Drowning in receipts and invoices?

Manual data entry is a time drain, stealing hours you could spend growing your business or simply relaxing.

It’s frustrating to be stuck in paperwork.

But what if there was an easier way?

What if you could automate most of that data entry?

AutoEntry is good, but the world of smart data management is always changing.

This article reveals the top 9 AutoEntry alternatives to help you achieve smarter data entry, reduce errors, and get your time back.

What Are the Best AutoEntry Alternatives?

Choosing the right data entry solution can be tough with so many options.

We’ve done the heavy lifting for you!

This list ranks the best AutoEntry alternatives available today.

So you can easily find your perfect fit for your business and say goodbye to manual data entry headaches.

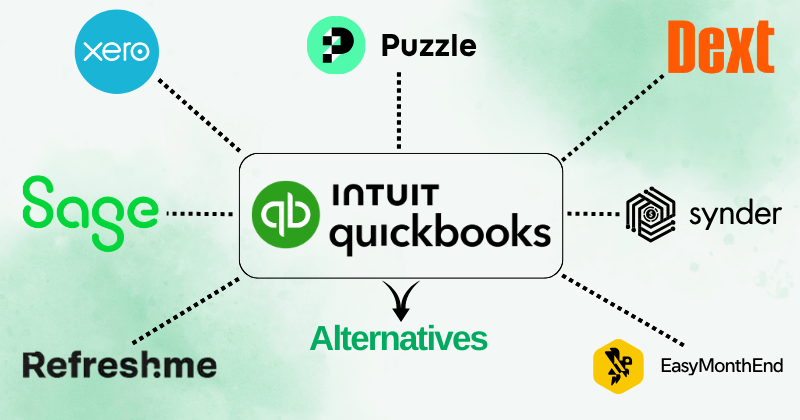

1. Xero (⭐4.8)

Xero is a popular cloud-based accounting software.

It’s really user-friendly for small businesses. Xero isn’t just for data entry.

It helps you with invoices, bills, and bank reconciliation.

Plus, it works great with Hubdoc for document management.

Unlock its potential with our Xero tutorial.

Also, explore our AutoEntry vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

2. Puzzle IO (⭐4.5)

Puzzle IO is a new AI-native accounting platform.

Instead, it gives you a super clear, real-time picture of your money, without all the confusing jargon.

Think of it as your financial dashboard, showing you exactly what’s happening with your cash.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our AutoEntry vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

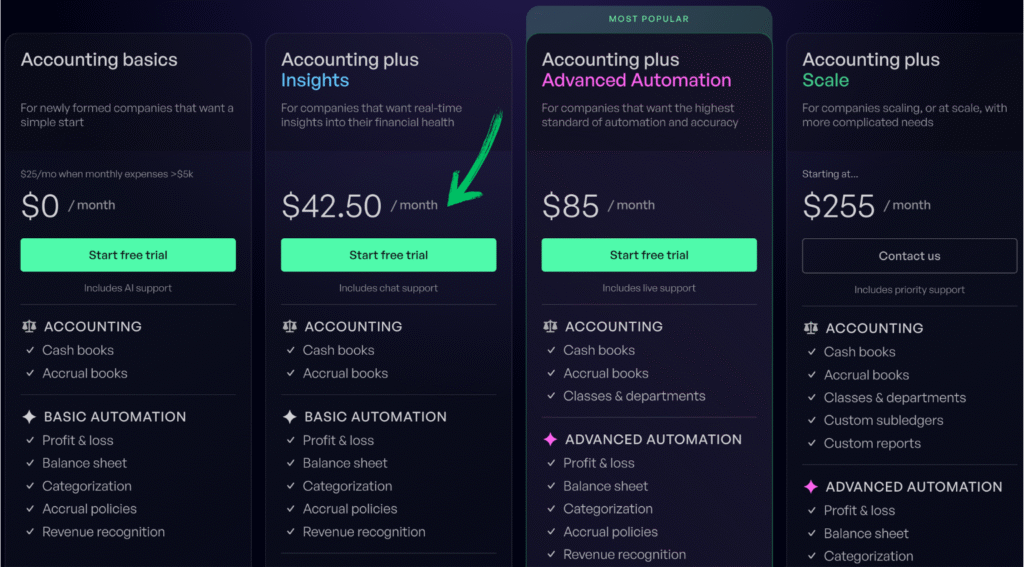

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext simplifies managing your receipts and invoices.

Just snap a pic or forward an email; Dext extracts key info, speeding up data entry into your accounting software.

