Quick Start

This guide covers every Zoho Books feature:

- Getting Started — Create account and basic setup

- How to Use Accounting Automation — Save hours on repetitive bookkeeping tasks

- How to Use Unified Invoicing and Accounting — Create and track invoices from one dashboard

- How to Use Collaboration & Portal Management — Give clients and team members secure access

- How to Use Mobile Accounting — Manage finances from your phone

- How to Use Create, Send, and Track Quotes — Win deals faster with professional estimates

- How to Use Project Management — Track time and bill clients by project

- How to Use Zoho Ecosystem — Connect with 50+ Zoho apps

- How to Use Manual Journal — Record custom adjustments and entries

- How to Use Zoho Analytics — Build custom financial reports and dashboards

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used Zoho Books for over 12 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

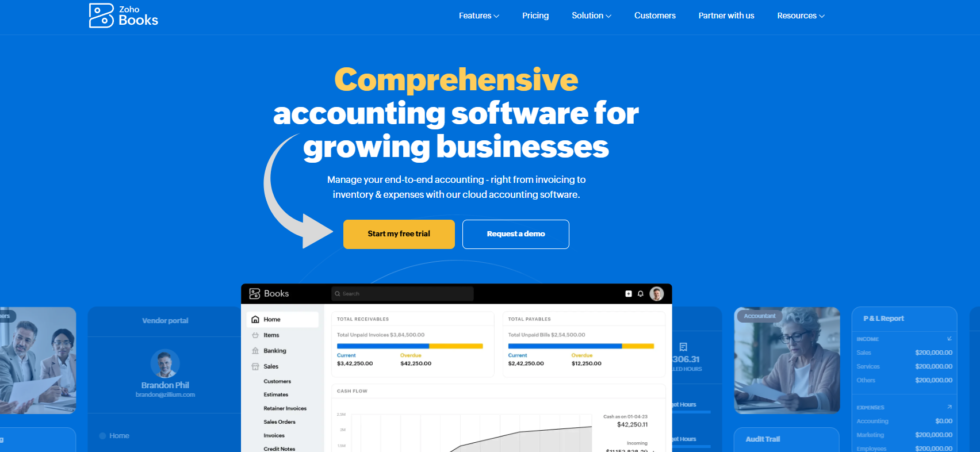

Zoho Books is one of the most powerful cloud accounting tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Zoho Books Tutorial

This complete Zoho Books tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Zoho Books

Automate your bookkeeping, invoicing, and expense tracking in one place. Zoho Books handles 90% of what major competitors offer at half the cost. Start free — no credit card required.

Getting Started with Zoho Books

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to zoho.com/books and click “Sign Up Free.”

Enter your email address and create a password.

You can also sign up with your Google account.

✓ Checkpoint: Check your inbox for a confirmation email from Zoho.

Step 2: Configure Your Company Profile

Enter your business name, address, and fiscal year.

Upload your company logo for branded invoices.

Select your base currency and tax preferences.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main dashboard with charts and sidebar.

Step 3: Complete Initial Setup

Set up your chart of accounts under Settings.

Import opening balances from your previous accounting year.

Connect your bank account to start receiving bank feeds.

✅ Done: You’re ready to use any feature below.

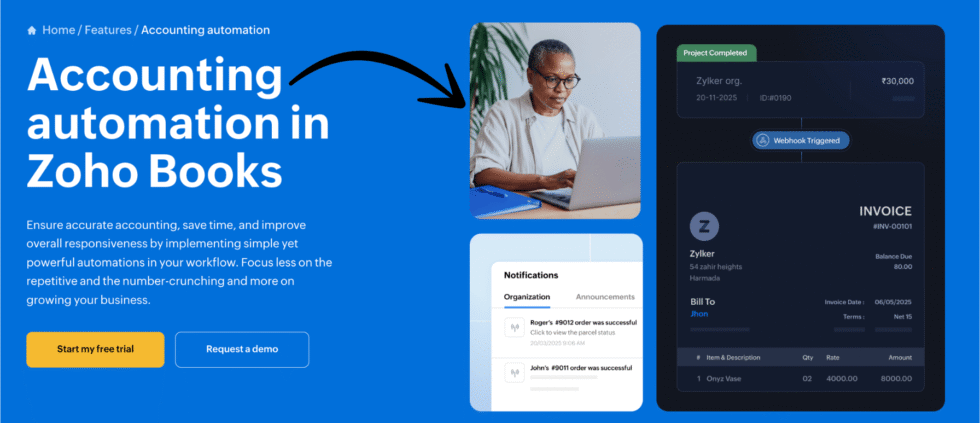

How to Use Zoho Books Accounting Automation

Accounting Automation lets you eliminate manual data entry and repetitive tasks.

Here’s how to use it step by step.

See Accounting Automation in action:

Now let’s break down each step.

