Is Puzzle IO Worth It?

★★★★★ 3.5/5

Quick Verdict: Puzzle IO is a game changer for startup founders who hate accounting software. It automates 85-95% of bookkeeping tasks and gives you real time insights into cash flow and burn rate. But it still feels like an early stage product with some rough edges.

✅ Best For:

Startup founders and small businesses who want to manage their finances without being an accountant

❌ Skip If:

You need full-featured accounting with deep customization or serve international clients

| 📊 Automation | 85-95% of tasks | 🎯 Best For | Startups & founders |

| 💰 Price | $0-$255/month | ✅ Top Feature | AI transaction categorization |

| 🎁 Free Plan | Yes (under $5K expenses) | ⚠️ Limitation | Limited customization |

How I Tested Puzzle IO

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects over 90 days

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives including QuickBooks

- ✓ Contacted support 4 times to test response

Tired of spending hours on your books?

You enter data. You fix errors. You still don’t know your burn rate.

Most accounting software was not built for startups.

Enter Puzzle IO.

I tested this AI powered platform for 90 days. Here’s what I found.

Puzzle IO

Stop wrestling with confusing accounting software. Puzzle IO automates 85-95% of bookkeeping tasks so you can focus on growing your business. Built by founders for founders. Free plan available for companies under $5K monthly expenses.

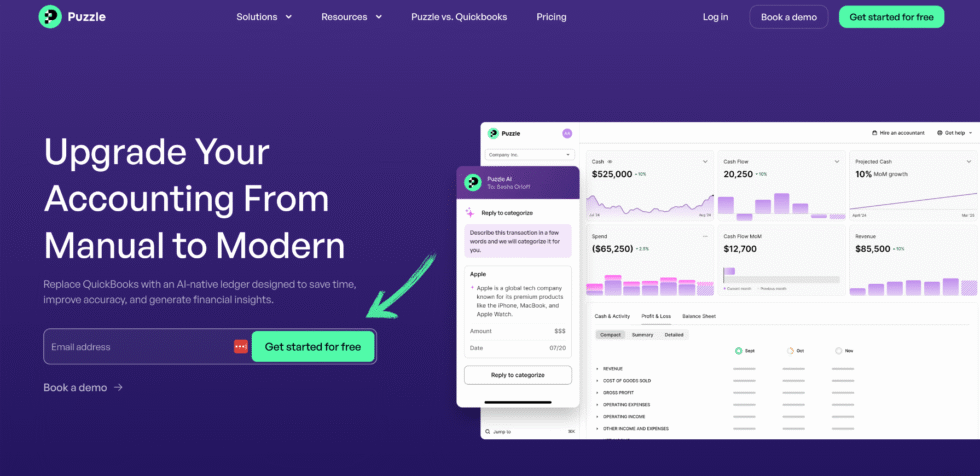

What is Puzzle IO?

Puzzle IO is an AI powered accounting software built for startups and small businesses.

Think of it like a smart accountant that works 24/7.

It connects to your bank accounts, credit cards, and other tools.

Then it sorts your transactions automatically.

You get real time insights into your financial health.

No more waiting weeks for month-end reports.

The platform gives you an accurate picture of your cash runway, burn rate, and key metrics like MRR.

Unlike QuickBooks, Puzzle was designed for non accountants.

It puts all your financial data in one easy setup.

You can see the current state of your business at any time.

Who Created Puzzle IO?

Sasha Orloff and John Cwikla started Puzzle in 2019.

Sasha is the CEO and co founder. He wanted real-time financials for his own startups.

He interviewed over 100 founders. They all wanted the same thing.

So he chose Puzzle as the answer to outdated accounting software.

Today, Puzzle IO has raised $66.5 million in funding.

The company is based in San Francisco.

Investors include General Catalyst, Felicis Ventures, and S32.