It keeps everything organized and accurate.

Unlock its potential with our Dext tutorial.

Also, explore our AutoEntry vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

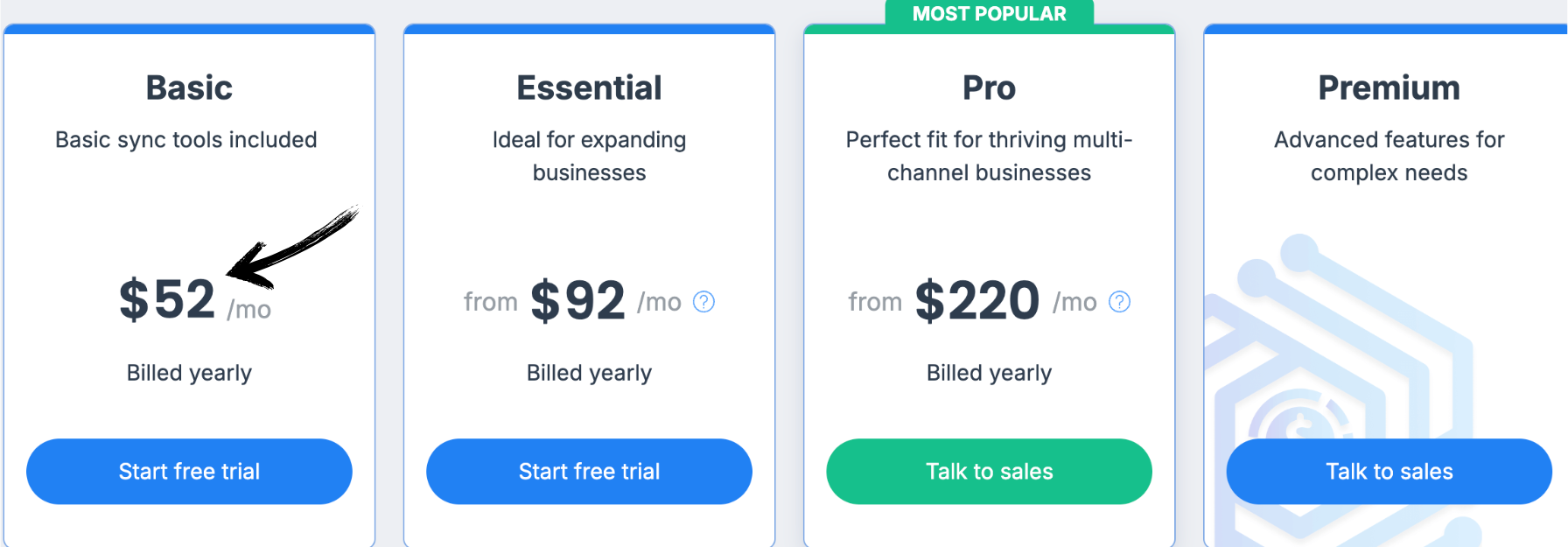

4. Synder (⭐3.8)

Synder connects your online sales to accounting software.

If you sell on Shopify or use Stripe, it sends sales data directly to QuickBooks or Xero.

It keeps your online sales records accurate.

Unlock its potential with our Synder tutorial.

Also, explore our AutoEntry vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Easy Month End is a tool designed to simplify your monthly financial close.

It’s built for finance teams and helps you track tasks and manage reconciliations.

No more messy spreadsheets or chasing people for sign-offs.

It keeps everything organized and auditable.

Unlock its potential with our Easy Month End tutorial.

Also, explore our AutoEntry vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