Step 1: Open the Automation Settings

Go to Settings and click “Automation” in the left menu.

You’ll see options for workflow rules, reminders, and webhooks.

Step 2: Create a Workflow Rule

Click “New Workflow Rule” and select your trigger module.

Choose the event that starts the automation.

Set conditions like “when invoice is overdue by 7 days.”

✓ Checkpoint: You should see your rule listed in the workflow rules page.

Step 3: Set the Action

Choose an action like send email, update field, or trigger webhook.

Save and activate your workflow rule.

✅ Result: Your accounting tasks now run on autopilot.

💡 Pro Tip: Set up automatic payment reminders first. This single rule can cut your overdue invoices by 40% or more.

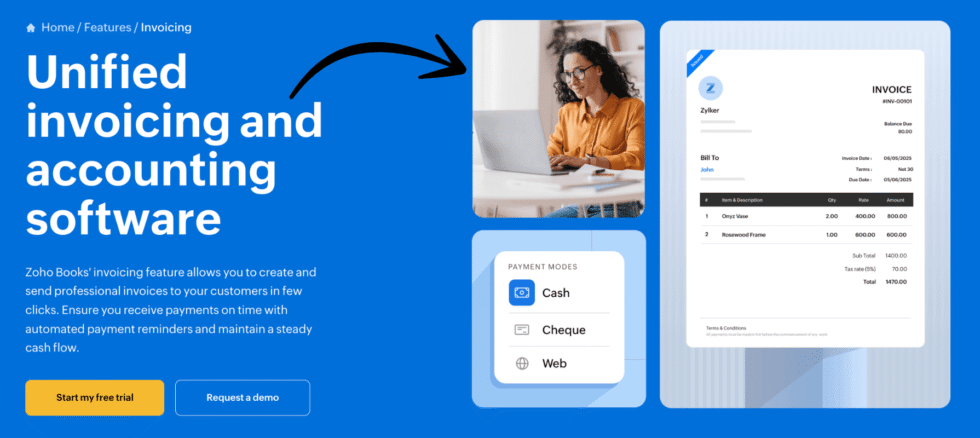

How to Use Zoho Books Unified Invoicing and Accounting

Unified Invoicing and Accounting lets you create, send, and track invoices without leaving your accounting workspace.

Here’s how to use it step by step.

Watch Unified Invoicing and Accounting in action:

Now let’s break down each step.

Step 1: Navigate to Invoices

Click “Invoices” in the left sidebar menu.

You’ll see all your existing invoices and their payment status.

Step 2: Create a New Invoice

Click the blue “+ New” button at the top right.

Select a customer from the dropdown to auto-fill their details.

Add line items, set payment terms, and apply taxes.

✓ Checkpoint: You should see the invoice preview with accurate totals.

Step 3: Send and Track the Invoice

Click “Save and Send” to email the invoice to your customer.

The journal entry is created automatically in your books.

✅ Result: Your invoice is sent and your accounting records update instantly.

💡 Pro Tip: Enable recurring invoices for repeat clients. Zoho Books will auto-generate and send them on your schedule.

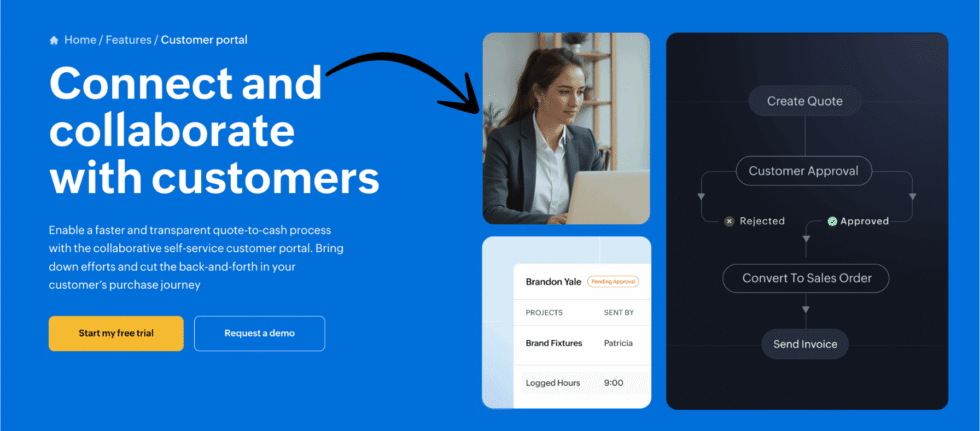

How to Use Zoho Books Collaboration & Portal Management

Collaboration & Portal Management lets you give clients and team members secure access to their billing information.

Here’s how to use it step by step.

Watch Collaboration & Portal Management in action:

Now let’s break down each step.

Step 1: Enable the Client Portal

Go to Settings and click “Customer Portal” under Preferences.

