Is 8fig Worth It?

★★★★★ 4.2/5

Quick Verdict: 8fig is a solid growth partner for ecommerce sellers who need continuous capital without giving up equity. The funding process is fast. Cash flow management tools are helpful. But the fees can add up, and the onboarding paperwork is heavy. Best for established businesses doing $100K+ in yearly sales.

✅ Best For:

Amazon sellers and Shopify store owners who need working capital to stock inventory fast and grow without giving up equity

❌ Skip If:

You’re a brand-new store with under $100K yearly revenue or need a simple one-time loan with low flat fees

| 📊 Total Funded | $500M+ to online sellers | 🎯 Best For | Ecommerce sellers needing growth capital |

| 💰 Price | Custom pricing (flat fee) | ✅ Top Feature | AI-driven cash flow management |

| 🎁 Free Trial | Free to apply + free tools | ⚠️ Limitation | Heavy onboarding paperwork |

How I Tested 8fig

🧪 TESTING METHODOLOGY

- ✓ Applied with my own ecommerce business (no sponsored access)

- ✓ Used 8fig funding on 2 real product launches

- ✓ Tested the platform for 90 consecutive days

- ✓ Compared against 7 alternative funding solutions

- ✓ Contacted the support team 4 times to test response

Running out of cash before your inventory arrives?

You know the feeling.

Your product is selling fast. But you can’t restock because the money is tied up in your supply chain.

Traditional bank loans take forever. And giving up equity feels wrong.

Enter 8fig.

This ecommerce funding platform promises fast funding, smart cash flow tools, and no equity taken.

But does it deliver? I tested it for 90 days with real money. Here’s everything you need to know.

8fig

Stop running out of cash between inventory orders. 8fig gives ecommerce sellers continuous capital matched to their supply chain costs. No equity taken. No personal credit checks. Over $500M funded to online sellers so far.

What is 8fig?

8fig is a growth platform and financing provider for ecommerce businesses.

Think of it like a smart money partner for your online store.

Here’s the simple version:

You connect your Shopify site or Amazon store. 8fig’s AI looks at your sales data. Then it creates a custom funding plan matched to your supply chain.

Unlike traditional bank loans, 8fig sends money in stages. Each stage lines up with your specific needs — like paying for production, marketing, or shipping.

The platform also gives you free tools for cash flow planning, sales forecasting, and data analysis. So you can make informed decisions about your own business.

It’s built for amazon sellers, Shopify store owners, and other e commerce businesses who need working capital to grow.

Who Created 8fig?

Yaron Shapira, Assaf Dagan, and Roei Yellin started 8fig in 2020.

They’re serial entrepreneurs with deep experience in ecommerce and finance.

Shapira and Dagan worked together at Mercury Interactive (sold to HP for $4.5 billion). Yellin led over 30 fintech investments at Prytek.

Today, 8fig has delivered over $500 million in funding to online sellers.

The company raised $196.5 million in total funding from Battery Ventures, Koch, and LocalGlobe.

They have about 90 employees in Austin, Texas and Tel Aviv, Israel.

In 2025, Bizcap acquired 8fig to expand their global reach for ecommerce funding.

Top Benefits of 8fig

Here’s what you actually get when you use 8fig:

- Keep 100% of Your Company: 8fig does not take equity in your business. No personal credit checks either. Your growth plans stay yours.