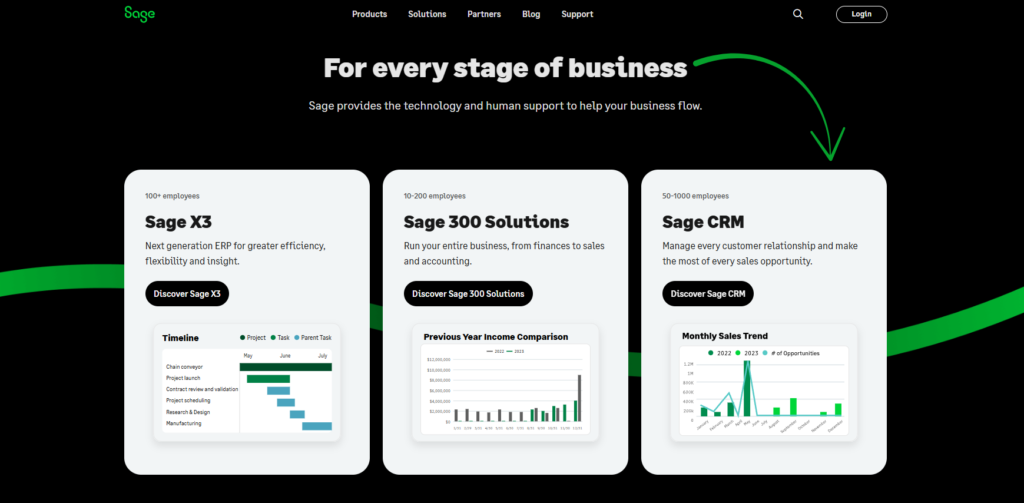

6. Sage (⭐️3.4)

So, Sage is a big name in the accounting world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

It’s a strong option for bigger businesses that need a comprehensive system.

It also connects with other accounting software.

Unlock its potential with our Sage tutorial.

Also, explore our Autoentry vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

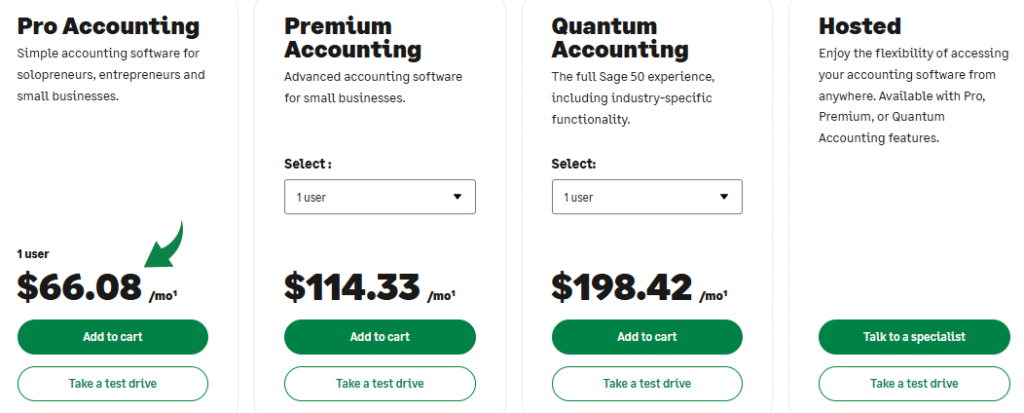

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. RefreshMe (⭐3.2)

RefreshMe is a less-known but viable option for small businesses.

It’s designed to be simple and affordable.

This tool can save you from a lot of headaches and make sure your data is accurate.

It’s a handy addition to your accounting routine.

Unlock its potential with our Refreshme tutorial.

Also, explore our Autoentry vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

