Quick Start

This guide covers every Expensify feature:

- Getting Started — Create account and basic setup

- How to Use Expense Management Process — Track and manage expenses in real time

- How to Use Expense Reports — Create and submit reports for approval

- How to Use Receipt Scanning — Snap photos and auto-extract data

- How to Use Expensify Card — Earn cash back on business spending

- How to Use Trip Offers — Book travel with built-in expense tracking

- How to Use Bill Pay and Invoicing — Send invoices and pay bills fast

- How to Use Easy Chats — Collaborate with your team on expenses

- How to Use Global Reimbursements — Pay employees in any currency

- How to Use Integration with Other Software — Sync with QuickBooks, Xero, and more

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used Expensify for over 12 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Expensify is one of the most powerful expense management tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Expensify Tutorial

This complete Expensify tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Expensify

Stop chasing receipts and wrestling with spreadsheets. Expensify automates expense tracking, report creation, and reimbursements for teams of any size. Try it free — no credit card required.

Getting Started with Expensify

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to expensify.com and click “Sign Up.”

Enter your email or phone number.

Choose between an individual or business account.

✓ Checkpoint: Check your inbox for a confirmation email.

Step 2: Download or Access the App

Expensify works on web, iOS, and Android.

Download the mobile app from the App Store or Google Play.

Log in with your new account.

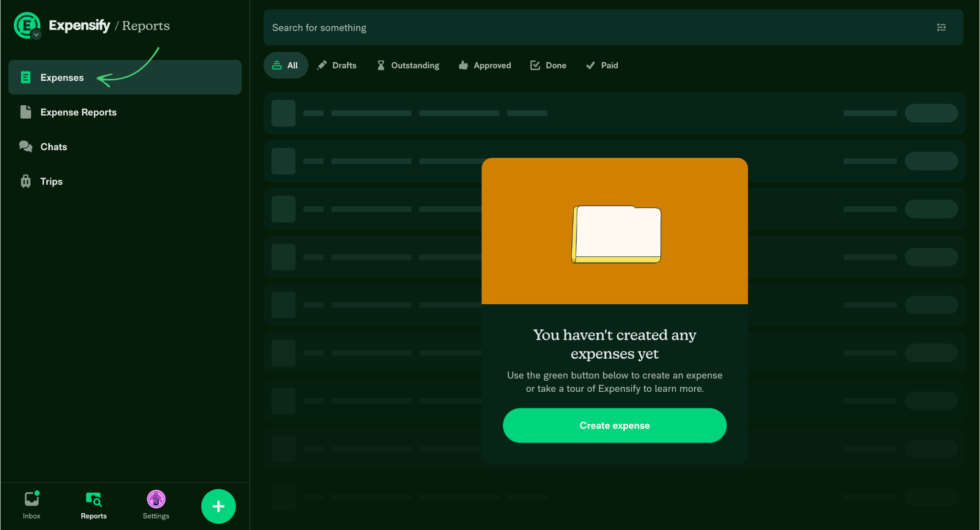

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main dashboard with recent transactions.

Step 3: Complete Initial Setup

Create a workspace to organize your expenses.

Set up expense categories and approval rules.

Enable two-factor authentication for security.

✅ Done: You’re ready to use any feature below.

How to Use Expensify Expense Management Process

Expense Management Process lets you track every business expense in real time.

Here’s how to use it step by step.

Watch Expense Management in action:

Now let’s break down each step.

Step 1: Open Your Workspace

Go to Settings and select your workspace.

Choose whether this is for personal or team use.

Step 2: Add an Expense

Tap the green “+” button on the dashboard.

Enter the amount, merchant, and category.

✓ Checkpoint: Your expense appears in the transaction list.

Step 3: Review and Categorize

Expensify auto-categorizes based on your past behavior.

Adjust the category if needed and add notes.

✅ Result: Your expense is tracked and ready for reporting.

💡 Pro Tip: Link your corporate credit card to auto-import transactions. Expensify supports 10,000+ banks worldwide.