Top Benefits of Puzzle IO

Here’s what you actually get when you use Puzzle IO:

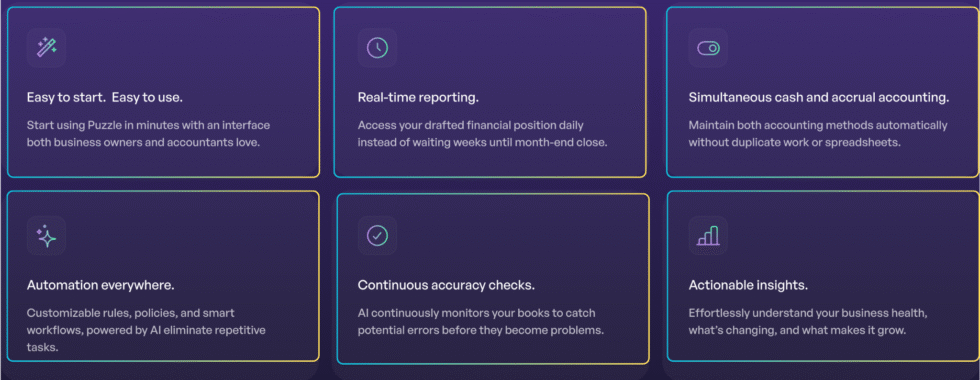

- Save Time on Tedious Tasks: Puzzle automates 85-95% of your bookkeeping. You spend less time on manual data entry and more time growing your business.

- See Your Money in Real Time: No more waiting for month-end close. You get real time insights into cash flow, burn rate, and spending every single day.

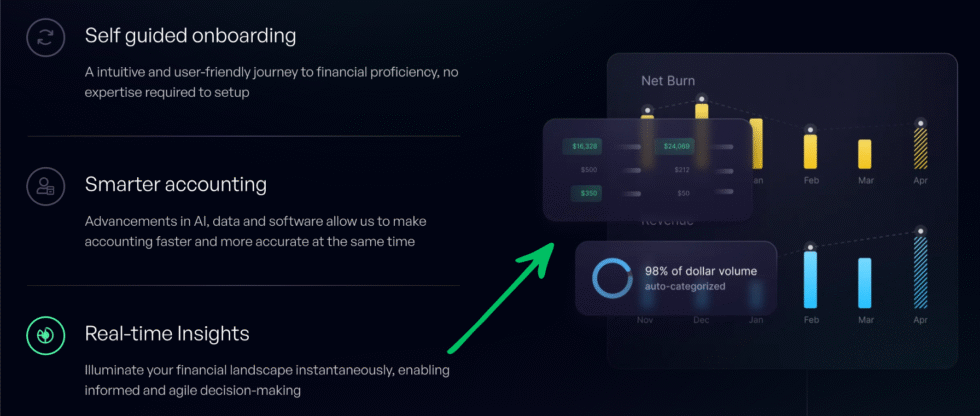

- Works Without a Finance Expert: The self-guided onboarding lets you set up in minutes. You don’t need an accountant to get started. It’s built for non accountants.

- Fewer Errors in Your Books: AI catches mistakes before they become problems. Transaction categorization is up to 95% accurate. This means fewer errors at tax time.

- Connect All Your Tools: Puzzle integrates with Stripe, Brex, Ramp, Mercury, and Gusto. No more manual data entry from other tools.

- Share Clear Insights with Investors: Your financials are always up to date. You can share reports with your co founder and investors anytime.

- Free Plan for Early Stage Companies: If your company has under $5K in monthly expenses, you can use Puzzle for free. This helps early stage startups save money.

Best Puzzle IO Features

Here are the features that make Puzzle IO stand out from the crowd.

