Thinking about doing your taxes online this year?

Feeling overwhelmed by the options? You’re not alone!

Many are searching for a simple, reliable way to file without the headache.

Taxfyle has been making waves, promising access to real CPAs and convenient filing.

But is it truly the best online accounting service in 2025?

This review examines Taxfyle features, pricing, & user experience to help you decide if it’s the right fit for your needs.

Let’s explore!

Save time and stress! 92% of Taxfyle users love its easy CPA access and secure e-filing. See why they recommend it!

What is Taxfyle?

Taxfyle is a service that helps you with your money stuff.

Think of it as having an accountant online.

If you own a business, Taxfyle can help with bookkeeping.

When it’s tax season, they make it easy to file your taxes and get your tax return.

You don’t have to figure it all out yourself. Real tax pros, like tax professionals, help you with your tax documents.

It’s like outsourcing your taxes so you can focus on other things as a business owner.

Taxfyle helps you deal with the IRS without all the stress.

They make it simpler to file your taxes.

Who Created Taxfyle?

Richard Lavina and Michael Mouriz founded Taxfyle in August 2015.

Richard, a CPA, saw a need for simpler tax filing.

Their vision: easy online access to tax professionals, like ordering a ride.

By connecting people with real experts online.

They wanted to make the tax return process less stressful for everyone, including business owners.

Top Benefits of Taxfyle

- Access to Real Tax Pros: Get help from qualified tax professionals, including CPAs and EAs, not just software. This means you can get expert advice tailored to your specific situation.

- Convenient Online Filing: Forget paper and long appointments. File your taxes from the comfort of your home, at your own pace, using their easy-to-navigate platform.

- Secure and Safe: Your sensitive tax documents are protected with strong security measures, giving you peace of mind during the entire tax return process.

- Saves You Time: Avoid the stress and time commitment of trying to understand complex tax laws on your own. Let the experts handle your tax filing.

- Help for Business Owners: Taxfyle offers specialized services for business tax needs and bookkeeping, freeing up your time to focus on running your company.

- Transparent Pricing: Know the cost upfront. Taxfyle provides clear pricing before you start, so there are no surprise fees during tax season.

- Efficient Tax Filing: The platform is designed to streamline the tax filing process, making it quicker and more efficient than traditional methods.

- Great for Outsourcing: For business owners, Taxfyle offers a reliable solution for outsourcing your bookkeeping and tax needs, saving you money on in-house staff.

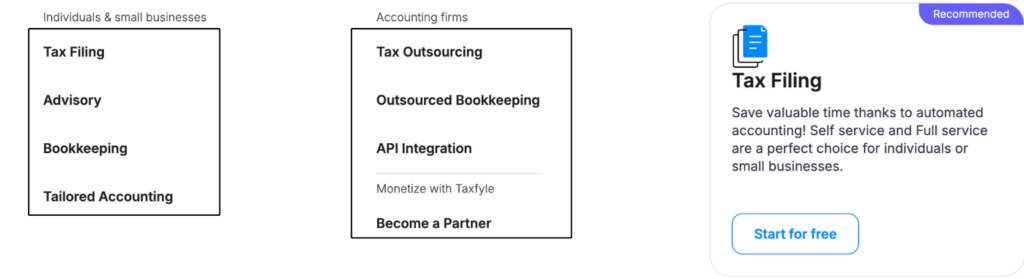

Best Features of Taxfyle

Taxfyle is more than just a way to file your taxes.

It has cool features that help regular people and business owners.

You get real tax pros to help you. Let’s look at some of the best parts:

