Quick Start

This guide covers every Puzzle IO feature:

- Getting Started — Create account and connect your bank

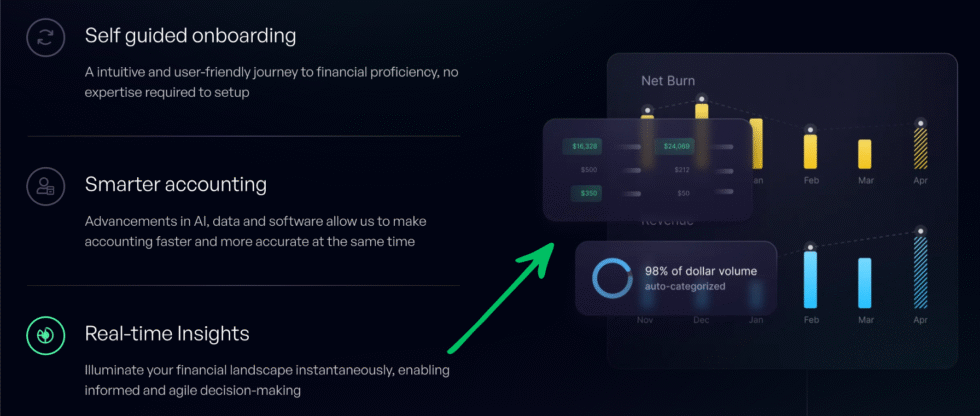

- How to Use Financial Insights — Track burn, runway, and cash in real time

- How to Use Tax Compliance — Stay IRS-ready with automated checks

- How to Use Bookkeeping Services — Connect with expert bookkeepers on demand

- How to Use Partner Ecosystem — Access CPAs and tax pros through Puzzle

- How to Use Accrual Automation — Automate revenue recognition and accruals

- How to Use Real-Time Insights — See your financial position daily

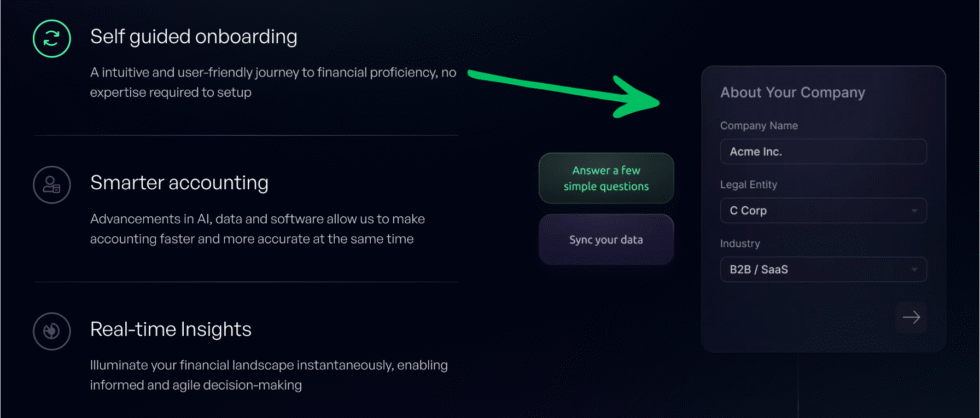

- How to Use Self-Guided Onboarding — Set up your books in minutes

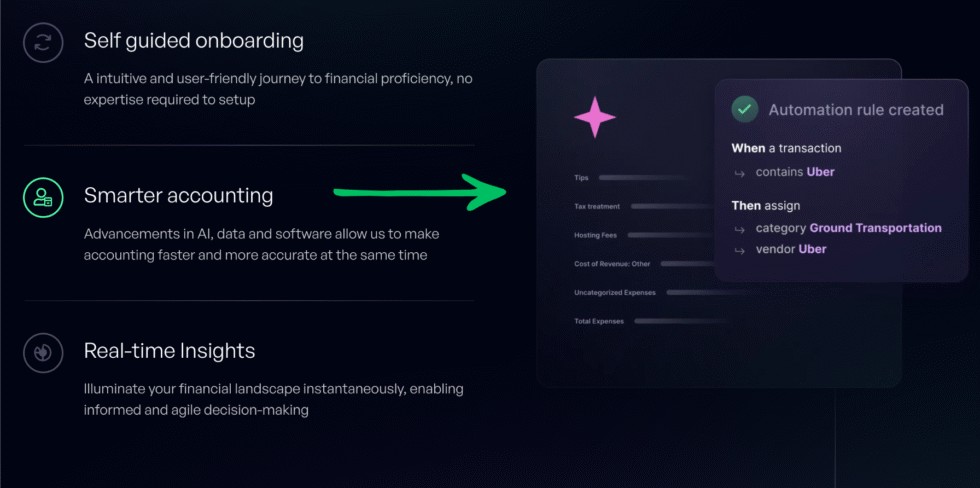

- How to Use Smarter Accounting — Let AI categorize 95% of transactions

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used Puzzle IO for over 6 months and tested every feature covered here. This how to use Puzzle IO article comes from real hands-on experience — not marketing fluff or vendor screenshots.

Puzzle IO is one of the most powerful AI accounting tools for startups today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Puzzle IO Tutorial

This complete Puzzle IO tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Puzzle IO

Stop wrestling with confusing accounting software. Puzzle IO automates 85-95% of bookkeeping tasks so you can focus on growing your startup. Try free — no credit card required.

Getting Started with Puzzle IO

Before using any feature, complete this one-time setup.