Toggle the portal on and customize the welcome message.

Step 2: Invite Clients to the Portal

Open any customer contact and click “Enable Portal Access.”

Your client receives an email invitation with login credentials.

✓ Checkpoint: You should see “Portal Enabled” next to the customer name.

Step 3: Manage User Roles and Permissions

Go to Settings and click “Users & Roles.”

Invite team members and assign custom role-based permissions.

✅ Result: Clients can view invoices and make payments without contacting you.

💡 Pro Tip: Let clients store payment info in the portal. This speeds up repeat payments and cuts billing inquiries by half.

How to Use Zoho Books Mobile Accounting

Mobile Accounting lets you manage your finances from anywhere using your phone.

Here’s how to use it step by step.

Watch Mobile Accounting in action:

Now let’s break down each step.

Step 1: Download the App

Search “Zoho Books” in the App Store or Google Play.

Download and install the free app on your device.

Step 2: Log In and Scan Receipts

Sign in with your Zoho Books credentials.

Tap the camera icon to scan a receipt using OCR technology.

The app auto-extracts vendor name, amount, and date.

✓ Checkpoint: You should see the expense created with receipt attached.

Step 3: Create Invoices on the Go

Tap “Invoices” then the “+” button to create a new invoice.

Select a customer, add items, and send it right from your phone.

✅ Result: You can handle accounting tasks from anywhere, anytime.

💡 Pro Tip: Snap every paper receipt immediately after a purchase. The OCR feature works best with clear, well-lit photos.

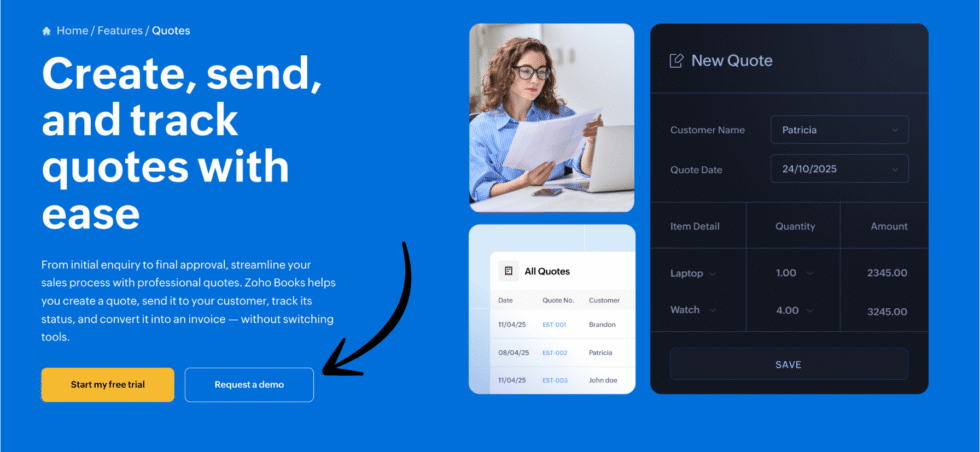

How to Use Zoho Books Create, Send, and Track Quotes

Create, Send, and Track Quotes lets you win deals faster with professional estimates.

Here’s how to use it step by step.

Watch Create, Send, and Track Quotes in action:

Now let’s break down each step.

Step 1: Navigate to Quotes

Click “Quotes” in the left sidebar under Sales.

Click “+ New” to start a fresh estimate.

Step 2: Build Your Quote

Select the customer and add line items with quantities and prices.

Set an expiry date and add any custom terms or notes.

✓ Checkpoint: You should see the quote total with all items listed.

Step 3: Send and Convert to Invoice

Click “Save and Send” to email the quote to your client.

Once accepted, click “Convert to Invoice” with one click.

✅ Result: Your quote is tracked and ready to convert into an invoice.

💡 Pro Tip: Use price lists to create different pricing tiers for different client segments. This saves time when building quotes.

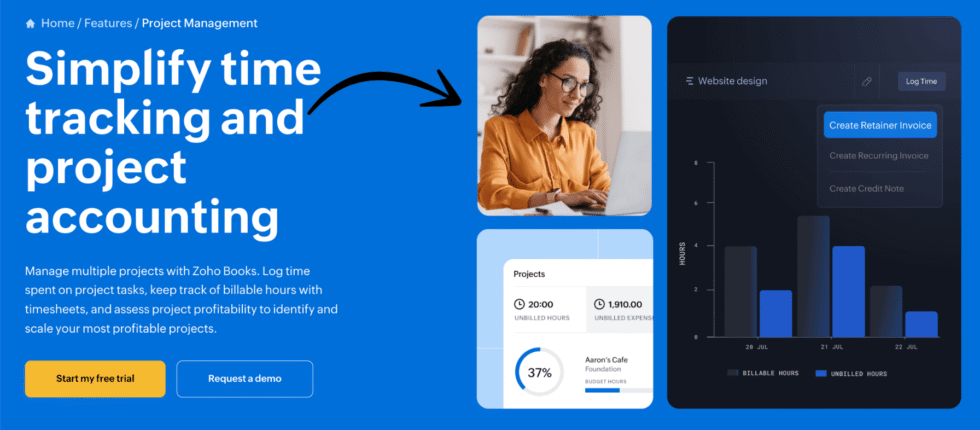

How to Use Zoho Books Project Management

Project Management lets you track time and bill clients based on hours worked.

