Quick Start

This guide covers every Docyt feature:

- Getting Started — Create account and basic setup

- How to Use Financial Bookkeeping & Reporting — Get real-time financial statements

- How to Use Real-Time Revenue Reconciliation — Match transactions automatically

- How to Use Automatic Flagging on Transactions — Catch errors before they spread

- How to Use Docyt Accountant Copilot — Automate bill pay and receipts

- How to Use Collaboration Tools — Work with your team in real time

- How to Use ERP Data Migration — Move data from existing systems

- How to Use Docyt 360 — Manage multiple businesses at once

- How to Use ClosingFlow — Speed up month-end close

- How to Use InsightFlow — Track KPIs and performance metrics

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used Docyt for over 6 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Docyt is one of the most powerful AI accounting tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Docyt Tutorial

This complete Docyt tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Docyt

Stop wrestling with manual bookkeeping. Docyt automates 80% of your accounting tasks with AI that learns your business. Save 500+ hours per year — try it free today.

Getting Started with Docyt

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to docyt.com and click “Start Free Trial.”

Enter your business email and create a password.

Select your business type from the dropdown menu.

✓ Checkpoint: Check your inbox for a confirmation email.

Step 2: Connect Your Financial Accounts

Click “Connect Accounts” on your dashboard.

Docyt connects with over 12,000 financial institutions.

Link your bank accounts, credit cards, and POS systems.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see your accounts listed on the dashboard.

Step 3: Connect QuickBooks Online

Go to Settings and click “Integrations.”

Select QuickBooks Online or Xero from the list.

Authorize the connection to sync your chart of accounts.

✅ Done: You’re ready to use any feature below.

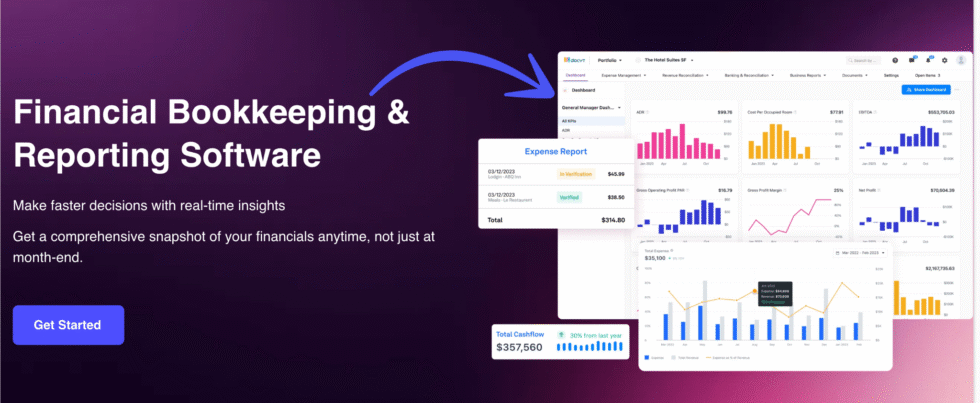

How to Use Docyt Financial Bookkeeping & Reporting

Financial Bookkeeping & Reporting lets you generate real-time financial statements across all locations.

Here’s how to use it step by step.

Step 1: Open the Reports Dashboard

Click “Reports” in the left sidebar menu.

You’ll see P&L, balance sheet, and cash flow options.

Step 2: Select Your Report Type

Choose from income statement, balance sheet, or cash flow.

Set your date range and business location filters.

Here’s what this looks like:

✓ Checkpoint: You should see your financial data populated in the report.

Step 3: Generate Consolidated Reports

Click “Consolidated View” to combine multiple locations.

Docyt merges data from all entities into one report.

✅ Result: You have real-time financial reports ready for decision-making.

💡 Pro Tip: Drill down into any line item to view the original source document. This saves hours during audits.

