Is Easy Month End Worth It?

★★★★★ 3.8/5

Quick Verdict: Easy Month End is a solid tool for finance teams who want to ditch Excel checklists. It helps you handle month end close, track reconciliations, and collect audit evidence in one place. Best for teams of 3-15 people who need better workflow management without the hassle of complex software.

✅ Best For:

Finance teams who need to streamline their month end close process and keep auditors happy

❌ Skip If:

You need full accounting software with bank feeds, invoicing, or payroll features

| 📊 Built By | Chartered Accountants | 🎯 Best For | Finance team tasks & close management |

| 💰 Price | $45/month | ✅ Top Feature | Audit-ready sign offs & tracking |

| 🎁 Free Trial | First month end free | ⚠️ Limitation | No accounting features built in |

How I Tested Easy Month End

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects across multiple entities

- ✓ Tested for 90 consecutive days through 3 close cycles

- ✓ Compared against 5 alternatives including Excel and Docyt

- ✓ Contacted support 4 times to test response quality

Does your finance team dread month end?

You spend hours in Excel checklists. You chase people for sign offs. Auditors ask for evidence you can’t find.

Manual processes make the month end close process more stressful and prone to errors.

Enter Easy Month End.

I tested it for 90 days with my finance team. Here’s what really happened.

Easy Month End

Stop wrestling with messy Excel checklists. Easy Month End helps your finance team handle month end close, quarter end, and year end tasks in one single platform. Your first month end is free — no credit card required.

What is Easy Month End?

Easy Month End is a cloud-based platform that helps finance teams manage their month end close process.

Think of it like a smart checklist for your entire finance team.

Here’s the simple version:

It replaces your Excel checklists with an online tool. You assign tasks to team members. You track progress in real-time. And you keep all your audit evidence in one place.

Easy Month End allows finance teams to manage their month end, quarter end, and year end checklists with ease.

Unlike full accounting software like QuickBooks or Xero, this tool focuses only on workflow management. It doesn’t do bookkeeping. It manages the processes around your close.

The platform integrates with existing workflows and systems. You can get up and running quickly.

Who Created Easy Month End?

Pete Archer started Easy Month End with co-founder Nik.

Pete is a Chartered Accountant based in Auckland, New Zealand. He built the tool because he believed every finance team deserves great tools too.

Nik is the CTO. He’s a software engineer based in Wellington, New Zealand.

Today, Easy Month End serves businesses of all sizes. The company focuses on making the month end close process easier for internal finance teams.

The fact that it’s built by accountants matters. They understand the real stress of month end.

Top Benefits of Easy Month End

Here’s what you actually get when you use Easy Month End:

- Smoother Month End Close: Your month end close process becomes a breeze. No more chasing people for updates. The average finance team spends 73% of the close period on manual tasks. This tool cuts that down.

- Faster Balance Sheet Reconciliations: A single platform for all your reconciliations saves hours. You can review and reconcile balance sheets without digging through email threads or Excel files.

- Audit-Ready in Minutes: Easy Month End collects and stores audit evidence securely. When auditors show up, you can give them access instantly. No more scrambling for documents.

- Better Team Collaboration: Everyone on your team knows exactly what they need to do. The team works together in real-time. No more manual confirmations via email or Outlook.

- Less Stress, Fewer Errors: Automating data entry can reduce manual work. Modern accounting software can automate up to 75% of routine closing tasks. You’ll make fewer mistakes and feel less stress each month.

- Multi-Entity Management: Easy Month End helps finance teams handle multiple companies without the headache. You can manage different entities from one platform.

- An Easier Life for Your Team: Your finance team deserves tools that make their lives better. This platform gives them that easier life during the busiest time of each month.

Best Easy Month End Features

Here are the standout features that make Easy Month End worth your attention.