It takes about 7 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to puzzle.io and click “Get Started.”

Enter your email and create a password.

You can also sign up with Google for faster access.

✓ Checkpoint: Check your inbox for a confirmation email.

Step 2: Connect Your Bank Accounts

Puzzle connects directly to Mercury, Ramp, Brex, and Stripe.

Click “Integrations” in the left sidebar.

Select your bank or payment provider and authorize access.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see your transactions loading in the dashboard.

Step 3: Complete Initial Setup

Follow the guided onboarding wizard to set your fiscal year.

Connect your payroll provider like Gusto, Rippling, or Deel.

Review the auto-categorized transactions Puzzle has already processed.

✅ Done: You’re ready to use any feature below.

How to Use Puzzle IO Financial Insights

Financial Insights lets you see burn rate, runway, and cash position in real time.

Here’s how to use it step by step.

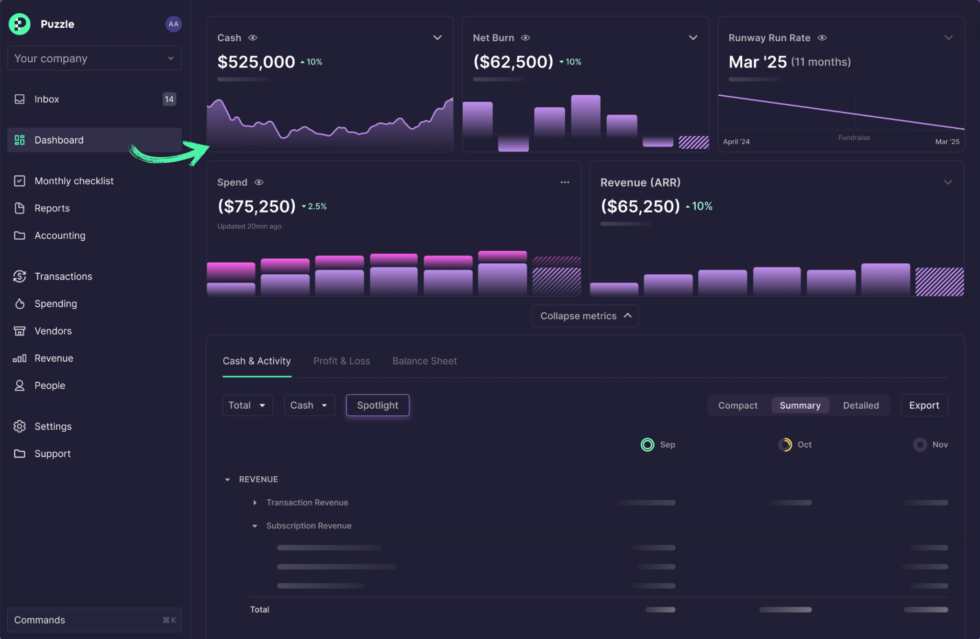

Step 1: Open the Dashboard

Click “Dashboard” in the left navigation menu.

Your key metrics appear at the top of the screen.

Step 2: Review Your Key Metrics

Check your burn rate, cash runway, and monthly spending trends.

Click any metric card to see a detailed chart breakdown.

Here’s what this looks like:

✓ Checkpoint: You should see your burn rate and runway displayed as charts.

Step 3: Export or Share Reports

Click the export button to download reports as PDF or CSV.