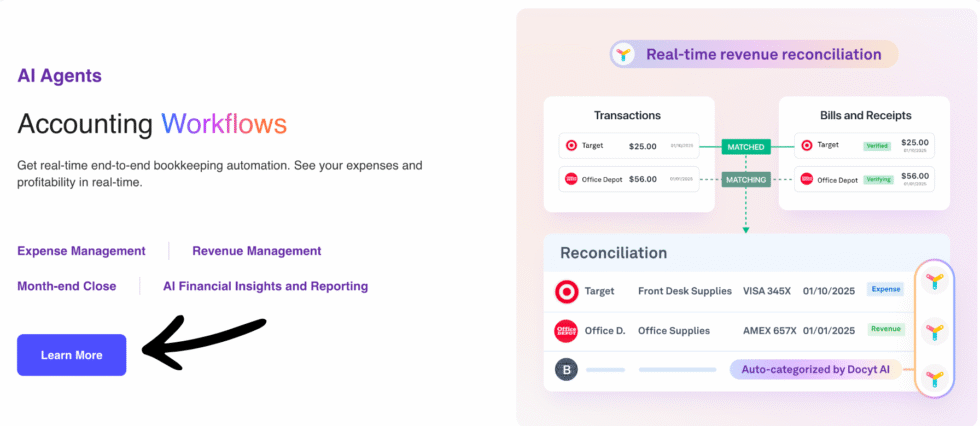

How to Use Docyt Real-Time Revenue Reconciliation

Real-Time Revenue Reconciliation lets you match transactions to bank feeds automatically.

Here’s how to use it step by step.

Step 1: Navigate to Revenue Center

Click “Revenue” in the main navigation menu.

Docyt pulls in data from your connected POS systems.

Step 2: Review Matched Transactions

The AI matches revenue entries to your bank deposits.

Green checkmarks show confirmed matches.

Here’s what this looks like:

✓ Checkpoint: You should see matched transactions with green status indicators.

Step 3: Resolve Unmatched Items

Click on any flagged item to review details.

Manually match or categorize the remaining transactions.

✅ Result: Your revenue is reconciled in real time with over 99% accuracy.

💡 Pro Tip: Connect all 30+ supported POS systems for fully automated revenue tracking across locations.

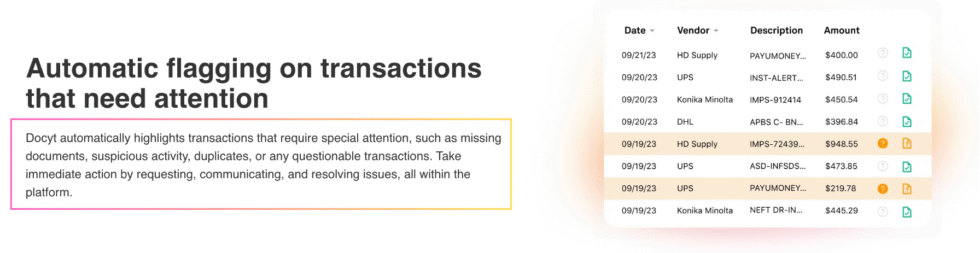

How to Use Docyt Automatic Flagging on Transactions

Automatic Flagging lets you catch duplicate invoices and unusual spending patterns instantly.

Here’s how to use it step by step.

Step 1: Open the Flagged Items Queue

Click “Flagged” in your transaction center.

Docyt’s AI scans every transaction for anomalies.

Step 2: Review Each Flagged Transaction

Click on a flagged item to see why it was marked.

The system shows duplicate detection and pattern alerts.

Here’s what this looks like:

✓ Checkpoint: You should see the reason for each flag with suggested actions.

Step 3: Approve or Dismiss Flags

Click “Approve” to confirm a legitimate transaction.

Click “Dismiss” if the flag was a false positive.

✅ Result: Suspicious transactions are caught before they hit your general ledger.

💡 Pro Tip: Review flagged items daily. The AI learns from your decisions and gets more accurate over time.

