Closing the books is always a nightmare.

You stay late staring at messy spreadsheets and tiny errors.

It feels like the work never ends.

This stress ruins your week and hurts your focus.

There is a better way to handle your accounting.

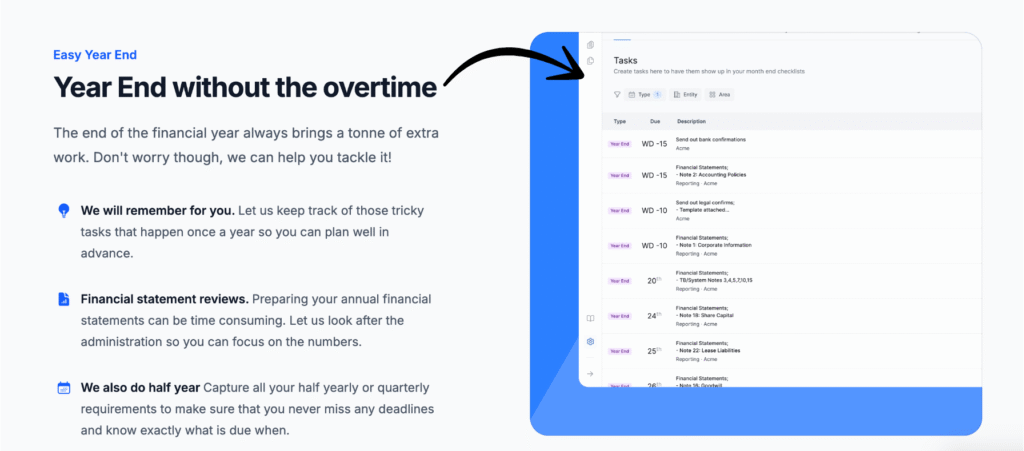

Learn how to use Easy Month End to fix your workflow. This tool automates your checklist and syncs with Xero instantly.

It makes reconciliation fast and simple. Stop wasting time on manual tasks.

Read this guide to finish your month-end close faster than ever before.

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial today!

Easy Month End Tutorial

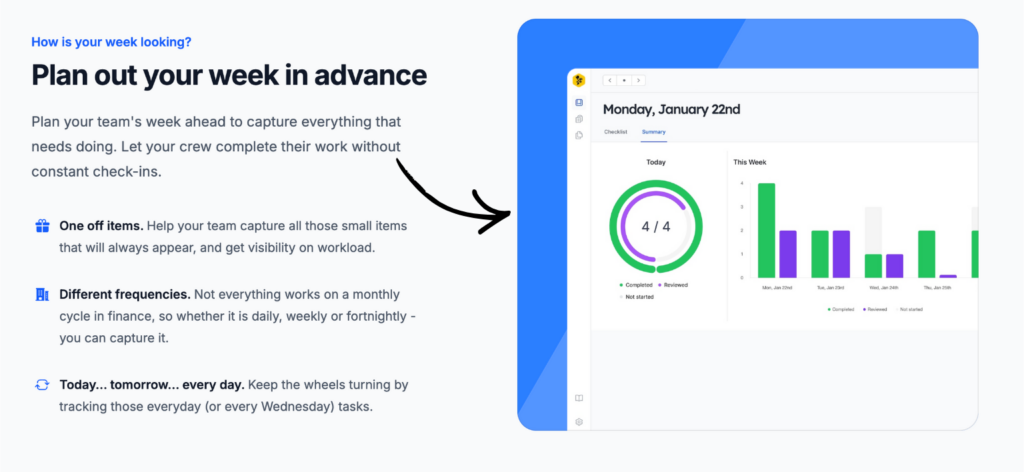

Getting started is easy. First, connect your Xero account to sync your data.

Next, create a digital checklist for your tasks.

Assign duties to your team and track progress in real time.

Follow these steps to finish your work faster.

How to Use Finance Task Management

Managing a month-end close process is hard for most finance teams.

You have to track many moving parts at once.

Easy Month End helps you organize these chores in one place.

This ensures you create accurate financial statements every single time.

Step 1: Build Your Master Checklist

- Open the “Templates” tab to start your list of recurring tasks.

