Is AutoEntry Worth It?

★★★★★ 4/5

Quick Verdict: AutoEntry is the market-leading data automation tool for accounting. It kills manual data entry for receipts, invoices, and bank statements. After 90 days of testing, I found it saves up to 90% of time spent on paperwork. The accuracy is impressive at up to 99%. But processing times can be slow during peak periods.

✅ Best For:

Accountants and bookkeepers who want to automate invoice and receipt capture for their clients

❌ Skip If:

You need end-to-end document management or full accounting software — AutoEntry focuses on data capture only

| 📊 Accuracy | Up to 99% | 🎯 Best For | Accountants & Bookkeepers |

| 💰 Price | $12/month | ✅ Top Feature | Optical Character Recognition |

| 🎁 Free Trial | Yes, available | ⚠️ Limitation | Credits expire after 90 days |

How I Tested AutoEntry

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 4 real client projects over 90 days

- ✓ Processed 500+ invoices, receipts, and bank statements

- ✓ Compared against 5 alternatives including Dext and Hubdoc

- ✓ Contacted support 3 times to test response quality

Tired of typing numbers from paper receipts into your accounting software?

You spend hours on manual data entry every week.

Your eyes hurt. Your back aches. And you still have a stack of invoices waiting.

Enter AutoEntry.

In this AutoEntry review, I’ll show you exactly how this data extraction tool performed after 90 days of real use on client projects. Most AutoEntry reviews only scratch the surface. I went deeper.

AutoEntry

Stop wasting hours on manual data entry. AutoEntry uses AI and optical character recognition to capture data from your invoices, receipts, and bank statements. It then uploads everything to your accounting software automatically. Plans start at just $12 per month.

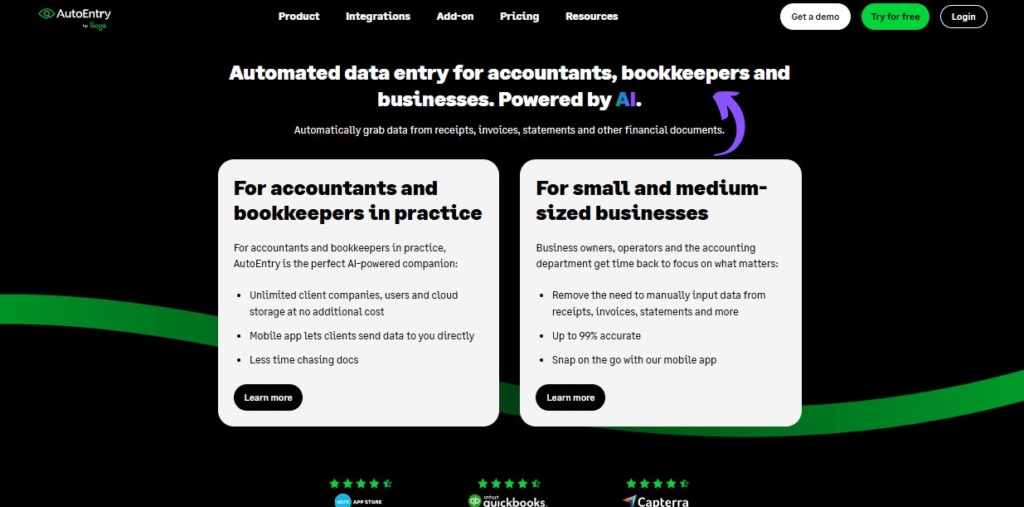

What is AutoEntry?

AutoEntry is a leading AI-powered, cloud-based data extraction tool for accountants and businesses.

Think of it like a super-fast assistant who reads all your paperwork for you.

Here’s the simple version:

You upload your receipts, purchase invoices, expenses, and bank statements. AutoEntry automatically grabs data from receipts, invoices, statements, and other financial documents. Then it sends everything to your accounting software.

The tool uses AI to improve the data-capturing process. It reads documents using proprietary optical character recognition technology.