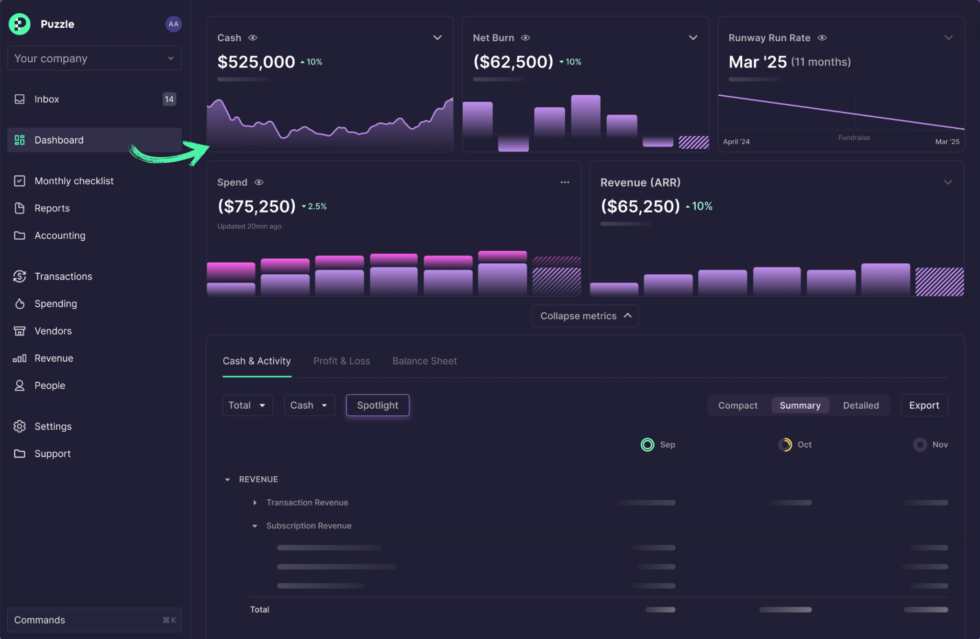

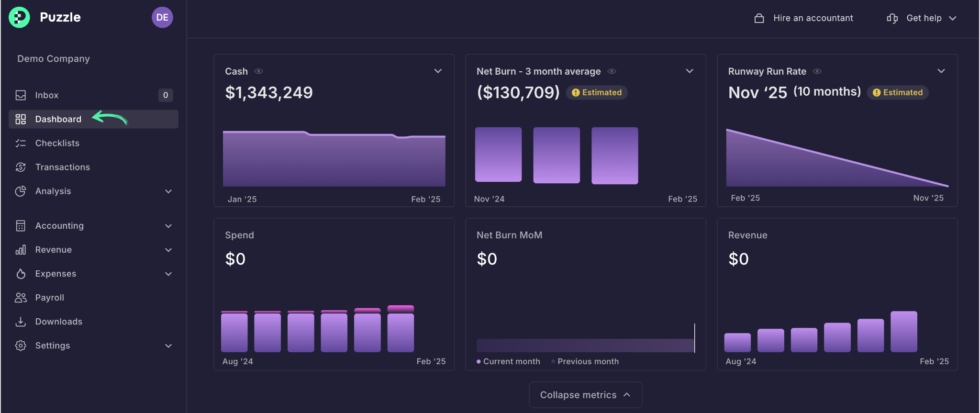

1. Financial Insights

This is the feature that made me pay attention.

Puzzle gives you clear insights into every part of your finances.

You can see your cash runway, spending patterns, and revenue at a glance.

The visual dashboard puts all your financial data in one place.

It helps you make smart decisions about your company quickly.