Share your dashboard link with investors or board members.

✅ Result: You have real-time visibility into your startup’s financial health.

💡 Pro Tip: Set up weekly email summaries to get a money-in and money-out report delivered to your inbox every Monday.

How to Use Puzzle IO Tax Compliance

Tax Compliance lets you stay IRS-ready with automated completeness checks.

Here’s how to use it step by step.

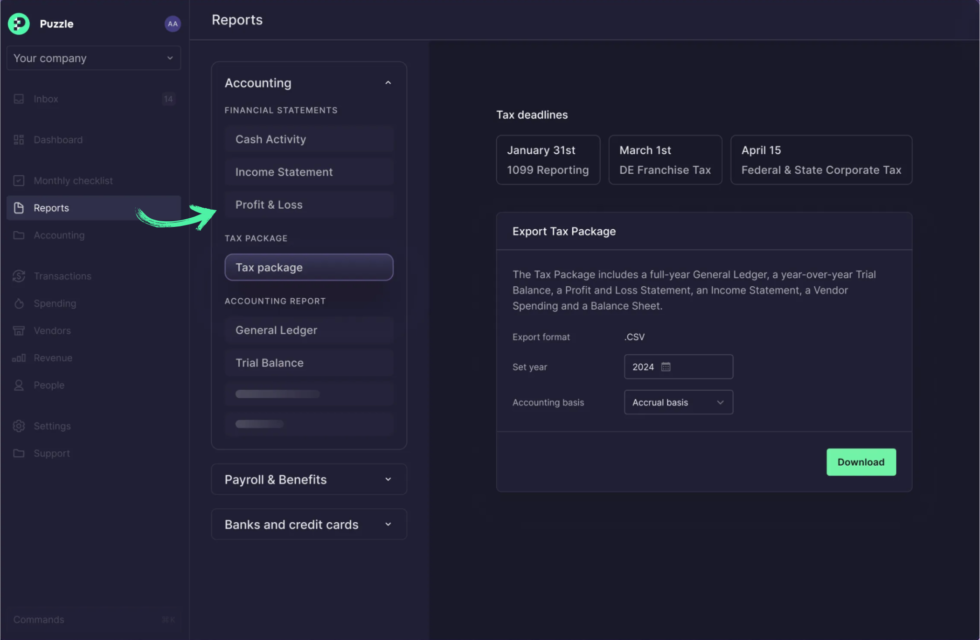

Step 1: Navigate to Accounting Tab

Click “Accounting” in the left sidebar menu.

This shows your general ledger and financial statements.

Step 2: Run Completeness Checks

Puzzle automatically flags uncategorized transactions that need attention.

Review the flagged items and confirm or correct the categories.

Here’s what this looks like:

✓ Checkpoint: You should see a compliance status indicator showing your readiness.

Step 3: Lock the Period

Once all transactions are categorized, lock the accounting period.

This prevents changes to historical financials after review.

✅ Result: Your books are locked and ready for tax filing or investor review.

💡 Pro Tip: Lock periods monthly right after your bookkeeper reviews. This prevents accidental changes to finalized numbers.

How to Use Puzzle IO Bookkeeping Services

Bookkeeping Services lets you connect with expert bookkeepers through Puzzle’s network.

Here’s how to use it step by step.

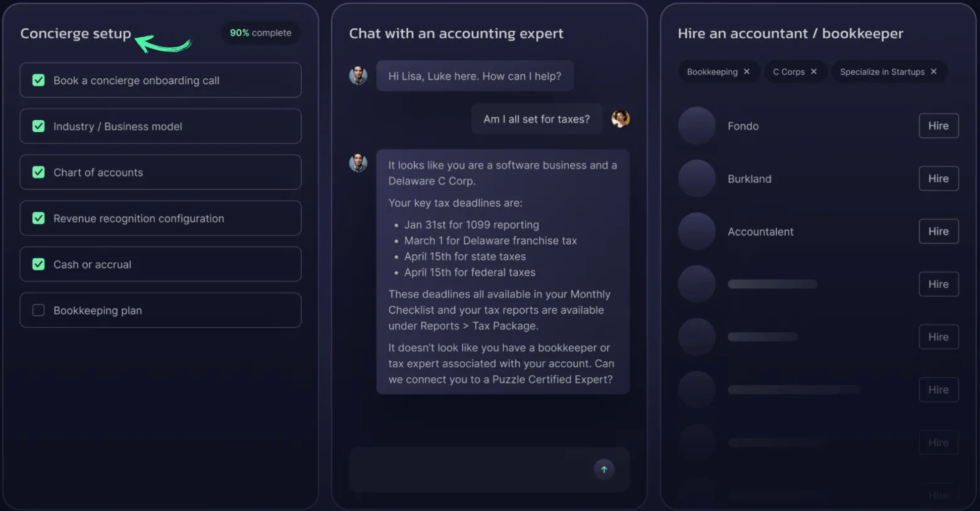

Step 1: Access the Partner Network

Click your account settings and find “Get Help.”