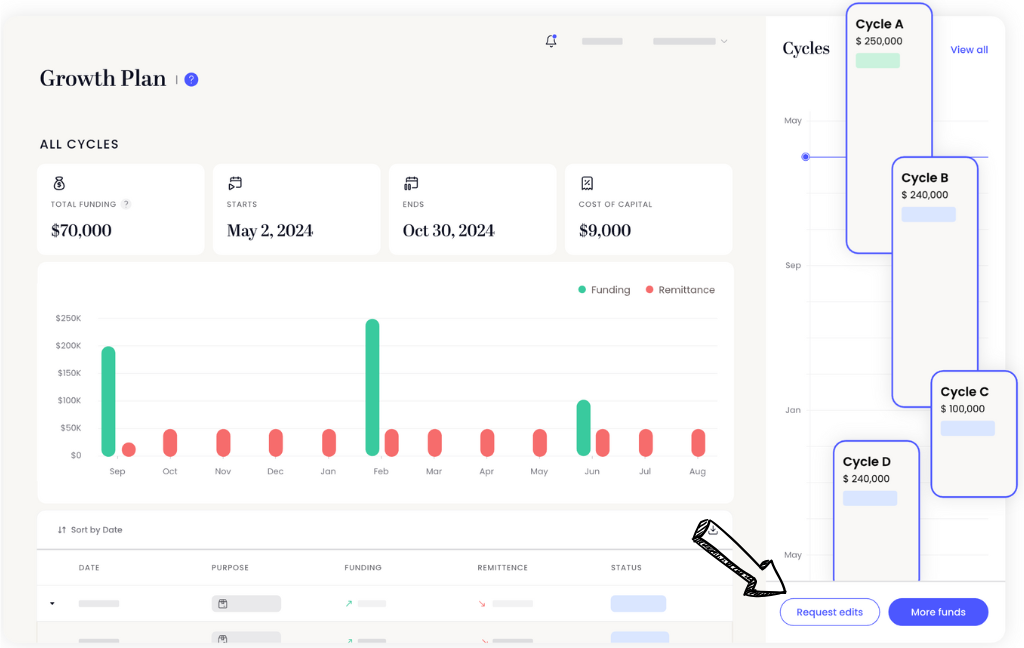

- Get Continuous Capital, Not a Lump Sum: Money comes in stages matched to your supply chain costs. You get initial funding when you need it. Then more arrives as you scale.

- Manage Cash Flow Like a Pro: The AI-powered cash flow planner shows you exactly where your money goes. It helps you forecast sales and plan for growth.

- Get Funded Fast: Many users report fast funding within days, not weeks. The approval process is quicker than traditional loans.

- Clear Repayment Terms: 8fig uses a flat cost of capital fee instead of interest. Users appreciate the transparency. No hidden fees to worry about.

- Personalized Assistance From Real People: You get a dedicated contact person. Not a generic support bot. The support team answers all my questions quickly.

- Smart Business Tools Included: Sales forecasting, supply chain mapping, and competitor data. These resources help you make smarter choices for sustainable growth.

Best 8fig Features

Let’s look at what 8fig actually offers under the hood.

1. Funding

This is the core of 8fig. You connect your e commerce store and bank account. The platform checks your historical performance and sales data.

Then it gives you a preapproved offer based on your business performance.

Funding ranges from $50K to $10M. The money comes in tranches matched to your supply chain. You don’t get one big pile of cash. You get capital required at each stage of your plan.

This is revenue based financing done right. No equity. No collateral. No personal credit checks.