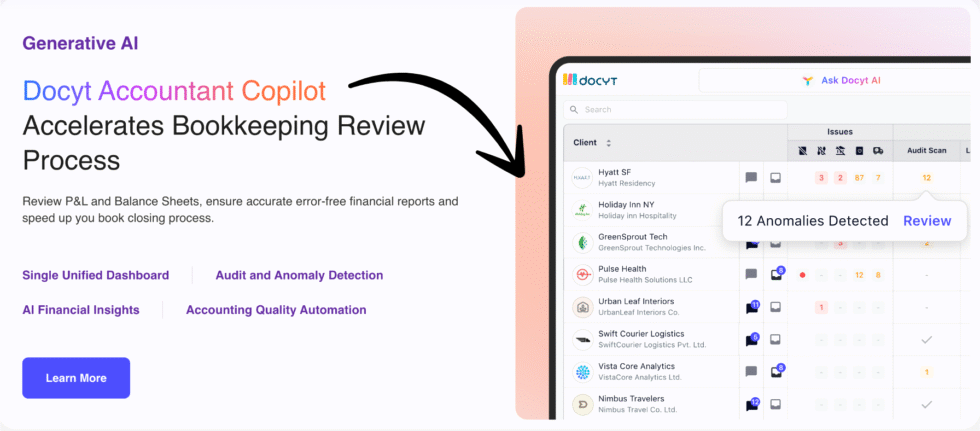

How to Use Docyt Accountant Copilot

Accountant Copilot lets you automate bill pay, receipt capture, and routine bookkeeping tasks.

Here’s how to use it step by step.

Step 1: Access Copilot from the Dashboard

Click the “Copilot” tab in your main navigation.

The AI agent (called GARY) handles routine tasks automatically.

Step 2: Upload Bills and Receipts

Drag and drop invoices into the Receipt Box.

You can also use the Docyt mobile app to snap photos.

Here’s what this looks like:

✓ Checkpoint: Your uploaded documents should appear with extracted data fields.

Step 3: Review and Approve Extracted Data

The AI extracts vendor name, amount, and category.

Verify the data and click “Approve” to process.

✅ Result: Bills are processed and ready for payment without manual data entry.

💡 Pro Tip: Use the mobile app to photograph receipts right after purchase. Docyt matches them to credit card transactions automatically.

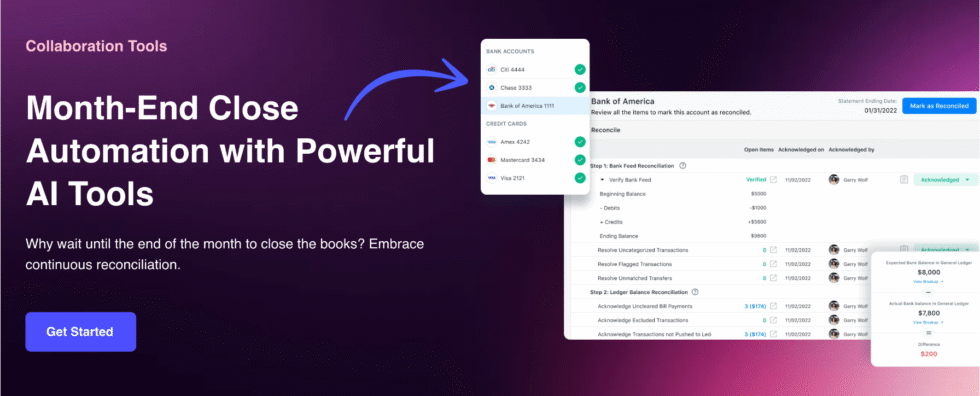

How to Use Docyt Collaboration Tools

Collaboration Tools lets you communicate with team members while verifying invoices and transactions.

Here’s how to use it step by step.

Step 1: Open the Chat Feature

Click the chat icon next to any transaction or invoice.

This opens a conversation thread linked to that item.

Step 2: Tag Team Members

Type @ followed by a team member’s name.

They’ll get a notification to review the item.

Here’s what this looks like:

✓ Checkpoint: Your tagged team member should receive a notification.

Step 3: Assign and Track Tasks

Create tasks with due dates and assign to specific people.

Track progress from the task management dashboard.

✅ Result: Your team stays aligned on every accounting task without email chains.

💡 Pro Tip: Use built-in task management for recurring month-end close checklists. It keeps your team on schedule.

How to Use Docyt ERP Data Migration

ERP Data Migration lets you move your existing accounting data into Docyt from other systems.

Here’s how to use it step by step.

Step 1: Start the Migration Wizard

Go to Settings and click “Data Migration.”

Select your current accounting system from the list.

Step 2: Map Your Chart of Accounts

Docyt auto-maps most accounts from your existing system.

Review the mapping and adjust any mismatches manually.