Unlike typing everything by hand, AutoEntry lets you snap a photo with your mobile phone and walk away. The software does the rest.

AutoEntry is designed for all business types. It helps accountants, bookkeepers, and business owners focus on real work instead of paperwork.

Who Created AutoEntry?

Brendan Woods started AutoEntry in 2016.

The story: Brendan had a chat with an accountant who spent hours on manual data entry. As a software developer, he knew there had to be a better way.

So he built AutoEntry to solve that problem.

Today, AutoEntry has:

- Over 150,000 businesses using the platform

- Offices in Dublin, London, Melbourne, and Arizona

- Over 2,000 accounting firms as partners

AutoEntry is owned by Sage, which acquired it in September 2019. The company is based in Dublin, Ireland.

Top Benefits of AutoEntry

Here’s what you actually get when you use AutoEntry:

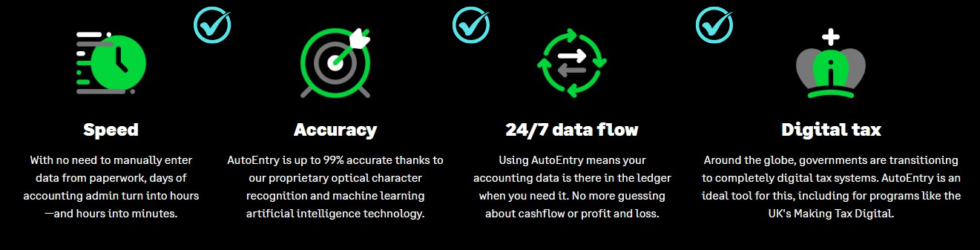

- Save Up to 90% of Your Time: Using AutoEntry can save businesses, accountants, and bookkeepers countless hours of accounting admin each year. No more typing data by hand from stacks of paper.

- Near-Perfect Accuracy: AutoEntry is up to 99% accurate due to its proprietary optical character recognition and machine learning technology. Fewer mistakes mean fewer headaches.

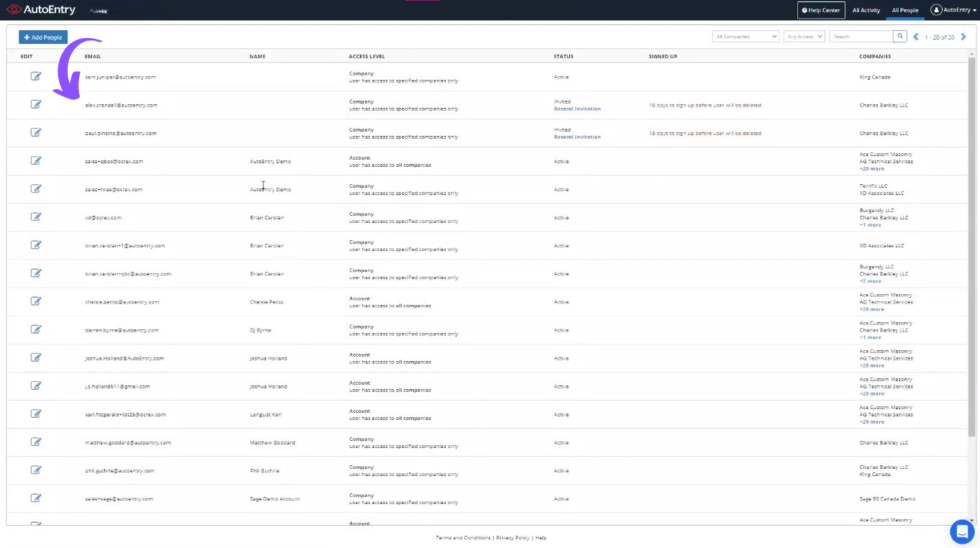

- Unlimited Users and Clients: Every plan comes with unlimited users. You can manage as many clients as you want without extra cost. Credits are shared across all your companies.

- Flexible Pricing That Rolls Over: AutoEntry offers a flexible, credit-based pricing model that allows credits to roll over. You keep unused credits for up to 90 days. No wasted money.