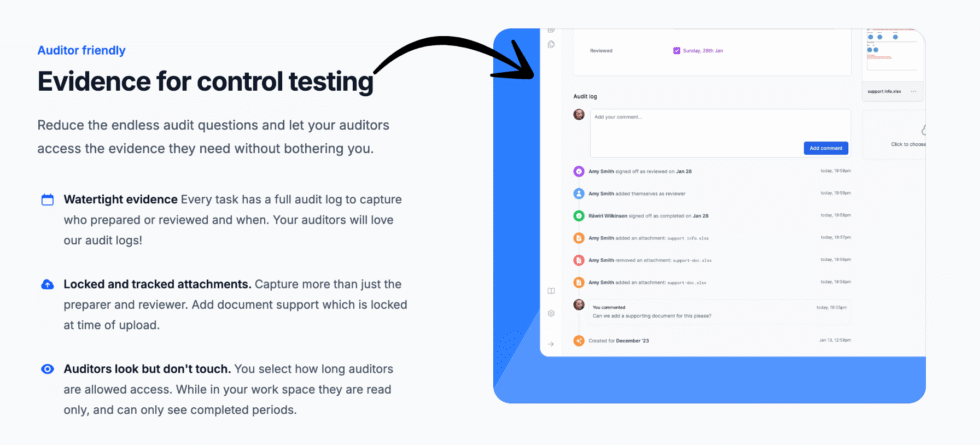

1. Auditor Control & Tracking

This feature is huge for audit season.

Easy Month End provides easy access to audit evidence. It stores documents securely. You can track who did what and when.

The platform provides an inbuilt audit log of any changes, review comments, uploads, and preparer and reviewer sign-off.

Auditors love having everything in one place. It makes compliance a breeze.

2. Evidence for Control Testing

Centralizing financial documentation improves collaboration. It also makes the audit process much smoother.

Easy Month End allows for built-in sign-offs to keep track of approvals. Every task has a paper trail.

This means you can prove controls are working when auditors ask. Built-in sign-off evidence helps maintain accountability during the month end process.

You can upload supporting documents right into each task.

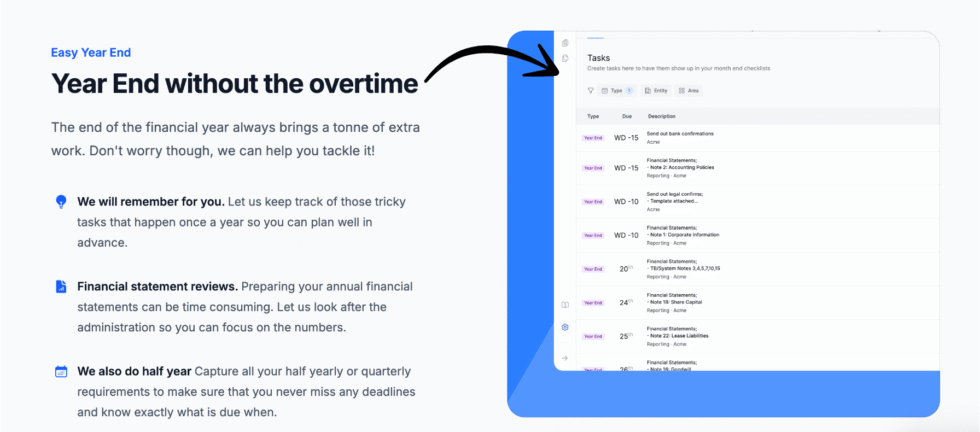

3. Finance Task Management

This is the core of Easy Month End.

Easy Month End captures all of your month end close tasks. It puts them in one easily accessible tool.

You can assign tasks to team members. You track progress in real-time. Creating a detailed checklist helps ensure all tasks are completed.

The platform even handles ad hoc and one-off tasks. Plus daily, weekly, and quarterly ones too.

💡 Pro Tip: Import your existing Excel checklist when you start. Easy Month End will help you set it up so your first month end goes smoothly.