Here’s what this looks like:

✓ Checkpoint: All accounts should show a green “Mapped” status.

Step 3: Run the Migration

Click “Start Migration” and wait for the process to complete.

Docyt verifies data integrity during the transfer.

✅ Result: Your historical data is now inside Docyt and ready for use.

💡 Pro Tip: Schedule migration during off-hours. The Docyt support team can assist with mid-year migrations from QuickBooks Desktop.

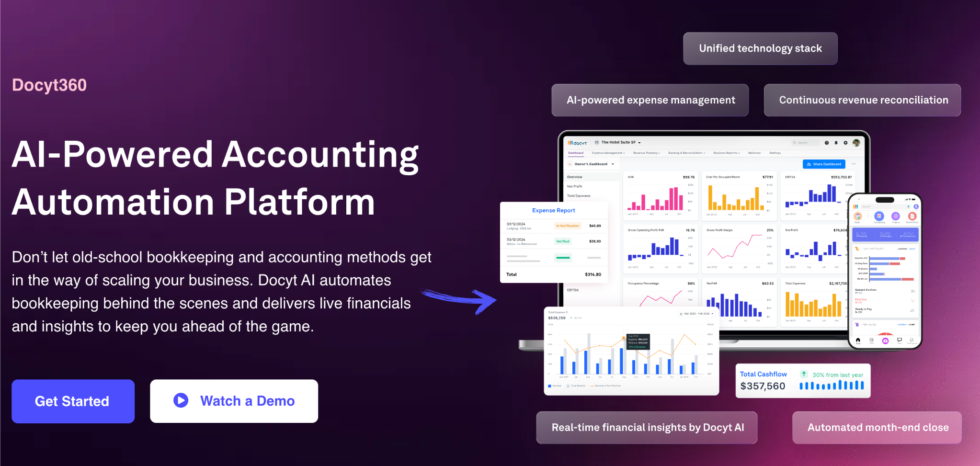

How to Use Docyt 360

Docyt 360 lets you manage multiple businesses or locations from a single unified dashboard.

Here’s how to use it step by step.

Step 1: Open the Multi-Entity Dashboard

Click “Docyt 360” from the main navigation.

You’ll see all your businesses listed in one view.

Step 2: Monitor Each Entity’s Status

Check reconciliation status, missing documents, and open tasks.

Color-coded indicators show which entities need attention.

Here’s what this looks like:

✓ Checkpoint: You should see all entities with their current status at a glance.

Step 3: Switch Between Entities

Click on any entity to drill into its specific books.

No need to log into separate QuickBooks accounts.

✅ Result: You can oversee 50+ client accounts without switching tools.

💡 Pro Tip: Use Docyt 360’s search to find any client file or transaction in seconds. It’s built for firms managing hundreds of clients.

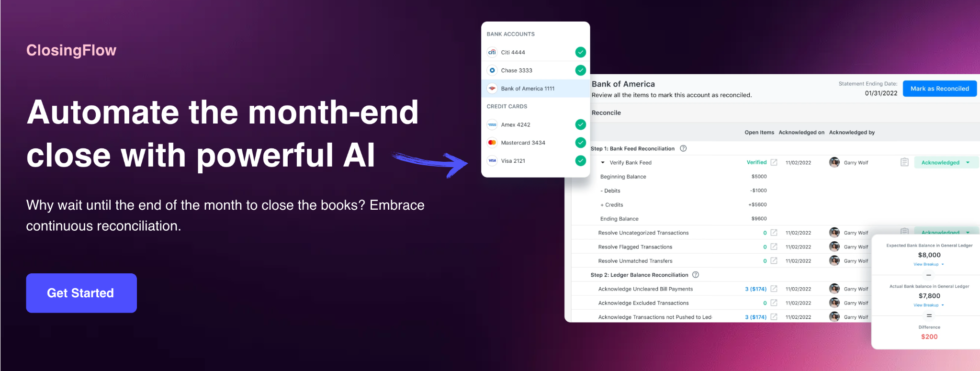

How to Use Docyt ClosingFlow

ClosingFlow lets you standardize and speed up your month-end close process.

Here’s how to use it step by step.

Step 1: Access the Close Tracker

Click “ClosingFlow” in the sidebar menu.

