Are you a small business owner or a freelancer looking for the best accounting software?

It’s tough to pick the right one, especially when you have options like Sage and Wave.

Both are popular, but they offer different things.

Don’t worry, we’re here to help you understand the key differences.

We’ll break down Sage vs Wave so you can decide which accounting software is the best.

Overview

We looked closely at both Sage and Wave.

We tested their features, ease of use, and what they cost.

This helped us see which one is better for different kinds of businesses.

Over 6 million customers trust Sage. With a customer satisfaction rating of 56 out of 100, its robust features are a proven solution.

Pricing: Free Trial Available. The premium plan at $66.08/month.

Key Features:

- Invoicing

- Payroll Integration

- Inventory Management

Over 4 million small businesses trust Wave to manage their finances. Explore Wave’s plans and find the right fit.

Pricing: Free plan available. Paid plan starts at $19/month.

Key Features:

- Invoicing

- Banking

- Payroll add-on.

What is Sage?

Let’s talk about Sage.

It’s been around for a while.

Lots of businesses use it. It helps keep track of money.

Think of it like a digital notebook for your business stuff.

Also, explore our favorite Sage alternatives…

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

What is Wave?

Okay, let’s talk about Wave.

Think of it like a helpful friend for your business money.

It lets you do things like send invoices and track what money comes in and goes out.

It can help you see the big picture of your business finances.

Also, explore our favorite Wave alternatives…

Our Take

Don’t settle for less! Join the over 2 million small businesses that rely on Wave’s powerful, free core accounting features to streamline their finances today.

Key Benefits

Wave’s strengths include:

- A 100% free core accounting plan.

- Serving over 2 million small businesses.

- Easy invoice creation and payment processing.

- No long-term contracts or warranties.

Pricing

- Starter Plan: $0month.

- Pro Plan: $19month.

Pros

Cons

Feature Comparison

This comparison provides a brief overview of Sage and Wave, two top accounting platform options.

We analyze how a feature-rich, scalable platform stacks up against a free accounting software, helping small business owners find the right fit for their needs.

1. Platform Scope and Target Audience

- Sage business cloud accounting is a full accounting platform designed for small businesses and medium sized businesses. The software includes features to manage sales, inventory, and payroll, helping companies manage their business’s finances effectively and grow.

- Wave is an online accounting solution designed for small business owners and freelancers. Its free accounting software and free platform are ideal for those just starting out or with very simple accounting needs, offering a straightforward way to manage their finances.

2. Accessibility and Unique Features

- Sage is a powerful desktop solution with robust cloud connectivity, though it can have mobile access limitations in some versions. It also has a powerful dedicated mobile app for on-the-go access. The platform is designed for accounting teams and pro accounting professionals.

- Wave makes financial management easy with its user-friendly interface. It’s a free platform that provides a great dedicated mobile app and solid invoicing features, giving peace of mind to small business owners. The ability to use the software for multiple companies on the same account is a valuable feature.

3. Core Accounting Features

- Sage business cloud offers a comprehensive set of accounting features, including pro accounting, expense management, and financial reporting. It helps you manage cash flow and provides robust tools to manage your finances effectively.

- Wave accounting review and user feedback show that its core accounting features are solid. It handles invoicing, expense management, and bank transactions effectively. The free bookkeeping software provides unlimited invoices, which is a great value, but it lacks some of the more advanced features found in Sage.

4. Automation and Efficiency

- Sage automates many manual tasks with features like bill tracking and identifying unreconciled differences between your bank and accounting records, helping your accounting teams to save time. It’s built for efficient workflow management and real time reporting.

- Wave makes managing finances simple by automating processes. It can auto import bank transactions and merge entries, reducing the need for manual tasks. The free starter plan helps businesses handle their day-to-day financial reporting with less effort and more efficiency.

5. Invoicing and Payments

- Sage allows you to create professional sales invoices, manage purchase orders, and accept various forms of payments. It is built to improve cash flow and helps you manage all aspects of your sales.