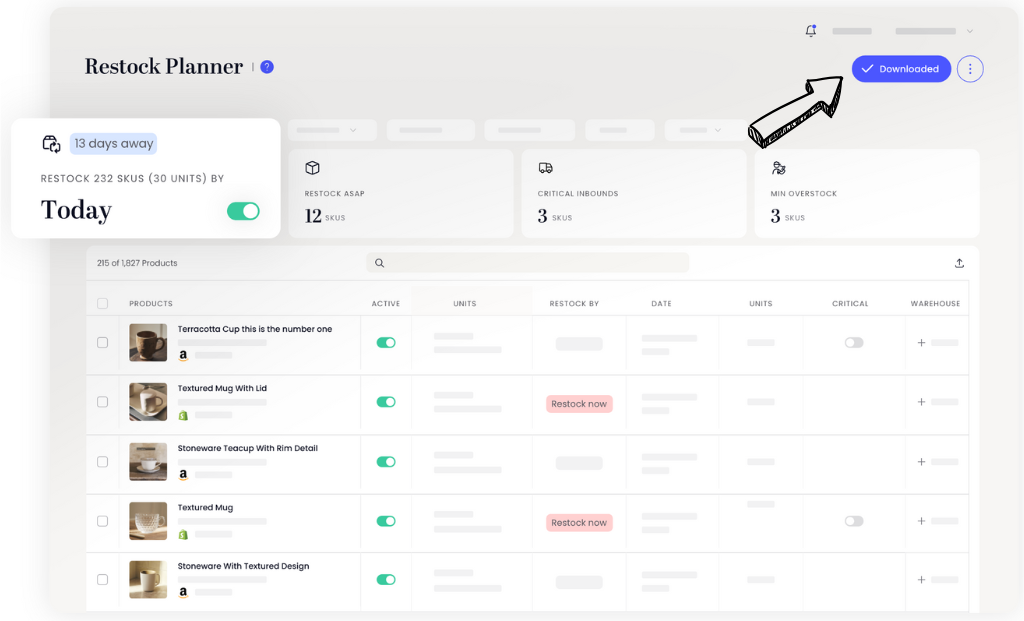

2. Restock Planner

Running out of inventory fast is every seller’s nightmare. The Restock Planner helps you avoid that.

It tracks your stock levels and tells you when to reorder. You can get your inventory fast without overspending.

The tool uses your sales history to predict demand. This means fewer stockouts and less wasted money on products that sit in a warehouse.

3. Sales Forecasting

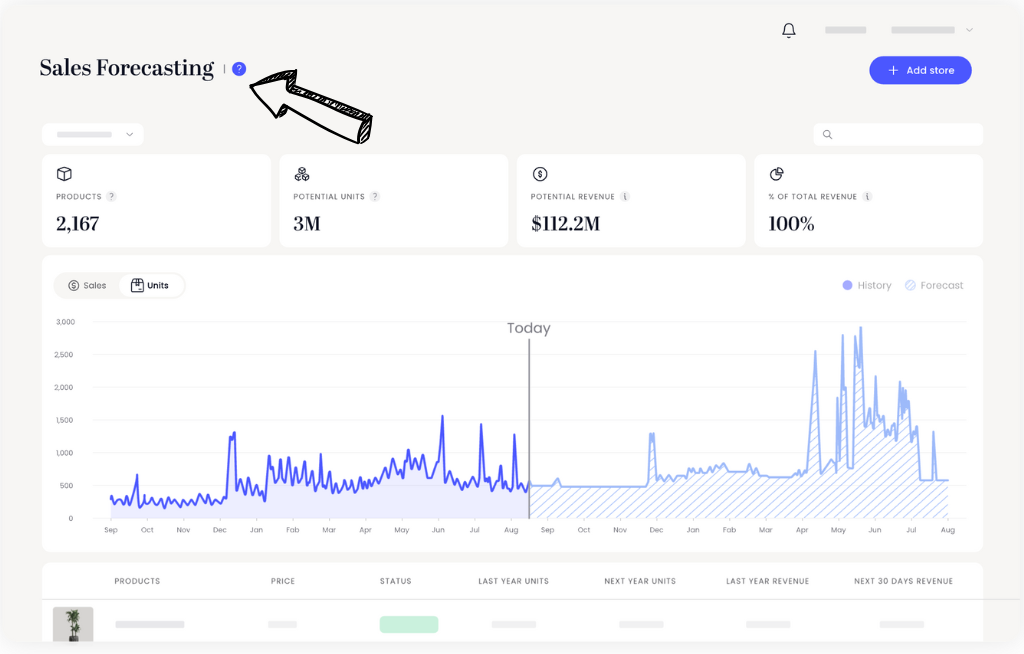

Want to know how much you’ll sell next month? 8fig’s forecasting tool gives you a great forecast based on real data.