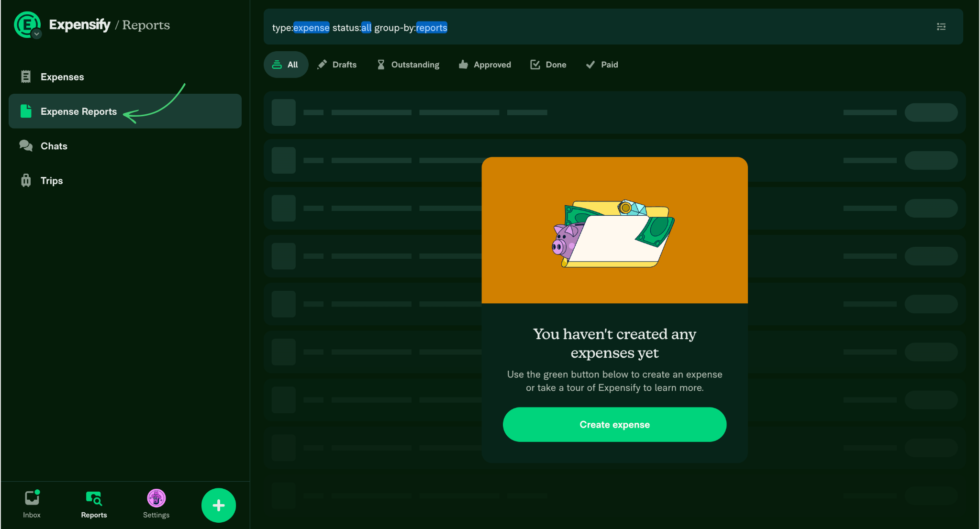

How to Use Expensify Expense Reports

Expense Reports lets you compile expenses and submit them for approval.

Here’s how to use it step by step.

Watch Expense Reports in action:

Now let’s break down each step.

Step 1: Create a New Report

Go to the Reports tab and tap “New Report.”

Give your report a clear name like “March Travel.

Step 2: Add Expenses to the Report

Select the expenses you want to include.

Expensify flags any policy violations automatically.

✓ Checkpoint: All selected expenses appear in your report.

Step 3: Submit for Approval

Review the total and tap “Submit.”

The report routes to your manager based on approval rules.

✅ Result: Your expense report is submitted and awaiting approval.

💡 Pro Tip: Turn on Scheduled Submit to auto-compile and send reports weekly. It saves you from forgetting to submit on time.