Browse the list of certified Puzzle bookkeepers and CPAs.

Step 2: Choose Your Expert

Filter by specialty, budget, and availability.

Puzzle matches you with the right expert for your needs.

Here’s what this looks like:

✓ Checkpoint: You should see available bookkeepers with ratings and specialties.

Step 3: Connect and Collaborate

Your bookkeeper gets direct access to your Puzzle account.

They can review, categorize, and approve transactions inside the platform.

✅ Result: You have a professional bookkeeper managing your books inside Puzzle.

💡 Pro Tip: Start with Puzzle’s self-guided tools first. Bring in a bookkeeper only when your finances grow more complex.

How to Use Puzzle IO Partner Ecosystem

Partner Ecosystem lets you access CPAs, tax preparers, and finance experts through Puzzle’s marketplace.

Here’s how to use it step by step.

Step 1: Open the Partner Marketplace

Navigate to the Partners section from your dashboard.

Browse certified Puzzle Advisors listed on the marketplace.

Step 2: Review Partner Profiles

Each partner shows their specialty, client reviews, and pricing.

Look for advisors who specialize in your industry or stage.

Here’s what this looks like:

✓ Checkpoint: You should see a list of verified partners with their credentials.

Step 3: Hire and Onboard Your Partner

Click “Connect” to send a request to your chosen partner.

They get instant access to your Puzzle data for collaboration.

✅ Result: You have a certified accounting professional connected to your books.

💡 Pro Tip: Ask your partner to become a Certified Puzzle Advisor. This ensures they know the platform inside and out.

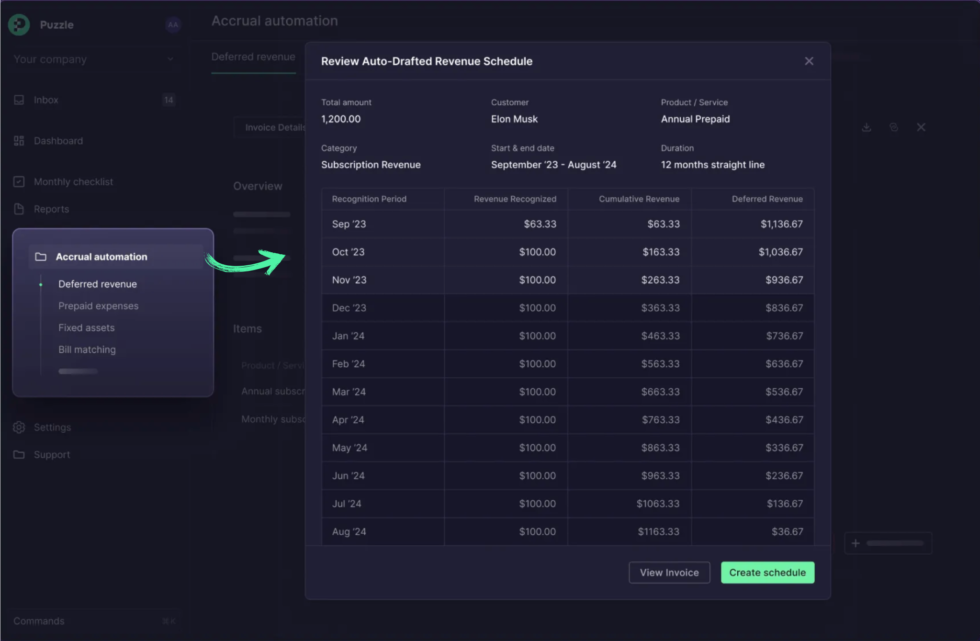

How to Use Puzzle IO Accrual Automation

Accrual Automation lets you manage revenue recognition and accrual accounting automatically.

Here’s how to use it step by step.

Step 1: Enable Accrual Accounting

Go to Settings and toggle on “Accrual Accounting.”