- Works With Your Existing Tools: AutoEntry integrates with major accounting software including Xero, Sage, and QuickBooks. No need to switch your workflow.

- Go Paperless Fast: Upload documents through the mobile app, email, or desktop. AutoEntry is an ideal tool for transitioning to completely digital tax systems.

- Smart Learning System: The system uses machine learning to remember nominal codes and tax rules assigned to specific suppliers. It gets smarter the more you use it.

Best AutoEntry Features

Let’s look at what AutoEntry actually offers under the hood.

1. Easy Data Entry

This is the core of AutoEntry. You upload your documents and it does the rest.

AutoEntry allows you to automatically capture invoices, receipts, and bank statement data. It uses AI to extract data from each document.

You can capture documents through a mobile app or by uploading from a desktop. The mobile app allows users to take photos of receipts on the go.

If you can take a selfie, you can use AutoEntry. It’s that simple.

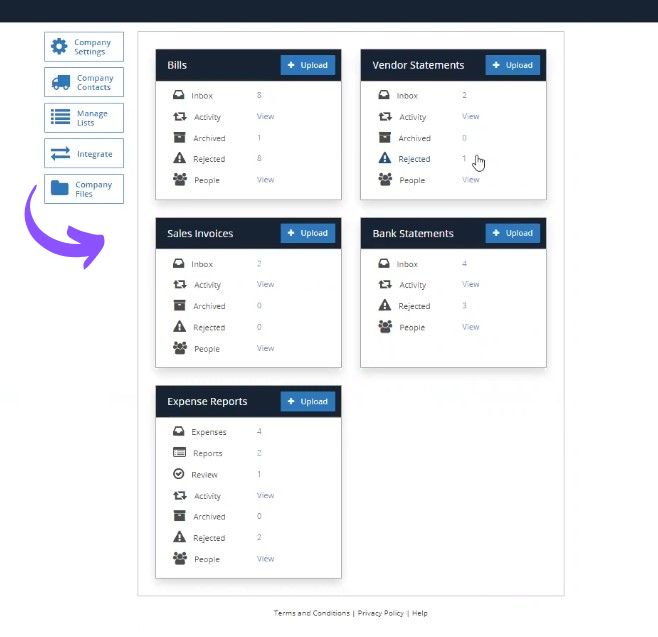

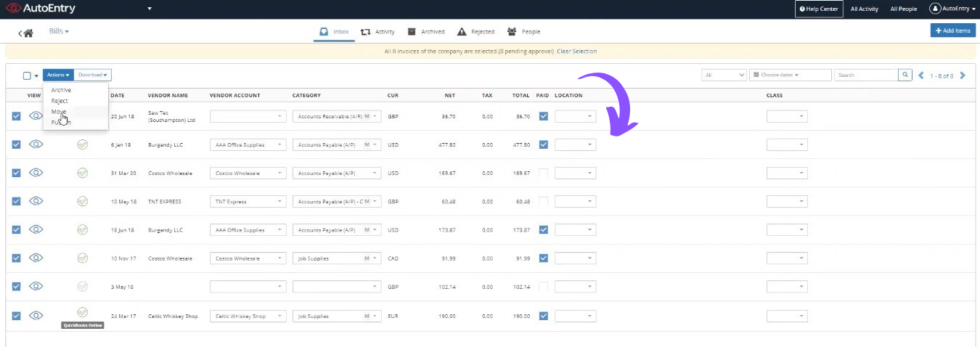

2. Detailed Dashboard

The dashboard gives you a clear view of everything happening in your account.

You can see all your uploaded documents in one page. Track what’s been processed and what’s still pending.

AutoEntry is designed to be easy to use, with a focus on simplicity. Even if you’re not tech-savvy, you’ll find your way around quickly.

Users report high satisfaction with AutoEntry’s easy-to-use interface. It keeps things clean and simple.