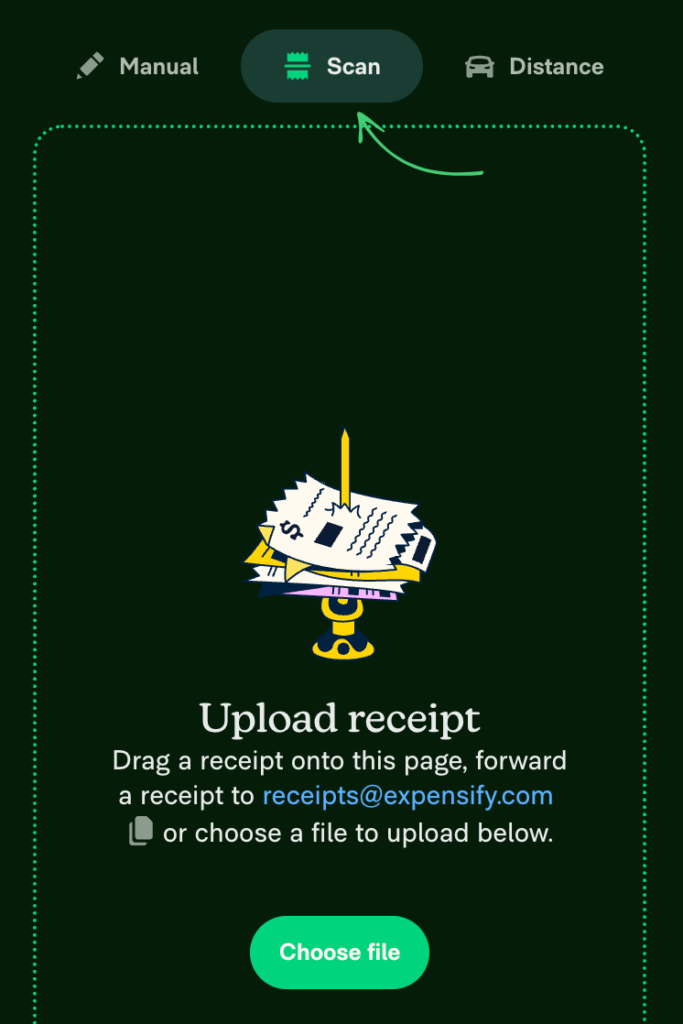

How to Use Expensify Receipt Scanning

Receipt Scanning lets you snap a photo and auto-extract expense data.

Here’s how to use it step by step.

Watch Receipt Scanning in action:

Now let’s break down each step.

Step 1: Open the Camera

Open the Expensify app and tap the green camera button.

Hold your phone steady over the receipt.

Step 2: Snap the Photo

Take a clear photo of the full receipt.

SmartScan reads the merchant, date, amount, and currency.

✓ Checkpoint: You see the extracted data in a new expense entry.

Step 3: Verify and Save

Check that SmartScan pulled the right details.

Tap save to add the expense to your report.

✅ Result: Your receipt is scanned, categorized, and filed.

💡 Pro Tip: Forward email receipts to receipts@expensify.com or text a photo to 47777 for hands-free scanning.

How to Use Expensify Expensify Card

Expensify Card lets you earn up to 2% cash back on all USD spend.

Here’s how to use it step by step.

Watch Expensify Card in action:

Now let’s break down each step.

Step 1: Request the Card

Go to Settings and select “Expensify Card.”

Your workspace admin must enable card access first.

Step 2: Set Spending Limits

Admins can set per-employee or per-category spending limits.

The card enforces your expense policies automatically.

✓ Checkpoint: Your card is active with limits applied.

Step 3: Make Purchases

Use the physical or virtual card for business purchases.

Transactions auto-import with matched receipts.

✅ Result: Expenses are tracked automatically with cash back earned.

💡 Pro Tip: Using the Expensify Card can save up to 50% on your monthly Expensify bill through cash back offsets.

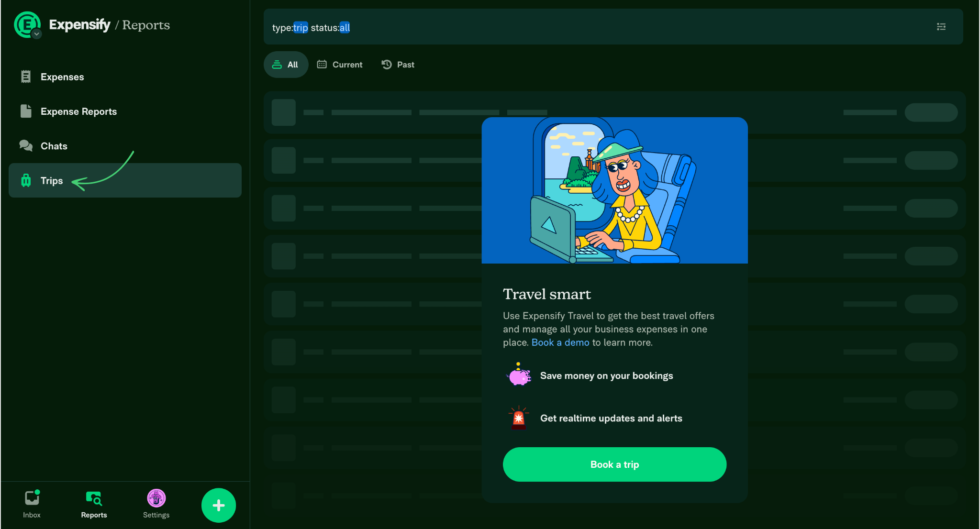

How to Use Expensify Trip Offers

Trip Offers lets you book flights, hotels, and cars inside Expensify.