You’ll see a checklist for every close task.

Step 2: Work Through the Close Checklist

Each task shows its status: pending, in progress, or complete.

Mark items done as you reconcile accounts and review entries.

Here’s what this looks like:

✓ Checkpoint: You should see progress bars updating as you complete each task.

Step 3: Finalize and Lock the Period

Once all tasks are green, click “Close Period.”

This locks the books and prevents further changes.

✅ Result: Month-end close is finished up to 5x faster than manual methods.

💡 Pro Tip: Create reusable close templates for each client type. This keeps your process consistent across all entities.

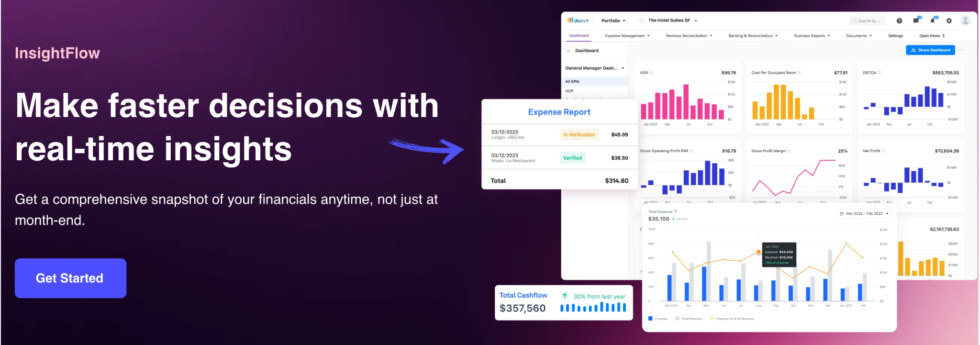

How to Use Docyt InsightFlow

InsightFlow lets you track industry-specific KPIs and performance metrics on custom dashboards.

Here’s how to use it step by step.

Step 1: Open the KPI Dashboard

Click “InsightFlow” in the main navigation.

Select your industry template (hotels, restaurants, retail, etc.).

Step 2: Customize Your Metrics

Add or remove KPIs that matter to your business.

Hotels can track RevPAR and ADR; restaurants can track plate costing.

Here’s what this looks like:

✓ Checkpoint: Your custom dashboard should display real-time KPI data.

Step 3: Set Alerts and Thresholds

Define alert thresholds for each KPI you’re tracking.

Docyt notifies you when metrics fall outside your target range.

✅ Result: You have a live pulse on your business performance at all times.

💡 Pro Tip: Share InsightFlow dashboards with your management team. They get real-time visibility without accessing the full accounting system.

Docyt Pro Tips and Shortcuts

After testing Docyt for over 6 months, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| Search transactions | Ctrl + F |

| Approve selected item | Ctrl + Enter |

| Switch between entities | Ctrl + Shift + E |

| Open receipt upload | Ctrl + U |

Hidden Features Most People Miss

- Bulk Actions: Select multiple invoices and batch-edit categories or verify them all at once. Saves massive time during month-end.

- Document Vault Search: Use keywords to find any receipt or invoice stored in the encrypted SOC2 Type II vault within seconds.

- Mobile Receipt Capture: The Docyt app lets you snap receipts on the go. They auto-match to credit card transactions overnight.

Docyt Common Mistakes to Avoid

Mistake #1: Skipping the Bank Feed Connection

❌ Wrong: Manually uploading bank statements instead of connecting live bank feeds.

✅ Right: Connect all bank accounts through Plaid for automatic daily transaction imports.

Mistake #2: Ignoring Flagged Transactions

❌ Wrong: Letting flagged items pile up and reviewing them all at month-end.

✅ Right: Review flagged transactions daily so the AI learns your preferences faster.

Mistake #3: Not Connecting Your POS System

❌ Wrong: Manually entering daily sales data from your point-of-sale system.

✅ Right: Connect your POS (Toast, Shopify, etc.) for automatic revenue sync and reconciliation.

Docyt Troubleshooting

Problem: Bank Feed Not Syncing

Cause: Your bank may require re-authentication after a password change or security update.

Fix: Go to Settings, click your bank connection, and re-enter your credentials. Check if your bank has two-factor changes.