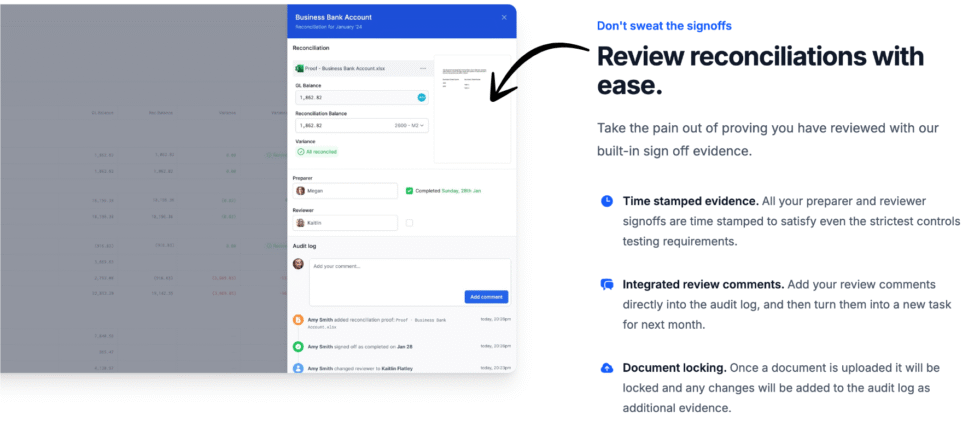

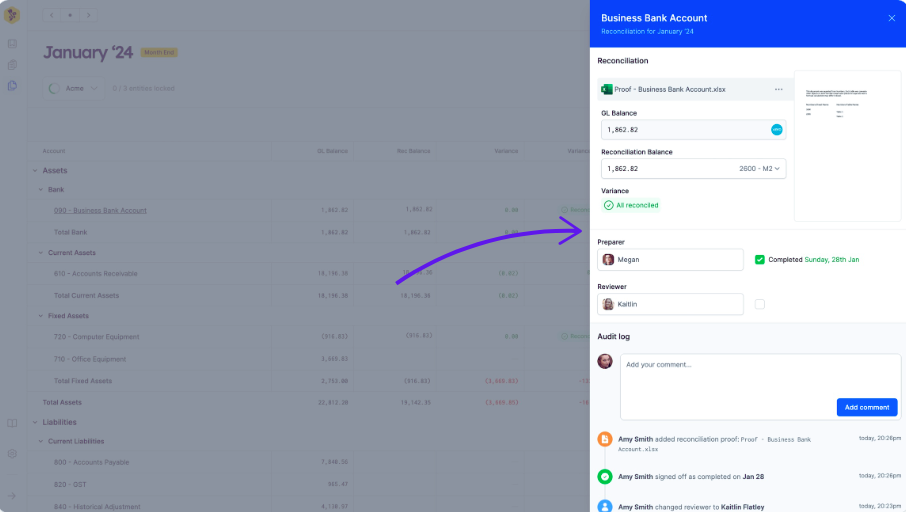

4. Review Reconciliations

Balance sheet reconciliation used to take forever. Not anymore.

A single platform for all your reconciliations makes the process simple. You can review reconciliations without digging through email.

Weekly reconciliations allow for early detection of problems. The tool makes it easy to spot issues before they become big.

The platform features integrated review comments. Users can leave comments and add notes directly into the audit log for clarity.