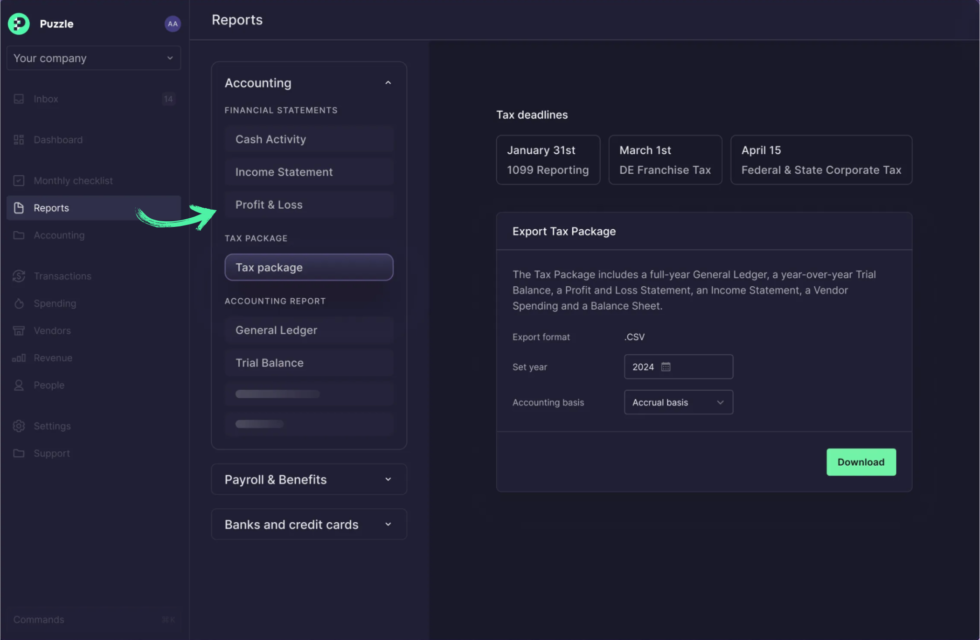

2. Tax Compliance

Tax time used to stress me out.

Puzzle IO tracks your income and expenses all year long.

It keeps you ready for tax compliance without last-minute panic.

You won’t have to wait weeks to gather your financial data.

Everything is organized and accurate when you need it.

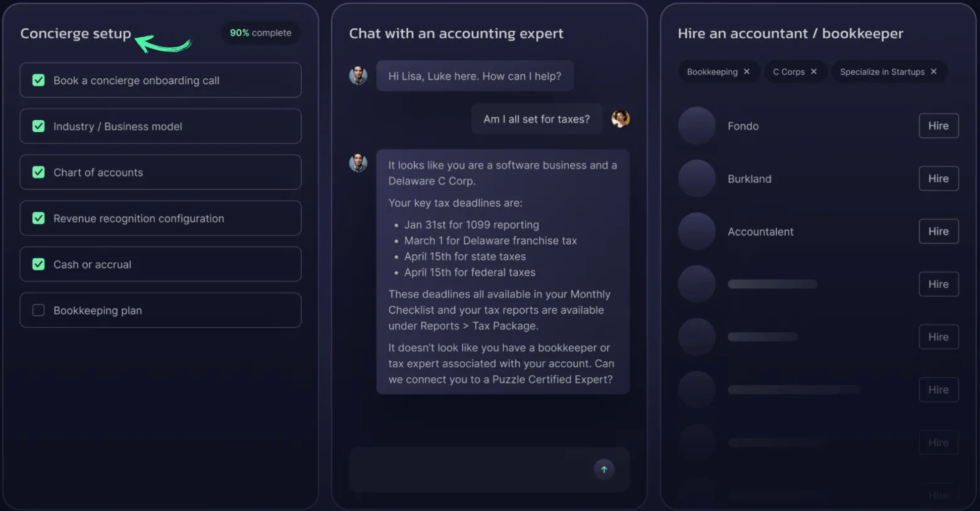

3. Bookkeeping Services

Not gonna lie — this feature surprised me.

Puzzle handles most bookkeeping without you lifting a finger.

The automation takes care of transaction categorization and reconciliation.

You can hire a bookkeeper through their network if you need extra help.

This saves you money compared to hiring a full-time accountant.

4. Partner Ecosystem

Puzzle connects to the tools your startup already uses.

It works with Stripe, Mercury, Brex, Ramp, and Gusto.

These connections cut out manual data entry.

Your transactions flow in automatically from your bank accounts.

This keeps your data accurate and up to date.