Here’s how to use it step by step.

Watch Trip Offers in action:

Now let’s break down each step.

Step 1: Open the Travel Tab

Tap the Travel section from the main menu.

Enter your destination, dates, and travel type.

Step 2: Browse and Book

Compare flights, hotels, or car rentals with live pricing.

Select your preferred option and confirm the booking.

✓ Checkpoint: Your booking confirmation appears in the app.

Step 3: Sync to Expenses

Travel expenses auto-populate in your expense report.

No manual data entry needed for booked trips.

✅ Result: Your trip is booked and expenses are tracked automatically.

💡 Pro Tip: Set travel policies so bookings follow company rules before approval. This prevents out-of-policy spending.

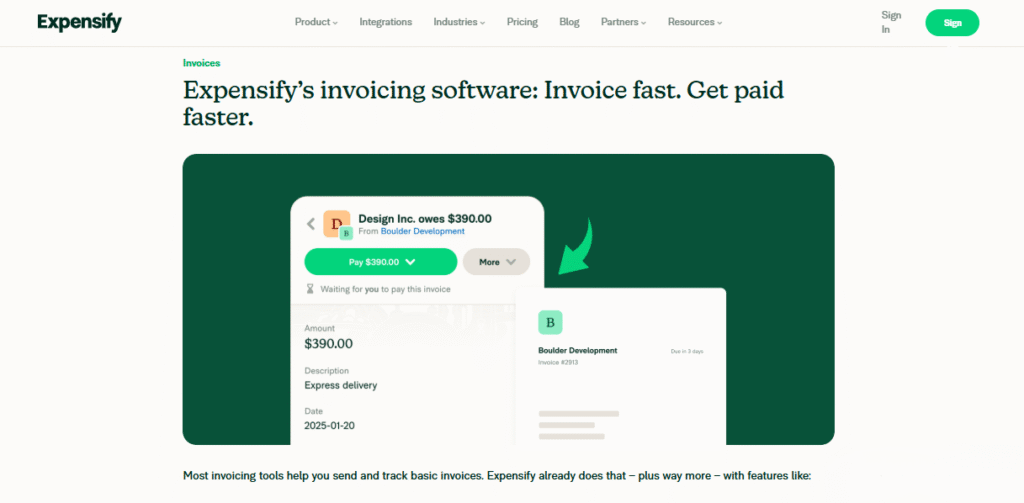

How to Use Expensify Bill Pay and Invoicing

Bill Pay and Invoicing lets you send invoices and pay bills in one place.

Here’s how to use it step by step.

Watch Bill Pay and Invoicing in action:

Now let’s break down each step.

Step 1: Create an Invoice

Go to the Invoices section and tap “New Invoice.”

Add the client details, line items, and due date.

Step 2: Send and Track

Send the invoice directly from Expensify.

Track payment status in real time on the dashboard.

✓ Checkpoint: Your invoice shows as “Sent” with the due date.

Step 3: Pay Bills

Upload vendor bills or forward them via email.

Approve and pay directly from the Bills section.

✅ Result: Invoices are sent and bills are paid without leaving Expensify.

💡 Pro Tip: Set up recurring invoices for regular clients to save time each billing cycle.