Puzzle maintains both cash and accrual books at the same time.

Step 2: Configure Revenue Rules

Connect your Stripe or invoicing tool for automatic revenue data.

Puzzle auto-generates accrual entries from your cash transactions.

Here’s what this looks like:

✓ Checkpoint: You should see accrual entries auto-drafted alongside your cash records.

Step 3: Review and Approve Accruals

Check the auto-drafted accrual entries in the Revenue tab.

Approve or adjust as needed before locking the period.

✅ Result: You have GAAP-compliant accrual accounting running on autopilot.

💡 Pro Tip: Review MRR and ARR metrics in the Revenue tab. These update automatically as Puzzle recognizes revenue from Stripe subscriptions.

How to Use Puzzle IO Built-in Accrual Automation

Built-in Accrual Automation lets you auto-generate accrual entries from any cash transaction without spreadsheets.

Here’s how to use it step by step.

Step 1: Navigate to Transactions

Click “Transactions” in the left sidebar.

Find a cash transaction you want to create an accrual for.

Step 2: Create Auto-Accrual Rules

Click the transaction and select “Create Accrual Schedule.”

Puzzle auto-drafts the accrual entries based on the transaction details.

Here’s what this looks like:

✓ Checkpoint: You should see scheduled accrual entries linked to the original cash transaction.

Step 3: Monitor Accrual Schedules

View all active accrual schedules in the Accounting tab.

Puzzle posts entries automatically each period until complete.

✅ Result: Accrual entries are auto-posted each period without manual journal entries.

💡 Pro Tip: Use auto-accruals for prepaid expenses like annual SaaS subscriptions. Puzzle spreads the cost across months automatically.

How to Use Puzzle IO Real-Time Insights

Real-Time Insights lets you see your drafted financial position daily instead of waiting for month-end.

Here’s how to use it step by step.

Step 1: Open Your Dashboard

Click “Dashboard” from anywhere in the app.

All your financial metrics update continuously throughout the day.

Step 2: Explore Metric Cards

Click any metric card to drill down into the data.

View burn rate, runway, ARR, MRR, and spending trends.

Here’s what this looks like:

✓ Checkpoint: You should see live charts with your current financial data.

Step 3: Share Insights with Stakeholders

Click “Share” to send a dashboard link to your investors or board.

They can view real-time data without needing a Puzzle account.

✅ Result: You and your stakeholders have 24/7 access to up-to-date financials.

💡 Pro Tip: Check the “People” tab for headcount and payroll cost trends. This is invaluable for tracking your biggest expense category.

How to Use Puzzle IO Self-Guided Onboarding

Self-Guided Onboarding lets you set up your books in minutes without needing an accountant.

Here’s how to use it step by step.

Step 1: Start the Setup Wizard

After signing up, Puzzle launches the guided setup automatically.

Follow the prompts to enter your company details and fiscal year.

Step 2: Connect Your Accounts

Add your bank, credit card, payroll, and payment processor accounts.

Puzzle uses direct APIs for Mercury, Ramp, Brex, Stripe, and Gusto.

Here’s what this looks like:

✓ Checkpoint: You should see all your connected accounts with a green status indicator.

Step 3: Review Auto-Categorized Transactions

Puzzle’s AI categorizes up to 95% of your transactions automatically.

Review the suggested categories and approve or adjust them.

✅ Result: Your books are set up and auto-categorized in under 10 minutes.

💡 Pro Tip: Create custom categorization rules during onboarding. Puzzle learns your patterns and applies them to future transactions.

How to Use Puzzle IO Smarter Accounting

Smarter Accounting lets you use AI to categorize, reconcile, and review transactions automatically.

Here’s how to use it step by step.

Step 1: Enable AI Autopilot

Go to Settings and turn on AI Categorizer and AI Lookup.

These two features make up Puzzle’s AI engine.

Step 2: Review AI Suggestions

Navigate to the Transactions tab to see AI-categorized entries.

Puzzle highlights low-confidence items for your manual review.

Here’s what this looks like:

✓ Checkpoint: You should see transactions color-coded by AI confidence level.

Step 3: Use AI Lookup for Guidance

Click “Ask AI” on any transaction for plain-English accounting guidance.

Describe the transaction and Puzzle suggests the correct category.

✅ Result: Your AI is processing 95%+ of transactions without manual input.