- Add items like reviewing the income statement and checking fixed assets.

- List every step needed to verify your financial data for the month.

- Save this template so you can reuse it for every future close process.

Step 2: Assign Ownership to Your Team

- Click the dropdown menu next to each task to tag a team member.

- Give specific people responsibility for verifying bank statements and financial records.

- Set clear deadlines so everyone knows when their part must be done.

- This clear ownership is the best way to maintain the company’s financial health.

Step 3: Track Real-Time Progress

- Use the main dashboard to see which tasks are finished and which are late.

- Check the status of the balance sheet and cash flow statement at a glance.

- Watch as your monthly financial statements come together without the usual stress.

- Use the comments section to fix errors quickly for accurate financial reporting.

Step 4: Finalize Your Financial Reporting

- Review the completed checklist to ensure nothing was missed.

- Confirm that all data matches your financial statements before finishing.

- Look at the overall financial health of the business through the summary view.

- Lock the tasks once you are satisfied that the period is officially closed.

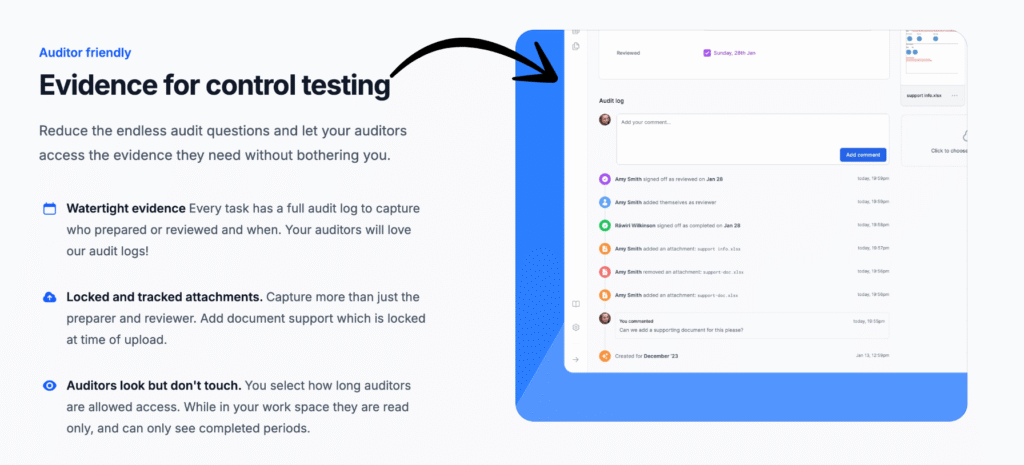

How to Use Auditor Control & Tracking

Preparing your books for an audit is a major task for finance and accounting teams.

You need to show exactly how you handled every dollar.

Easy Month End makes this simple by letting auditors see your work without getting in the way.

Follow these steps to set up a smooth monthly closing process.

Step 1: Set Up Read-Only Auditor Access

- Go to the “User Settings” menu and invite your external auditor.

- Choose the “View Only” permission level for their account.

- This allows them to see your financial data collection without changing anything.

- They can look at the previous month or any other accounting period they need to check.

Step 2: Centralize Your Supporting Documents

- Upload your bank reconciliation reports and copies of your bank and credit account statements.

- Attach proof for accounts payable and accounts receivable directly to the tasks.

- Make sure every one of your financial transactions has a receipt or a note attached.

- This makes it easy for the auditor to find the “why” behind your journal entries.

Step 3: Review the Digital Audit Trail

- Use the tracking tool to see a timestamped history of every action taken.

- Show who approved the customer payments and when they did it.

- This log proves you followed best practices throughout the month.

- Having a clear trail is the fastest way to prepare financial statements that auditors will trust.

Step 4: Perform the Final Review

- Run a final review of all auditor-facing folders to ensure they are organized.

- Double-check that all files are labeled correctly for an accurate financial report.

- Once everything is in order, you can close the books with confidence.

- Your transparency will save time and money during the year-end audit.