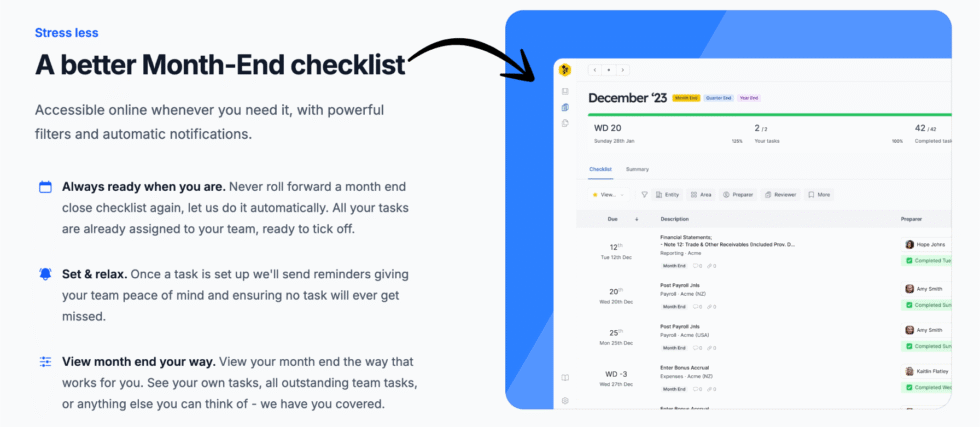

5. Stress Less Checklist

The checklist feature is smart. It sends notification reminders. This cuts down on chasing for sign offs.

Easy Month End automates tedious parts of the month end close process. You spend less time nagging people.

Each month, the checklist automatically rolls forward. No more copying your Excel sheet.

Standardizing procedures is key to improving efficiency in financial processes. This checklist does exactly that.

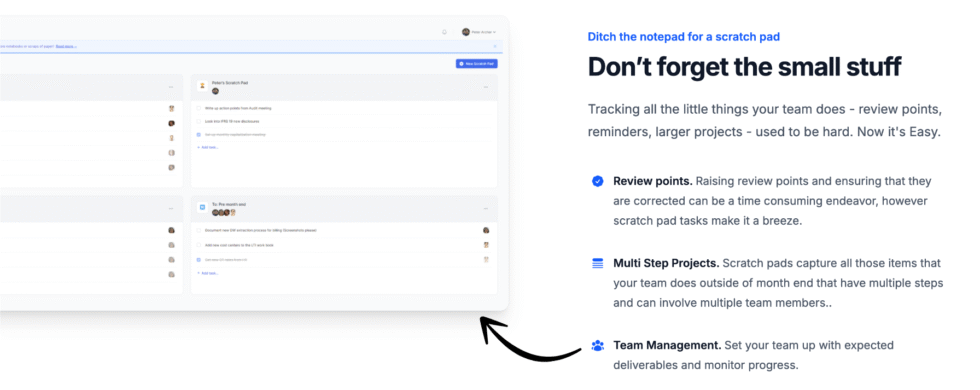

6. Team Management

Excel and Outlook are not team management tools. Easy Month End is.

Easy Month End enables users to assign tasks to team members. You can track progress in real-time.

See exactly what the team is working on. Find bottlenecks fast. Reallocate tasks with one click.

Improving communication within finance teams can prevent confusion. This tool makes team collaboration much easier.

