Having to handle 1099 forms can be a real headache, right?

Are you tired of the paperwork and the worry of getting it all done correctly and on time? You’re not alone!

Many small businesses and individuals struggle with this every year.

That’s why finding the right e-filing platform is crucial. Could Tax1099 be the answer you’re looking for?

Let’s dive into a detailed Tax1099 review to see if it truly lives up to the hype as the best e-filing platform.

Ready to join the 150,000+ businesses who e-filed over 5 million forms with Tax1099 last year? Simplify your tax season. Explore this leading eFiling platform now!

What is Tax1099?

Tax1099 is software from Zenwork that helps you create and e-file your tax form 1099 easily.

If you pay a vendor or another person who isn’t an employee, you likely need to file 1099 forms with the IRS.

Tax1099.com makes this simpler.

You can collect tax info from your recipient and import data from Excel or other programs like Xero.

It helps you handle different 1099s, like the 1099-NEC.

You can even upload your forms and fix errors.

Many accountants and cpa firms use this provider for processing these forms for their clients.

It offers integration with other tools to make the whole process smooth.

Who Created Tax1099?

Zenwork, founded by Sanjeev Singh, launched Tax1099 in 2009.

Their goal was simple: make e-filing tax forms like 1099s easier.

Zenwork envisioned user-friendly software for businesses and accountants to navigate IRS requirements and manage vendor payments without the usual hassle.

Top Benefits of Tax1099

- Easy E-filing: Effortlessly e-file various tax forms, including 1099-NEC and other 1099s, simplifying the filing process.

- Saves Time: Quickly upload data or enter it directly, bypassing manual steps and speeding up submissions to the IRS.

- Reduces Errors: The digital platform minimizes manual data entry mistakes, leading to more accurate filings and fewer penalties.

- Seamless Integration: It connects smoothly with Xero, Excel, and other tools for easy data import and streamlined workflows.

- Simple Recipient Handling: Efficiently collect and organize recipient details, ensuring accurate information for 1099 filings.

- Secure Processing: Your sensitive tax data is protected with secure processing measures.

- Ideal for Professionals: A valuable tool for accountants and cpa firms managing filings for numerous clients.

- Correction Features: Easily fix and resubmit any incorrect tax form filings electronically.

Best Features of Tax1099

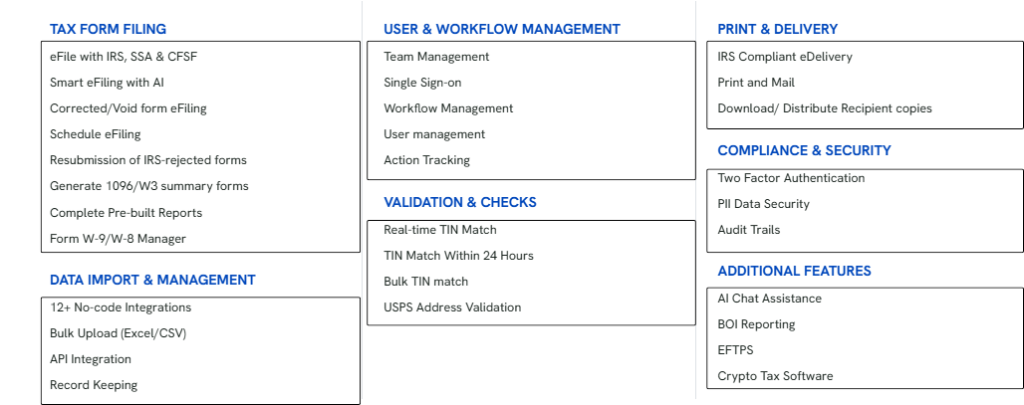

Tax1099 isn’t just another way to file taxes.

It has some really neat tools that make the whole process of handling 1099s much simpler and less stressful.

Let’s look at five of the best things it can do for you.