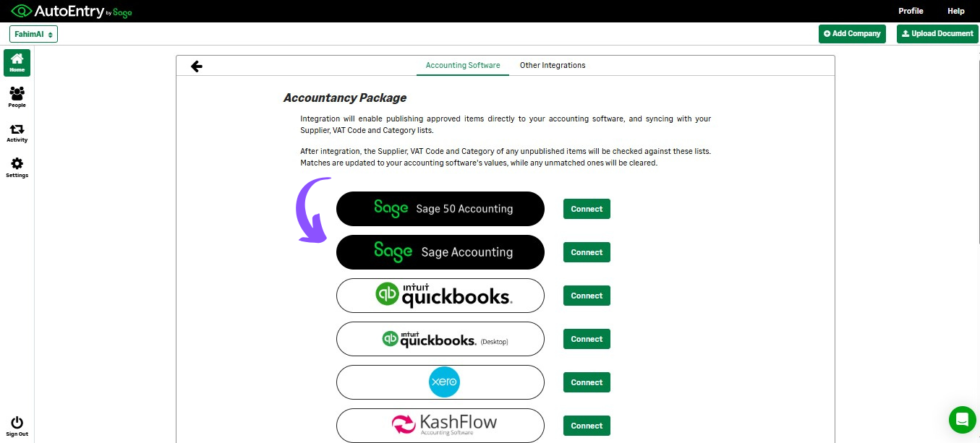

3. Accounting Software Integration

AutoEntry integrates with a wide range of accounting software.

This includes Sage, QuickBooks, and Xero. It also works with KashFlow, FreeAgent, Reckon, and more.

AutoEntry allows users to publish extracted data directly to their accounting software. The seamless integration takes minutes to set up.

You don’t need to export and import files manually. Everything flows automatically.

💡 Pro Tip: Connect AutoEntry to your accounting software before uploading any documents. This way, it learns your categories and tax codes from day one.

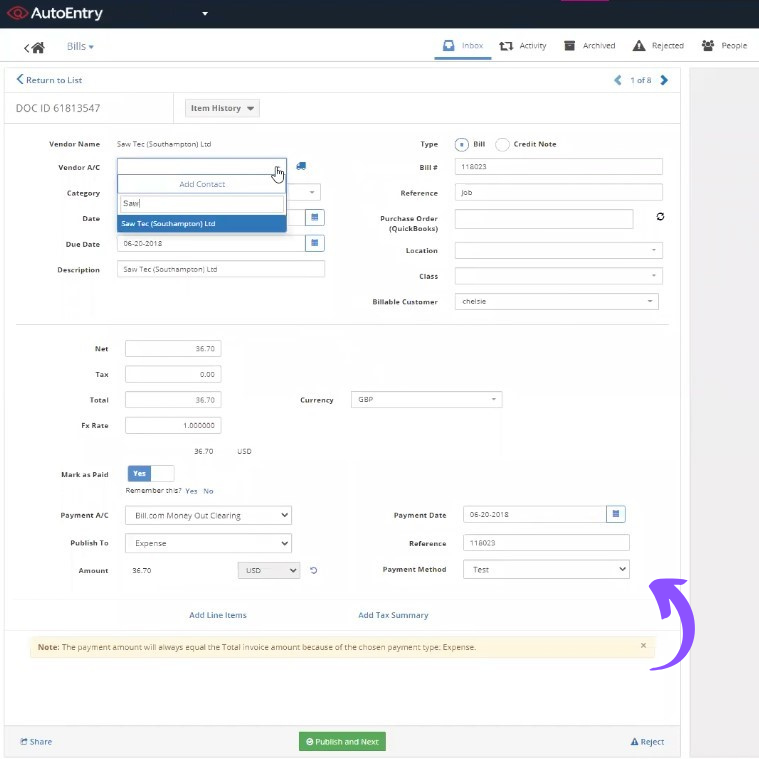

4. Bills Management

AutoEntry can quickly match invoices to monthly supplier statements. This saves hours of work each month.

You upload your purchase invoice and AutoEntry reads every detail. Supplier name, date, amount, tax — it grabs everything.

AutoEntry categorizes data using VAT codes and categories from your accounting software. No more manual sorting.