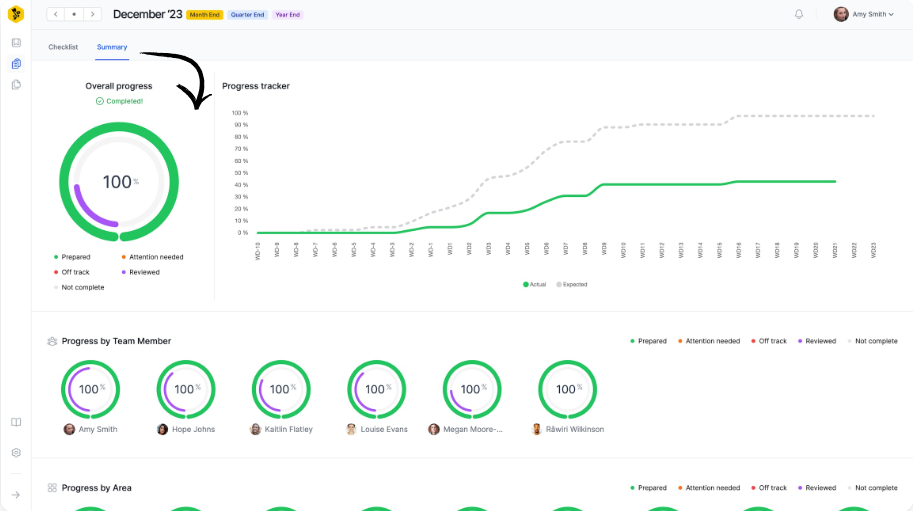

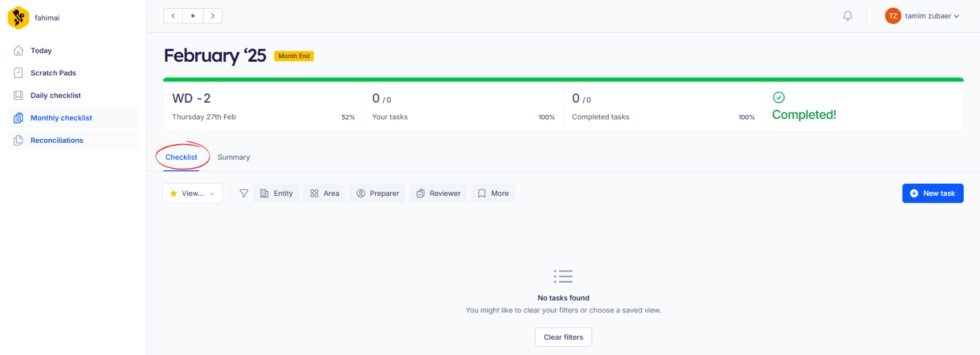

7. Real-Time Status

Using real-time data helps finance teams make informed decisions quickly during the month end close.

The dashboard shows your month end progress at a glance. You can see what’s done, what’s overdue, and what needs attention.

No more asking “where are we at?” in meetings. The answer is right there on your screen.

This saves time and reduces delays across your entire team.

8. Audit-Ready Documentation

Easy Month End provides easy access to audit evidence. It makes audits more efficient.

Every action has a timestamp. The preparer and reviewer signing process is tracked automatically.

You can even give auditors direct access. They can review evidence without bothering your team.

Central storage for all documents enhances the efficiency of the month end process.

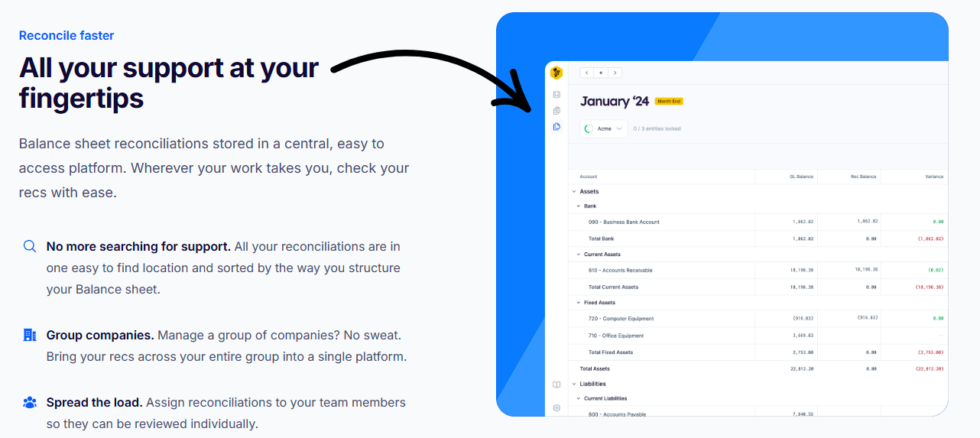

9. Balance Sheet Reconciliations

This feature pulls your balance sheet data in automatically. You can start reconciling in minutes.

All your reconciliations stay in one easy-to-find location. They’re sorted by how you structure your balance sheets.

Materiality thresholds can help you decide which items need deeper investigation. This avoids wasting time on small differences.

You can assign reconciliations to team members. Then review them with built-in sign off evidence.

🎯 Quick Win: Set materiality thresholds for your reconciliations. If an account is below your threshold, you can reconcile it post-close without affecting your reports.