Here’s how to use it step by step.

Watch Project Management in action:

Now let’s break down each step.

Step 1: Create a New Project

Go to “Projects” in the sidebar and click “+ New Project.”

Enter the project name, customer, and billing method.

Step 2: Log Time Entries

Open your project and click “Log Time” to add hours.

Select the task, enter hours, and add notes about the work done.

✓ Checkpoint: You should see the logged time in the project timesheet.

Step 3: Generate an Invoice from Time Entries

Click “Create Invoice” inside the project dashboard.

Select the unbilled time entries to include on the invoice.

✅ Result: Your project hours are billed accurately to the client.

💡 Pro Tip: Set up project budgets and track them in real time. This prevents scope creep and keeps profitability in check.

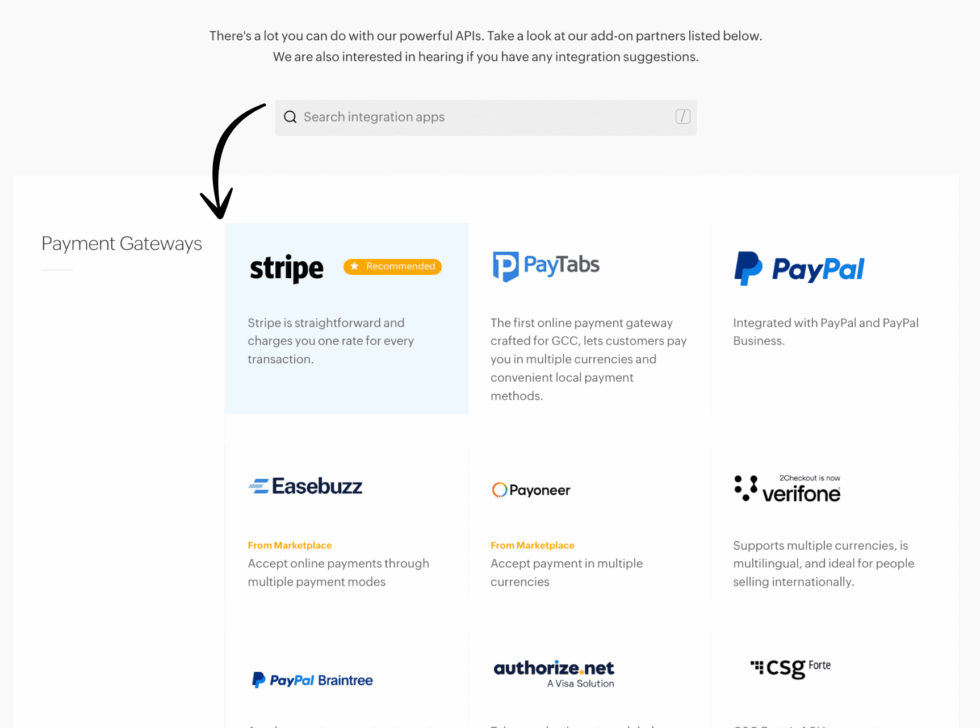

How to Use Zoho Books Zoho Ecosystem

Zoho Ecosystem lets you connect Zoho Books with 50+ Zoho apps for a unified business platform.

Here’s how to use it step by step.

Watch Zoho Ecosystem in action:

Now let’s break down each step.

Step 1: Open Integrations

Go to Settings and click “Integrations” in the sidebar.

Browse available Zoho apps like CRM, Inventory, and Payroll.

Step 2: Connect a Zoho App

Click “Connect” next to the app you want to link.

Authorize the connection and configure sync settings.

✓ Checkpoint: You should see “Connected” status for the linked app.

Step 3: Verify Data Sync

Create a test transaction and confirm it appears in both apps.

Check that contacts and items sync correctly between systems.

✅ Result: Your Zoho apps share data and work as one system.

💡 Pro Tip: Connect Zoho CRM first. Sales deals automatically convert to invoices, saving you double data entry.