1. Data Import & Management

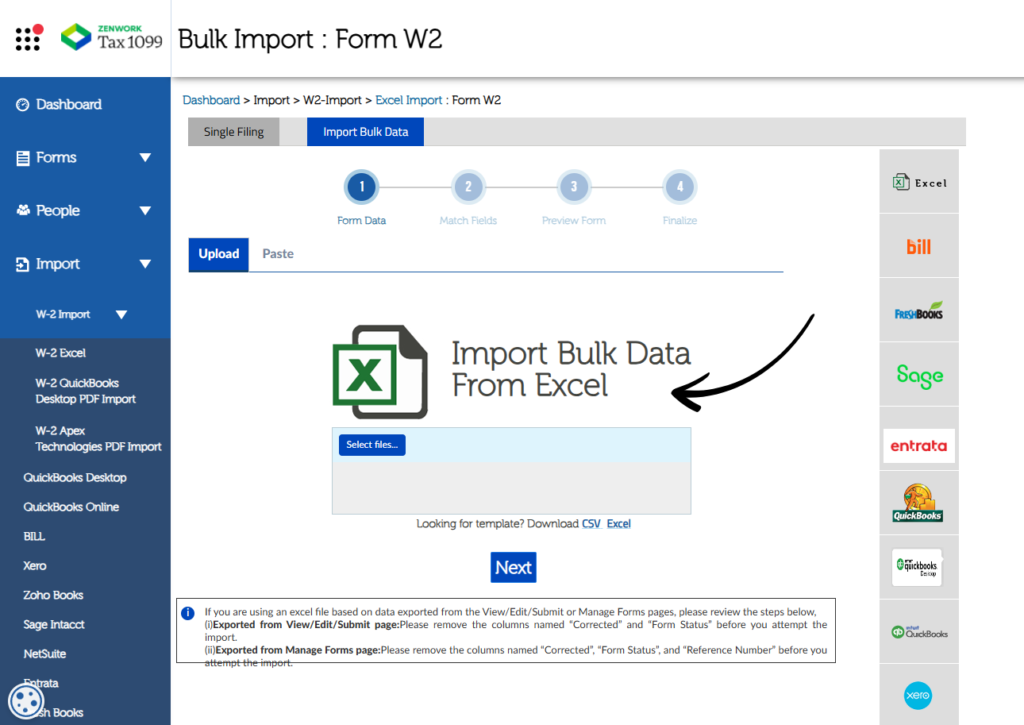

Tired of typing everything in? Tax1099 lets you upload info easily.

You can use excel or connect with Xero.

This saves you time & helps avoid mistakes when you have lots of 1099s to handle.

You can also see and check your info before sending it to all your recipients.

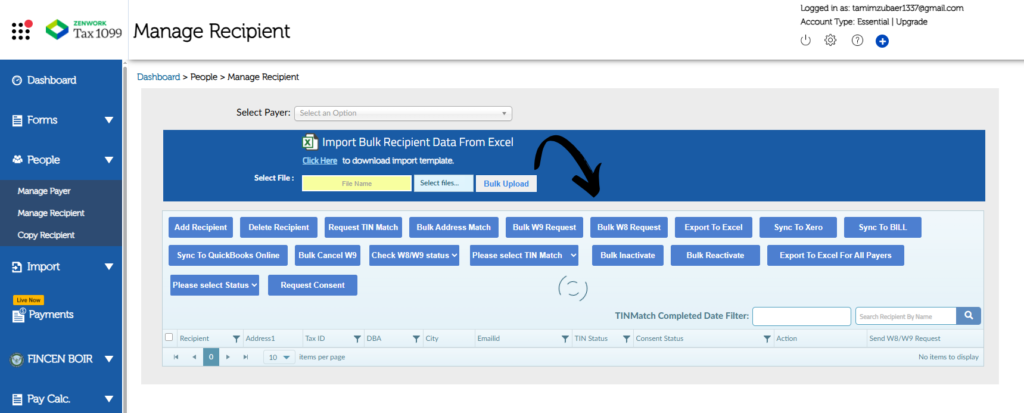

2. Manage Recipients

Keeping track of who you paid can be tricky. Tax1099 helps you collect and keep their info safe.

You can update names and addresses easily.

This makes sure you have what you need to file 1099 forms right for the IRS.

