Quick Start

This guide covers every Sage feature:

- Getting Started — Create account and basic setup

- How to Use Smarter Financial Reports — Generate profit/loss statements in seconds

- How to Use Multi-Currency Accounting — Handle international transactions with ease

- How to Use Inventory Management — Track stock levels in real time

- How to Use Digital Record-Keeping — Go paperless with secure cloud storage

- How to Use Bank Reconciliation — Match transactions automatically

- How to Use Balance Sheet Report — See your financial health at a glance

- How to Use Sage Copilot — Get AI-powered accounting help

- How to Use Advanced Inventory Management — Manage complex stock across locations

- How to Use Project Management — Track costs and profits by project

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Troubleshooting | Pricing | Alternatives

Why Trust This Guide

I’ve used Sage for over 12 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Sage is one of the most powerful cloud accounting tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Sage Tutorial

This complete Sage tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Sage

Manage your business finances from anywhere with cloud-based accounting. Sage handles invoicing, bank reconciliation, and financial reports so you can focus on growth. Start free — no credit card needed.

Getting Started with Sage

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to sage.com and click “Try for Free.”

Enter your email, name, and create a password.

Choose your country and business type.

✓ Checkpoint: Check your inbox for a confirmation email.

Step 2: Access the Dashboard

Log in at sage.com from any web browser.

You can also download the Sage app for iOS or Android.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main dashboard with cash flow overview.

Step 3: Complete Initial Setup

Add your business name, address, and tax details.

Connect your bank account for automatic transaction imports.

Set your financial year start date and currency.

✅ Done: You’re ready to use any feature below.

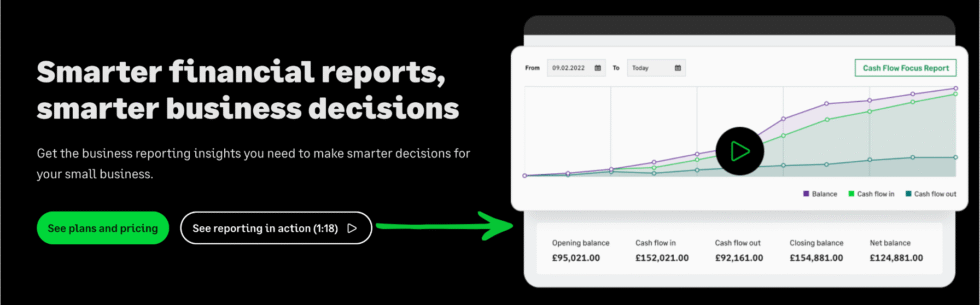

How to Use Sage Smarter Financial Reports

Smarter Financial Reports lets you generate detailed profit/loss and cash flow statements in seconds.

Here’s how to use it step by step.

Step 1: Open the Reports Section

Click “Reports” in the left sidebar menu.

You’ll see a list of available report types.

Step 2: Choose Your Report Type

Select Profit and Loss, Balance Sheet, or Cash Flow.

Set the date range you want to review.

Here’s what this looks like:

✓ Checkpoint: You should see your report with totals and breakdowns.

Step 3: Export or Share

Click “Export” to download as PDF or Excel.

You can also email reports directly to your accountant.

✅ Result: You’ve created a financial report ready to share.

💡 Pro Tip: Compare two date ranges side by side to spot trends fast.