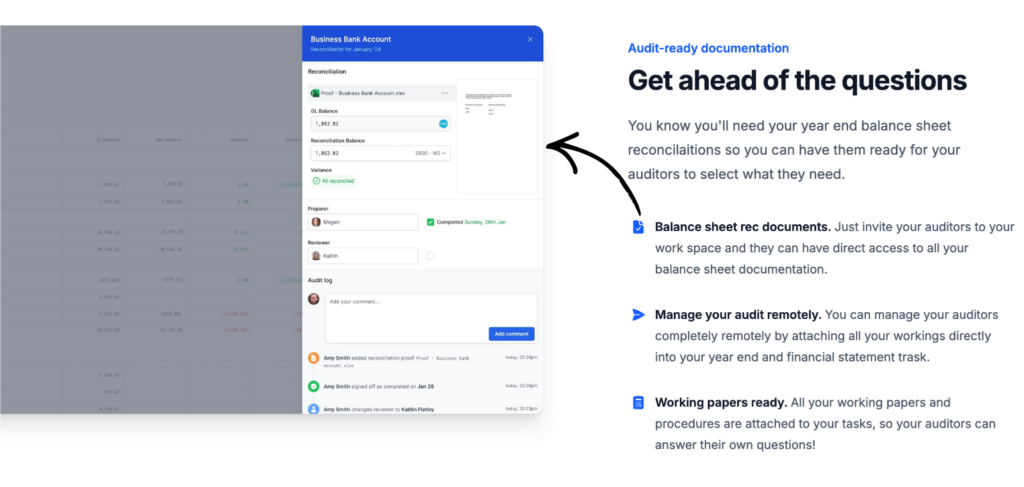

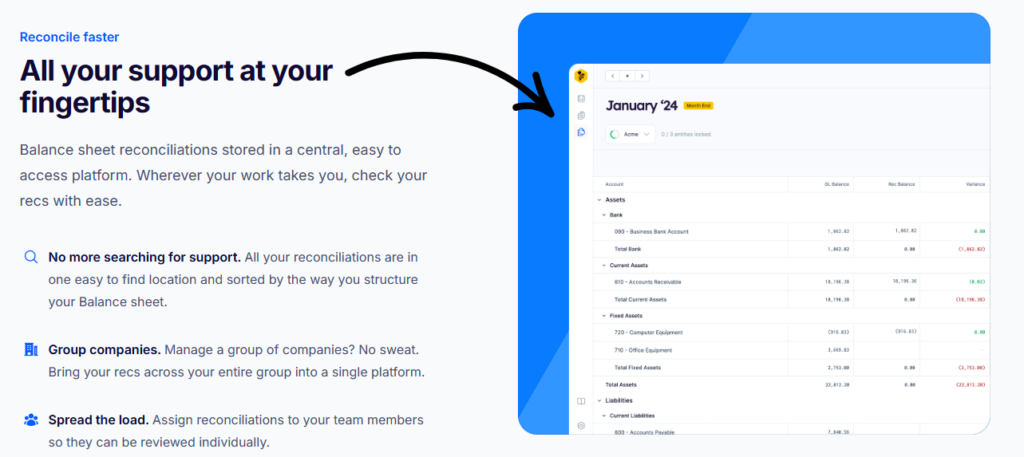

How to Use Balance Sheet Reconciliations

The accounting department often struggles to keep account balances straight.

If you don’t reconcile accounts correctly, your reports will be wrong.

Using Easy Month End helps your accounting team stay up to date without the stress.

Step 1: Connect Your General Ledger

- Start by linking your accounting software to Easy Month End.

- This allows the system to collect data and pull in your latest general ledger numbers.

- Once linked, it will show your cash balances, bank accounts, and credit accounts.

- Getting all the data in one place reduces errors caused by manual typing.

Step 2: Match Balances with Supporting Documentation

- Compare your software balance to your supporting documentation, like credit card transactions.

- Check your fixed asset activity and any new asset purchases made during the month.

- Review prepaid and accrued expenses to ensure they are in the correct period.

- If you see accounting errors, you can post journal entries to fix them immediately.

Step 3: Verify Revenue and Vendor Invoices

- Review your revenue recognition to ensure sales are recorded properly.

- Reconcile accounts payable by checking all unpaid vendor invoices.

- Go through expense reports and an inventory count if your business holds stock.