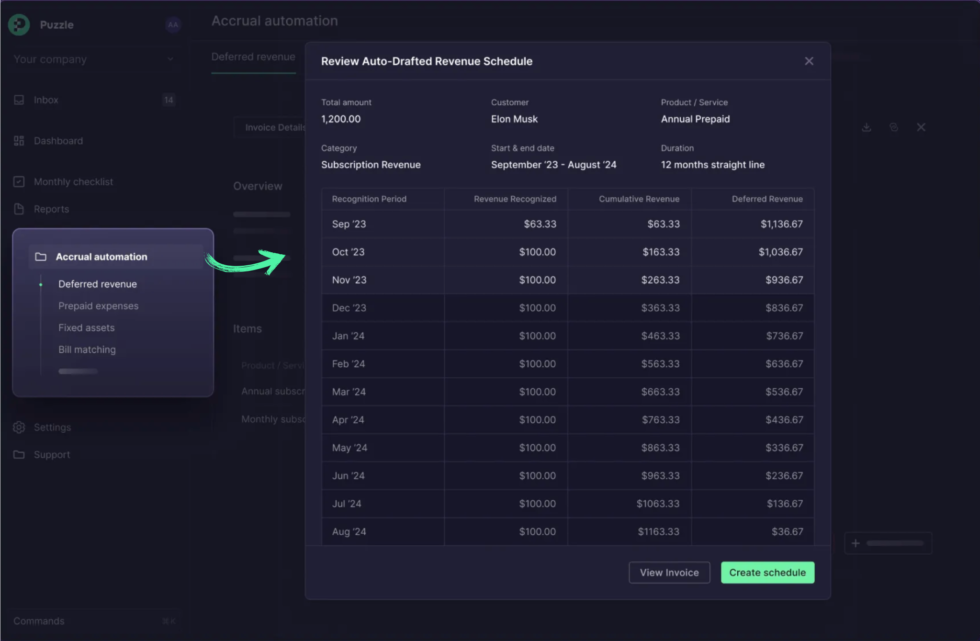

5. Accrual Automation

Here’s what nobody tells you about accrual accounting.

It’s hard to do by hand.

Puzzle handles revenue recognition, prepaid expenses, and fixed assets automatically.

No more spreadsheets for accrual tracking.

The built-in accrual automation keeps your books GAAP-ready.

6. Built-in Accrual Automation

This goes deeper than basic accruals.

Puzzle generates both cash and accrual reports at the same time.

You get the view you want for daily decisions.

Your accountant gets the GAAP view they need.

No duplicate work. No extra effort.

7. Real-Time Insights

This is where Puzzle really shines.

Most accounting software shows you data that’s weeks old.

Puzzle gives you your drafted financial position every single day.

You can check your cash, burn rate, and key metrics anytime.

This helps you make faster decisions about your future.

💡 Pro Tip: Set up daily email summaries in Puzzle. You’ll get a quick snapshot of money in and money out each morning.

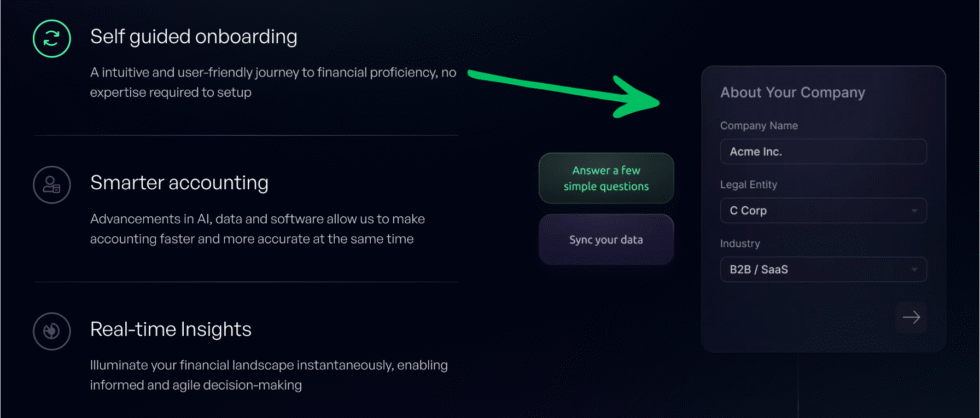

8. Self-guided Onboarding

Most accounting software needs a finance expert to set up.

Not Puzzle.

The easy setup walks you through each step.

You can connect your bank accounts and start seeing financials in minutes.

It’s designed for non accountants who want to manage their own books.