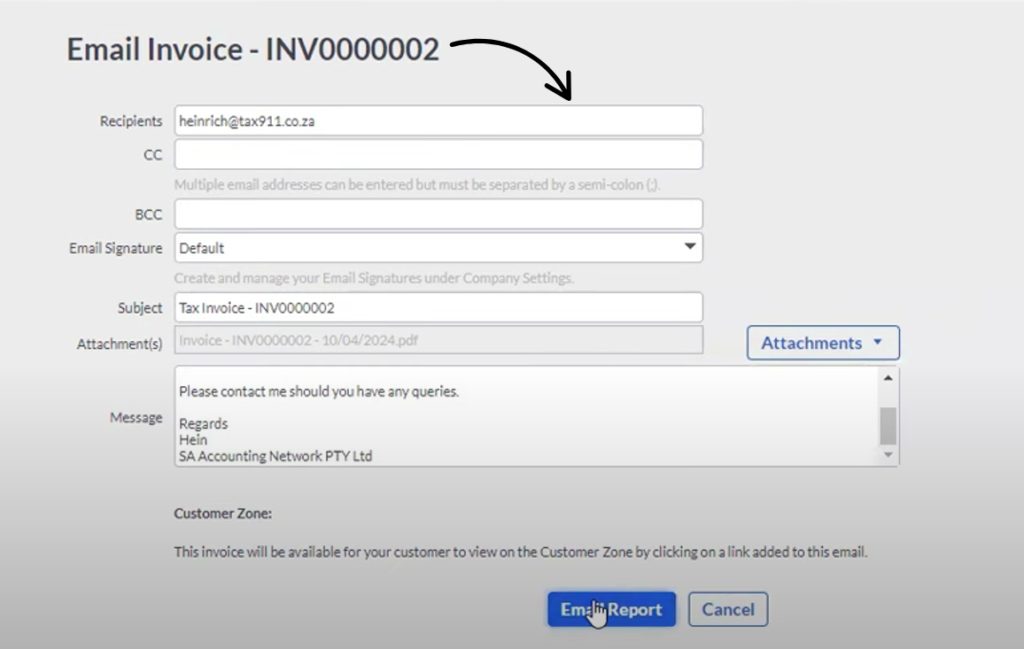

- Wave offers a great invoicing software with unlimited invoices on its free version. It sends automated payment reminders and allows you to accept multiple online payments, including credit card payments and bank payments. Wave also offers recurring invoices and recurring billing on its Pro Plan, which is an important feature for many small business owners.

6. Inventory and Job Costing

- Sage provides a robust inventory management system. It can create product variations, sync inventory automatically, and issue low stock alerts so you don’t miss a sale. It also has job costing and cost codes to track the profitability of specific projects.

- Wave does not offer native inventory management or job costing tools. This can be a potential drawbacks for companies that need to manage physical inventory. The wave integrates with third party apps to cover some of these needs, but it is not a built-in feature.

7. Payroll Processing

- Sage payroll is an optional add-on that offers comprehensive payroll software for accounting and payroll. It helps businesses manage active employee and contractor payments, ensuring compliance and accurate tax filing.

- Wave payroll is an optional add-on for accounting and payroll. It helps a business run payroll and ensures that each independent contractor paid is done correctly. However, it is a paid add-on, so it is not a part of the core free accounting features.

8. Support and Resources

- Sage provides extensive support through sage university, its community hub, and direct assistance to answer questions. If you need further assistance, you can find a wealth of articles and tutorials to resolve any issues.

- Wave offers support through its help center with articles, and its community hub is a place where users can answer questions and share best practices. Its support model is not as hands-on as Sage’s but its free starter plan and paid pro plan both offer some level of support.

9. Pricing and Plans

- Sage is a professional accounting platform with higher prices. It has a range of subscription level plans, and its pricing increases based on the features and users. This can be a potential drawbacks for very small companies.

- The Wave review often highlights its free accounting software as a major selling point. Wave offers a free starter plan with its core accounting features, and then a paid pro plan for more advanced tools like payroll processing and more. This makes it a great entry point for a solo user.

What to look for in an Accounting Software?

- Scalability: The best small business accounting software should handle your existing accounting data seamlessly. A robust paid plan often allows for multiple users and even unlimited users, so you won’t have to worry about additional costs as your team expands. You should be able to track your most revenue and manage your general ledger without limits.

- Support: What kind of help is available if you have questions? A good provider like wave financial offers a wealth of resources. You should look for articles and tutorials that explain key features or help you generate reports. The best support is available during regular business days and provides a discounted rate for professional services through their sage marketplace or partner network.

- Ease of Use: Is it something you and your team can learn quickly? An easy to use interface is a key features for any financial software. It should help you track expenses with a simple click and feature tools for digital receipt capture and auto merge to save you less time. The software should handle transactions automatically and give you a simple way to track personal finance and business money management features.