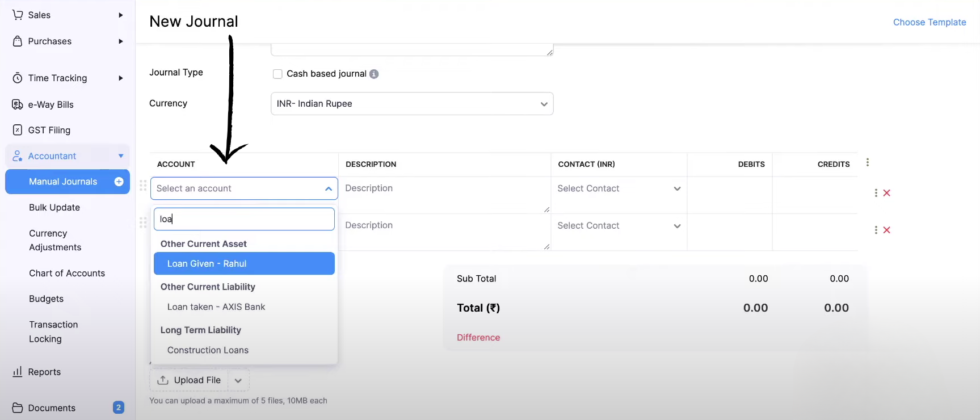

How to Use Zoho Books Manual Journal

Manual Journal lets you record custom adjustments like depreciation and accruals.

Here’s how to use it step by step.

Watch Manual Journal in action:

Now let’s break down each step.

Step 1: Navigate to Manual Journals

Go to “Accountant” in the sidebar and click “Manual Journals.”

Click “+ New Journal” to create a new entry.

Step 2: Enter Debit and Credit Lines

Select accounts for each line and enter debit or credit amounts.

Make sure your total debits equal total credits.

✓ Checkpoint: The “Difference” field at the bottom should show $0.00.

Step 3: Save the Journal Entry

Add a reference number and notes for audit trail purposes.

Click “Save” to post the entry to your general ledger.

✅ Result: Your custom adjustment is recorded in the general ledger.

💡 Pro Tip: Always add detailed notes to journal entries. Your future self (or accountant) will thank you during audits.

How to Use Zoho Books Zoho Analytics

Zoho Analytics lets you build custom financial reports and visual dashboards.

Here’s how to use it step by step.

Watch Zoho Analytics in action:

Now let’s break down each step.

Step 1: Access Reports

Click “Reports” in the left sidebar to see 70+ built-in reports.

Browse categories like Profit & Loss, Balance Sheet, and Cash Flow.

Step 2: Customize a Report

Open any report and click “Customize” to adjust filters and columns.

Set date ranges and compare trends across different time periods.

✓ Checkpoint: You should see the filtered report with your custom parameters.

Step 3: Schedule and Export Reports

Click “Schedule” to receive reports via email on a set schedule.

Export reports as PDF, Excel, or CSV for sharing with stakeholders.

✅ Result: You have custom financial dashboards tailored to your business.

💡 Pro Tip: Create a custom dashboard with your top 5 KPIs. Check it daily for a quick pulse on your business health.

Zoho Books Pro Tips and Shortcuts

After testing Zoho Books for over 12 months, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| View all shortcuts | Shift + ? |

| Create new invoice | C then I |

| Create new expense | C then E |

| Switch organization | O |

| Search transactions | / (forward slash) |

| Save current form | Alt + S |

Hidden Features Most People Miss

- Bank Rules: Create rules to auto-categorize bank transactions. Go to Banking and click “Rules” to set matching criteria by payee or amount.

- Recurring Expenses: Set up auto-recorded expenses for subscriptions. Go to Expenses and click “Make Recurring” on any expense entry.

- Custom Functions: Write Deluge scripts to extend Zoho Books. Go to Settings, then Automation, then Custom Functions for advanced workflows.

Zoho Books Common Mistakes to Avoid

Mistake #1: Skipping Opening Balances

❌ Wrong: Starting fresh without importing last year’s closing balances.

✅ Right: Import your previous year’s closing balances before recording any new transactions.

Mistake #2: Not Reconciling Monthly

❌ Wrong: Waiting until year-end to reconcile bank accounts.

✅ Right: Reconcile bank accounts monthly to catch errors and fraud early.

Mistake #3: Using Generic Chart of Accounts

❌ Wrong: Keeping the default chart of accounts without customizing it.

✅ Right: Customize your chart of accounts to match your business and tax reporting needs.

Zoho Books Troubleshooting

Problem: Bank Feeds Not Syncing

Cause: Your bank’s connection token may have expired or the aggregator is down.

Fix: Go to Banking, click the bank account, and select “Refresh.” If that fails, disconnect and reconnect the bank feed.

Problem: Trial Balance Doesn’t Match

Cause: Opening balances were not imported correctly or transactions were entered in the wrong period.

Fix: Run the Trial Balance report and compare each account. Check opening balances under Settings for discrepancies.

Problem: Invoice Email Not Received by Customer

Cause: The customer’s email provider may be blocking Zoho emails or the address is incorrect.