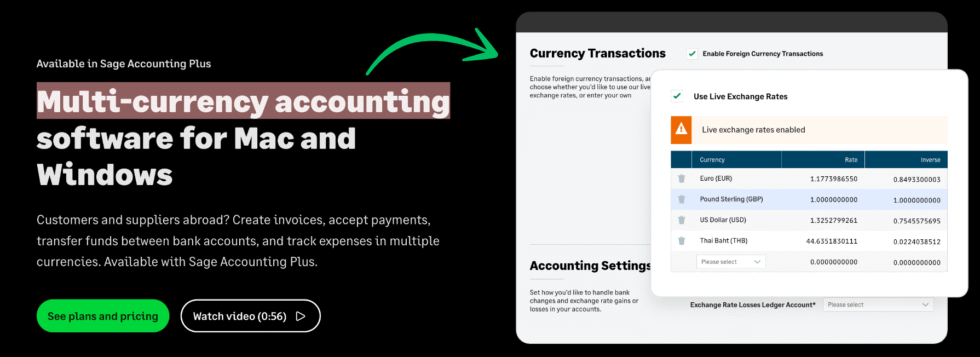

How to Use Sage Multi-Currency Accounting

Multi-Currency Accounting lets you send invoices and track expenses in any currency.

Here’s how to use it step by step.

Step 1: Enable Multi-Currency

Go to Settings then click “Currency.”

Toggle on “Multi-Currency” to activate the feature.

Step 2: Add Foreign Currencies

Click “Add Currency” and search for the one you need.

Sage updates exchange rates automatically each day.

Here’s what this looks like:

✓ Checkpoint: You should see your added currencies in the list.

Step 3: Create a Foreign Currency Invoice

When creating an invoice, select the customer’s currency.

Sage converts amounts to your base currency automatically.

✅ Result: You can now invoice clients in their local currency.

💡 Pro Tip: Set a default currency per customer to save time on repeat invoices.

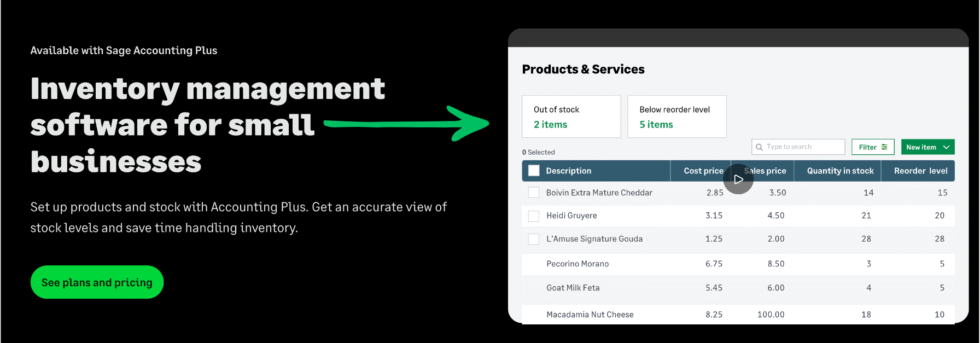

How to Use Sage Inventory Management

Inventory Management lets you track stock levels and get alerts when items run low.

Here’s how to use it step by step.

Step 1: Add Your Products

Go to “Products & Services” in the sidebar.

Click “New Item” and enter the product name and price.

Step 2: Set Stock Quantities

Enter the current quantity on hand for each item.

Set a reorder level to get low stock alerts.

Here’s what this looks like:

✓ Checkpoint: You should see your products with stock levels listed.

Step 3: Monitor Stock Automatically

Sage updates inventory when you create invoices or bills.

Check the inventory report to see stock value and movements.

✅ Result: Your stock levels update automatically with every sale.

💡 Pro Tip: Use the inventory valuation report before tax season for accurate numbers.

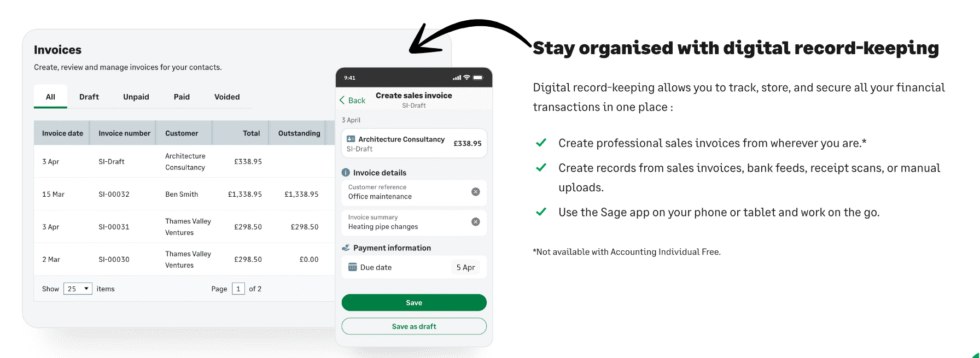

How to Use Sage Digital Record-Keeping

Digital Record-Keeping lets you store receipts, invoices, and documents in the cloud.