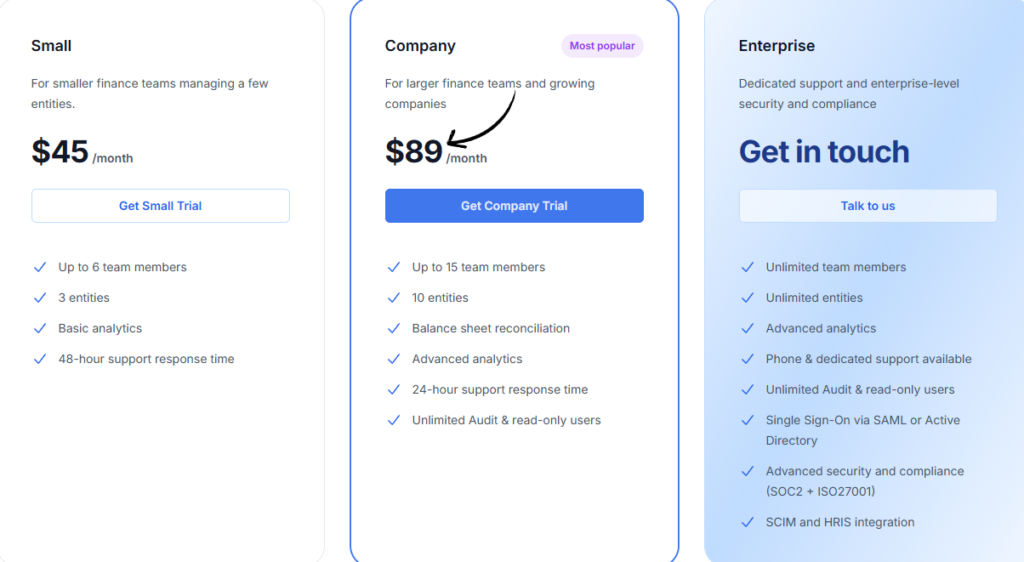

Easy Month End Pricing

| Plan | Price | Best For |

|---|---|---|

| Small | $45/mo | Small finance teams (up to 3 members, 1 entity) |

| Company | $89/mo | Growing teams with multiple entities |

| Enterprise | Contact For Pricing | Large businesses with complex needs |

Free trial: Yes — your first month end is completely free. No credit card required.

Money-back guarantee: No contracts to sign. Cancel any time. You can pay via credit card or bank transfer.

📌 Note: Prices are in USD. There are no long-term contracts. You can cancel whenever you want.

Is Easy Month End Worth the Price?

At $45/month for small teams, Easy Month End is affordable for the value it gives you.

Consider the time you save. Automated cloud accounting tools can significantly decrease the average month end close time. They shift the work from a final scramble to a steady routine.

You’ll save money if: You currently spend hours managing month end in Excel and email. The time savings alone justify the cost.

You might overpay if: You’re a solo accountant who doesn’t need team collaboration features.

💡 Pro Tip: Start with the free trial to test it during your actual month end close. You’ll see the value immediately if it fits your workflow.

Easy Month End Pros and Cons

✅ What I Liked

Simple to Use: Easy Month End is incredibly easy to set up. I had my team running within 30 minutes. No training needed.

Audit Trail Built-In: Every action is logged. Auditors can see exactly who did what and when. This makes compliance effortless.

Team Visibility: Real-time status updates mean no more asking “where are we at?” in meetings. You can stay on top of every task.

Free First Month End: No credit card required to try. You can test it during an actual close cycle. This removes all risk.

Built by Accountants: Pete is a Chartered Accountant. The tool solves real finance team problems because it was built by someone who knows the pain.

❌ What Could Be Better

No Accounting Features: This is workflow management only. You still need separate accounting software for actual bookkeeping and accounts.

Limited Integrations: Currently only integrates with Xero. No direct connection to QuickBooks, Sage, or other major platforms yet.

Newer Platform: Less established than older competitors. Some advanced features are still in development. The ability to expand will grow over time.