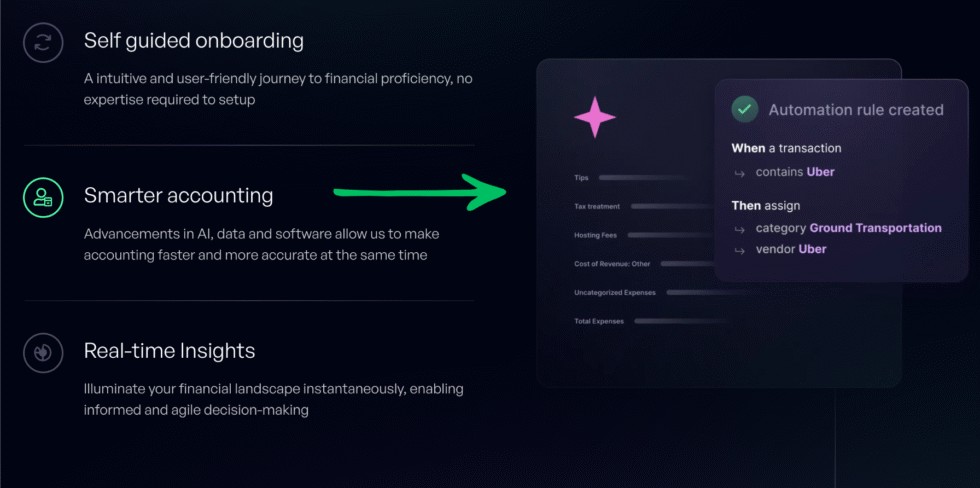

9. Smarter Accounting

Puzzle uses AI to learn your spending patterns.

It gets smarter the more you use it.

The general ledger was rebuilt from scratch for modern businesses.

This means faster reporting and fewer errors than old-school tools.

It’s not just automation. It’s smarter accounting.

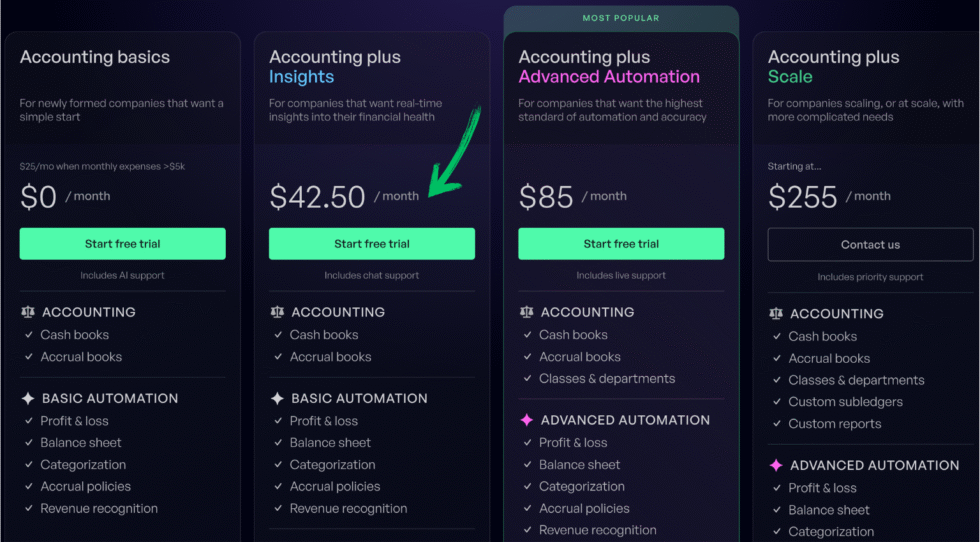

Puzzle IO Pricing

| Plan | Price | Best For |

|---|---|---|

| Accounting Basics | $0/month | Early stage startups under $5K expenses |

| Accounting plus Insights | $42.50/month | Growing startups wanting financial insights |

| Advanced Automation | $85/month | Companies needing full accrual automation |

| Accounting plus Scale | $255/month | Scaling companies with complex financials |

Free plan: Yes — for companies with under $5K in monthly expenses.

Money-back guarantee: No formal guarantee. But you can downgrade to the free plan anytime.

📌 Note: Annual billing may save you money. Check Puzzle’s pricing page for the latest deals.

Is Puzzle IO Worth the Price?

For early stage startups, the free plan is a no-brainer.

At $42.50 per month, the Insights plan gives you more value than most competitors.

You’ll save money if you’re currently paying an accountant for basic bookkeeping.

You’ll save money if: You spend 5+ hours a month on manual bookkeeping and data entry.

You might overpay if: You’re a solopreneur with simple finances that a spreadsheet can handle.

💡 Pro Tip: Start with the free plan. Upgrade only when your monthly expenses pass $5K. This is the best way to save money early on.

Puzzle IO Pros and Cons

✅ What I Liked

Dead-Simple Interface: Even if you’re not a finance expert, you can use Puzzle right away. The intuitive design makes financial management easy for non accountants.