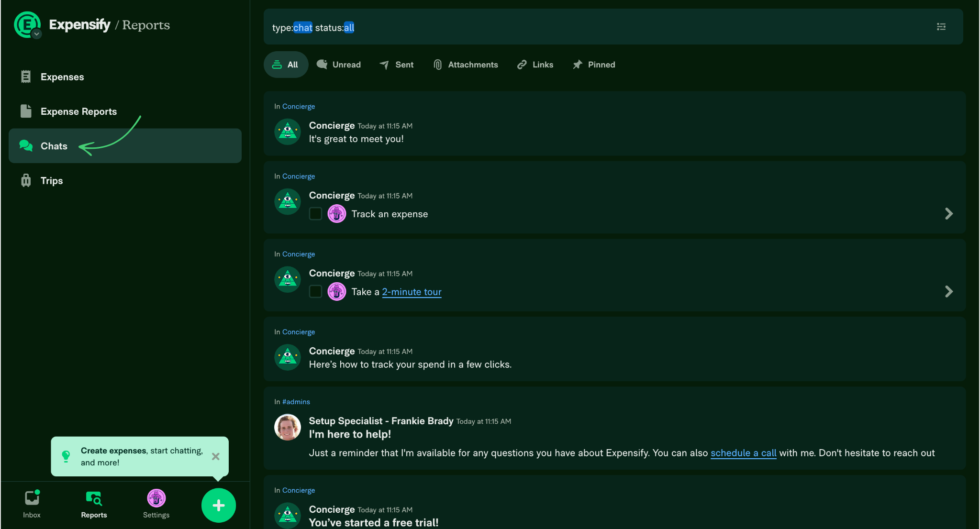

How to Use Expensify Easy Chats

Easy Chats lets you discuss expenses with your team right inside the app.

Here’s how to use it step by step.

Watch Easy Chats in action:

Now let’s break down each step.

Step 1: Open a Chat

Tap the chat icon from the bottom navigation bar.

Start a new chat or open an existing thread.

Step 2: Send a Message

Type your question or comment about an expense.

Tag team members using @ to notify them.

✓ Checkpoint: Your message appears in the chat thread.

Step 3: Resolve Issues Inline

Approve or reject expenses directly from the chat.

No need to switch between apps for approvals.

✅ Result: Expense questions are resolved without email back-and-forth.

💡 Pro Tip: Use group chats for team-wide expense discussions. It keeps all context in one place.

How to Use Expensify Global Reimbursements

Global Reimbursements lets you pay employees or contractors in their local currency.

Here’s how to use it step by step.

Watch Global Reimbursements in action:

Now let’s break down each step.

Step 1: Enable Global Reimbursements

Go to Workspace Settings and select Reimbursements.

Turn on the Global Reimbursements option.

Step 2: Add Bank Details

Enter your company’s bank account for outgoing payments.

Employees add their local bank details in their profile.

✓ Checkpoint: Bank accounts are verified and connected.

Step 3: Process Reimbursements

Approve an expense report and click “Reimburse.”

Expensify handles currency conversion automatically.

✅ Result: Employees receive payment in their local currency.

💡 Pro Tip: Reimbursements can arrive as soon as the next business day. Approve reports promptly for faster payouts.

How to Use Expensify Integration with Other Software

Integration with Other Software lets you sync Expensify with your accounting tools.

Here’s how to use it step by step.

Watch Integration in action:

Now let’s break down each step.

Step 1: Choose Your Integration

Go to Workspace Settings and select “Accounting.

Pick from QuickBooks, Xero, NetSuite, Sage Intacct, or others.

Step 2: Connect and Authorize

Log in to your accounting software when prompted.

Grant Expensify permission to sync data.

✓ Checkpoint: You see a green “Connected” status.

Step 3: Map Categories and Export

Map Expensify categories to your chart of accounts.

Set up auto-export so approved reports sync instantly.

✅ Result: Expense data flows into your accounting software in real time.

💡 Pro Tip: Expensify connects with 45+ apps including Gusto, Uber, Lyft, and ADP. Check the full list in your workspace settings.

Expensify Pro Tips and Shortcuts

After testing Expensify for over 12 months, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| New Expense | Ctrl + N (Cmd + N on Mac) |

| Submit Report | Ctrl + Enter |

| Open SmartScan | Tap green camera button (mobile) |

| Search Expenses | Ctrl + F (Cmd + F on Mac) |

Hidden Features Most People Miss

- Email Receipt Forwarding: Send receipts to receipts@expensify.com and they auto-scan without opening the app.

- Text-to-Receipt: Text a receipt photo to 47777 (US numbers) for instant expense creation.

- Scheduled Submit: Auto-submit expense reports on a weekly or monthly schedule so you never forget.

Expensify Common Mistakes to Avoid

Mistake #1: Not Capturing Receipts Right Away

❌ Wrong: Waiting until the end of the month to scan a pile of receipts.