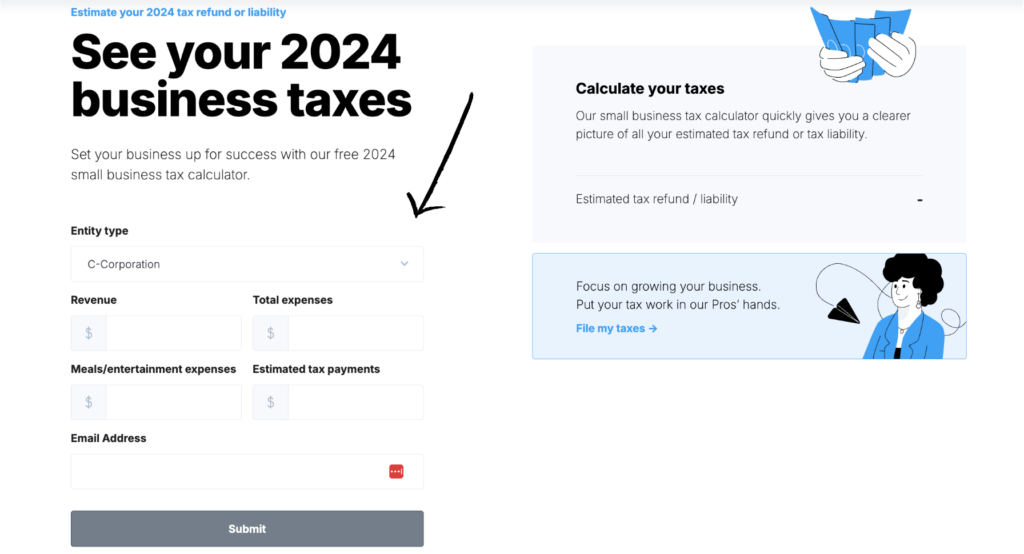

1. Business Tax Calculator

If you own a business, this tool helps you guess how much you might owe in business tax.

You put in some numbers, and it gives you an idea.

This helps business owners plan their money better for their business tax return.

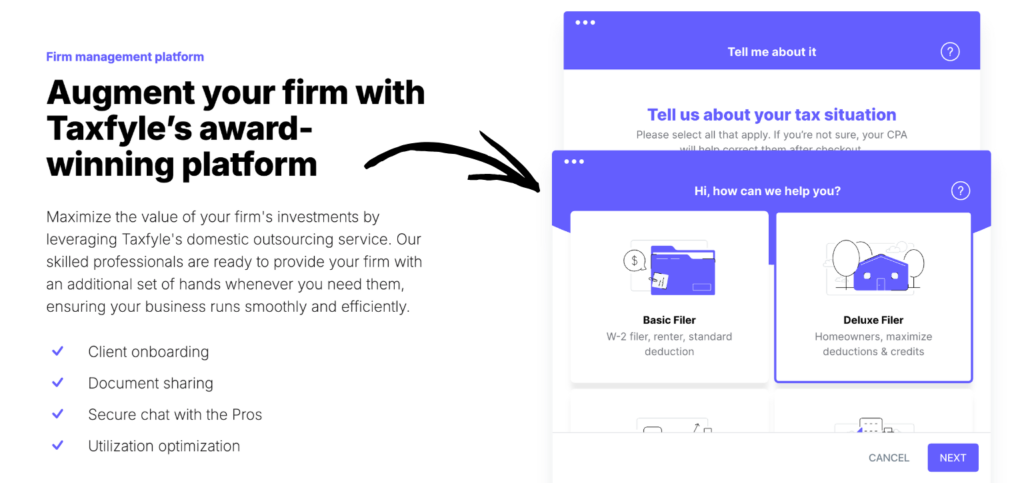

2. Firm Management

If you have a company that does taxes, this helps you keep things organized.

You can manage tax documents and give work to your tax professionals.

It makes it easier to outsource tasks, especially when it’s busy tax season.