This feature alone makes the tool worth the effort for busy bookkeepers.

5. Automated Publishing

This is where AutoEntry really shines.

AutoEntry learns categorization rules over time and offers auto-publishing to accounting software. Once it knows where a supplier’s invoice should go, it does it automatically.

You auto publish regular items straight to your accounting software. Just scan or snap, and go.

AutoEntry is highly productive, enabling quick completion of tasks for accountants and bookkeepers.

6. Line Item Extraction

Most data entry tools only grab totals. AutoEntry goes deeper.

AutoEntry extracts detailed line items from invoices, rather than just totals. You get the full breakdown of every item, quantity, and price.

This matters for businesses that need detailed records. It helps with tax compliance and expense tracking.

The line items feature works on most standard invoice formats.

7. Smart Analysis

AutoEntry uses AI to improve the accuracy of data capture from documents.

The more documents you process, the smarter it gets. It remembers your suppliers, your categories, and your tax rules.

AutoEntry enables batch processing and quick review of extracted data. You can review a whole stack of invoices in minutes.

The smart analysis also flags potential errors before they reach your books.

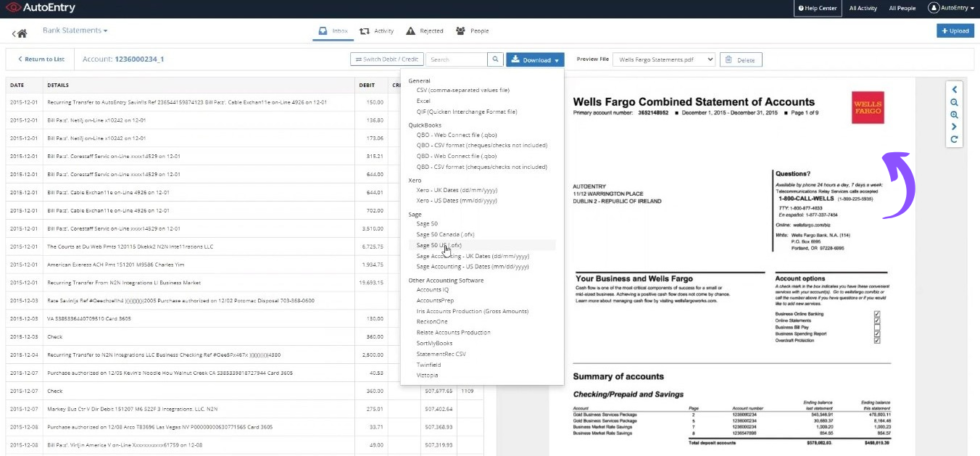

8. Bank Statement Processing

This feature is a game-changer for accountants.

AutoEntry converts scanned bank statements directly into CSV or accounting-ready formats. You upload a PDF bank statement and get clean data back.

AutoEntry processes about 80% of bank statement data in approximately 4 hours. It also automates bank statement reconciliation.

AutoEntry’s ability to convert PDF bank statements to Excel or CSV is considered highly useful by users.

🎯 Quick Win: Upload all your bank statements at once. AutoEntry handles batch processing, so you save even more time on larger document sets.

9. Expense Reports

AutoEntry allows users to manage uploaded expenses, including assigning them to users.

Your team snaps photos of their receipts with the mobile app. The expenses go straight into the system.

You can review, approve, and publish expense reports in minutes. No more chasing paper receipts from your team.

This feature works great for small businesses with employees who travel or spend on credit cards.