Problem: Transactions Categorized Incorrectly

Cause: The AI may misinterpret new vendors it hasn’t seen in your historical data.

Fix: Manually recategorize the transaction. Docyt learns from your correction and applies it going forward.

Problem: QuickBooks Sync Errors

Cause: A mismatch between your Docyt chart of accounts and QuickBooks settings.

Fix: Go to Integrations, disconnect and reconnect QuickBooks. Then remap any accounts that show errors.

📌 Note: If none of these fix your issue, contact Docyt support via chat or email.

What is Docyt?

Docyt is an AI-powered accounting automation tool that handles bookkeeping, reconciliation, and real-time reporting for businesses and accounting firms.

Think of it like an AI bookkeeper that never sleeps and learns your business patterns over time.

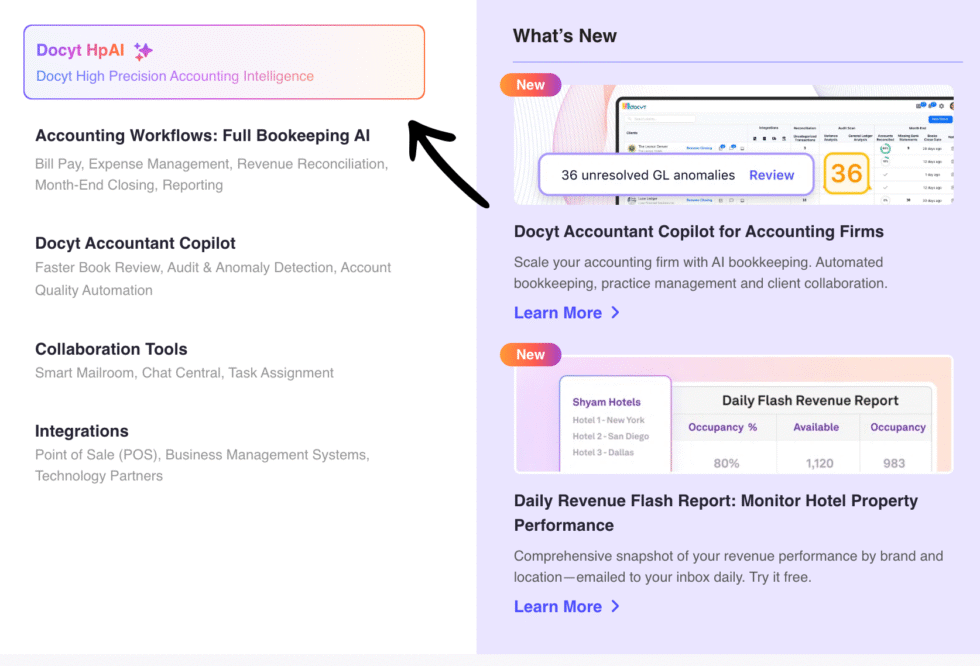

It includes these key features:

- Financial Bookkeeping & Reporting: Real-time P&L, balance sheet, and cash flow statements

- Real-Time Revenue Reconciliation: Automatic matching of transactions to bank feeds

- Automatic Flagging: AI detection of duplicates, anomalies, and suspicious patterns

- Accountant Copilot: Automated bill pay, receipt capture, and expense management

- Collaboration Tools: Built-in chat, task assignment, and team workflows

- ERP Data Migration: Easy transfer from existing accounting systems

- Docyt 360: Multi-entity management from one dashboard

- ClosingFlow: Standardized month-end close with checklists

- InsightFlow: Industry-specific KPI dashboards and alerts

For a full review, see our Docyt review.