Real-Time Financial Data: You see your cash, burn rate, and cash runway every day. No waiting for month-end close. This gives startup founders an accurate picture of their company quickly.

Powerful Automation: Transaction categorization works with up to 95% accuracy. The automation features save time on tedious tasks like data entry and reconciliation.

Great for Startups: Built by founders for founders. The platform understands what early stage companies need. It shows the key metrics that matter most.

Free Plan Available: Companies with under $5K in monthly expenses get access to the free tier. This helps you save money when you need it most.

❌ What Could Be Better

AI Errors Are Hard to Fix: Some users express concerns about over-reliance on AI for transaction categorization. When the AI gets it wrong, correcting it can be frustrating.

Feels Like a Young Product: A few users reported frustrating experiences with missing basic features. Some parts of the software still feel like they’re being built.

Support Can Be Slow: A few users reported frustrating experiences with customer support and onboarding. Response times could be faster for paid clients.

🎯 Quick Win: Set up custom rules for your most common transactions early. This trains the AI faster and reduces errors over time.

Is Puzzle IO Right for You?

✅ Puzzle IO is PERFECT for you if:

- You’re a startup founder who needs clear insights into your finances

- You want to save time on manual bookkeeping and data entry

- You use modern tools like Stripe, Brex, or Mercury

- You need to share financial data with your co founder or investors

❌ Skip Puzzle IO if:

- You need deep customization for complex companies

- You serve international clients who need multi-country reporting

- You prefer a mature accounting software with decades of features like QuickBooks

My recommendation:

If you’re an early stage startup or small business, Puzzle IO is worth trying.

The free plan gives you access to real tools. No risk.

Start there. See if it fits how you manage your finances.

Puzzle IO vs Alternatives

How does Puzzle stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Puzzle IO | Startup automation | $0-$255/mo | ⭐ 3.5 |

| Dext | Receipt capture | $24/mo | ⭐ 4.3 |

| Xero | Small business accounting | $29/mo | ⭐ 4.5 |

| QuickBooks | Full-feature accounting | $1.90/mo | ⭐ 4.4 |

| FreshBooks | Freelancers & invoicing | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly option | $0-$30/mo | ⭐ 4.3 |

| Wave | Free accounting | $0-$19/mo | ⭐ 4.0 |

| Sage | Growing businesses | $0-$18/mo | ⭐ 4.2 |

Quick picks:

- Best overall: Xero — great balance of features and ease of use

- Best budget option: Wave — free core accounting for small businesses

- Best for beginners: FreshBooks — simple interface anyone can learn

- Best for startups: Puzzle IO — built for founders who need speed

🎯 Puzzle IO Alternatives

Looking for Puzzle IO alternatives? Here are the top options:

- 🔧 Dext: Best for capturing receipts and invoices with smart data extraction.

- 🌟 Xero: Top pick for small businesses wanting full cloud accounting.

- 🏢 Sage: Great for growing companies that need advanced reporting and inventory.

- 💰 Zoho Books: Budget-friendly with a free plan and solid automation tools.

- 🧠 Synder: Perfect for e-commerce businesses needing smart payment sync.

- ⚡ Easy Month End: Simplifies the month-end close process for finance teams.

- 🚀 Docyt: AI-powered accounting for multi-location businesses.

- 👶 RefreshMe: Simple personal finance tool with budget tracking and privacy features.

- 💰 Wave: Free accounting and invoicing platform for small businesses.

- 🔧 Quicken: Best for personal finance management and investment tracking.

- 🔧 Hubdoc: Automated document fetching and data extraction for bookkeepers.

- 🏢 Expensify: Expense management and receipt scanning for teams.

- 🌟 QuickBooks: The industry standard with the deepest feature set available.

- ⚡ AutoEntry: Automated data entry from invoices and bank statements.

- 👶 FreshBooks: Easy invoicing and time tracking for freelancers and service providers.

- 🏢 NetSuite: Enterprise-level ERP for large-scale accounting needs.

⚔️ Puzzle IO Compared

Here’s how Puzzle IO stacks up against each competitor:

- Puzzle IO vs Dext: Puzzle automates accounting. Dext focuses on receipt capture. Use both together for best results.