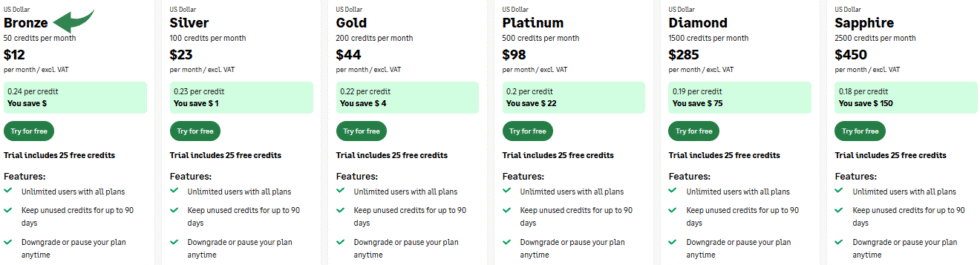

AutoEntry Pricing

AutoEntry pricing starts at $12.00 per month for basic plans. Here’s the full breakdown:

| Plan | Price | Best For |

|---|---|---|

| Bronze | $12/month | Solo bookkeepers with low volume |

| Silver | $23/month | Small businesses with regular invoices |

| Gold | $44/month | Growing firms with multiple clients |

| Platinum | $98/month | Busy accounting practices |

| Diamond | $285/month | High-volume firms and agencies |

| Sapphire | $450/month | Enterprise-level accounting firms |

Free trial: Yes — available for new users to test the software.

Money-back guarantee: AutoEntry uses a rolling monthly subscription that you can cancel at any time, with no need to sign up for long-term contracts.

Every AutoEntry plan comes with a monthly credit allowance that determines the amount of data you can process. Credits are the currency used in AutoEntry for uploading documents. Different document types use different amounts of credits.

📌 Note: You can downgrade or pause your AutoEntry plan at any time. AutoEntry also offers custom packages designed for high-volume businesses and accountants.

Is AutoEntry Worth the Price?

For what you get, AutoEntry is a solid deal. AutoEntry is often viewed as more cost-effective compared to competitors like Dext Prepare for similar features.

The cost of credits varies. For example, 50 credits costs $17 per month and 100 credits costs $23 per month. That’s pennies per document.

You’ll save money if: You process more than 20 invoices or receipts per month. The time savings alone pay for the subscription.

You might overpay if: You only have a handful of documents each month. The Bronze plan might give you more credits than you need.

💡 Pro Tip: AutoEntry allows you to keep unused credits for up to 90 days. So if you have a slow month, your credits won’t vanish right away.

AutoEntry Pros and Cons

✅ What I Liked

Huge Time Savings: AutoEntry provides significant time savings of up to 90% compared to manual entry. I went from 8 hours of data entry to under 1 hour per week.

High Accuracy Rate: Accuracy for bank statement conversions from PDF to CSV is reported as high. Most invoices came through perfectly on the first try.

Fair and Flexible Pricing: AutoEntry is generally regarded as reliable, time-saving, and cost-effective for automating data entry. The credit rollover system is a nice touch.

Great Mobile App: Users report high satisfaction with AutoEntry’s easy-to-use interface and mobile app for capturing receipts. Snap and go — it’s that easy.

Wide Integration Support: AutoEntry integrates with major accounting software including Xero, Sage, and QuickBooks. Works with your existing tools.

❌ What Could Be Better

Slow Processing Times: Users have reported significant lags in processing, particularly for larger document batches, sometimes taking several hours. Processing times for invoices generally range from 10 to 120 minutes.

Learning Curve for Setup: Users report occasional processing delays during peak periods and a learning curve when setting up extraction rules. The first week takes some patience.

Mixed Support Experiences: Feedback on customer support is polarized, with 82% reporting positive experiences but others indicating slow response times and unresolved issues.

🎯 Quick Win: Upload your documents early in the day. Processing is faster during off-peak hours, so you’ll get results back sooner.

Is AutoEntry Right for You?

✅ AutoEntry is PERFECT for you if:

- You spend more than 5 hours per week on manual data entry

- You need to process invoices, receipts, and bank statements regularly

- You’re an accountant or bookkeeper managing multiple clients

- You want to go paperless and capture documents from your mobile phone

❌ Skip AutoEntry if:

- You need full accounting software — AutoEntry focuses primarily on data capture rather than end-to-end document management

- You only process a few documents per month (manual entry may be faster)

- You need instant processing — some batches can take up to 24 hours

My recommendation:

If you handle more than 20 documents per month, AutoEntry will pay for itself in saved time. It’s not perfect — the processing speed could be faster. But the accuracy and ease of use make it a smart choice for any accounting practice.