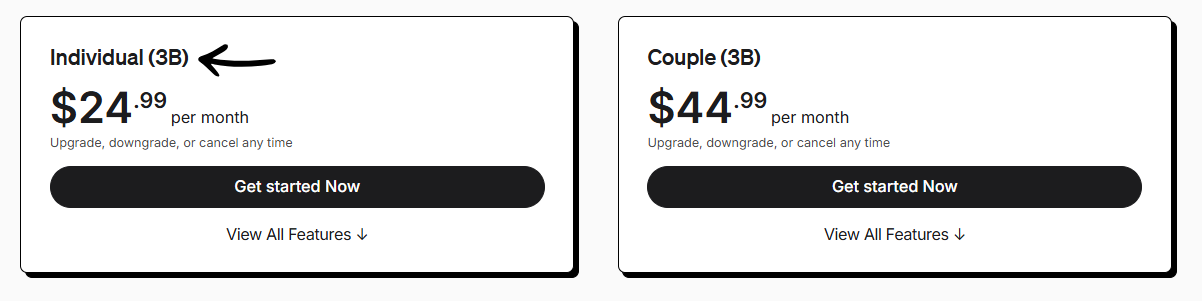

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

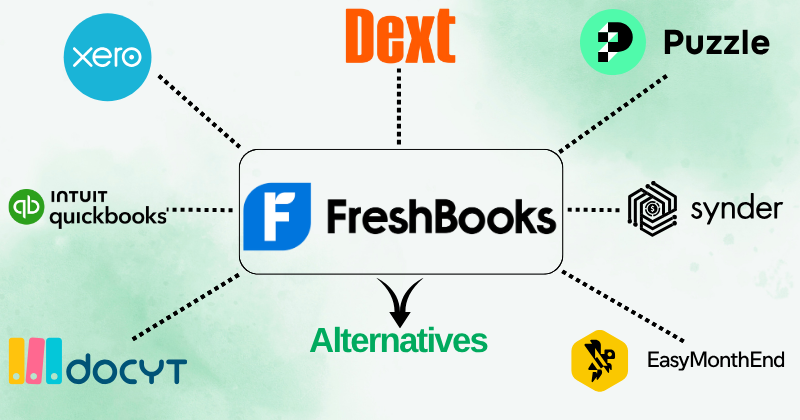

8. FreshBooks (⭐3.0)

FreshBooks is a popular accounting software, especially for freelancers and small businesses.

It makes invoicing super easy.

You can also track time, manage expenses, and follow up on payments.

It simplifies how you bill clients and track your hours and is designed to save you time on admin tasks.

Unlock its potential with our FreshBooks tutorial.

Also, explore our AutoEntry vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is a huge name in accounting software.

Many small and medium-sized businesses use it. It’s an all-in-one tool.

It’s great for managing all your money tasks, like invoicing, tracking costs, and even payroll.

It even lets you snap pictures of receipts.

Unlock its potential with our QuickBooks tutorial.

Also, explore our AutoEntry vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

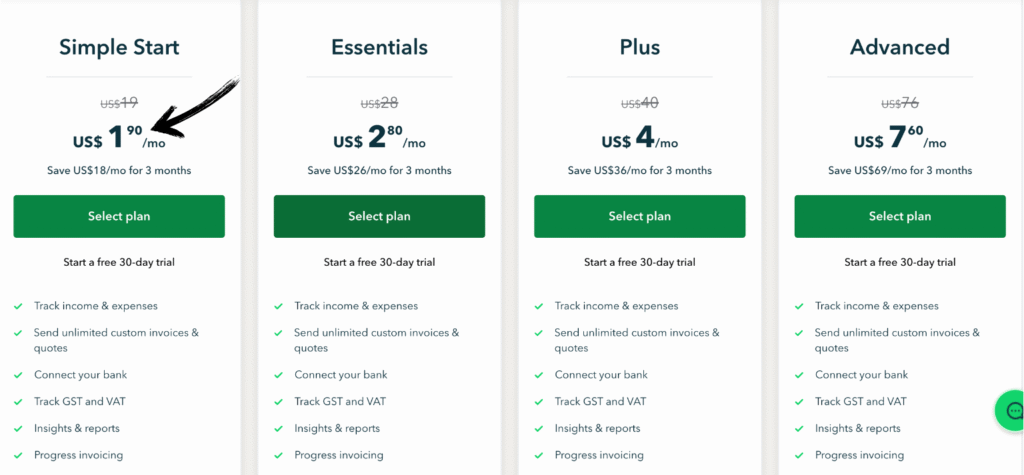

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

When doing our research to find the best alternative to AutoEntry, we used these factors to determine the best fit for our customers’ specific needs:

- Pricing: How much did each product cost? We evaluated if the pricing was a cost-effective solution for various businesses.

- Features: What were the key features of each product? We focused on how each alternative was a comprehensive solution for financial document management. This included the ability to easily capture, process, and extract relevant data, including structured data and document data, from invoices, receipts, pdf bank statements, and other financial documents. We also sought out a user friendly interface and specific features like the ability to extract line items, and the accuracy of the data capture. We considered integration capabilities with popular tools like QuickBooks Online and other business systems to ensure a seamless transfer and improve operational efficiency and financial management. We also focused on Atera’s AI features, such as its IT Autopilot and AI Copilot, which help automate tasks and boost efficiency. The IT Autopilot is an AI agent that can handle mundane tasks and resolve tickets autonomously, while the AI Copilot is an intelligent companion for technicians that provides instant guidance and context-aware suggestions.

- Negatives: What was missing from each product? We identified any missing features or potential drawbacks that could impact the accounts payable process or overall financial management. We also noted any issues that might affect the accuracy of the data extraction for large volumes of documents.

- Support or refund: Do they offer a community, support & refund policy? We assessed the level of customer support offered, looking for providers with better customer support and helpful resources for customers of other tools. We also considered the availability of rules to automate the process and improve efficiency.

Wrapping Up

In this guide, we’ve covered the key factors for choosing an alternative to AutoEntry.

We looked at pricing and important features like document processing and invoice processing.

We also considered the ability to handle sales invoices and receipts and bank statements from various sources.