💡 Pro Tip: The more transactions you confirm, the smarter Puzzle gets. Spend 5 minutes reviewing AI suggestions weekly for best accuracy.

Puzzle IO Pro Tips and Shortcuts

After testing Puzzle IO for over 6 months, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| Navigate between transactions | ↑ / ↓ Arrow Keys |

| Approve a transaction category | Enter |

| Open search | Ctrl + K (⌘ + K on Mac) |

| Undo last action | Ctrl + Z (⌘ + Z on Mac) |

Hidden Features Most People Miss

- Email Transaction Replies: When AI flags an unknown transaction, you can reply by email with the category. No need to log in.

- Slack Integration: Connect Puzzle to Slack to query your cash balance or latest metrics directly in your workspace.

- Simultaneous Cash and Accrual: Puzzle maintains both accounting methods at once. Switch views instantly without duplicate work.

Puzzle IO Common Mistakes to Avoid

Mistake #1: Trusting AI Categorization Without Review

❌ Wrong: Approving all AI-categorized transactions without checking them.

✅ Right: Review AI suggestions weekly. Correct mistakes early so the AI learns your patterns faster.

Mistake #2: Skipping Bank Account Connections

❌ Wrong: Manually uploading CSV files instead of connecting accounts directly.

✅ Right: Use direct API connections for Mercury, Ramp, Brex, and Stripe. You get richer data and real-time syncing.

Mistake #3: Not Locking Accounting Periods

❌ Wrong: Leaving past months unlocked so anyone can edit historical data.

✅ Right: Lock each period after review. This protects finalized financials from accidental changes.

Puzzle IO Troubleshooting

Problem: Bank Connection Keeps Disconnecting

Cause: Some banks use Plaid connections that expire after 90 days.

Fix: Go to Integrations, disconnect the account, then reconnect it. Use direct API integrations where available for more stable connections.

Problem: AI Miscategorized a Transaction

Cause: The AI hasn’t seen enough similar transactions to learn your pattern.

Fix: Manually correct the category and create a custom rule. Puzzle will apply this rule to future matching transactions.

Problem: Financial Reports Show Incorrect Balances

Cause: Uncategorized transactions are skewing your totals.

Fix: Go to Transactions, filter by “Uncategorized,” and process all pending items. Your reports will update in real time.

📌 Note: If none of these fix your issue, contact Puzzle IO support at support@puzzle.io.

What is Puzzle IO?

Puzzle IO is an AI-powered accounting tool that automates bookkeeping for startups and small businesses.

Think of it like having a smart bookkeeper that works 24/7 inside your bank accounts.

It includes these key features:

- Financial Insights: Real-time burn rate, runway, and cash position dashboards

- Tax Compliance: Automated completeness checks and period locking

- Bookkeeping Services: On-demand access to certified bookkeepers and CPAs

- Partner Ecosystem: Marketplace of vetted accounting professionals

- Accrual Automation: Automatic revenue recognition and accrual entries

- Real-Time Insights: Daily drafted financial position without month-end delays

- Self-Guided Onboarding: Set up your books in minutes without an accountant

- Smarter Accounting: AI categorizes up to 95% of transactions automatically

For a full review, see our Puzzle IO review.