Fix: Verify the customer email, check their spam folder, and ask them to whitelist zoho.com. You can also resend from the invoice page.

📌 Note: If none of these fix your issue, contact Zoho Books support.

What is Zoho Books?

Zoho Books is a cloud-based accounting tool that automates bookkeeping, invoicing, and financial management for small businesses.

Think of it like having a full-time accountant that works 24/7 for a fraction of the cost.

Watch this quick overview:

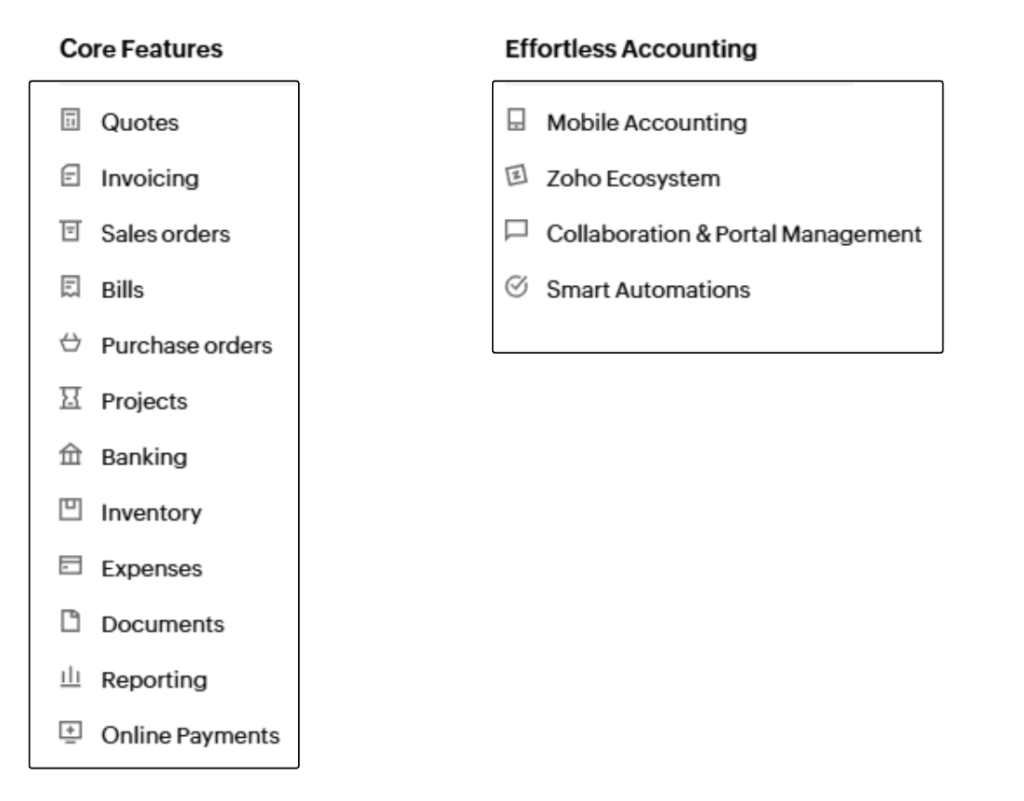

It includes these key features:

- Accounting Automation: Automates recurring invoices, payment reminders, and bank categorization.

- Unified Invoicing and Accounting: Create, send, and track invoices with automatic journal entries.

- Collaboration & Portal Management: Give clients and team members secure access to billing data.

- Mobile Accounting: Manage finances from your phone with receipt scanning.

- Create, Send, and Track Quotes: Build professional estimates and convert them to invoices.

- Project Management: Track time, manage budgets, and bill clients by project.

- Zoho Ecosystem: Connect with 50+ Zoho apps for a unified business platform.

- Manual Journal: Record custom adjustments like depreciation and accruals.

- Zoho Analytics: Build custom reports and dashboards with 70+ built-in templates.

For a full review, see our Zoho Books review.