Here’s how to use it step by step.

Step 1: Upload a Document

Click the “Attachments” icon on any transaction.

Drag and drop your receipt or invoice file.

Step 2: Attach to Transactions

Link the uploaded file to the matching transaction.

Sage stores everything securely in the cloud.

Here’s what this looks like:

✓ Checkpoint: You should see the attachment icon next to your transaction.

Step 3: Search and Retrieve

Use the search bar to find any stored document by name or date.

No more digging through paper files or folders.

✅ Result: All your financial documents are stored and linked to transactions.

💡 Pro Tip: Snap photos of receipts with the mobile app right after a purchase.

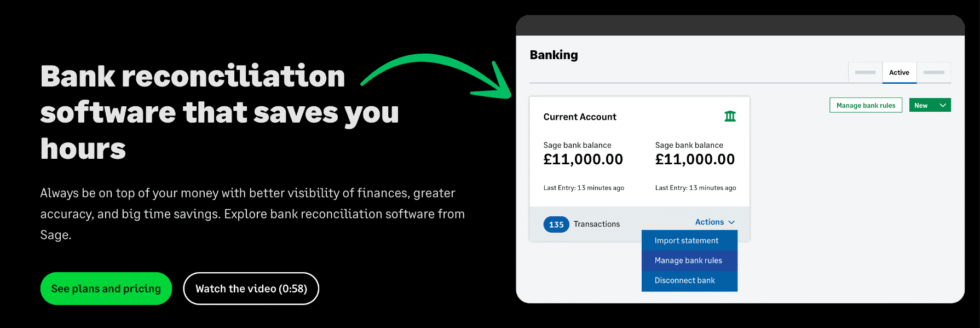

How to Use Sage Bank Reconciliation

Bank Reconciliation lets you match bank transactions with your accounting records automatically.

Here’s how to use it step by step.

Step 1: Connect Your Bank

Go to “Banking” and click “Connect Account.”

Search for your bank and log in securely.

Step 2: Review Imported Transactions

Sage pulls in your latest bank transactions automatically.

It suggests matches with existing invoices and bills.

Here’s what this looks like:

✓ Checkpoint: You should see matched and unmatched transactions.

Step 3: Confirm Matches

Click “Accept” on correct matches or assign categories manually.

Create rules so Sage categorizes recurring transactions for you.

✅ Result: Your bank and books now match perfectly.

💡 Pro Tip: Create bank rules for recurring charges like rent or subscriptions to save time.