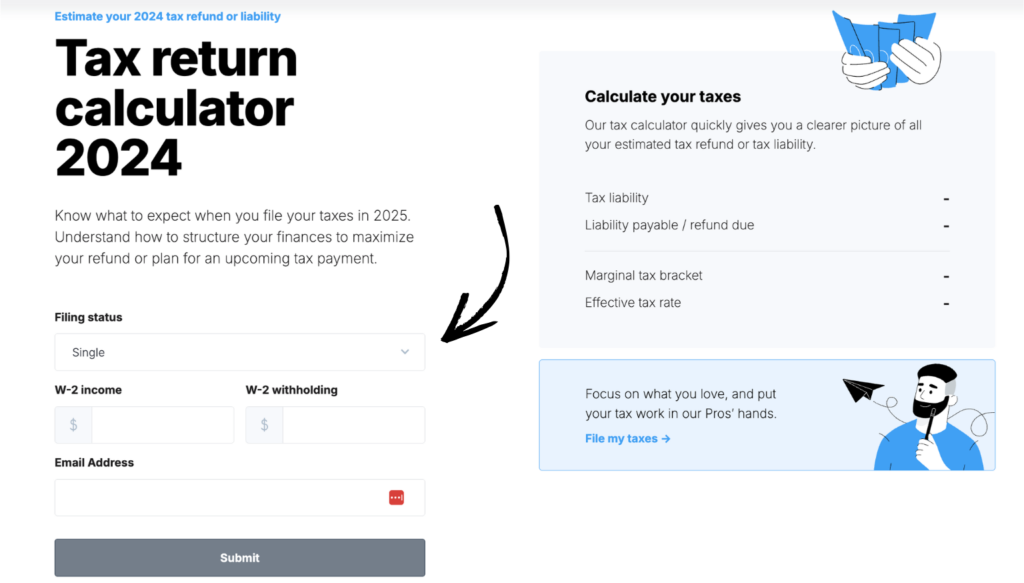

3. Tax Return Calculator

Want to know if you’ll get money back or owe?

This tool helps you guess your tax return.

You put in some simple info, and it gives you an idea before you file your taxes.

4. Outsourcing

Taxfyle lets you give your taxes to someone else to handle.

Regular people can outsource their whole tax filing.

Business owners can outsource their bookkeeping and business tax work.

This saves time, especially during tax season.

5. Powerful API

If you have a business or make software, this lets Taxfyle work with other programs.

It helps move tax documents and money information easily.

Making things simpler for business owners who want to use Taxfyle with other tools.

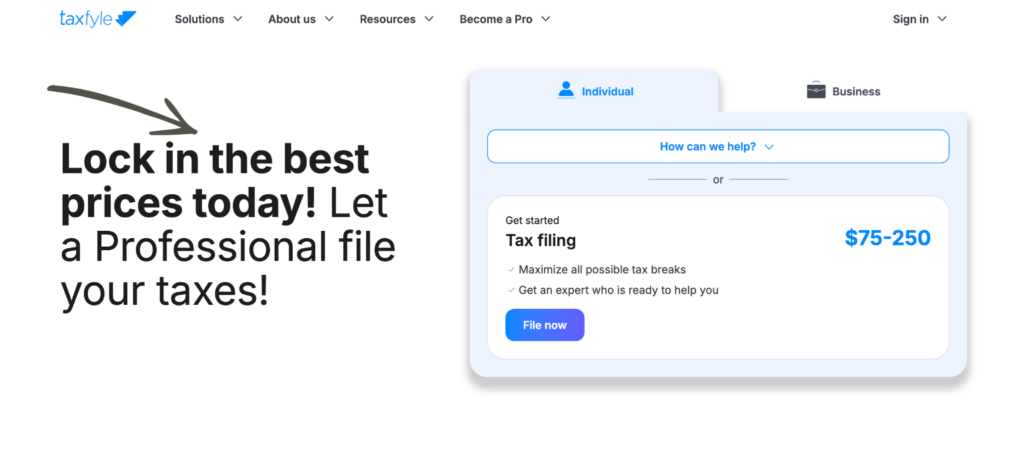

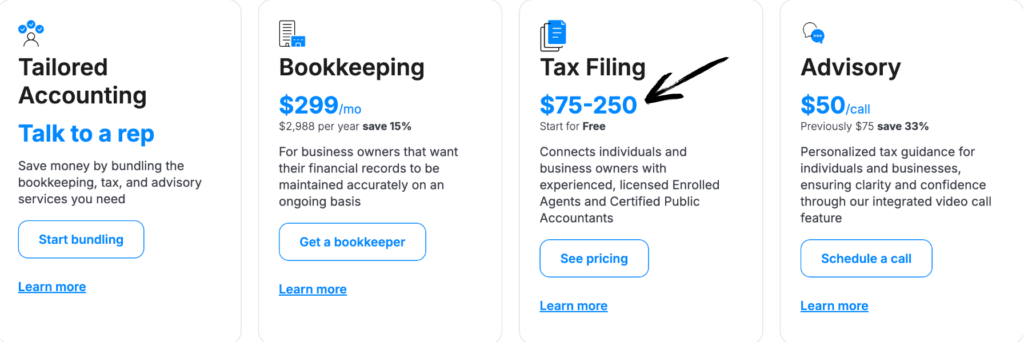

Pricing

Taxfyle offers different pricing tiers based on the complexity of your tax situation.

