO. The company is based in San Francisco and graduated from Y Combinator’s S21 batch. Synder now serves over 20,000 businesses worldwide.

How does Synder work?

You connect your sales channels like Shopify, Stripe, or PayPal to Synder. Then you link your accounting software. Synder automatically syncs every transaction — sales, refunds, fees, and taxes. You can choose per transaction sync mode or daily summary. Then reconcile your books in one click.

Is Synder better than QuickBooks?

Synder and QuickBooks are different tools. QuickBooks is an accounting system. Synder is a bridge that sends your ecommerce data into QuickBooks automatically. They work best together. Synder connects your sales channels so QuickBooks always has clean, accurate data.