- Specific Needs: Does it handle the unique things your business does? The right accounting software offers the flexibility to accept online payments via bank accounts and to track billable hours for your customers. You should be able to create unique records and customize contact fields for your specific needs, and the system should handle credit card transaction and recurring expenses with ease.

- Security: How safe is your financial data with this software? Data security is a top priority. Look for features like multi factor authentication and online backups to protect your sensitive financial information. For businesses, providers like wave financial are often trusted as a secure alternative to larger competitors like quickbooks online, and a great many users will recommend wave as a safe option.

Final Verdict

So, which accounting software is best? It truly depends on your needs.

For freelancers or very small businesses, Wave is often the winner.

It’s free and user-friendly, perfect for managing basic income and expenses.

However, if your business is growing or needs more complex tools, Sage is likely the better choice.

It offers deeper features like better inventory and payroll options.

We’ve looked at both closely, comparing everything from billing to scalability.

Trust our research to help you pick the right tool for your business.

More of Sage

It’s helpful to see how Sage stacks up against other popular software.

Here is a brief comparison with some of its competitors.

- Sage vs Puzzle IO: While both handle accounting, Puzzle IO is designed specifically for startups, focusing on real-time cash flow and metrics like burn rate.

- Sage vs Dext: Dext is primarily a tool for automating data capture from receipts and invoices. It often works alongside Sage to make bookkeeping faster.

- Sage vs Xero: Xero is a cloud-based option known for being user-friendly, especially for small businesses. Sage can offer more robust features as a business grows.

- Sage vs Synder: Synder focuses on syncing e-commerce platforms and payment systems with accounting software like Sage.

- Sage vs Easy Month End: This software is a task manager that helps you keep track of all the steps needed to close your books at the end of the month.

- Sage vs Docyt: Docyt uses AI to automate bookkeeping and eliminate manual data entry, providing a highly automated alternative to traditional systems.

- Sage vs RefreshMe: RefreshMe is not a direct accounting competitor. It focuses more on employee recognition and engagement.

- Sage vs Zoho Books: Zoho Books is part of a large suite of business apps. It’s often praised for its clean design and strong connections to other Zoho products.

- Sage vs Wave: Wave is known for its free plan, which offers basic accounting and invoicing, making it a popular choice for freelancers and very small businesses.

- Sage vs Quicken: Quicken is more for personal or very small business finances. Sage offers more robust features for a growing business, like payroll and advanced inventory.

- Sage vs Hubdoc: Hubdoc is a document management tool that automatically collects and organizes financial documents, similar to Dext, and can integrate with accounting platforms.

- Sage vs Expensify: Expensify is an expert at managing expenses. It’s great for receipt scanning and automating expense reports for employees.

- Sage vs QuickBooks: QuickBooks is a major player in the small business accounting world. It’s known for its user-friendly interface and a wide range of features.

- Sage vs AutoEntry: This is another tool that automates data entry from receipts and invoices. It works well as an add-on to accounting software like Sage.

- Sage vs FreshBooks: FreshBooks is especially good for freelancers and service-based businesses, with a focus on simple invoicing and time tracking.

- Sage vs NetSuite: NetSuite is a full-scale ERP system for larger businesses. Sage has a range of products, with some competing at this level, but NetSuite is a bigger, more complex solution.

More of Wave

- Wave vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Wave vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Wave vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Wave vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Wave vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Wave vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Wave vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Wave vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Wave vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Wave vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Wave vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Wave vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Wave vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Wave vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Wave vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Wave truly free for small businesses?

Yes, Wave offers a completely free plan for basic accounting, invoicing, and receipt scanning. They make money from payment processing and payroll services, which are optional add-ons.

Can Sage integrate with other business tools?

Yes, Sage offers various integrations with other business software. This allows you to connect it with tools for CRM, e-commerce, and more, depending on your specific Sage product and plan.

Which is better for freelancers, Sage vs Wave?

For most freelancers, Wave is generally better. Its free plan and user-friendly interface are perfect for managing simple income and expenses without extra costs.

Does Wave offer payroll services?

Yes, Wave does offer payroll services as a paid add-on. It’s available for businesses in the US and Canada, helping you manage employee payments, taxes, and direct deposits.

Is Sage more complex than QuickBooks?

Sage can be seen as more complex than some entry-level QuickBooks versions. Both offer strong features, but Sage often caters to businesses needing more advanced or industry-specific accounting solutions.