✅ Right: Scan each receipt the moment you get it. SmartScan takes 3 seconds.

Mistake #2: Skipping Expense Categories

❌ Wrong: Leaving all expenses in the default “Other” category.

✅ Right: Set up custom categories that match your accounting chart of accounts.

Mistake #3: Not Setting Up Approval Workflows

❌ Wrong: Having no approval process so anyone can submit anything.

✅ Right: Configure multi-level approvals based on expense amount and department.

Expensify Troubleshooting

Problem: SmartScan Not Reading Receipts

Cause: Blurry photo, crumpled receipt, or poor lighting.

Fix: Flatten the receipt on a dark surface. Make sure the full receipt is in frame with good lighting. Retake the photo.

Problem: Expenses Not Syncing with Accounting Software

Cause: Expired authorization token or mismatched categories.

Fix: Go to Workspace Settings, disconnect the integration, and reconnect. Verify your category mapping matches your chart of accounts.

Problem: Report Stuck in “Processing” Status

Cause: Missing receipt or policy violation flagged on an expense.

Fix: Check the report for red flags. Attach any missing receipts and fix violations. Then resubmit the report.

📌 Note: If none of these fix your issue, contact Expensify support via Concierge chat or email concierge@expensify.com.

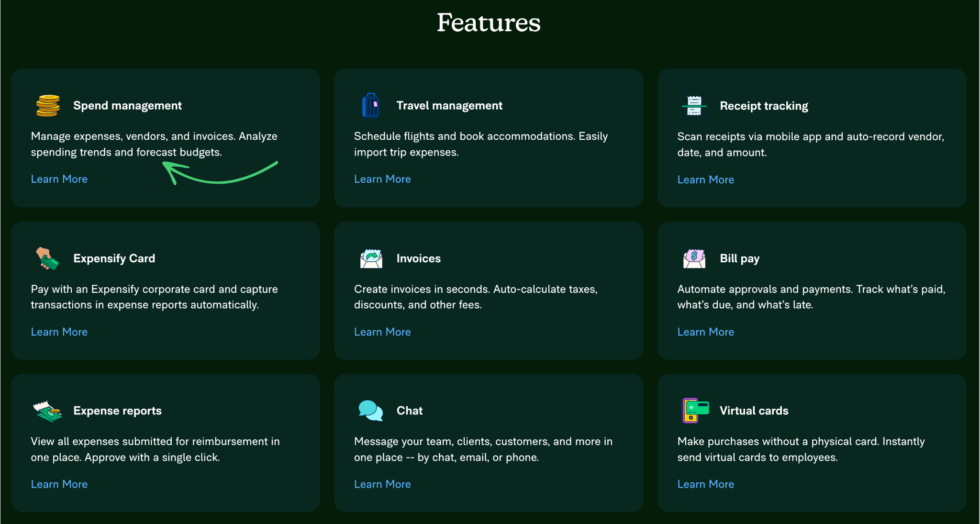

What is Expensify?

Expensify is an expense management tool that automates how businesses track, report, and reimburse expenses.

Think of it like a personal assistant for your receipts and expense reports.

Watch this quick overview:

It includes these key features:

- Expense Management Process: Track every business expense from purchase to reimbursement.

- Expense Reports: Compile, submit, and approve reports with auto-policy checks.

- Receipt Scanning: SmartScan extracts merchant, date, and amount from any receipt photo.

- Expensify Card: Corporate card with up to 2% cash back and real-time expense tracking.

- Trip Offers: Book flights, hotels, and cars with expenses synced automatically.

- Bill Pay and Invoicing: Send invoices and pay vendor bills from one dashboard.

- Easy Chats: Team messaging built into the expense workflow.

- Global Reimbursements: Pay employees in their local currency worldwide.

- Integration with Other Software: Syncs with QuickBooks, Xero, NetSuite, and 45+ apps.

For a full review, see our Expensify review.