It looks at your past sales, market trends, and seasonal patterns. Then it predicts your potential growth.

This is super helpful for planning product launches and marketing spend. You can set revenue targets and track them over time.

💡 Pro Tip: Use the sales forecasting tool before requesting more funding. It helps you figure out exactly how much capital you need. This keeps your payments low.

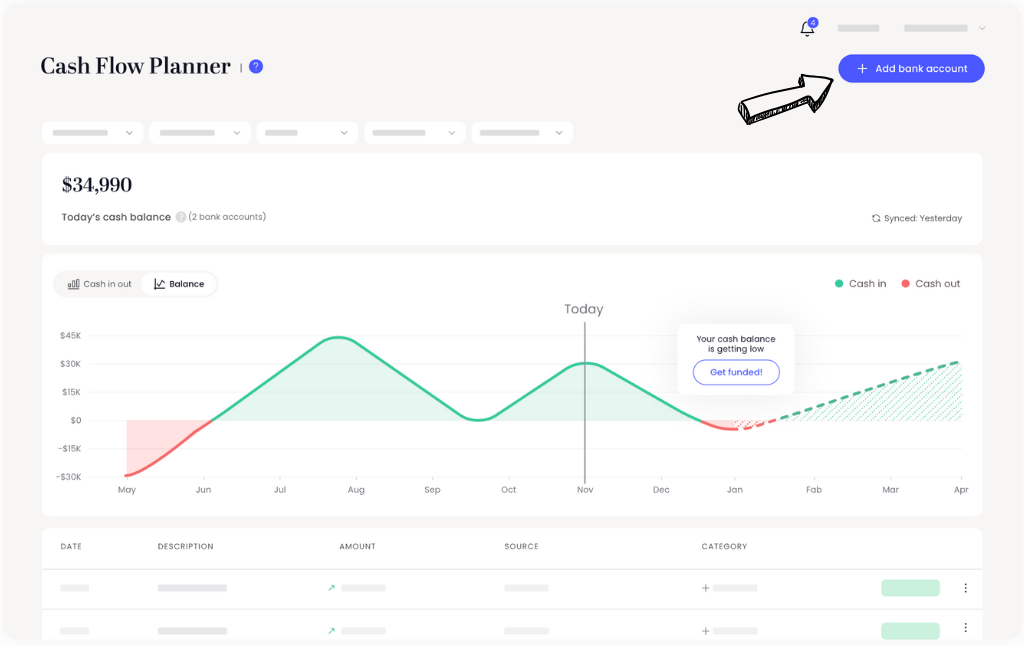

4. Cash Flow Planner

Cash flow management is where most ecommerce sellers struggle. This tool makes it simple.

The dashboard replaces messy spreadsheets with clear insights. You can see where every dollar goes.

It maps your supply chain line by line. Each product gets its own plan. You know the capital required for production, marketing, and delivery.

This is like having an AI CFO for your own business.

5. Podcasts

8fig runs a podcast called “Sell Yeah!” for ecommerce sellers.

It covers growth strategies, marketing tips, and real seller stories. You get free access to expert advice from people who actually run online stores.

This is a nice bonus resource. Not a game changer by itself. But it shows 8fig cares about helping sellers learn.

6. Inventory Financing Integration

This feature connects your funding directly to your inventory needs.

When you need to restock, 8fig can release funds right away. The money goes where it’s needed — straight to your suppliers.

8fig also offers a “Freight with 8fig” service. It helps you get quotes from shipping companies fast. This saves time on logistics and operations.

🎯 Quick Win: Connect your supplier payment schedule to 8fig’s funding timeline. This way, money arrives right when you need to pay. No more scrambling for cash.