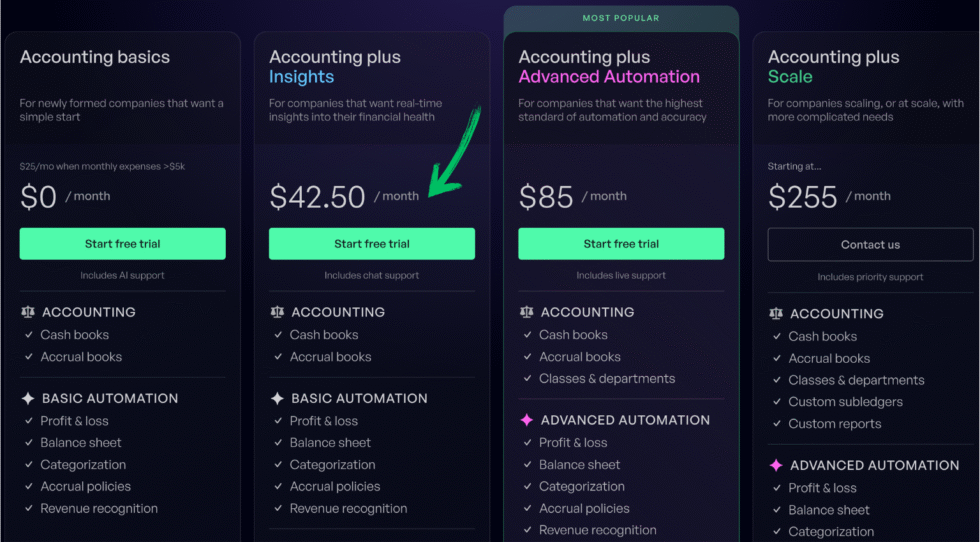

Puzzle IO Pricing

Here’s what Puzzle IO costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Accounting basics | $0/month | Early-stage startups getting started with bookkeeping |

| Accounting plus Insights | $42.50/month | Founders who need real-time financial dashboards |

| Advanced Automation | $85/month | Growing startups that want AI-powered categorization |

| Accounting plus Scale | $255/month | Scaling companies with complex accounting needs |

Free trial: Yes, the Accounting basics plan is free forever with core features.

Money-back guarantee: Contact support for refund options on paid plans.

Here’s what the pricing page looks like:

💰 Best Value: Accounting plus Insights at $42.50/month — gives you the real-time dashboards most startup founders need without paying for full automation.

Puzzle IO vs Alternatives

How does Puzzle IO compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Puzzle IO | AI-powered startup accounting | $0-$255/mo | ⭐ 3.5 |

| QuickBooks | General small business accounting | $1.90/mo+ | ⭐ 4.4 |

| Xero | Multi-currency and international | $29/mo+ | ⭐ 4.5 |

| FreshBooks | Freelancers and service businesses | $21/mo+ | ⭐ 4.3 |

| Zoho Books | Budget-friendly SMB accounting | $0-$30/mo | ⭐ 4.3 |

| Wave | Free basic accounting | $0-$19/mo | ⭐ 4.0 |

| NetSuite | Enterprise-level ERP | Custom | ⭐ 4.5 |

| Expensify | Expense management | $5/mo+ | ⭐ 4.1 |

Quick picks:

- Best overall: Puzzle IO — best AI automation for startups with real-time metrics

- Best budget: Wave — free plan covers invoicing and basic accounting

- Best for beginners: FreshBooks — clean interface with guided setup

- Best for enterprise: NetSuite — full ERP with multi-entity consolidation

🎯 Puzzle IO Alternatives

Looking for Puzzle IO alternatives? Here are the top options:

- 🚀 Dext: Automates receipt capture and data extraction for faster expense processing. Starts at $24/mo.

- 🌟 Xero: Strong multi-currency support and clean interface for international startups. Plans from $29/mo.

- 🏢 Sage: Trusted enterprise accounting with flexible plans for growing businesses. Free tier available.

- 💰 Zoho Books: Budget-friendly accounting with a free plan for businesses under $50K revenue. Starts at $0/mo.

- ⚡ Synder: Specializes in e-commerce and multi-channel payment reconciliation. Plans from $52/mo.

- 🔧 Easy Month End: Speeds up month-end close with automated checklists and workflows. From $45/mo.

- 🧠 Docyt: AI-powered back-office accounting for restaurants and real estate. Starts at $299/mo.

- 🔒 RefreshMe: Personal finance tracking with automated budgeting and savings tools. From $24.99/mo.

- 💰 Wave: Completely free invoicing and accounting for freelancers and small teams. Free plan available.

- 📊 Quicken: Personal and small business finance management with budgeting tools. From $2.99/mo.

- 🎯 Hubdoc: Captures and organizes financial documents from over 1,000 sources. $12/mo.

- ⭐ Expensify: Top expense tracking with receipt scanning and approval workflows. From $5/member/mo.

- 🔥 QuickBooks: Industry standard with the largest accountant network and app ecosystem. From $1.90/mo.

- 👶 AutoEntry: Automated data entry that pulls numbers from receipts and invoices. From $12/mo.

- 🎨 FreshBooks: Beautiful invoicing and time tracking built for service-based businesses. From $21/mo.

- 🏢 NetSuite: Full ERP with advanced revenue recognition and multi-entity consolidation. Custom pricing.

For the full list, see our Puzzle IO alternatives guide.

⚔️ Puzzle IO Compared

Here’s how Puzzle IO stacks up against each competitor:

- Puzzle IO vs Dext: Puzzle is a full accounting platform while Dext focuses only on receipt capture and data extraction.