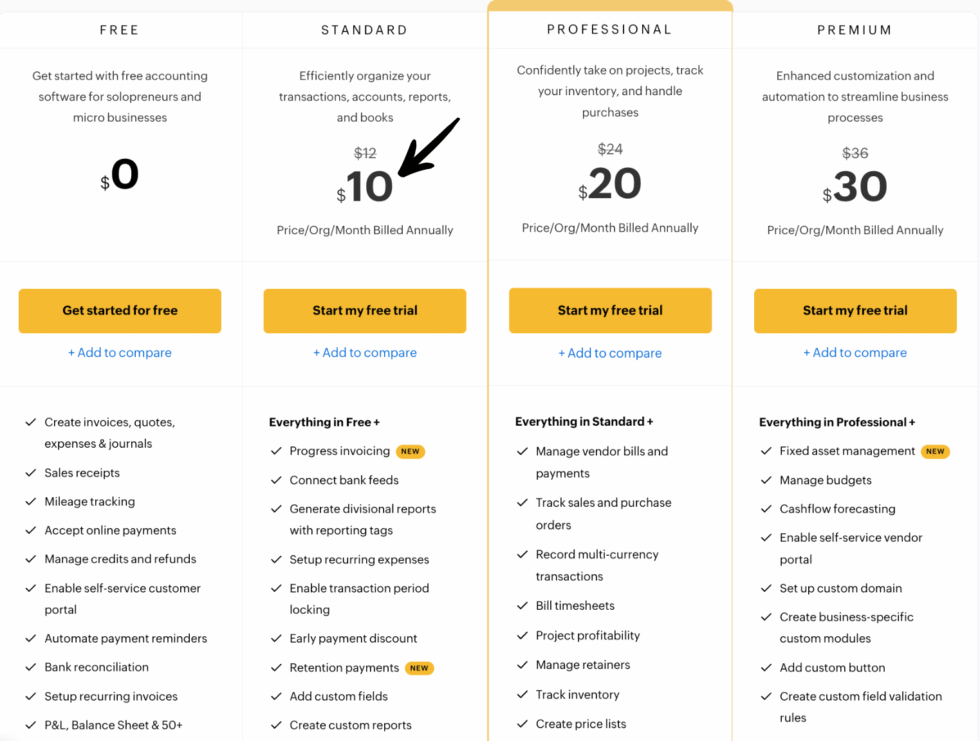

Zoho Books Pricing

Here’s what Zoho Books costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Free | $0/month | Freelancers and startups under $50K revenue |

| Standard | $10/organization/month | Small businesses needing invoicing and bank feeds |

| Professional | $20/organization/month | Growing teams that need project tracking and purchase orders |

| Premium | $30/month | Businesses needing inventory, budgeting, and custom reports |

Free trial: Yes, 14-day free trial on all paid plans with full features.

Money-back guarantee: Zoho offers a refund within 45 days of purchase.

💰 Best Value: Professional at $20/month — includes purchase orders, project tracking, and multi-currency support for growing businesses.

Zoho Books vs Alternatives

How does Zoho Books compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Zoho Books | All-in-one accounting for SMBs | $0–$30/mo | ⭐ 4.3 |

| QuickBooks | Brand familiarity in the US | $1.90/mo+ | ⭐ 4.4 |

| Xero | Third-party integrations | $29/mo+ | ⭐ 4.5 |

| FreshBooks | Freelancers and service businesses | $21/mo+ | ⭐ 4.3 |

| Wave | Free accounting for solopreneurs | $0–$19/mo | ⭐ 4.0 |

| Sage | UK and international compliance | $0–$18/mo | ⭐ 4.2 |

| NetSuite | Enterprise-level ERP | Custom | ⭐ 4.5 |

| Expensify | Expense management | $5/user/mo+ | ⭐ 4.1 |

Quick picks:

- Best overall: Zoho Books — best value with full automation at the lowest cost

- Best budget: Wave — free plan covers invoicing and basic accounting

- Best for beginners: FreshBooks — simple interface built for non-accountants

- Best for enterprise: NetSuite — full ERP for large-scale operations

🎯 Zoho Books Alternatives

Looking for Zoho Books alternatives? Here are the top options:

- 🚀 Dext: Best for automated receipt capture and data extraction. Pulls info from receipts, invoices, and bank statements instantly.

- 💰 Docyt: AI-powered accounting automation for multi-location businesses. Handles back-office bookkeeping at scale.

- 🎨 Sage: Trusted global accounting brand with strong compliance tools. Great for UK-based businesses and international tax handling.

- ⚡ Xero: Over 1,000 third-party app integrations for maximum flexibility. Beautiful interface with strong bank reconciliation.

- 🔒 Easy Month End: Simplifies the month-end close process for accounting teams. Automates checklists and reconciliation workflows.

- 🧠 Puzzle IO: AI-native accounting built for startups and SaaS companies. Connects directly to your bank and payment processors.

- 👶 Synder: Syncs e-commerce and payment platform transactions automatically. Perfect for Shopify, Stripe, and PayPal sellers.

- 🏢 RefreshMe: Personal finance tracking and credit monitoring tool. Best for individuals managing personal budgets alongside business.

- 🔧 Wave: Free accounting and invoicing for solopreneurs and freelancers. No credit card needed to get started.

- 🌟 Quicken: Personal and small business finance manager with budgeting tools. Ideal for tracking both personal and business expenses.

- ⭐ Hubdoc: Document collection and data extraction for bookkeepers. Automatically fetches bills and receipts from vendors.

- 🎯 Expensify: Expense reporting and reimbursement made simple for teams. SmartScan captures receipt data in seconds.

- 💼 QuickBooks: Most popular accounting software in the US with massive accountant network. Strong payroll and tax filing features.