The right tool will have various features to meet your specific requirements.

The best personal finance software or business tool needs to accurately create and handle data.

There are many great options out there, but finding the one that works for you is key.

We hope this guide helps you make a smart choice.

Finding a popular choice that meets your needs can make a big difference in your work.

Frequently Asked Questions

What is AutoEntry by Sage?

AutoEntry is an intelligent automation tool that digitizes financial paperwork. It captures data from scanned receipts, invoices, and bank statements, then publishes it directly to your accounting software. It essentially eliminates manual data entry for bookkeepers.

How much does Sage AutoEntry cost?

AutoEntry uses a credit-based pricing model rather than a strict monthly subscription. Plans typically start around $12 to $15 per month for a bundle of credits (e.g., 50 credits). One standard invoice usually costs one credit, while bank statements cost more per page.

Is AutoEntry free?

No, it is not a free tool. However, it offers a free trial so you can test its accuracy before committing. Unlike many competitors that force high-tier subscriptions, its pay-as-you-go credit system is often more cost-effective for fluctuating workloads.

Does AutoEntry work with QuickBooks?

Yes, it integrates seamlessly with both QuickBooks Online and QuickBooks Desktop. You can snap a photo of a receipt, and AutoEntry will extract the data and push it directly into QuickBooks as a transaction.

What is the alternative to AutoEntry?

Top competitors include Dext Prepare (formerly Receipt Bank) and Hubdoc. Dext is highly regarded for its mobile app and volume handling, while Hubdoc is a strong contender often favored by Xero users for its direct integration.

When did Sage buy AutoEntry?

Sage acquired AutoEntry in 2019. This acquisition allowed Sage to embed powerful data automation directly into its ecosystem, though AutoEntry continues to integrate with other platforms like Xero and QuickBooks.

Does AutoEntry work with Sage 200?

AutoEntry integrates natively with Sage 50 and Sage Business Cloud Accounting. For Sage 200, integration is often achieved through specific connectors or by exporting data as CSV files and importing them, as direct native syncing is less standard than with Sage 50.

More Facts about Autoentry Alternatives

- Expensify is a tool that helps you track your spending and generate reports.

- DocuClipper is a tool that reads text from financial papers. It can pull information from bank statements, tax forms, and receipts with 99% accuracy. It is very fast and turns that information into Excel or CSV files.

- Hubdoc is a website that stores your documents in the cloud. It organizes your bills and receipts by automatically reading the important numbers on them. It usually costs $12 USD a month.

- Docparser is a tool that extracts specific data from various file types, such as PDFs, Word documents, and Excel sheets.

- Dext Prepare uses the cloud to help businesses handle their money paperwork. It captures, reads, and organizes bills and receipts to speed up the process.

- MoneyThumb is built to turn PDF bank statements into special files that accounting software can understand.

- Datamolino reads invoices quickly and accurately. It can read the detailed list of items on a bill, not just the total price, and it has real people ready to help if the computer makes a mistake.

- AutoEntry is software that automates data entry for businesses. It works with many types of papers, including invoices, receipts, and bank statements.

- Comparing Dext and AutoEntry: Both tools read receipts and invoices to save time and stop mistakes. They both connect easily with popular accounting programs like Xero and QuickBooks Online. However, some users think Dext is easier for new users.

- Customer Support: Both Dext and AutoEntry offer help through articles or by speaking with a support representative. Many people say AutoEntry’s support team is very helpful.

- AutoEntry Performance: Users say AutoEntry saves them a lot of time. However, some people have had technical trouble with the app that syncs their data.

- Why People Switch: Some users look for alternatives to AutoEntry due to price or missing features. For example, switching to Datamolino has helped some businesses improve their data entry processes.

- Zoho Expense automatically handles spending reports and integrates with other apps in the Zoho family.

- DataSnipper is made to help with the “accounts payable” process (paying bills). It helps check invoices and fix mistakes.

- Enterprise Tools: Kofax Capture and ABBYY FlexiCapture are powerful tools designed for large companies with large volumes of unorganized documents to process.

- Zapier is a tool that connects different apps. It helps them “talk” and do work automatically so you don’t have to do it by hand.

- Cost Differences: DocuClipper costs about 5 cents per page. In comparison, AutoEntry can cost around 54 cents for the same amount of work.

- SaasAnt Transactions is a tool for moving long lists of transactions into or out of QuickBooks and Xero all at once.

- Rossum uses smart Artificial Intelligence (AI) to read and process large amounts of documents quickly.