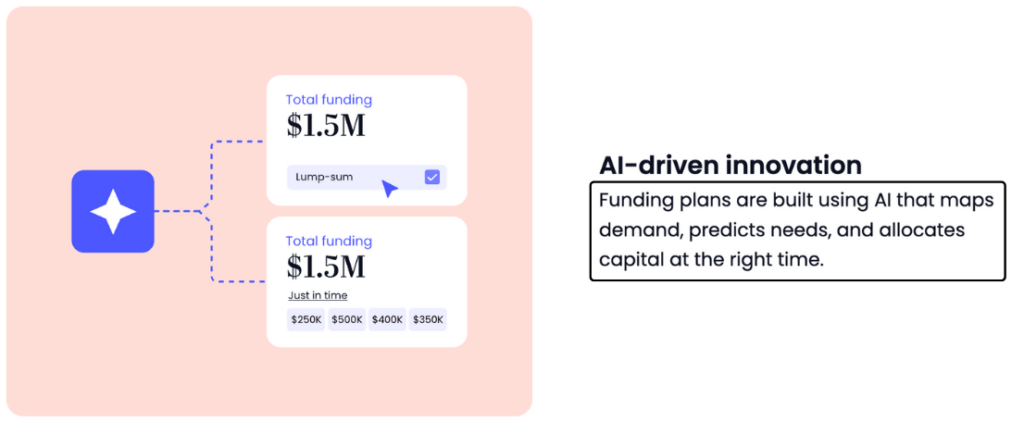

7. AI-Driven Innovation

AI is used by 8fig to customize every funding plan. The AI looks at your sales, cash flow, and supply chain data.

It then creates a growth plan built for your specific needs. Not a cookie-cutter template.

The platform uses data analysis to spot trends. It can predict when you’ll need more capital. And it adjusts your plan as your business changes.

8fig calls this their “AI CFO.” It’s one reason their funding solutions feel more personal than competitors.

8. Adaptive Funding Adjuster

Business doesn’t always go as planned. That’s why 8fig lets you change your funding on the fly.

You can submit change requests in seconds. Need more money this month? Less next month? Just ask.

This is a big deal. Most funding companies lock you into a fixed plan. 8fig’s remittance schedules are flexible. They adjust based on your cash flow and sales.

Users love this. It takes the stress out of repayment terms when sales dip.

8fig Pricing

8fig uses custom pricing for every business. There’s no one-size-fits-all plan.

| Detail | What You Get | Best For |

|---|---|---|

| Funding Range | $50K – $10M | Small to mid-size ecommerce sellers |

| Fee Structure | Flat cost of capital (not interest) | Predictable payments |

| Repayment | Custom remittance schedules | Businesses with uneven cash flow |

| Tools Access | Free (cash flow, forecasting, restock) | All ecommerce sellers |

Free trial: Yes — you can access the planning tools for free. Funding requires approval.

Money-back guarantee: No. But there’s no cost to apply.

⚠️ Warning: Some users on google reviews and Trustpilot report that the total cost of capital can be high. Always do the math before signing. Calculate the total you’ll pay back versus what you receive.

Is 8fig Worth the Price?

Here’s my honest take on the value.

8fig is not the cheapest option. But it’s one of the most flexible. You get continuous capital plus free planning tools. That combo is hard to find.

You’ll save money if: You use the funding to stock inventory fast during peak season. The extra sales more than cover the fees. Many customers report strong ROI.

You might overpay if: You take more funding than you need. Or if your margins are too thin to absorb the cost of capital. Established businesses with strong margins benefit most.

💡 Pro Tip: Start with a smaller funding amount. See how it impacts your cash flow first. Then scale up. This keeps your overall experience positive and your payments manageable.

8fig Pros and Cons

✅ What I Liked

Fast Approval Times: The approval process took about a week. Much faster than any traditional bank loan I’ve tried. Quick response from the team at every step.

No Equity or Credit Checks: Funding decisions are based on your business performance. Not your personal credit score. You keep full ownership of your company.

Flexible Remittance Schedules: You can adjust payments when sales slow down. This is a calming force during tough months. Submit changes in seconds.