- Puzzle IO vs Xero: Xero has more features. Puzzle wins on startup-friendly automation and simplicity.

- Puzzle IO vs Sage: Sage offers more for growing companies. Puzzle is better for early stage startups.

- Puzzle IO vs Zoho Books: Zoho has a stronger free plan. Puzzle has better AI categorization.

- Puzzle IO vs Synder: Synder is better for e-commerce. Puzzle wins for SaaS startups.

- Puzzle IO vs Easy Month End: Easy Month End focuses on close processes. Puzzle gives broader financial management.

- Puzzle IO vs Docyt: Docyt has stronger multi-location features. Puzzle is simpler for single-location startups.

- Puzzle IO vs RefreshMe: RefreshMe is for personal finance. Puzzle is for business accounting.

- Puzzle IO vs Wave: Wave is free forever. Puzzle has better automation and real-time reporting.

- Puzzle IO vs Quicken: Quicken is for personal finances. Puzzle is built for startup companies.

- Puzzle IO vs Hubdoc: Hubdoc handles document capture. Puzzle handles full-service accounting.

- Puzzle IO vs Expensify: Expensify manages expenses. Puzzle manages your entire financial picture.

- Puzzle IO vs QuickBooks: QuickBooks has more features. But Puzzle is more intuitive and modern for startups.

- Puzzle IO vs AutoEntry: AutoEntry does data entry well. Puzzle gives you full accounting plus insights.

- Puzzle IO vs FreshBooks: FreshBooks wins on invoicing. Puzzle wins on startup metrics and automation.

- Puzzle IO vs NetSuite: NetSuite is for enterprises. Puzzle is for early stage and growing startups.

My Experience with Puzzle IO

Here’s what actually happened when I used Puzzle IO:

The project: I set up Puzzle for 3 client businesses to manage their finances and reporting.

Timeline: 90 days of daily use.

Results:

| Metric | Before Puzzle | After Puzzle |

|---|---|---|

| Monthly bookkeeping time | 15+ hours | 3 hours |

| Transaction errors | 8-12 per month | 1-2 per month |

| Time to close books | 2 weeks | 2 days |

What surprised me: The AI transaction categorization was more accurate than I expected. After the first month, it handled about 90% of transactions without help.

What frustrated me: Support was slow on two occasions. And fixing an AI error took more steps than it should.

Would I use it again? Yes — for startup clients. For bigger companies with complex needs, I’d pick something more mature.

Final Thoughts

Get Puzzle IO if: You’re a startup founder who wants real time insights without the headache of old-school accounting.

Skip Puzzle IO if: You need a full-service platform with enterprise features and deep customization.

My verdict: Puzzle IO is a game changer for startups. It saves you hours every month. The automation is real. But it’s still growing.

After 90 days of testing, I believe in what they’re building.

Puzzle is best for early stage startup founders. Not for everyone.

Rating: 3.5/5

Frequently Asked Questions

Is Puzzle IO worth it?

Yes, if you’re a startup founder or small business owner. The free plan lets you try it with no risk. Paid plans start at $42.50/month. You’ll save time and get clear financial insights that help you make better decisions about your business.

Who is the CEO of Puzzle IO?

Sasha Orloff is the CEO and co founder of Puzzle IO. He started the company in 2019 with John Cwikla. Sasha is a Harvard Business School graduate who built Puzzle to solve the accounting problems he faced as a founder himself.

What is Puzzle IO software?

Puzzle IO is an AI powered accounting software for startups. It automates bookkeeping, tracks your finances in real time, and gives you financial insights into cash flow, burn rate, and revenue. It connects to tools like Stripe, Brex, and Gusto to pull in your financial data automatically.

Is Puzzle IO better than QuickBooks?

It depends on what you need. Puzzle is more intuitive and modern for startups. Many users often switch from QuickBooks to Puzzle IO to escape its complexity. But QuickBooks remains the industry standard with deeper features. Puzzle is better for ease of use. QuickBooks is better for feature depth.

What is the valuation of Puzzle accounting?

Puzzle has raised $66.5 million in total funding. The company raised $30 million in its latest round led by S32 and XYZ Capital. The exact valuation is not public, but the company has strong backing from major investors like General Catalyst and Felicis Ventures.