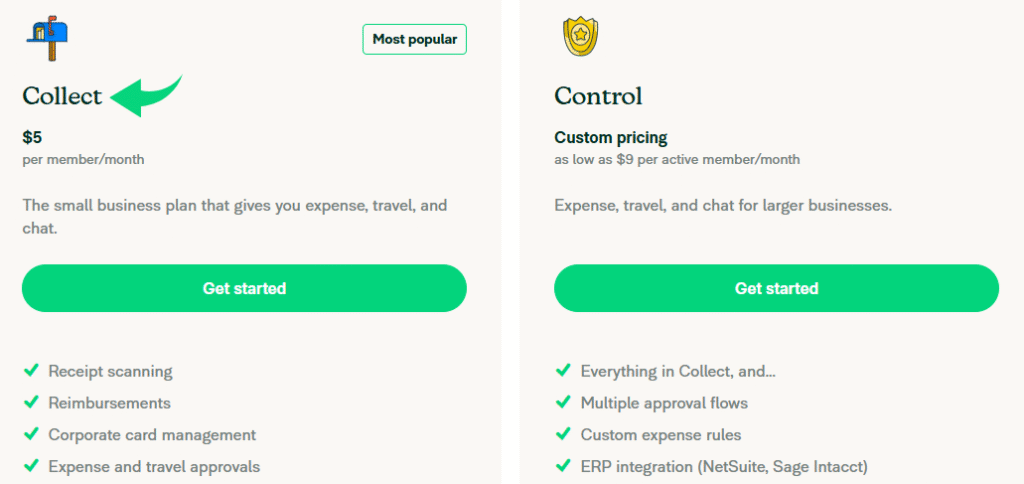

Expensify Pricing

Here’s what Expensify costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Collect | $5/member/month | Small teams needing basic expense tracking and approvals |

| Control | Starts at $9/member/month | Larger teams needing advanced policies and compliance |

Free trial: Yes, 30-day free trial on both paid plans.

Money-back guarantee: No formal guarantee, but you can cancel anytime.

💰 Best Value: Collect plan at $5/member/month — it includes expense tracking, corporate cards, travel booking, and team chat with no annual commitment.

Expensify vs Alternatives

How does Expensify compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Expensify | All-in-one expense management | $5/member/mo | ⭐ 4.1 |

| QuickBooks | Accounting with expense tracking | $1.90/mo | ⭐ 4.4 |

| Xero | Cloud accounting for small business | $29/mo | ⭐ 4.5 |

| FreshBooks | Invoicing and expense tracking | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | $0/mo | ⭐ 4.3 |

| Wave | Free accounting for small teams | $0/mo | ⭐ 4.0 |

| Sage | Enterprise-grade accounting | $7/mo | ⭐ 4.2 |

| Dext | Receipt capture and data extraction | $24/mo | ⭐ 4.3 |

Quick picks:

- Best overall: Expensify — all-in-one expense management with SmartScan and corporate cards.

- Best budget: Wave — free accounting and invoicing for small businesses.

- Best for beginners: FreshBooks — simple interface with strong invoicing features.

- Best for accounting: QuickBooks — the industry standard for small business bookkeeping.

🎯 Expensify Alternatives

Looking for Expensify alternatives? Here are the top options:

- 🚀 Puzzle IO: AI-powered accounting that automates month-end close and financial reporting for startups.

- 📊 Dext: Captures receipts and extracts data with high accuracy, then pushes it to your accounting software.

- 🌟 Xero: Cloud accounting platform with strong invoicing, bank feeds, and multi-currency support for growing teams.

- ⚡ Synder: Syncs sales data from payment platforms like Stripe and PayPal directly into your accounting books.

- 🔧 Easy Month End: Speeds up month-end reconciliation with automated matching and review workflows for accountants.

- 🧠 Docyt: AI bookkeeping that automates expense categorization, revenue tracking, and real-time financial reports.

- 🏢 Sage: Enterprise-ready accounting with payroll, inventory, and compliance tools for mid-size businesses.

- 💰 Zoho Books: Affordable accounting with free plan, smart automation, and deep Zoho ecosystem integration.