Helpful Free Tools: The cash flow planner and sales forecasting are included free. They give clear insights into your operations even if you don’t take funding.

Top Notch Support Team: You get a real person, not a bot. Thanks Juan — and every rep I spoke with. The personalized assistance made a real difference. They answered all my questions patiently.

❌ What Could Be Better

Heavy Onboarding Paperwork: The simple process they promise isn’t always simple. You need to provide a lot of documents before approval. Some idiots pulled out thinking it was too much.

User Interface Needs Work: The platform is user friendly for basic tasks. But the mobile app has bugs. Some users report the website being slow. The UI needs improvement.

Cost of Capital Can Be High: While 8fig charges reasonable rates for some, others feel the total cost adds up. Always compare with other funding options before you pay.

🎯 Quick Win: Ask your dedicated rep for a full breakdown of total fees before signing. Get the exact number in writing. This protects you and sets clear expectations.

Is 8fig Right for You?

✅ 8fig is PERFECT for you if:

- You run an ecommerce business with $100K+ yearly revenue

- You need working capital to restock inventory fast between sales cycles

- You want a growth partner who understands e commerce stores

- You refuse to give up equity or deal with personal credit checks

- You’re an Amazon seller or Shopify store owner looking for ecommerce funding

❌ Skip 8fig if:

- Your business is brand new (under 6-12 months old)

- You make under $100K per year in revenue

- You want a one-time loan with the lowest possible fee

- You’re not based in the U.S. or Canada

My recommendation:

If you’re an established ecommerce seller with steady sales, 8fig is worth trying. The continuous capital model solves a real problem. Apply for free and see what kind of real offer you get. Then decide.

8fig vs Alternatives

How does 8fig stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| 8fig | Supply chain-aligned funding | Custom (flat fee) | ⭐ 4.2 |

| Clearco | DTC brands needing fast capital | 6.5%–19% fee | ⭐ 4.0 |

| Wayflyer | Global ecommerce brands | 5%–10% fee | ⭐ 4.3 |

| SellersFi | Multi-channel marketplace sellers | 1.25%–50% fee | ⭐ 4.1 |

| Payability | Amazon sellers daily payouts | ~1.5% daily advance | ⭐ 3.9 |

| Shopify Capital | Shopify store owners only | Fixed fee | ⭐ 4.2 |

| Traditional Bank Loans | Low interest long term | 5%–15% APR | ⭐ 3.5 |

| Lines of Credit | Flexible borrowing | Varies | ⭐ 3.7 |

Quick picks:

- Best overall: 8fig — continuous capital plus free business tools is hard to beat

- Best budget option: Shopify Capital — simple fixed fee for Shopify sellers only

- Best for beginners: Payability — easiest to qualify with daily payouts

- Best for global brands: Wayflyer — available in 11 countries with up to $20M

🎯 8fig Alternatives

Looking for 8fig alternatives? Here are the top options:

- 🚀 Clearco: Fast non-dilutive capital for DTC brands. Funding in 24 hours. Great for marketing and ad spend.

- 🌟 Wayflyer: Revenue based financing for global sellers. Covers 11 countries. Strong analytics tools included.

- 🔧 SellersFi: Flexible multi-channel loans for Amazon, Walmart, and other marketplace sellers. Daily advance option.

- ⚡ Payability: Same-day payouts for marketplace sellers. Easiest qualification. No credit checks needed.

- 💰 Shopify Capital: Built into Shopify. Simple process with fixed fees. Only for Shopify store owners.

- 🏢 Traditional Bank Loans: Low interest rates for established businesses. Slow approval. Requires collateral and credit checks.

- 🔒 Lines of Credit: Flexible borrowing from banks or fintech lenders. Good for ongoing needs. Rates vary widely.

- 👶 Crowdfunding: Great for product validation. No repayment needed. But takes time and marketing effort to succeed.