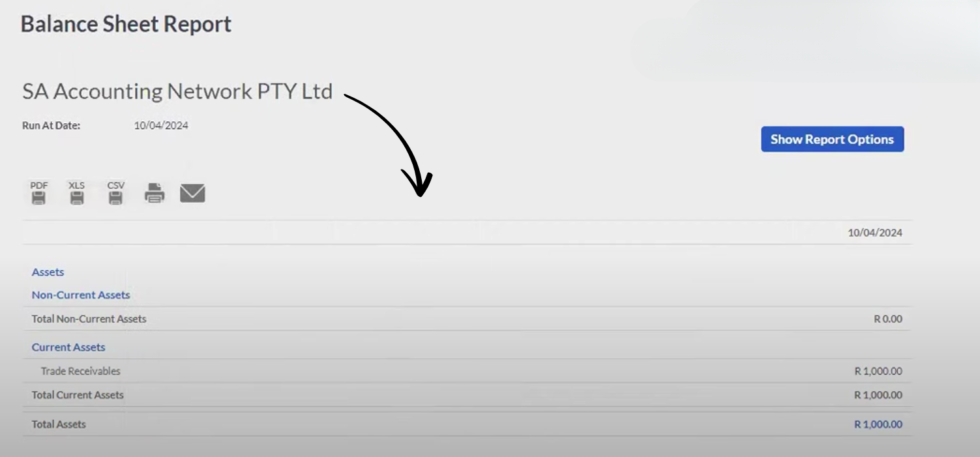

How to Use Sage Balance Sheet Report

Balance Sheet Report lets you see your assets, liabilities, and equity at any point in time.

Here’s how to use it step by step.

Step 1: Navigate to Reports

Click “Reports” in the sidebar menu.

Select “Balance Sheet” from the report list.

Step 2: Set Your Date

Pick the “as of” date for your balance sheet snapshot.

You can view current or historical data.

Here’s what this looks like:

✓ Checkpoint: You should see assets, liabilities, and equity totals.

Step 3: Drill Down Into Details

Click any line item to see the transactions behind it.

Export the report for your accountant or tax filing.

✅ Result: You have a clear picture of your business’s financial health.

💡 Pro Tip: Run balance sheets monthly to catch discrepancies early.

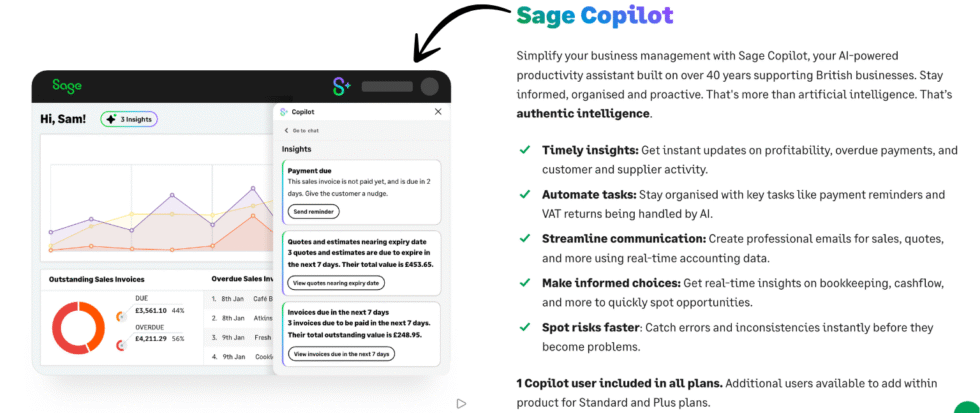

How to Use Sage Copilot

Sage Copilot lets you get AI-powered answers about your finances instantly.

Here’s how to use it step by step.

Step 1: Open Sage Copilot

Click the Copilot icon in the top right corner of the dashboard.

A chat panel opens on the right side of your screen.

Step 2: Ask a Question

Type a question like “What were my top expenses last month?”

Copilot analyzes your data and provides an answer.

Here’s what this looks like:

✓ Checkpoint: You should see a clear answer with supporting data.

Step 3: Take Action on Insights

Copilot can run reports or navigate to transactions for you.

Use follow-up questions to dig deeper into any answer.

✅ Result: You got instant financial insights without running manual reports.

💡 Pro Tip: Ask Copilot about overdue invoices to quickly see who owes you money.