Here’s a general overview of their pricing structure:

| Plan Name | Estimated Price |

| Tailored Accounting | Custom Pricing |

| Bookeeping | $299/mo |

| Tax Filling | $75-250 |

| Advisory | $50/call |

Pros and Cons

Choosing the right tax filing service is important.

Understanding the good and bad points helps you decide if Taxfyle fits your needs.

Let’s look at the main advantages & disadvantages.

Pros

Cons

Alternatives of Taxfyle

While Taxfyle offers a unique approach with its access to tax professionals, several other online tax filing services cater to different needs & budgets.

Here are a few alternatives:

- TurboTax: A popular choice known for its user-friendly interface and step-by-step guidance. It offers various tiers for different tax complexities.

- H&R Block Online: Similar to TurboTax, it provides online filing options with the added benefit of potential in-person support if needed.

- FreeTaxUSA: A budget-friendly option that offers free federal filing and charges a small fee for state returns. It’s a good choice for simpler tax situations.

- Credit Karma Tax (now Cash App Taxes): Offers free federal and state filing. It’s a straightforward option for those with less complex returns.

- Local CPA or Accountant: For highly complex tax situations or personalized advice, a local tax professional can offer tailored support and in-depth knowledge.

Personal Experience with Taxfyle

We decided to try Taxfyle, and it significantly simplified our workflow.

The ability to connect directly with experienced tax professionals was a game-changer.

Here’s what we found particularly beneficial:

- Direct Access to Tax Pros: We could ask specific questions related to our business tax and receive timely, expert advice.

- Efficient Document Management: Uploading and organizing tax documents was straightforward, saving us considerable time.

- Simplified Complex Returns: The platform handled intricate returns, including investment income and self-employment taxes, with ease.

- Firm Management Tools: For our collaborative efforts, the firm management features allowed us to assign tasks and track progress effectively.

- Time Savings: Outsourcing the more complex tax filing aspects to Taxfyle freed up our team to focus on other critical tasks.

Overall, Taxfyle provided a professional and efficient way to navigate the complexities of tax season.

Final Thoughts

Taxfyle offers a new way to handle your taxes.

You get to work with real tax professionals online, which is super helpful.

It can save you time & stress, especially during tax season.

If your taxes are simple, it might cost a bit more than basic software.

But if you have a business or your taxes are tricky, Taxfyle can be a great choice.

You get expert help without leaving your house.

Ready to ditch the tax stress? See how Taxfyle can simplify your tax filing today!

Frequently Asked Questions

How does Taxfyle work?

Taxfyle connects you with qualified tax professionals like CPAs and EAs online. You upload your tax documents, answer questions, and a pro prepares and files your taxes securely. It’s a convenient way to handle your tax return without meeting in person.

Is Taxfyle safe to use?

Yes, Taxfyle uses strong encryption and security measures to protect your sensitive tax documents and personal information. They prioritize your privacy throughout the entire tax filing process.

How much does Taxfyle cost?

Taxfyle’s pricing varies depending on the complexity of your tax return. Simple federal returns start at a lower price, with additional costs for state filings and more complex situations like business tax. You’ll see the price before you start.

Can Taxfyle help with business taxes?

Yes, Taxfyle offers services for business owners, including help with business tax returns, bookkeeping, and access to tax professionals experienced in business taxation. They can assist with various business structures.

What if I have questions about my tax return?

Taxfyle allows you to communicate directly with the tax professional assigned to your tax return. You can ask questions & get clarification throughout the tax filing process, ensuring you understand your results.