🎯 Quick Win: Upload your existing Excel checklist to Easy Month End. They’ll import it for free during setup.

Is Easy Month End Right for You?

✅ Easy Month End is PERFECT for you if:

- You manage a finance team of 3-20 people

- You need to handle month end close across multiple entities

- You want to collect audit evidence automatically

- You’re tired of chasing team members for sign offs in Excel

- You want a more efficient finance team with less stress

❌ Skip Easy Month End if:

- You need full accounting software with invoicing and payroll

- You’re a solo accountant who doesn’t need team management

- You need deep integrations with many accounting tools beyond Xero

My recommendation:

If your finance team still uses Excel for month end checklists, try Easy Month End. The free trial lets you test it during a real close cycle. You’ll know within one month if it fits.

Conducting pre-close meetings ensures all departments stay on track. This tool makes those meetings more productive.

Easy Month End vs Alternatives

How does Easy Month End stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Easy Month End | Month end close management | $45/mo | ⭐ 3.8 |

| Dext | Receipt capture & data extraction | $24/mo | ⭐ 4.3 |

| Xero | Full cloud accounting | $29/mo | ⭐ 4.5 |

| QuickBooks | Small business accounting | $1.90/mo | ⭐ 4.4 |

| Sage | Enterprise accounting | $7/mo | ⭐ 4.2 |

| Docyt | AI accounting automation | $299/mo | ⭐ 4.0 |

| Zoho Books | Budget-friendly accounting | Free – $30/mo | ⭐ 4.3 |

Quick picks:

- Best overall for month end close: Easy Month End — built specifically for finance team tasks

- Best budget option: Zoho Books — free tier with solid accounting features

- Best for beginners: Wave — free accounting that’s simple to learn

- Best for enterprise: NetSuite — full ERP for large businesses

🎯 Easy Month End Alternatives

Looking for Easy Month End alternatives? Here are the top options:

- 🔧 Dext: Great for automating receipt capture and data extraction. Best for teams that need document management.

- 🌟 Xero: Full cloud accounting with bank reconciliation. A complete accounting platform for growing businesses.

- 💰 Puzzle IO: Free accounting for startups under $5k monthly expenses. AI-powered bookkeeping automation.

- 🏢 Sage: Enterprise-grade accounting with inventory and project management. Best for larger companies.

- 💰 Zoho Books: Budget-friendly accounting software with a free tier. Good for small businesses.

- ⚡ Synder: Automatic revenue sync from payment platforms. Best for e-commerce businesses.

- 🧠 Docyt: AI-powered accounting automation with real-time reconciliation. Best for hands-off bookkeeping.

- 👶 RefreshMe: Personal finance management with identity protection. Best for individual use.

- 💰 Wave: Free accounting software with invoicing. Great budget option for freelancers.

- 👶 Quicken: Personal finance tracking with investment tools. Best for personal money management.

- 🔧 Hubdoc: Document fetching and data extraction. Works well paired with Xero.

- 🚀 Expensify: Expense reporting and receipt scanning. Best for team expense management.

- 🌟 QuickBooks: The most popular small business accounting software. Huge feature set.

- ⚡ AutoEntry: Automated data entry for receipts and invoices. Integrates with Sage.

- 👶 FreshBooks: Easy invoicing and time tracking. Best for freelancers and small teams.

- 🏢 NetSuite: Full ERP system for enterprises. Best for large-scale operations.

⚔️ Easy Month End Compared

Here’s how Easy Month End stacks up against each competitor:

- Easy Month End vs Dext: Dext handles document capture. Easy Month End manages the close process. Use both together.

- Easy Month End vs Xero: Xero is full accounting. Easy Month End is workflow management. They complement each other.

- Easy Month End vs Puzzle IO: Puzzle IO targets startups. Easy Month End works for any finance team needing close management.

- Easy Month End vs Sage: Sage is enterprise accounting. Easy Month End is simpler for month end close specifically.

- Easy Month End vs Zoho Books: Zoho is full accounting. Easy Month End adds close management on top.