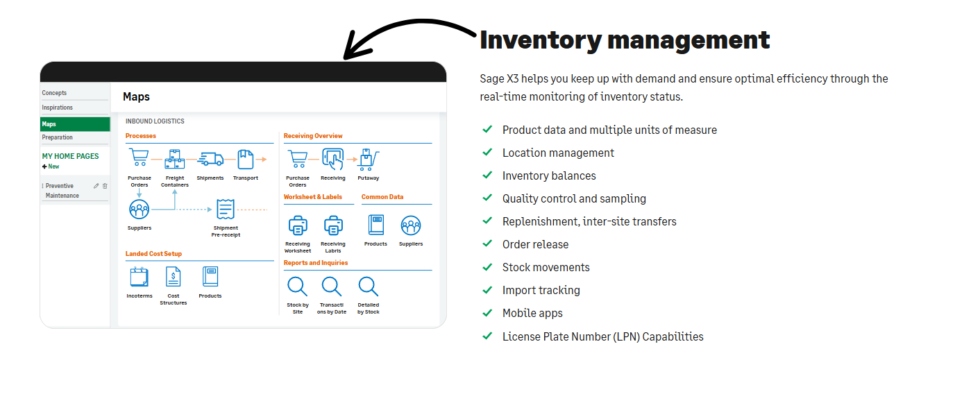

How to Use Sage Advanced Inventory Management

Advanced Inventory Management lets you track stock across multiple locations and warehouses.

Here’s how to use it step by step.

Step 1: Set Up Multiple Locations

Go to Settings and enable “Multiple Locations.”

Add each warehouse or storage location by name and address.

Step 2: Assign Stock to Locations

Open a product and assign quantities per location.

You can transfer stock between locations easily.

Here’s what this looks like:

✓ Checkpoint: You should see stock split across your locations.

Step 3: Run Location-Based Reports

Generate inventory reports filtered by specific locations.

Track which locations sell fastest and restock accordingly.

✅ Result: You can manage stock across all locations from one dashboard.

💡 Pro Tip: Set different reorder levels per location based on local demand.

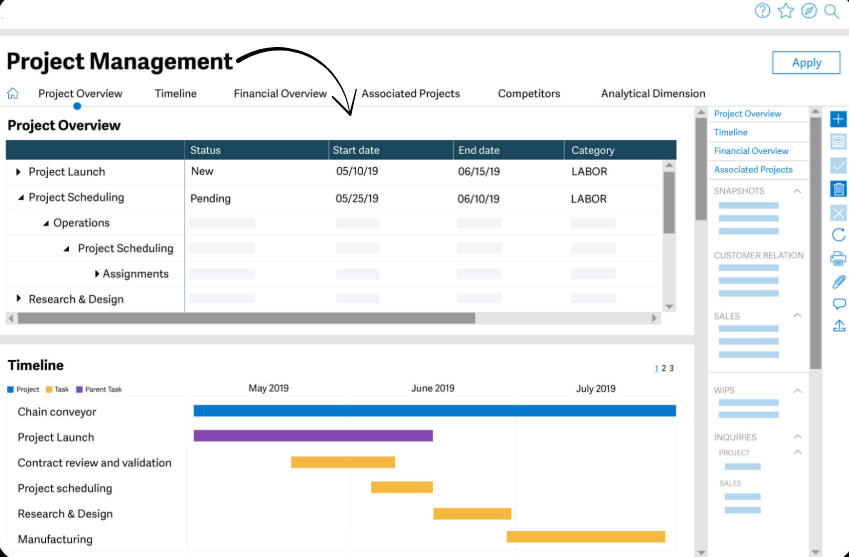

How to Use Sage Project Management

Project Management lets you track costs, revenue, and profitability per project.

Here’s how to use it step by step.

Step 1: Create a New Project

Go to “Projects” and click “New Project.”

Add the project name, client, and budget.

Step 2: Assign Transactions to Projects

Tag invoices, expenses, and bills to the relevant project.

All costs and income roll up into the project view.

Here’s what this looks like:

✓ Checkpoint: You should see project income and expenses side by side.

Step 3: Review Project Profitability

Check the project report to see profit margins.

Compare actual costs against your original budget.

✅ Result: You know exactly which projects make money and which don’t.

💡 Pro Tip: Set budget alerts to get notified when project costs reach 80% of budget.

Sage Pro Tips and Shortcuts

After testing Sage for over 12 months, here are my best tips.