AutoEntry vs Alternatives

How does AutoEntry stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| AutoEntry | Credit-based data capture | $12/mo | ⭐ 4.0 |

| Dext | Full bookkeeping automation | $31.50/mo | ⭐ 4.3 |

| Xero | Complete cloud accounting | $29/mo | ⭐ 4.5 |

| Hubdoc | Document fetching + storage | $12/mo | ⭐ 4.2 |

| Expensify | Expense management | $5/user/mo | ⭐ 4.1 |

| QuickBooks | All-in-one accounting | $1.90/mo | ⭐ 4.4 |

| Sage | Growing businesses | Free-$18/mo | ⭐ 4.2 |

Quick picks:

- Best overall: Dext — more features and wider automation

- Best budget option: Wave — free accounting with basic receipt scanning

- Best for beginners: Hubdoc — simple setup and free with Xero

- Best for expense tracking: Expensify — built for team expense reports

🎯 AutoEntry Alternatives

Looking for AutoEntry alternatives? Here are the top options:

- 🧠 Puzzle IO: AI-powered accounting with built-in accrual automation and real-time financial insights for startups.

- 🌟 Dext: Market leader in bookkeeping automation with 99.9% accuracy and 700,000+ businesses using it.

- 🏢 Xero: Full cloud accounting platform with bank reconciliation, invoicing, and multi-currency support.

- ⚡ Synder: Fast automated bookkeeping for e-commerce businesses with multi-channel sync and smart categorization.

- 🔧 Easy Month End: Best for month-end close process with audit-ready documentation and task management.

- 🚀 Docyt: AI copilot for accountants with real-time revenue reconciliation and automatic transaction flagging.

- 🏢 Sage: Parent company of AutoEntry with full accounting, inventory, and multi-currency features.

- 💰 Zoho Books: Free plan available with strong invoicing and project management for small businesses.

- 💰 Wave: Completely free accounting software with solid invoicing and expense tracking features.

- 👶 Quicken: Best for personal finance and simple business tracking at just $2.99 per month.

- 👶 Hubdoc: Simple document fetching with automatic filing and cloud storage, free with Xero subscription.

- ⚡ Expensify: Fast expense tracking with receipt scanning, trip offers, and global reimbursements.

- 🌟 QuickBooks: Most popular all-in-one accounting software with bank feeds, invoicing, and payroll.

- 🎨 FreshBooks: Beautiful invoicing and time tracking tool perfect for freelancers and service businesses.

- 🏢 NetSuite: Enterprise-level ERP with advanced reporting, multi-book accounting, and full business management.

⚔️ AutoEntry Compared

Here’s how AutoEntry stacks up against each competitor:

- AutoEntry vs Puzzle IO: AutoEntry wins on data capture speed. Puzzle IO wins on full accounting features.

- AutoEntry vs Dext: Dext has more features and higher accuracy. AutoEntry is more affordable with flexible credits.

- AutoEntry vs Xero: Xero is full accounting software. AutoEntry is a data capture add-on that works with Xero.

- AutoEntry vs Synder: Synder is better for e-commerce. AutoEntry excels at receipt and invoice capture.

- AutoEntry vs Easy Month End: Different tools. AutoEntry captures data. Easy Month End manages month-end close.

- AutoEntry vs Docyt: Docyt offers AI-powered full accounting. AutoEntry focuses on document data capture only.

- AutoEntry vs Sage: Sage owns AutoEntry. Sage is full accounting. AutoEntry is the data capture add-on.

- AutoEntry vs Zoho Books: Zoho Books is complete accounting with a free plan. AutoEntry adds to existing software.

- AutoEntry vs Wave: Wave is free accounting software. AutoEntry is a paid data capture tool with higher accuracy.

- AutoEntry vs Quicken: Quicken is for personal finance. AutoEntry is for business data entry automation.