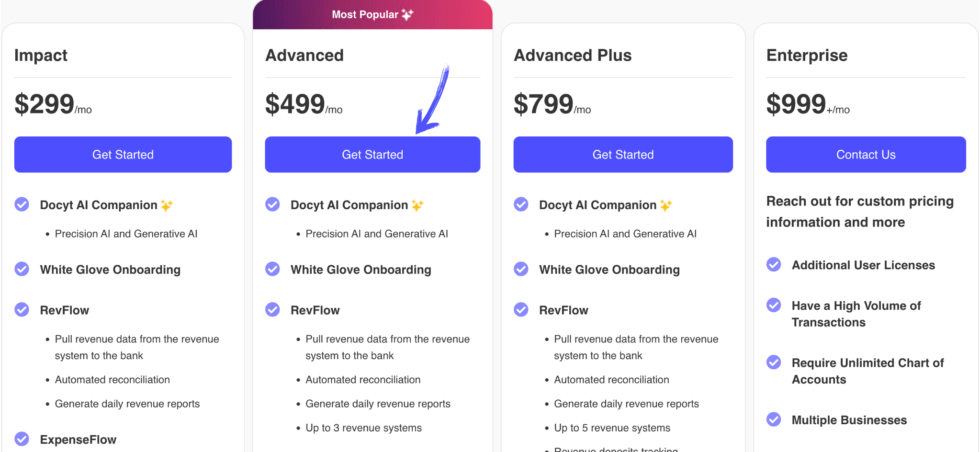

Docyt Pricing

Here’s what Docyt costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Impact | $299 per month | Small businesses with basic bookkeeping needs |

| Advanced | $499 per month | Growing businesses needing full automation |

| Advanced Plus | $799 per month | Multi-location businesses with advanced reporting |

| Enterprise | $999 per month | Large firms and franchise operations |

Free trial: Yes — 7-day free trial available for all plans.

Money-back guarantee: Contact Docyt sales for details on their refund policy.

💰 Best Value: Advanced plan at $499/month — it includes full AI automation and revenue reconciliation for most businesses.

Docyt vs Alternatives

How does Docyt compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Docyt | AI-powered full bookkeeping | $299/mo | ⭐ 4.0 |

| Dext | Receipt data extraction | $24/mo | ⭐ 4.3 |

| Xero | Cloud accounting platform | $29/mo | ⭐ 4.5 |

| QuickBooks | Small business accounting | $1.90/mo | ⭐ 4.4 |

| FreshBooks | Invoicing and freelancers | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly bookkeeping | $0/mo | ⭐ 4.3 |

| Sage | Small business compliance | $7/mo | ⭐ 4.2 |

| NetSuite | Enterprise ERP | Custom | ⭐ 4.5 |

Quick picks:

- Best overall: Docyt — Full AI automation for bookkeeping and reporting

- Best budget: Zoho Books — Free plan with solid features for small businesses

- Best for beginners: QuickBooks — Most popular with the largest support community

- Best for enterprise: NetSuite — Full ERP for large organizations

🎯 Docyt Alternatives

Looking for Docyt alternatives? Here are the top options:

- 🚀 Dext: Automates receipt data extraction and syncs to your accounting software. Great for reducing manual data entry.

- 💰 Xero: Popular cloud accounting platform with strong invoicing and bank reconciliation features for small businesses.

- 🎨 Easy Month End: Focused on month-end close automation with checklists and team task management starting at $45/mo.

- ⚡ Puzzle IO: Modern accounting platform with real-time insights and automation for startups and growing companies.

- 🔒 Sage: Trusted accounting software for compliance-focused small businesses with plans starting at $7/mo.

- 🧠 Zoho Books: Budget-friendly cloud accounting with a free plan and strong automation features for small teams.

- 👶 Synder: Connects e-commerce and payment platforms to your accounting software for automated reconciliation.

- 🏢 RefreshMe: Personal financial management tool that tracks expenses and invoices for individuals and couples.

- 🔧 Wave: Free accounting software with invoicing and receipt scanning for freelancers and small businesses.

- 🌟 Quicken: Personal and small business finance tool for budgeting, spending tracking, and financial planning.

- ⭐ Hubdoc: Automatically fetches financial documents and syncs them to your accounting software for easy access.

- 🎯 Expensify: Expense management platform with smart scanning and automated approval workflows starting at $5/member/mo.

- 💼 QuickBooks: The most widely used small business accounting software with plans starting at $1.90/mo.

- 📊 AutoEntry: Automates data entry from receipts and invoices directly into your accounting software from $12/mo.

- 🔥 FreshBooks: User-friendly invoicing and accounting for freelancers and service-based businesses from $21/mo.

- 🏢 NetSuite: Full enterprise ERP system with advanced accounting, CRM, and inventory for large organizations.