Keyboard Shortcuts

| Action | Shortcut |

|---|---|

| Create new invoice | Ctrl + I |

| Go to dashboard | Ctrl + D |

| Search transactions | Ctrl + F |

| Save current entry | Ctrl + S |

Hidden Features Most People Miss

- Bank Rules: Create automatic categorization rules so repeating transactions get sorted without your input.

- Quote to Invoice: Convert accepted quotes to invoices in one click — no retyping needed.

- Email Tracking: See when a client opens your invoice so you know the best time to follow up.

Sage Common Mistakes to Avoid

Mistake #1: Not Reconciling Bank Feeds Weekly

❌ Wrong: Waiting until month-end to reconcile all transactions at once.

✅ Right: Reconcile transactions weekly to catch errors early and keep books clean.

Mistake #2: Ignoring Bank Rules

❌ Wrong: Manually categorizing the same recurring transaction every month.

✅ Right: Set up bank rules once and let Sage categorize recurring charges automatically.

Mistake #3: Not Attaching Receipts to Transactions

❌ Wrong: Keeping paper receipts in a shoebox and hoping for the best at tax time.

✅ Right: Upload receipt photos immediately using the Sage mobile app.

Sage Troubleshooting

Problem: Bank Feed Not Syncing

Cause: Your bank may have changed its security requirements or login process.

Fix: Disconnect and reconnect your bank account in Settings under Banking.

Problem: Invoice Not Showing as Paid

Cause: The payment was not matched to the correct invoice during reconciliation.

Fix: Go to Banking, find the payment, and manually match it to the open invoice.

Problem: Reports Showing Wrong Numbers

Cause: Transactions may be dated in the wrong period or uncategorized.

Fix: Check for uncategorized transactions in Banking and verify all dates are correct.

📌 Note: If none of these fix your issue, contact Sage support.

What is Sage?

Sage is a cloud accounting tool that helps small businesses manage invoicing, expenses, and financial reports from anywhere.

Think of it like having a bookkeeper built into your browser.

Watch this quick overview:

It includes these key features:

- Smarter Financial Reports: Generate profit/loss and cash flow reports in seconds.

- Multi-Currency Accounting: Invoice and track expenses in any currency worldwide.

- Inventory Management: Track stock levels that update automatically with each sale.

- Digital Record-Keeping: Store receipts and documents securely in the cloud.

- Bank Reconciliation: Match bank transactions with your records automatically.

- Balance Sheet Report: View assets, liabilities, and equity at any point in time.

- Sage Copilot: Get AI-powered answers about your business finances instantly.

- Advanced Inventory Management: Manage stock across multiple locations and warehouses.

- Project Management: Track costs and profitability per project or job.

For a full review, see our Sage review.

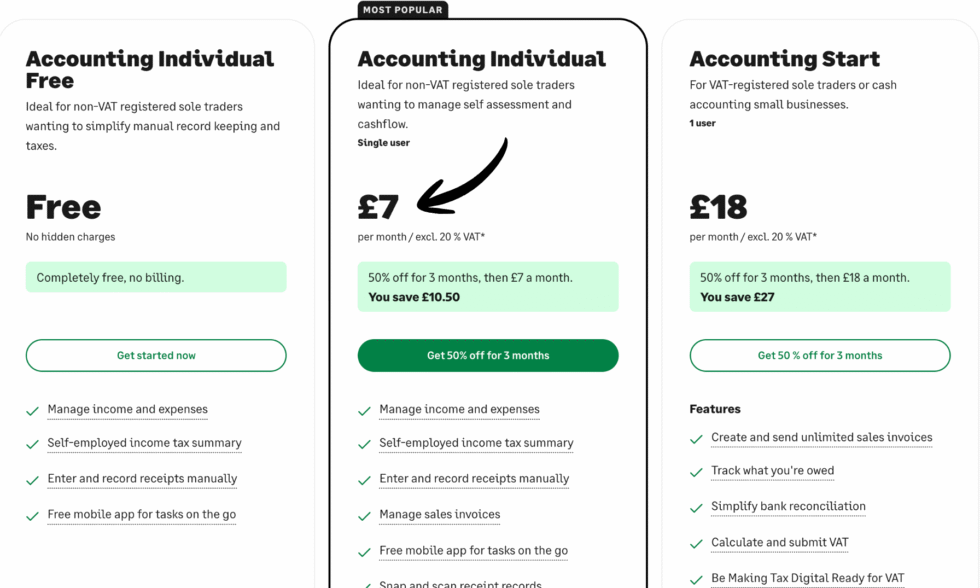

Sage Pricing

Here’s what Sage costs in 2026:

| Plan | Price | Best For |

|---|---|---|

| Accounting Individual | Free | Freelancers and sole traders getting started |

| Accounting Individual | $7/mo | Self-employed users who need invoicing and expenses |

| Accounting Start | $18/mo | Small businesses needing full accounting features |

Free trial: Yes, Sage offers a free plan for individuals.

Money-back guarantee: Cancel anytime with no long-term contract.

💰 Best Value: Accounting Start at $18/mo — it includes bank reconciliation, invoicing, and full reporting.

Sage vs Alternatives

How does Sage compare? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| Sage | Cloud accounting for small businesses | Free – $18/mo | ⭐ 4.2 |

| Dext | Receipt capture and expense automation | $24/mo | ⭐ 4.3 |

| Xero | Full-featured cloud accounting | $29/mo | ⭐ 4.5 |

| QuickBooks | All-in-one small business accounting | $1.90/mo | ⭐ 4.4 |

| FreshBooks | Invoicing-first accounting | $21/mo | ⭐ 4.3 |

| Zoho Books | Budget-friendly accounting | Free – $10/mo | ⭐ 4.3 |

| Wave | Free basic accounting | Free – $19/mo | ⭐ 4.0 |

| NetSuite | Enterprise-grade ERP accounting | Custom | ⭐ 4.5 |

Quick picks:

- Best overall: Xero — most complete cloud accounting with strong integrations.

- Best budget: Wave — free invoicing and accounting for startups.

- Best for beginners: Sage — simple interface with guided setup wizard.

- Best for enterprise: NetSuite — full ERP with advanced financial controls.

🎯 Sage Alternatives

Looking for Sage alternatives? Here are the top options:

- 🚀 Dext: Captures receipts with AI and pushes data directly to your accounting software for hands-free bookkeeping.

- 🧠 Docyt: AI-powered accounting that automates categorization, reconciliation, and financial close for busy teams.

- 🌟 Xero: Cloud accounting with 1,000+ app integrations, strong invoicing, and real-time bank feeds worldwide.

- 📊 Easy Month End: Simplifies month-end close with checklists, reconciliation tracking, and audit-ready documentation.

- 💰 Puzzle IO: Free accounting basics with AI-powered insights for startups and early-stage companies.

- ⚡ Zoho Books: Budget-friendly accounting with invoicing, expenses, and inventory in one affordable platform.

- 🔧 Synder: Syncs sales from Stripe, PayPal, and Shopify directly into your accounting software automatically.

- 🎨 RefreshMe: Simple personal finance tracking with clean interface for individuals and couples.

- 💼 Wave: Free accounting and invoicing with optional paid payroll for freelancers and small businesses.

- 🔒 Quicken: Desktop-first personal and business finance tracking with bank sync starting at $2.99/month.

- ⭐ Hubdoc: Fetches bills and receipts automatically from vendors and stores them in the cloud.

- 🎯 Expensify: Expense reporting with smart scan receipts, automatic approvals, and reimbursement tracking.

- 🔥 QuickBooks: Most popular small business accounting with payroll, invoicing, and tax tools built in.

- 👶 AutoEntry: Scans and extracts data from invoices and receipts then pushes to your accounting app.

- 🏢 FreshBooks: Built for service businesses with powerful invoicing, time tracking, and client portals.

- 💎 NetSuite: Enterprise ERP with advanced financial management, multi-entity support, and global consolidation.