- Puzzle IO vs Xero: Xero wins for international businesses. Puzzle wins for US startups needing real-time burn and runway metrics.

- Puzzle IO vs Sage: Sage is better for established enterprises. Puzzle is purpose-built for venture-backed startups.

- Puzzle IO vs Zoho Books: Zoho is cheaper but lacks startup metrics like burn rate and ARR tracking. Puzzle fills that gap.

- Puzzle IO vs Synder: Synder excels at e-commerce reconciliation. Puzzle is better for SaaS and subscription-based startups.

- Puzzle IO vs Easy Month End: Easy Month End speeds up close processes. Puzzle automates the entire accounting workflow.

- Puzzle IO vs Docyt: Docyt targets restaurants and real estate. Puzzle is better for tech startups and SaaS companies.

- Puzzle IO vs RefreshMe: RefreshMe is personal finance focused. Puzzle is a full business accounting platform for startups.

- Puzzle IO vs Wave: Wave is free but basic. Puzzle adds AI automation and investor-grade financial reporting.

- Puzzle IO vs Quicken: Quicken is for personal finance. Puzzle is built for startup business accounting with team features.

- Puzzle IO vs Hubdoc: Hubdoc captures documents only. Puzzle is a complete accounting system with AI categorization.

- Puzzle IO vs Expensify: Expensify handles expense reports. Puzzle manages your entire general ledger and financial statements.

- Puzzle IO vs QuickBooks: QuickBooks has more accountant support. Puzzle has better AI automation and startup-specific metrics.

- Puzzle IO vs AutoEntry: AutoEntry automates data entry only. Puzzle provides full AI-powered accounting and reporting.

- Puzzle IO vs FreshBooks: FreshBooks is best for invoicing. Puzzle is better for startups tracking burn, runway, and ARR.

- Puzzle IO vs NetSuite: NetSuite is a full ERP for large companies. Puzzle gives startup-grade visibility without ERP complexity.

Start Using Puzzle IO Now

You learned how to use every major Puzzle IO feature:

- ✅ Financial Insights

- ✅ Tax Compliance

- ✅ Bookkeeping Services

- ✅ Partner Ecosystem

- ✅ Accrual Automation

- ✅ Built-in Accrual Automation

- ✅ Real-Time Insights

- ✅ Self-Guided Onboarding

- ✅ Smarter Accounting

Next step: Pick one feature and try it now.

Most people start with Financial Insights.

It takes less than 5 minutes.

Frequently Asked Questions

What is Puzzle accounting software?

Puzzle IO is an AI-powered accounting platform built for startups and small businesses. It automates 85-95% of bookkeeping tasks like transaction categorization, reconciliation, and accrual accounting. The platform connects to modern fintech tools like Stripe, Mercury, Ramp, and Brex for real-time financial data.

Is Puzzle IO a good site?

Puzzle IO is highly rated by startup founders for its clean interface and powerful automation. It has a 5.0 rating on Product Hunt based on 33 reviews. The platform has raised $66.5M in funding from investors like General Catalyst and Felicis Ventures, showing strong market confidence.

Is Puzzle an ERP?

No, Puzzle IO is not a full ERP system. It is an AI-native accounting platform that gives startups ERP-style visibility without the complexity. For companies needing full ERP features like multi-entity consolidation and advanced procurement, tools like NetSuite or Campfire may be better suited.

Can you use AI to solve puzzles?

Puzzle IO uses AI to solve accounting challenges, not traditional puzzles. Its AI Categorizer processes over 95% of transactions automatically. The AI Lookup feature lets you ask accounting questions in plain English and get category suggestions based on context.

Who is the CEO of Puzzle IO?

Sasha Orloff is the CEO and co-founder of Puzzle IO. He co-founded the company in 2019 along with John Cwikla. The company is based in San Francisco and has raised $66.5M in total funding across 3 rounds.

How does Puzzle IO differ from QuickBooks?

Puzzle IO is built for startups with modern fintech stacks while QuickBooks targets general small businesses. Puzzle offers direct API connections to Mercury, Ramp, and Brex, plus native startup metrics like burn rate and runway. QuickBooks has a larger accountant network and more third-party integrations.

How much does Puzzle IO cost?

Puzzle IO offers four plans: Accounting basics at $0/month, Accounting plus Insights at $42.50/month, Advanced Automation at $85/month, and Accounting plus Scale at $255/month. The free plan includes core accounting features to get started.