For the full list, see our Docyt alternatives guide.

⚔️ Docyt Compared

Here’s how Docyt stacks up against each competitor:

- Docyt vs Dext: Docyt is a full bookkeeping platform while Dext focuses on receipt extraction. Choose Docyt for end-to-end automation.

- Docyt vs Xero: Xero is a cloud GL system. Docyt adds AI automation on top of your existing GL for hands-free bookkeeping.

- Docyt vs Easy Month End: Easy Month End handles month-end close only. Docyt covers full accounting plus close automation with ClosingFlow.

- Docyt vs Puzzle IO: Puzzle IO targets startups with modern reporting. Docyt suits multi-entity businesses needing AI-driven automation.

- Docyt vs Sage: Sage is better for simple compliance needs. Docyt wins for AI automation and multi-location bookkeeping.

- Docyt vs Zoho Books: Zoho Books is budget-friendly with a free plan. Docyt is better for businesses needing AI-powered automation at scale.

- Docyt vs Synder: Synder excels at e-commerce reconciliation. Docyt covers full-cycle bookkeeping beyond just payment syncing.

- Docyt vs RefreshMe: RefreshMe is for personal finance tracking. Docyt is built for business accounting and multi-entity management.

- Docyt vs Wave: Wave is free but limited in automation. Docyt provides AI-powered categorization and real-time reconciliation.

- Docyt vs Quicken: Quicken is for personal finance and budgeting. Docyt is a business-grade accounting automation platform.

- Docyt vs Hubdoc: Hubdoc fetches and organizes documents. Docyt does that plus full bookkeeping, reconciliation, and reporting.

- Docyt vs Expensify: Expensify handles expense reports. Docyt covers expense management plus full accounting automation.

- Docyt vs QuickBooks: QuickBooks is a general ledger tool. Docyt adds AI automation on top of QuickBooks for hands-free bookkeeping.

- Docyt vs AutoEntry: AutoEntry automates data entry from receipts. Docyt goes beyond data entry into full accounting automation.

- Docyt vs FreshBooks: FreshBooks is great for invoicing and freelancers. Docyt is built for multi-entity businesses needing full automation.

- Docyt vs NetSuite: NetSuite is a full ERP for large enterprises. Docyt is more focused on AI bookkeeping for SMBs and accounting firms.

Start Using Docyt Now

You learned how to use every major Docyt feature:

- ✅ Financial Bookkeeping & Reporting

- ✅ Real-Time Revenue Reconciliation

- ✅ Automatic Flagging on Transactions

- ✅ Accountant Copilot

- ✅ Collaboration Tools

- ✅ ERP Data Migration

- ✅ Docyt 360

- ✅ ClosingFlow

- ✅ InsightFlow

Next step: Pick one feature and try it now.

Most people start with Financial Bookkeeping & Reporting.

It takes less than 5 minutes.

Frequently Asked Questions

How does Docyt work?

Docyt connects to your bank feeds, credit cards, and POS systems. Its AI engine (called HpAI) automatically categorizes transactions, reconciles accounts, and generates real-time financial reports. It uses 128 billion data points trained across 20+ industries to deliver precise categorization without manual input.

How much does Docyt cost?

Docyt pricing starts at $299/month for the Impact plan and goes up to $999/month for Enterprise. Each business location requires its own subscription. A 7-day free trial is available so you can test the platform before committing.

What accounting software is most used?

QuickBooks is the most widely used accounting software for small businesses. However, Docyt works alongside QuickBooks by adding AI-powered automation. Many businesses use both — QuickBooks as the general ledger and Docyt as the automation layer on top.

Which AI tool is best for accounting?

Docyt is one of the top AI tools for accounting. It’s purpose-built for bookkeeping automation, unlike general AI tools adapted for finance. Its HpAI engine delivers over 99% accuracy in transaction categorization and saves businesses an average of 500 hours per year.

Who is the CEO of Docyt?

Sid Saxena is the co-founder and CEO of Docyt. Under his leadership, Docyt secured $12 million in pre-Series B funding in August 2025 and launched the HpAI engine for accounting automation. The company has grown to serve accounting firms and multi-entity businesses across 20+ industries.