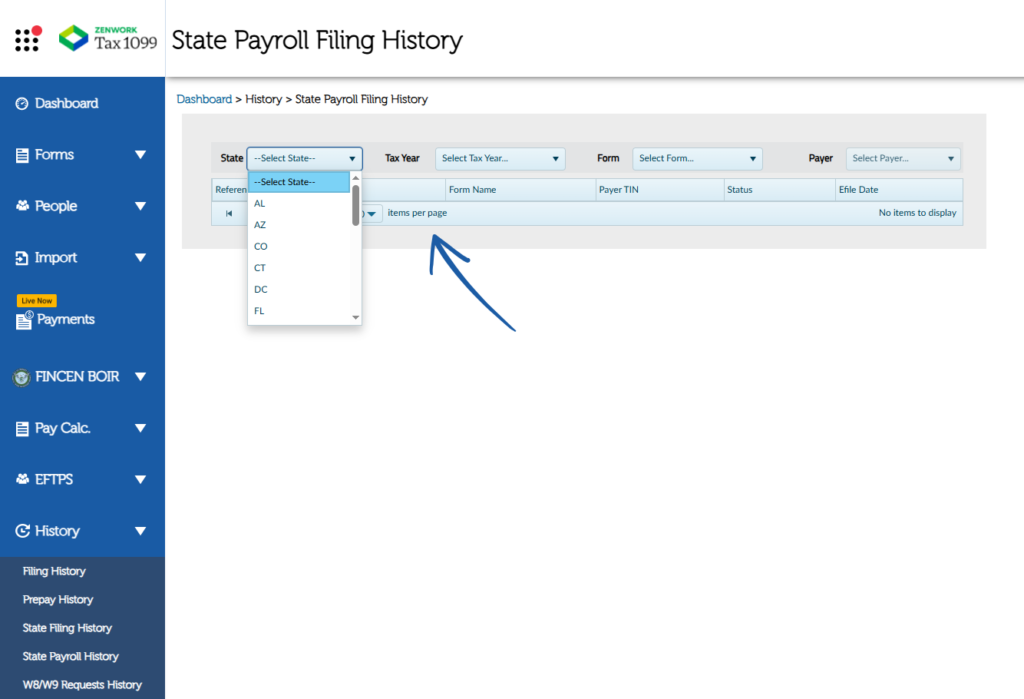

3. State Payroll Filing History

If you have to file in your state, too, Tax1099 keeps track of it.

You can see what you sent before.

This helps you stay organized and follow all the state rules along with the main e-file rules.

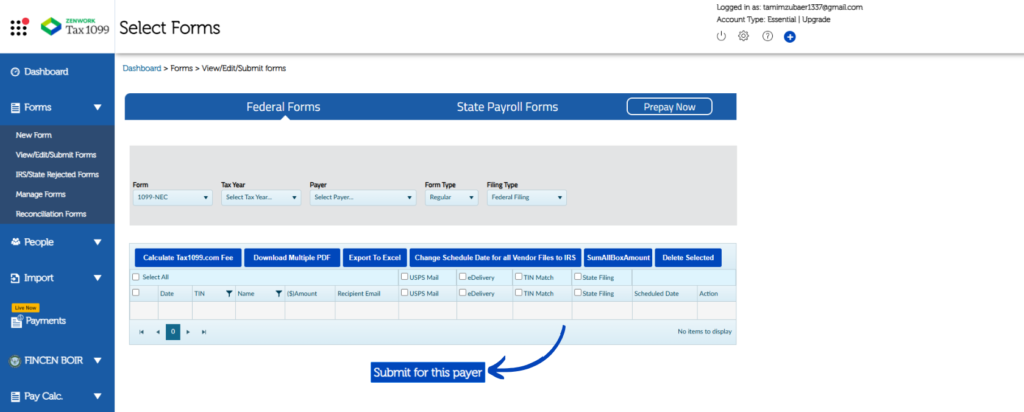

4. Tax Form Filing

The main thing Tax1099 does is help you file your tax forms.

Whether it’s the 1099-NEC or other 1099s, it walks you through it.

It knows all the IRS rules. You can create, check, and e-file right on tax1099.com.