- 👶 Wave: Completely free invoicing and accounting for freelancers and micro-businesses with no hidden fees.

- 🔒 Hubdoc: Fetches bills and receipts from vendors automatically and files them into your accounting system.

- ⭐ QuickBooks: The most popular small business accounting software with payroll, invoicing, and expense tracking.

- 🎯 AutoEntry: Automated data entry that scans receipts and invoices and pushes data to major accounting platforms.

- 💼 FreshBooks: User-friendly invoicing and time tracking with built-in expense management for service businesses.

- 🔥 NetSuite: Full-scale ERP with advanced expense management, financial planning, and global compliance features.

For the full list, see our Expensify alternatives guide.

⚔️ Expensify Compared

Here’s how Expensify stacks up against each competitor:

- Expensify vs Puzzle IO: Expensify wins for expense management. Puzzle IO is better for automated month-end accounting.

- Expensify vs Dext: Both scan receipts well. Expensify offers a full expense workflow while Dext focuses on data capture.

- Expensify vs Xero: Xero is a full accounting platform. Expensify is stronger at expense reporting and receipt scanning.

- Expensify vs Synder: Synder excels at e-commerce sales sync. Expensify is better for employee expense management.

- Expensify vs Easy Month End: Easy Month End focuses on reconciliation. Expensify covers the full expense lifecycle.

- Expensify vs Docyt: Docyt offers AI bookkeeping. Expensify is better for teams needing receipt scanning and travel.

- Expensify vs Sage: Sage handles enterprise accounting and payroll. Expensify is easier to set up for expense tracking.

- Expensify vs Zoho Books: Zoho Books has a free plan and full accounting. Expensify wins on SmartScan and corporate cards.

- Expensify vs Wave: Wave is free but limited. Expensify offers more automation and better team expense features.

- Expensify vs Hubdoc: Hubdoc pulls bills automatically. Expensify adds receipt scanning, approvals, and reimbursements.

- Expensify vs QuickBooks: QuickBooks is better for full accounting. Expensify is better for expense reporting and SmartScan.

- Expensify vs AutoEntry: AutoEntry focuses on data entry automation. Expensify offers a complete expense management platform.

- Expensify vs FreshBooks: FreshBooks is great for invoicing. Expensify is stronger at expense tracking and corporate cards.

- Expensify vs NetSuite: NetSuite is a full ERP for enterprises. Expensify is more affordable and faster to deploy.

Start Using Expensify Now

You learned how to use every major Expensify feature:

- ✅ Expense Management Process

- ✅ Expense Reports

- ✅ Receipt Scanning

- ✅ Expensify Card

- ✅ Trip Offers

- ✅ Bill Pay and Invoicing

- ✅ Easy Chats

- ✅ Global Reimbursements

- ✅ Integration with Other Software

Next step: Pick one feature and try it now.

Most people start with Receipt Scanning.

It takes less than 5 minutes.

Frequently Asked Questions

How do I submit expenses using Expensify?

Open the app and scan your receipt with SmartScan. The expense is created automatically with the merchant, date, and amount. Add it to a report and tap Submit. Your manager receives it for approval based on your company’s workflow rules.

Is Expensify easy to learn?

Yes. Most users get comfortable within 10 minutes. The interface is clean and SmartScan handles the heavy lifting. You snap a photo and Expensify does the rest. The mobile app is especially beginner-friendly.

Is Expensify no longer free?

Expensify still offers free basic features including 25 SmartScans per month and personal expense tracking. Paid plans start at $5/member/month on the Collect plan. Business features like approval workflows and accounting integrations require a paid plan.

Is Expensify good for small business?

Expensify is excellent for small businesses. The Collect plan at $5/member/month includes expense tracking, corporate cards, travel booking, and team chat. It connects with QuickBooks and Xero. The flat pricing makes budgeting simple.

What is the difference between QuickBooks and Expensify?

QuickBooks is a full accounting platform for bookkeeping, payroll, and taxes. Expensify focuses on expense management with SmartScan, receipt tracking, and reimbursements. Many businesses use both together since Expensify integrates directly with QuickBooks.