- This step helps you catch mistakes and catch issues early before they become big problems.

Step 4: Finalize the Month End Close Checklist

- Mark all the tasks on your month-end close checklist as finished.

- Ensure your cash flow matches the financial activity you recorded.

- This gives you a view of your true financial position, enabling leaders to make informed decisions.

- By automating these repetitive tasks, you avoid human error and missed deadlines.

Alternatives to Easy Month End

- Dext: This software focuses on automating data extraction from receipts and invoices. It saves time on manual data entry by digitizing your paperwork.

- Xero: This is a popular cloud-based accounting platform. It’s an alternative for Atera’s bookkeeping features, offering tools for invoicing, bank reconciliation, and expense tracking.

- Puzzle io: This is a modern accounting software built specifically for startups. It helps with financial reporting and automation, offering real-time insights and a focus on streamlining the books for a faster close.

- Sage: A well-known provider of business management software, Sage offers a range of accounting and financial solutions that can serve as an alternative to Atera’s financial management module.

- Zoho Books: Part of the Zoho suite, this is a strong accounting tool for small to medium businesses. It helps with invoicing, expense tracking, and inventory management, and is a good alternative for those who need comprehensive financial tools.

- Synder: This software focuses on syncing your e-commerce and payment platforms with your accounting software. It’s a useful alternative for businesses that need to automate data flow from sales channels into their books.

- Easy Month End: This tool is designed specifically to streamline the month-end closing process. It’s a specialized alternative for businesses that want to improve and automate their financial reporting and reconciliation tasks.

- Docyt: An AI-powered bookkeeping platform, Docyt automates financial workflows. It is a direct competitor for Atera’s AI-driven bookkeeping features, offering real-time data and automated document management.

- RefreshMe: This is a personal financial management platform. While not a direct business alternative, it offers similar features like expense and invoice tracking.

- Wave: This is a popular free financial software. It’s a good choice for freelancers and small businesses for invoicing, accounting, and receipt scanning.

- Quicken: A well-known tool for personal and small business finance. It helps with budgeting, spending tracking, and financial planning.

- Hubdoc: This software is a document management tool. It automatically fetches your financial documents and syncs them to your accounting software.

- Expensify: This platform focuses on expense management. It is great for receipt scanning, business travel, and creating expense reports.

- QuickBooks: One of the most widely used accounting software programs. QuickBooks is a strong alternative that offers a full set of tools for financial management.

- AutoEntry: This tool automates data entry. It is a good alternative for the receipt and invoice capture features within Atera.

- FreshBooks: This program is great for invoicing and accounting. It is popular with freelancers and small businesses that need a simple way to track time and expenses.

- NetSuite: A powerful and complete cloud-based business management suite. NetSuite is an alternative for larger businesses that need more than just financial management.

Easy Month End Compared

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

Conclusion

Mastering your financial close does not have to be a struggle.

Many finance teams spend too much time on manual work.

Easy Month-End changes that organize your accounting tasks in one place.

You can trust your accurate data when it is time to prepare reports.

No more worrying about missed steps or late tax filings.

This tool helps you stay on track every single month.

It makes your job easier and faster. Start using these steps today to take control of your books.

You deserve a stress-free close every time.

Frequently Asked Questions

What are the steps for the month-end closing?

You must record all income, reconcile bank accounts, and review your balance sheet. Finally, post necessary journal entries and lock the period to ensure your financial reports are accurate.

What is the easiest way to do bank reconciliation?

The easiest way is to use automation software. Connect your bank feed to your accounting tool to automatically match transactions, leaving only unusual discrepancies for you to check manually.

What happens if month end isn’t done right?

Poorly managed closes lead to incorrect financial statements, bad business decisions, and tax errors. It can also cause stress during audits and lead to costly penalties from regulatory authorities.

What are typical month-end tasks?

Common tasks include reconciling bank and credit accounts, reviewing accounts payable and receivable, counting inventory, and recording depreciation. Teams also verify prepaid expenses and accruals during this time.

What does EOM mean in accounting?

EOM stands for “End of Month.” It refers to the date when a reporting period concludes and the process of finalizing all financial transactions for that specific month begins.

How to close accounts payable at the month’s end?