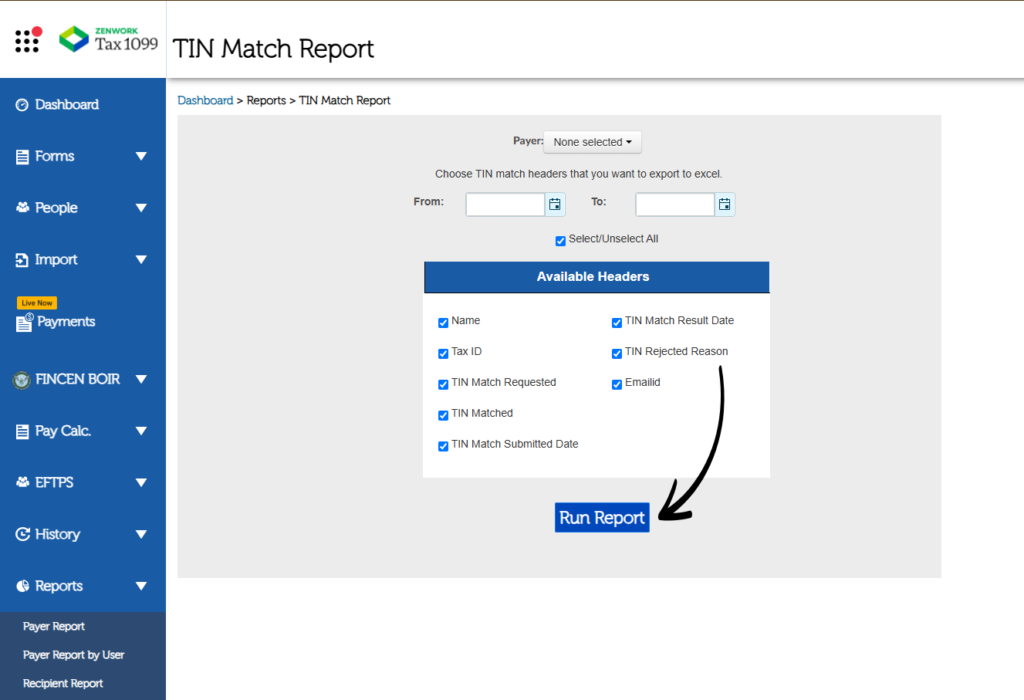

5. TIN Match Report

Scared of putting in the wrong tax ID numbers? Tax1099 has a TIN Match Report.

It checks the numbers with the IRS before you e-file.

This helps you avoid getting in trouble for wrong info and saves you time later.

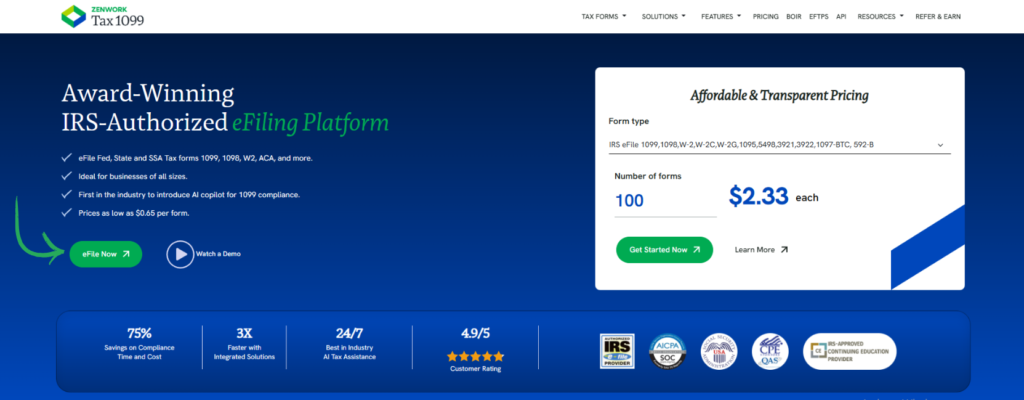

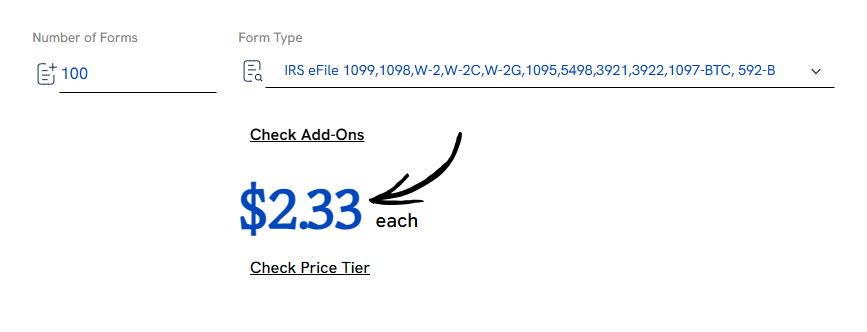

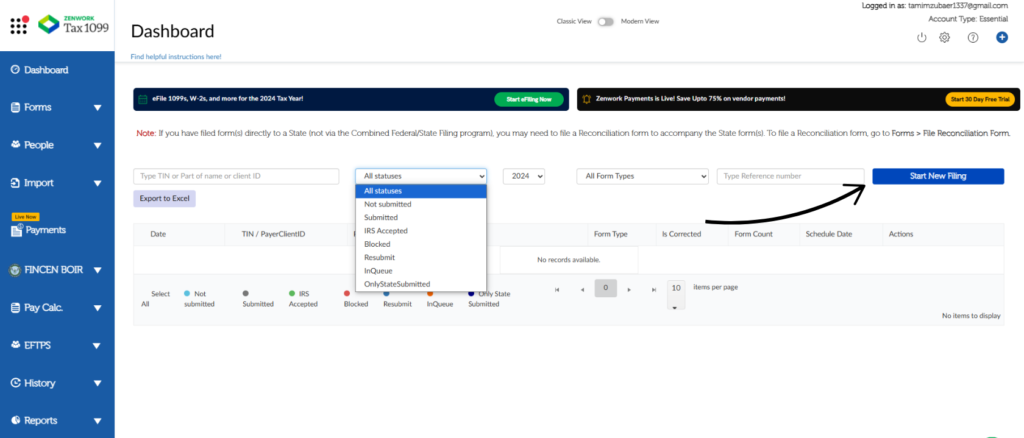

Pricing

Tax1099 offers different ways to pay, depending on how many forms you need to file and if you need extra services.