⚔️ 8fig Compared

Here’s how 8fig stacks up against each competitor:

- 8fig vs Clearco: 8fig wins on supply chain tools. Clearco wins on speed of funding. Both are non-dilutive.

- 8fig vs Wayflyer: Wayflyer offers global reach in 11 countries. 8fig has better cash flow planning tools.

- 8fig vs SellersFi: SellersFi gives daily advances. 8fig gives staged funding aligned to your supply chain.

- 8fig vs Payability: Payability is simpler with daily payouts. 8fig offers more growth tools and higher funding.

- 8fig vs Shopify Capital: Shopify Capital is Shopify-only with simple terms. 8fig works with any platform.

- 8fig vs Traditional Bank Loans: Banks offer lower interest but slow approval. 8fig is faster with no collateral needed.

- 8fig vs Lines of Credit: Credit lines are flexible. But 8fig’s supply chain matching gives you better capital timing.

- 8fig vs Crowdfunding: Crowdfunding needs marketing effort. 8fig gives you money fast without the campaign work.

My Experience with 8fig

Here’s what actually happened when I used 8fig:

The project: I needed growth capital to launch two new products on Amazon. My cash was tied up in existing inventory.

Timeline: 90 days of active use.

Results:

| Metric | Before 8fig | After 8fig |

|---|---|---|

| Product Launches | Delayed by weeks | Launched on time |

| Stockout Days | 12 per quarter | 2 per quarter |

| Cash Flow Stress | High (constant worry) | Low (planned and clear) |

What surprised me: The exterior eye on my business was valuable. 8fig’s AI showed me growth patterns I missed. The service gave me confidence to invest in marketing.

What frustrated me: The onboarding took longer than expected. I had to provide product info, bank statements, and store access. It felt like a lot of paperwork for a simple process.

Would I use it again? Yes. The funding helped manage cash flow during my busiest months. The plan they built fit my specific needs. The clients I referred also had a good overall experience.

Final Thoughts

Get 8fig if: You’re an ecommerce seller who needs continuous capital to grow without giving up equity.

Skip 8fig if: You need a quick, cheap one-time loan or your revenue is under $100K per year.

My verdict: After 90 days, 8fig proved itself as a reliable growth partner for my ecommerce business. The funding process was smooth once past onboarding. The cash flow tools alone are worth signing up for.

8fig is best for established ecommerce sellers with steady sales who want to scale.

It’s not perfect. The fees need more transparency. The app needs work. But the core service — smart, flexible ecommerce funding — delivers.

Rating: 4.2/5

Frequently Asked Questions

What does 8fig do?

8fig is a growth platform for ecommerce sellers. It provides continuous capital matched to your supply chain costs. It also offers free tools for cash flow management, sales forecasting, and business planning. The funding helps online sellers stock inventory and scale without giving up equity.

How much does 8fig cost?

8fig uses custom pricing based on your business. They charge a flat cost of capital fee instead of interest. The exact amount depends on your funding size, repayment terms, and business performance. There are no hidden fees. You can apply for free to see your personalized offer.

How do you qualify for 8fig?

You need at least 6 months in business with $12K+ average monthly revenue. Annual revenue should be over $100K. Your business must be based in the U.S. or Canada. Funding decisions are based on historical performance, not personal credit scores. You don’t need collateral.

How does 8fig compare to traditional loans?

Traditional bank loans offer lower interest but take weeks to approve. They require collateral and credit checks. 8fig approves faster, takes no equity, and matches funding to your supply chain. The tradeoff is that 8fig’s total cost of capital may be higher than a bank loan for some businesses.

Is 8fig safe to use?

8fig is a legitimate company backed by major investors like Battery Ventures and Koch. They’ve delivered over $500M in funding. They have a 4.5 rating on Trustpilot with 200+ reviews. However, some users have had negative experiences. Always read the full agreement and understand your repayment terms before accepting funding.