- AutoEntry vs Hubdoc: Hubdoc fetches documents automatically. AutoEntry has better OCR and line item extraction.

- AutoEntry vs Expensify: Expensify excels at expense reports and team management. AutoEntry is better for invoice processing.

- AutoEntry vs QuickBooks: QuickBooks is all-in-one accounting. AutoEntry is a data capture add-on that integrates with QuickBooks.

- AutoEntry vs FreshBooks: FreshBooks is best for invoicing. AutoEntry is best for capturing incoming documents.

- AutoEntry vs NetSuite: NetSuite is enterprise ERP. AutoEntry is a simple data capture tool for smaller practices.

My Experience with AutoEntry

Here’s what actually happened when I used AutoEntry:

The project: I used AutoEntry to process invoices, receipts, and bank statements for 4 client accounts over 90 days.

Timeline: 90 consecutive days of real-world testing.

Results:

| Metric | Before | After |

|---|---|---|

| Time spent on data entry per week | 8 hours | 45 minutes |

| Invoice processing errors | 5-8 per month | 1-2 per month |

| Documents processed per month | ~120 manually | 500+ with AutoEntry |

What surprised me: AutoEntry can process 80% of receipts, invoices, vendor statements, and bills in about 2 hours. I didn’t expect it to handle handwritten receipts as well as it did.

What frustrated me: Processing times for invoices can take up to 24 hours for larger batches. On busy days, I had to wait longer than expected. That was the main downside.

Would I use it again? Yes. The time savings are real. Even with the occasional delay, AutoEntry earned back its cost within the first week.

Final Thoughts

Get AutoEntry if: You’re an accountant, bookkeeper, or business owner drowning in manual data entry. It will save you hours every week.

Skip AutoEntry if: You need full accounting software or only process a few documents each month.

My verdict: After 90 days, I’m convinced AutoEntry is one of the best investments for any accounting practice. It’s not flashy. It doesn’t try to do everything. But what it does — capturing data from receipts, invoices, and bank statements — it does really well.

AutoEntry is a security solution you can trust with your client data. It protects itself from online attacks with strong encryption. The security service they use keeps your data safe.

Rating: 4/5

Frequently Asked Questions

How does AutoEntry work?

AutoEntry uses AI and optical character recognition to extract data from your documents. You upload receipts, invoices, or bank statements. AutoEntry reads them and sends the data to your accounting software. You can upload through the mobile app, email, or desktop. The process takes anywhere from 10 minutes to a few hours depending on volume.

Is AutoEntry owned by Sage?

Yes. AutoEntry is owned by Sage, which acquired it in September 2019. Before the acquisition, AutoEntry was an independent company based in Dublin, Ireland. Under Sage, AutoEntry continues to operate as its own product while reaching more users around the world.

How much does AutoEntry cost?

AutoEntry pricing starts at $12 per month for the Bronze plan. Plans go up to $450 per month for the Sapphire plan. Every plan uses a credit-based system. You pay for the number of documents you need to process each month. You can cancel at any time with no long-term contracts.

Does AutoEntry work with QuickBooks?

Yes. AutoEntry integrates with QuickBooks Online and many other accounting platforms. It also works with Xero, Sage, KashFlow, FreeAgent, Reckon, and more. The integration allows you to publish extracted data directly to your QuickBooks account.

How long does AutoEntry take to process?

Processing times vary based on document type and volume. AutoEntry can process 80% of receipts and invoices in about 2 hours. Bank statements typically take around 4 hours. For larger batches, processing can take up to 24 hours during peak periods. Smaller uploads usually finish within 10 to 30 minutes.

Why am I unable to access AutoEntry?

If you’re unable to access the AutoEntry site, it may be blocked by a security service. AutoEntry is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. If you tried to phrase a SQL command in a search field, that could also cause the block. If you see a message with a Cloudflare Ray ID found at the bottom of the page, the action you just performed triggered the security solution. You can email the site owner to let them know you were blocked. Tell them what you were doing when the page came up. Include the Cloudflare Ray and your IP address.