Here’s a simple look at some of the costs:

| Plan Name | Price |

| Check add on | $2.33 each |

Pros and Cons

Choosing the right e-filing platform is important.

Understanding the good and bad points of Tax1099 can help you to decide if it fits your needs.

Here’s a quick look at its main advantages and disadvantages.

Pros

Cons

Alternatives Of Tax1099

If Tax1099 doesn’t seem like the perfect fit, you can consider other e-filing platform options for your 1099s.

Here are a few alternatives:

- Intuit Tax Forms: Known for its user-friendly interface and integration with QuickBooks, it’s a popular choice for those already in the Intuit ecosystem.

- Track1099: This platform focuses on simplicity and offers various pricing tiers, potentially suitable for different business sizes.

- eFileMyForms: This offers direct IRS filing and recipient mailing services, emphasizing straightforward processing.

- 1099 Pro: Provides more advanced features, including state filing and data import options, catering to businesses with more complex needs.

- IRS Filing Options (Directly): For a limited number of forms, the IRS offers free electronic filing options like IRS FIRE, though it may require more technical setup.

Remember to compare features, pricing, and ease of use to find the eFiling platform that best meets your specific requirements for handling tax forms like the 1099-NEC and other 1099s.

Personal Experience with Tax1099

This past tax season, our team needed a more efficient way to handle 1099s for our numerous vendors.

The manual process was time-consuming & prone to errors.

We decided to try Tax1099, hoping for a smoother e-file experience. Here’s how it worked for us:

- Easy Data Import: The data import feature was a lifesaver. We were able to quickly upload our Excel spreadsheet containing all the recipient information, saving us hours of manual entry.

- Streamlined Recipient Management: Managing recipient details became much simpler. We could easily review and update information within the platform, ensuring accuracy for all our 1099-NEC and other 1099s.

- Efficient Tax Form Filing: The tax form filing process was straightforward. The platform guided us through each step, making it easy to create and e-file directly with the IRS.

- Peace of Mind with TIN Match: Using the TIN Match Report feature helped us identify and correct potential errors in recipient tax identification numbers before submission, reducing the risk of penalties.

- Seamless Xero Integration: The integration was incredibly helpful for our accounting team using Xero. It allowed for a direct flow of information and further simplified the process.

Overall, Tax1099 significantly improved our 1099 filing process.

The time saved and the increased accuracy made it a valuable tool for our team.

Final Thoughts

Dealing with paper 1099s is a pain. The Tax1099 website makes it easier to e-file.

You can keep track of vendors and check their tax numbers.

Uploading your information and filing different tax forms, like the 1099-NEC, is simple.

It costs money, and the price goes up if you have many forms or need extra help.

However, for many small businesses and accountants, the Tax1099 website can save time and worry when taxes are due.

Want to file your 1099s easier in 2025?

Think about using the Tax1099 website to see if it’s right for you.

Frequently Asked Questions

What kinds of tax forms can I file with Tax1099?

You can e-file many tax forms on Tax1099.com, including the common 1099-NEC and other 1099s, like the 1099-MISC. The website supports various IRS forms for different payment types.

How does Tax1099 help me manage my recipients?

Tax1099 lets you easily collect and store recipient information. You can upload data, update details, and keep everything organized for accurate 1099 filing. This makes managing your vendor contacts simpler.

Is my information safe when I use Tax1099?

Yes, Tax1099 uses secure processing to protect your sensitive data. They follow industry standards to keep your tax information safe when you e-file your tax forms through their platform.

Can Tax1099 integrate with my accounting software?

Yes, Tax1099 offers integration with some accounting software like Xero. This allows for a smoother flow of your financial data, making it easier to import information for your 1099 filings.

What if I make a mistake on a 1099 form I filed with Tax1099?

Tax1099 allows you to fix errors on previously filed forms. You can make corrections and resubmit them electronically to the IRS, helping you stay compliant.