For the full list, see our Sage alternatives guide.

⚔️ Sage Compared

Here’s how Sage stacks up against each competitor:

- Sage vs Dext: Sage is full accounting software while Dext focuses on receipt capture. Use both together for best results.

- Sage vs Docyt: Docyt offers deeper AI automation for mid-size firms. Sage is simpler and more affordable for small teams.

- Sage vs Xero: Xero has more third-party integrations. Sage wins on pricing with a free plan available.

- Sage vs Easy Month End: Easy Month End specializes in close management. Sage covers full accounting beyond just month-end.

- Sage vs Puzzle IO: Both offer free plans. Puzzle IO targets startups while Sage scales better for growing businesses.

- Sage vs Zoho Books: Both are affordable. Zoho Books offers more CRM integration through the Zoho ecosystem.

- Sage vs Synder: Synder excels at e-commerce transaction sync. Sage provides broader accounting features beyond sales data.

- Sage vs RefreshMe: RefreshMe is personal finance only. Sage handles full business accounting with invoicing and reports.

- Sage vs Wave: Wave is free but limited. Sage offers more features and better inventory management at a low cost.

- Sage vs Quicken: Quicken focuses on personal finance. Sage is built for business accounting with invoicing and payroll.

- Sage vs Hubdoc: Hubdoc auto-fetches bills but needs accounting software. Sage handles everything in one platform.

- Sage vs Expensify: Expensify focuses on expense reports. Sage covers full accounting including invoicing and banking.

- Sage vs QuickBooks: QuickBooks has more users and integrations. Sage offers a free plan and simpler interface for beginners.

- Sage vs AutoEntry: AutoEntry scans documents into accounting software. Sage is the accounting software itself with built-in scanning.

- Sage vs FreshBooks: FreshBooks is better for service-based invoicing. Sage offers stronger inventory and multi-currency features.

- Sage vs NetSuite: NetSuite is enterprise-grade ERP. Sage is more affordable and easier to set up for small businesses.

Start Using Sage Now

You learned how to use every major Sage feature:

- ✅ Smarter Financial Reports

- ✅ Multi-Currency Accounting

- ✅ Inventory Management

- ✅ Digital Record-Keeping

- ✅ Bank Reconciliation

- ✅ Balance Sheet Report

- ✅ Sage Copilot

- ✅ Advanced Inventory Management

- ✅ Project Management

Next step: Pick one feature and try it now.

Most people start with Smarter Financial Reports.

It takes less than 5 minutes.

Frequently Asked Questions

How do you properly use Sage?

Start by creating a free account at sage.com and connecting your bank. Then set up your chart of accounts and begin creating invoices. Sage walks you through each step with a guided setup wizard that takes about 3 minutes.

Can I teach myself Sage?

Yes, Sage is designed for people with no accounting background. The interface is simple and includes built-in help guides. Most users learn the basics within a few hours of hands-on practice.

How to use Sage as a beginner?

Begin with invoicing and bank reconciliation. These two features give you the most value fastest. Once comfortable, add inventory tracking and financial reports. Follow the step-by-step tutorials above for each feature.

Is Sage accounting software easy to use?

Yes, Sage is one of the easiest accounting tools for small businesses. It uses plain language instead of accounting jargon. The dashboard shows your cash flow, invoices, and bills in one place without any complex setup.

How much does Sage cost per month?

Sage starts with a free plan for individuals. Paid plans begin at $7/mo for self-employed users and go up to $18/mo for the Accounting Start plan. There are no long-term contracts and you can cancel anytime.

Is Sage different than QuickBooks?

Yes. Sage offers a free plan and a simpler interface. QuickBooks has more integrations and a larger user community. Both handle core accounting well, but Sage is better for beginners who want lower costs.

How long does it take to learn Sage software?

Most users learn basic invoicing and banking in 1-2 hours. Full comfort with all features takes about a week of regular use. Sage Copilot also helps by answering your questions as you learn.