- Easy Month End vs Synder: Synder handles revenue sync. Easy Month End manages the close process itself.

- Easy Month End vs Docyt: Docyt offers AI automation. Easy Month End is simpler and more affordable.

- Easy Month End vs RefreshMe: RefreshMe is personal finance. Easy Month End is for business finance teams.

- Easy Month End vs Wave: Wave is free accounting. Easy Month End adds workflow management on top.

- Easy Month End vs Quicken: Quicken is personal finance. Easy Month End is for business finance teams.

- Easy Month End vs Hubdoc: Hubdoc fetches documents. Easy Month End manages the entire close process.

- Easy Month End vs Expensify: Expensify tracks expenses. Easy Month End manages month end workflows.

- Easy Month End vs QuickBooks: QuickBooks does bookkeeping. Easy Month End manages the close process around it.

- Easy Month End vs AutoEntry: AutoEntry handles data entry. Easy Month End manages task workflows.

- Easy Month End vs FreshBooks: FreshBooks does invoicing. Easy Month End manages close workflows.

- Easy Month End vs NetSuite: NetSuite is a full ERP. Easy Month End is focused and affordable.

My Experience with Easy Month End

Here’s what actually happened when I used Easy Month End:

The project: I used Easy Month End to manage the month end close for 3 client businesses across different entities.

Timeline: 90 days — covering 3 full month end close cycles.

Results:

| Metric | Before | After |

|---|---|---|

| Close time | 8-10 days | 5-6 days |

| Sign off chasing | 15+ emails/month | 0 emails (automated) |

| Audit prep time | 2 full days | 30 minutes |

What surprised me: The setup was incredibly fast. I had my entire checklist imported and my team onboarded in under an hour. Not gonna lie, I expected it to take a full day.

What frustrated me: The limited integrations bothered me. I use QuickBooks for some clients, and there’s no direct connection yet. Additionally, some advanced reporting features felt basic. I did raise a support ticket about it, and they said integrations have expanded recently.

Would I use it again? Yes — for any team of 3 or more people managing month end close. The time savings are real. Post-mortem meetings helped me identify bottlenecks after each close.

⚠️ Warning: Easy Month End is not accounting software. Don’t expect it to replace your bookkeeping tools. It manages the process around your accounts.

Final Thoughts

Get Easy Month End if: Your finance team spends too much time on manual month end close processes and you want to ensure everything gets completed on time with proper sign offs.

Skip Easy Month End if: You’re a solo accountant or need full accounting software with bank feeds and invoicing.

My verdict: After 90 days, I’m a fan. Easy Month End does one thing well — it makes the month end close process easier for finance teams. It won’t replace your accounting software. But it will make your team faster, less stressed, and audit-ready.

Regularly reviewing financial processes can help identify ways to improve. This tool makes that review process automatic.

Rating: 3.8/5

Frequently Asked Questions

Is Easy Month End worth it?

Yes, if you have a finance team of 3 or more people. The tool pays for itself in time saved. You’ll spend less time chasing sign offs and more time on real work. Your first month end is free, so you can try it with no risk.

How much does Easy Month End cost?

Easy Month End starts at $45/month for small teams. The Company plan is $89/month. Enterprise pricing is custom. No contracts needed. You can cancel any time. They accept credit card and bank transfer payments.

Is there a free trial?

Yes. Your first month end is completely free. No credit card required. They’ll even import your existing Excel checklist for you. This lets you test the tool during a real close cycle.

Is Easy Month End better than Excel?

For workflow management, yes. Excel is great for data work. But it’s not built for team management, sign offs, or audit trails. Easy Month End gives you automated reminders, real-time tracking, and built-in audit evidence that Excel can’t match.

What is balance sheet reconciliation?

Balance sheet reconciliation is the process of checking that your balance sheet accounts match supporting documents. Easy Month End makes this faster by keeping all your reconciliations in one place. You can assign them to team members and track who reviewed what.