- 📊 AutoEntry: Automated data entry for invoices, receipts, and bank statements. Integrates with Xero, QuickBooks, and Sage.

- 🔥 FreshBooks: Clean, simple invoicing and accounting for service-based businesses. Excellent time tracking and client management.

- 💎 NetSuite: Full enterprise ERP with advanced financial management and reporting. Built for mid-size to large organizations.

For the full list, see our Zoho Books alternatives guide.

⚔️ Zoho Books Compared

Here’s how Zoho Books stacks up against each competitor:

- Zoho Books vs Dext: Zoho Books is a full accounting suite while Dext focuses only on receipt capture. Use both together for best results.

- Zoho Books vs Docyt: Zoho Books costs far less and suits most SMBs. Docyt is better for multi-location restaurant or hospitality businesses.

- Zoho Books vs Sage: Zoho Books wins on price and automation. Sage has stronger payroll and UK compliance features.

- Zoho Books vs Xero: Zoho Books is cheaper with built-in ecosystem apps. Xero wins on third-party integrations with 1,000+ options.

- Zoho Books vs Easy Month End: Zoho Books is a complete accounting tool. Easy Month End is a specialist close management add-on.

- Zoho Books vs Puzzle IO: Zoho Books offers more mature features. Puzzle IO is newer with AI-first design for tech startups.

- Zoho Books vs Synder: Zoho Books handles full accounting. Synder specializes in e-commerce transaction syncing.

- Zoho Books vs RefreshMe: Zoho Books is built for business accounting. RefreshMe focuses on personal finance and credit monitoring.

- Zoho Books vs Wave: Both have free plans. Zoho Books offers more automation and features as you grow.

- Zoho Books vs Quicken: Zoho Books is cloud-native for businesses. Quicken is better for personal finance management.

- Zoho Books vs Hubdoc: Zoho Books is full accounting software. Hubdoc is a document collection tool that feeds into your accounting app.

- Zoho Books vs Expensify: Zoho Books covers full accounting. Expensify is purpose-built for team expense reporting only.

- Zoho Books vs QuickBooks: Zoho Books costs less and has a generous free plan. QuickBooks has more US accountant familiarity.

- Zoho Books vs AutoEntry: Zoho Books does invoicing, banking, and reporting. AutoEntry only handles automated data entry for documents.

- Zoho Books vs FreshBooks: Zoho Books offers more features at a lower price. FreshBooks has a simpler interface for service businesses.

- Zoho Books vs NetSuite: Zoho Books is ideal for SMBs on a budget. NetSuite is for enterprises needing full ERP capabilities.

Start Using Zoho Books Now

You learned how to use every major Zoho Books feature:

- ✅ Accounting Automation

- ✅ Unified Invoicing and Accounting

- ✅ Collaboration & Portal Management

- ✅ Mobile Accounting

- ✅ Create, Send, and Track Quotes

- ✅ Project Management

- ✅ Zoho Ecosystem

- ✅ Manual Journal

- ✅ Zoho Analytics

Next step: Pick one feature and try it now.

Most people start with Accounting Automation.

It takes less than 5 minutes.

Frequently Asked Questions

Is Zoho Books easy to use?

Yes, Zoho Books has an intuitive dashboard that most users pick up within an hour. The sidebar navigation groups features logically. Built-in tooltips and a setup wizard guide you through initial configuration without needing accounting expertise.

How to use Zoho for beginners?

Start by creating your account and completing the company profile setup. Then connect your bank account for automatic feeds. Begin with invoicing since it’s the most common task. Follow the step-by-step guides in this tutorial for each feature.

What are the disadvantages of Zoho Books?

Zoho Books has limited scalability for large enterprises needing multi-entity support. The inventory management is basic compared to dedicated tools. Third-party integrations outside the Zoho ecosystem are fewer than competitors like Xero.

Is Zoho Books better than QuickBooks?

Zoho Books costs significantly less and offers a free plan for businesses under $50K revenue. QuickBooks has stronger US accountant familiarity and more payroll options. For small businesses wanting value, Zoho Books delivers 90% of the functionality at half the cost.

Is Zoho Books actually free?

Yes, Zoho Books has a forever-free plan for businesses with annual revenue under $50,000. The free plan includes invoicing, expense tracking, bank reconciliation, and reporting. Paid plans start at $10/month when you need more features or higher revenue limits.

How many users can you have on Zoho Books?

The free plan supports 1 user. The Standard plan supports 3 users. Professional supports 5 users. Premium supports 10 users. You can add more users to any paid plan for an additional per-user fee.

How much do Zoho Books cost per year?

Zoho Books ranges from free to $360/year on the Premium plan when billed monthly. Annual billing gives you a discount. The Standard plan costs about $100/year, the Professional about $200/year, and Premium about $300/year with annual billing.