Ensure all vendor invoices are entered and matched to purchase orders. Verify that payments made match your records and reconcile the total outstanding balance to your general ledger.

More Facts about Easy Month End

- Everyone can see which tasks are really worked on in real time. This helps the team work better together to finish the month’s work.

- The software has ready-to-use forms. You can use them to quickly create large reports, such as the Income Statements & Balance Sheet.

- Once the boss approves the numbers, you can “lock” the month. This keeps the data safe while you start the next month.

- You can track every task and set due dates. This will helps everyone on the team know exactly what to do and when to do it.

- You don’t have to wait until the end of the month to check your work. Doing a “soft close” in the middle of the month helps you find mistakes early.

- If you record your work every day, you won’t have a giant pile of work waiting for you on the last day of the month.

- Easy Month End lets you record special items like “depreciation.” This ensures your final reports accurately reflect the true value of the company’s assets.

- Keep all your proof and paperwork in one spot. This makes it easy for auditors to check your work without asking a million questions.

- Closing the month is a very important job. It ensures the company’s financial records are accurate and completed on time.

- The closing process includes several steps: checking bank records, reviewing sales, correcting errors, and preparing final reports.

- Closing the books correctly helps the company pay the right amount of taxes and see exactly how much cash is in the bank.

- When your records are organized and correct, the yearly “audit” (a big check-up) is much faster and less stressful.

- Many different people in the company need to help out. They check to ensure every dollar spent or earned is recorded.

- Fast teams usually finish their monthly reports in 5 days. Teams that aren’t as fast might take 10 days or even longer.

- If a team is messy or doesn’t communicate, closing the month can take weeks.

- When data is scattered across different locations, it slows down and leads to mistakes.

- Doing everything by hand can lead to errors. It also makes the closing process take much longer than it should.

- A “checklist” is a simple list of every job the money team must finish before they can say the month is officially over.

- A good checklist turns a boring chore into a smart plan that helps the whole company grow.

- Using templates means everyone does the work the same way every time. This keeps everything neat.

- Talking clearly with your teammates is one of the most important parts of finishing the month-end work.

- Teams should look for ways to do better next time. Identifying “roadblocks” helps the team work more quickly in the future.

- A “close calendar” shows who owns each task and when it is due. This makes sure no one misses a deadline.

- Checking your most important accounts once a week is a great way to catch errors before they become big problems.

- Writing down how to do things and naming a “leader” for each task makes everyone more responsible.

- “Continuous accounting” means doing a little bit of work every day instead of saving it all for a stressful final week.

- After the month is over, teams should discuss what went wrong. This helps them fix the same problems before they happen again.

- Setting a strict timeline is the best way to ensure the work stays on track and finishes on time.

- When the money data is correct, leaders can make smart choices that keep the company safe and successful.

- Checking everything carefully helps you find and fix errors right away. This keeps the company in compliance with the rules.

- Good records help the company plan for the future. It’s like having a map that enables you to set goals and spend money wisely.

- Closing the month correctly helps the company manage its cash. This ensures there is enough money to pay bills and buy new things.

- When your reports are honest and clear, people like investors will trust the company more.

- A strong closing process eliminates “manual” mistakes—the kind of errors people make when they are tired or rushing.

- The first step in closing is gathering all the info, like how much money came in and how much was spent on bills.

- Once you have the info, you have to verify it by comparing it to bank statements and receipts.

- The team must check everything the company owns—like computers or trucks—to see how much value they lost over time.

- You must record bills that are due soon and payments made early. This shows the company’s true “money health.”

- After all the numbers are checked, the final reports (the Balance Sheet & Income Statement) are put together.

- The very last step is a final look-over. This is a double-check to make sure everything is perfect before the work is done.

- Reconciling is like a matching game. You compare the company’s records with the bank’s records to ensure they match exactly.

- Easy Month End can “talk” to your other computer programs. It pulls in data automatically, so you don’t have to type it all in by hand.

- Automation tools help the team spend less time on boring “copy-paste” work and more time thinking about how to help the business.

- Using technology ensures that data is consistent across departments, preventing confusing arguments.

- Computer systems are great at spotting weird things (anomalies) in the data that a human might miss.